What is a Heikin Ashi Candlestick Chart Pattern?

The Heikin Ashi Candlestick pattern is almost the same as the traditional candlesticks, with one big difference—the former is an averaged out version of the latter. The chart pattern can help traders spot Forex market trends, predict future prices, and determine the ideal time to enter, exit, or stay in the market. Let's take a look at what Heikin Ashi Candlestick really is and how you can effectively use it as a Forex trading strategy.

Understanding Heikin Ashi Candlestick

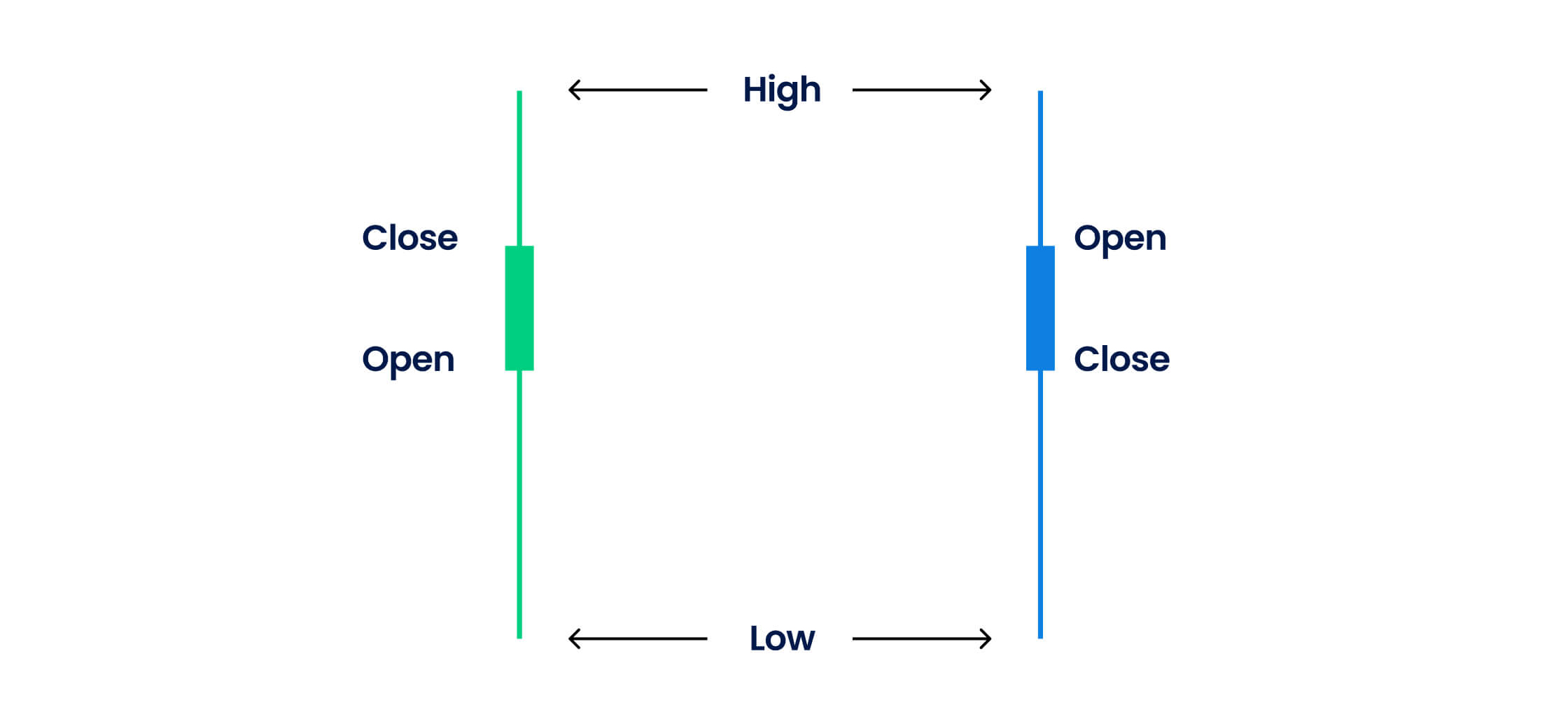

The Heikin Ashi Candlestick aims to filter out any noise in the currency pair prices by creating a chart pattern with averaged out prices. The pattern helps traders understand the market direction, trends, gaps, and reversals. It does not use the open, close, high, and low currency pair prices like the standard candlestick charts to depict the price movement graphically. Instead, it uses a formula based on two-period averages that help give the chart a smoother appearance, unaffected by any extreme price moves.

- The open price is the first trade price of the currency pair during the day

- The close price is the last trade price

- The high price, at the topmost portion of the candlestick, depicts the highest traded price

- The low price, at the bottom-most portion of the candlestick, depicts the lowest traded price

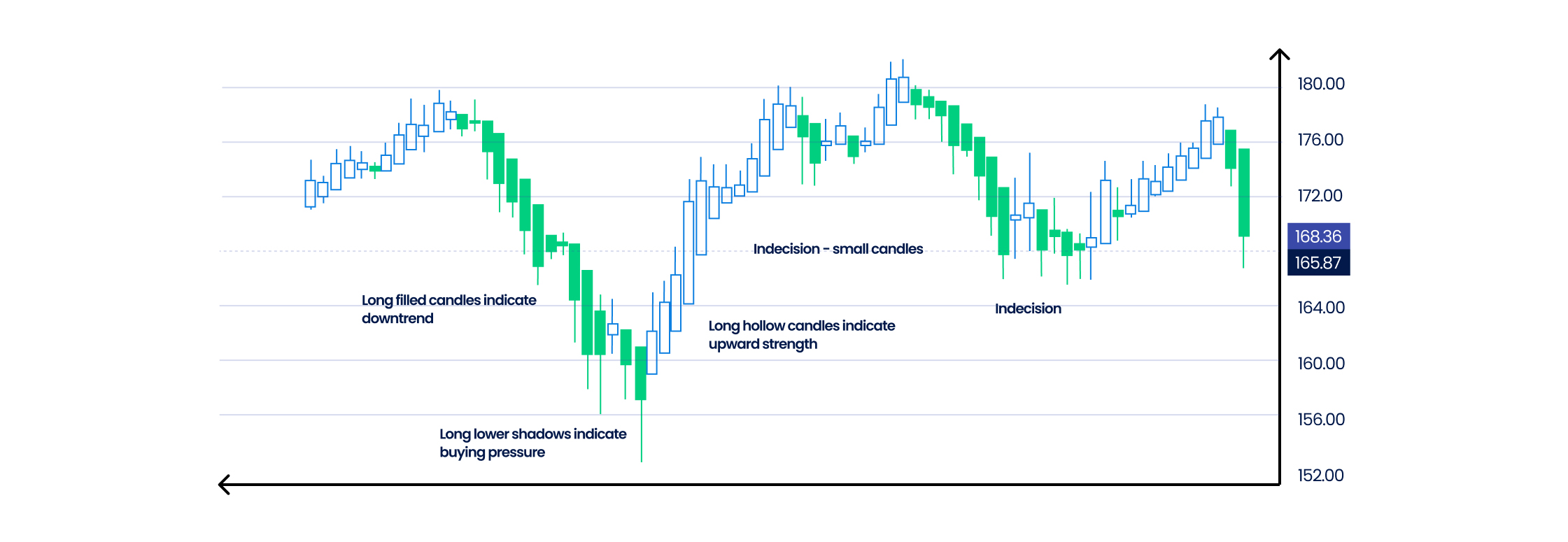

It is important to note that candles in the Heikin Ashi pattern with less or no shadow on top signal strong selling pressures in the market. On the other hand, candles with less or no lower shadow signal strong buying pressures in the market.

Calculating the Heikin Ashi Candlestick

The Heikin Ashi Candlestick calculation helps traders get all the separate candlesticks that the pattern consists of through the set of four price points - the high price, low price, open price, and close price.

- The first Heikin Ashi close price (indicating the current bar's average price) = 1/4 (open price + high price + low price + close price)

- The first Heikin Ashi open price (indicating the midpoint of the previous bar) = 1/2 (the opening price of the last bar + closing price of the last bar)

- The first Heikin Ashi high price (the highest price point in the period taken) = Maximum Value [High price, Open price, Close price]

- The first Heikin Ashi low price (the lowest price point in the period taken) = Minimum Value [Low price, Open price, Close price]

Trading the Heikin Ashi Candlestick pattern

- When the candles do not have any lower shadows/tails or appear green in colour, they indicate a strong market uptrend, signalling traders to enter long positions

- All hollow candles send a bullish trend indication, signalling traders to exit short positions as soon a possible

- Filled, red, or candles that do not have higher shadows indicate a strong downtrend/bearish trend, indicating traders to short positions and exit long positions

- When a candle has a short body and is surrounded by lower and upper shadows/tails, it indicates a market trend reversal where traders can either enter or exit the market as per the market direction

- In the above situation, traders who wish to maximise profits enter into a short position when the market is in an uptrend and expected to reverse (with falling prices). Similarly, they enter a long position if the market is in a downtrend and it is expected to witness increasing prices.

Top three use cases of Heikin Ashi Candlestick

1. Identifying the candlesticks without shadows

The Heikin Ashi Candlestick pattern helps traders identify the candlesticks that come without any lower shadow, which are responsible for depicting a strong bullish trend. The beginning of this bullish trend enables trades to enter long positions in the market to gain maximum potential profits. The higher the number of candlesticks in a pattern without a tail/shadow, the stronger is the trend expected to be, with higher certainty about the profits. On the other hand, the pattern also enables traders to identify candlesticks without any upper shadows, which depicts a strong yet stable downward bearish trend with falling prices, signalling traders to short the positions to minimise losses.

2. Ascertaining the trend pauses and reversals

In the Heikin Ashi Candlestick pattern, the candles with small bodies signal traders about market trend reversals and pauses. A smaller candle opens right after the first candle in a continued trend and either closes above or below, indicating the trend reversal. Thereafter, a third candle, also with a small body, is formed to confirm the market's trend reversal.

3. Determining strong bullish and bearish market trends

The Heikin Ashi Candlesticks also help traders identify when to enter or exit the market by providing the strong bullish or bearish trend reversal points in the chart. As soon as a bullish trend emerges, traders exit their short positions and take long positions to maximise profits. Whereas, as soon as a bearish trend emerges, traders exit their long positions and take short positions to minimise losses.

Trade the Heikin Ashi Candlestick pattern to level up your trading strategy

This means the Heikin Ashi Candlesticks do not have any irrelevant price fluctuations. All the noise is filtered out for the traders to only receive significant price points necessary to trade in the market.

Blueberry Markets is a leading, globally regulated trader that gives you access to a seamless trading experience and advanced trading tools to make trading more profitable for you.

Sign up for a live trading account

or try a risk-free demo account to make the most out of the Heikin Ashi Candlestick pattern.

Recommended Topics

-

Guide to Utilizing a No Stop-loss Trading Strategy in Forex

Stop-loss orders can sometimes make a trade order restrictive, which could eventually lead traders to get out of a trade prematurely due to a false market signal.

-

How to Copy Trade With MetaTrader

Copy trading provides a useful way for beginner level traders to learn from experienced traders.

-

What are Forex Expert Advisors?

Forex Expert Advisors (EAs) enable the automation of forex trading.

-

How to Use The Accumulation/Distribution Indictor in Forex

The Accumulation/Distribution (A/D) indicator can determine buying and selling pressures of a currency pair as it helps identify the relationship between the currency pair's price and volume.

-

What is Commodity Channel Index?

The Commodity Channel Index (CCI) is a technical indicator that can identify overbought or oversold levels in market conditions as well as potential trend reversals and trade signals.

-

Top Fundamental Trading Strategies You Should Know

Fundamental trading strategies are popular among traders who want to make informed investment decisions based on real-world data and events rather than solely on technical analysis.

-

How to Use Martingale Strategy For Trading

The Martingale strategy acts as a popular high-risk trading strategy used in various financial markets including Forex and stocks.

-

What is The Forex Linear Regression?

Forex linear regression enables you to predict future price movements by comparing the current and historical currency pair prices.

-

Top Advanced Forex Trading Strategies You Should Know

Advanced forex trading strategies are perfect for experienced forex traders.

-

What is The Oscillator of Moving Average in Forex?

The Oscillator of Moving Average (OsMA) is a technical indicator that helps in determining a trend’s strength in the forex market.

-

What Are Bear and Bull Power Indicators?

Bear and bull power indicators in forex measure the power of bears (sellers) and bulls (buyers) to identify ideal entry points.

-

How to Trade With The On Balance Volume Indicator

The On Balance Volume (OBV) indicator analyses the forex price momentum to measure the market’s buying and selling pressure.

-

How to Use The Alligator Indicator in Forex Trading

The Alligator indicator can identify market trends and determine ideal entry and exit points based on the trend’s strength.

-

How to Use Inside Bar Trading Strategy

Inside bar trading offers ideal stop-loss positions and helps identify strong breakout levels.

-

What is the Martingale Trading Strategy in Forex?

The Martingale trading strategy increases the possibility of winning a trade in the forex market.

-

How to Use The Forex Arbitrage Trading Strategy

Forex arbitrage trading strategy allows you to profit from the difference in currency pair prices offered by different forex brokers.

-

The Beginner’s Guide to MQL5

MetaTrader, as a platform, has built-in functions that assist in technical analysis and trade management while also allowing traders to develop their own indicators and trading strategies.

-

How to Use DeMarker Indicator For Forex Trading

Every trader needs to know precisely when to enter or exit a forex market.

-

How to Use The Accelerator Oscillator For Forex Trading

The Accelerator Oscillator indicator helps detect different trading values that protect traders from entering bad trades.

-

A Forex Trader’s Guide to Awesome Oscillator

When you understand market momentum, you can better identify market reversals.

-

What is Money Flow Index?

The Money Flow Index can analyse the volume and price of currency pairs in the market.

-

What is The Ichimoku Kinko Hyo Indicator?

The Ichimoku Kinko Hyo indicator provides traders with the market’s current momentum, direction and trend strength.

-

Top Pullback Trading Strategies

Pullback trading strategies provide traders with ideal entry points to trade along with the existing trend.

-

What is High Wave Candlestick?

The High Wave Candlestick pattern occurs in a highly fluctuating market and provides traders with entry and exit levels in the current trend.

-

What is the Parabolic SAR indicator?

Identifying market trends becomes easier with the Parabolic SAR indicator as it provides the ideal entry and exit signals in strong trending markets.

-

What is Currency Correlation?

Currency correlations help trade multiple currencies in the forex market by identifying the market trends of each currency pair.

-

Price Action Trading Strategy

A Price Action Trading Strategy helps find ideal entry and exit points depending on expert opinions, news announcements, or technical indicators.

-

Average True Range

Average True Range (ATR) helps in identifying how much a currency pair price has fluctuated. This, in turn, helps traders confirm price levels at which they can enter or exit the market and place stop-loss orders according to the market volatility.

-

Moving Average Crossover

The Moving Average Crossover is a valuable tool to find the middle price-point of a trend in forex trading. When currency prices crossover their current moving averages, it helps traders identify the favorable buying or selling points for the currency.

-

What is the Bullish Engulfing Candlestick?

Bullish Engulfing Candlesticks helps in identifying an uptrend reversal in the market. This candlestick pattern stands out because a trader does not need to wait until the entire pattern is completed to enter a trade.

-

How To Trade The Gartley Pattern

The Gartley pattern helps identify price breakouts and signals where the currency pairs are headed. The pattern is also widely used in the forex market to determine strong support and resistance levels.

-

How to Trade Forex With NFP V-Shaped Reversal

A Non Farm Payroll (NFP) V-shaped reversal refers to a sudden increase or decrease in the currency pair prices right after an NFP report is released.

-

Candlestick Patterns: Top Candlestick Charts Every Trader Should Know

Candlestick patterns depict the price movement of assets in a graphical manner. Candlestick patterns also enable traders to predict market behaviour.

-

What is the Evening Star Candlestick Pattern?

Evening Star Candlestick Patterns help traders identify ideal exit levels in the forex market by signalling a slowed upward momentum and strengthened downward momentum.

-

How to Use Ichimoku Cloud in Forex?

The Ichimoku Cloud provides a clear market trend direction to the traders and helps them make market decisions accordingly.

-

Pennants Pattern: How to trade bearish and bullish pennants

Pennant Patterns work as a continuation signal in the forex market and help identify the ideal entry and exit price points

-

How to Trade Forex With Renko Charts

Renko Chart is a technical indicator that provides strong market trend directions by filtering out minor price movements

-

What are Ascending and Descending Triangle Patterns?

The Ascending and Descending Triangle Patterns confirm continued trends in the forex market.

-

How to Identify Cup and Handle Pattern in Forex Trading

The Cup and Handle Pattern is a technical price chart that forms the shape of a Cup and a Handle, which indicates a bullish reversal signal.

-

What is the Head and Shoulders pattern?

The Head and Shoulders pattern is a trend reversal indicator that predicts bullish to bearish and bearish to bullish reversals in the forex market.

-

What is the Hammer Candlestick Pattern?

Hammer Candlesticks enable traders to identify potential market reversal points, determine the ideal time to enter the market and place buy or sell orders accordingly.

-

What is The Opening Range Breakout Strategy

The Opening Range Breakout (ORB) Strategy involves taking forex positions when the currency pair prices break below or above the previous day's high or low

-

Morning Star Indicator

The Morning Star Indicator helps identify strong trend reversals in the forex market and enables you to take trade position entry decisions accordingly.

-

How Does Stochastic Indicator Work in Forex Trading?

Stochastic Indicator helps traders identify overbought and oversold market conditions that substantially lead to market reversals.

-

Favourite Fib Fibonacci Retracement

Fibonacci retracement strategies help traders identify the market's support and resistance levels, trend reversal points, and entry and exit decisions.

-

Multiple Time Frame Analysis in Forex

By monitoring different currency pairs in different time frames, you can make your Forex trades more successful and profitable.

-

What are Bollinger Bands?

The Bollinger bands can help identify overbought and oversold market conditions, protecting you against placing any orders that could lead to losses.

-

Andrew's Pitchfork Trading Strategy

Andrew's Pitchfork is a Forex trading strategy that can predict protracted market swings and help you in identifying potential market trends that can indicate potential exit and entry points.

-

Fibonacci Retracement

Fibonacci retracements are one of the most popular methods for predicting currency prices in the Forex market. Predicting upward or downward market movement can help traders with accurate price analysis for exiting or entering the market.

-

Trading in Volatile Markets

Forex volatility is the measure of how frequently a currency's value changes. A currency either has high volatility or low volatility depending on how much its value deviates from its average value.

-

The ABCD pattern

One of the most classic chart patterns, the Forex ABCD pattern represents the perfect harmony between price and time.

-

The Bearish Gartley Pattern

The Bearish Gartley pattern was introduced in 1935, by H.M. Gartley in his book, “Profits in the Stock Market”. The pattern helps Forex traders in identifying higher probabilities of selling opportunities.

-

The Bullish 3 Drive pattern

The Bullish Three Drive pattern in Forex trading is a rare pattern that gives traders information about the Forex market's potential at its most Bearish point, and in turn, suggests probabilities for a market reversal.

-

What is the MACD Indicator?

The Moving Average Convergence Divergence (MACD) indicator helps traders quickly identify short-term trend directions and reversals in the forex markets. You can use the MACD indicator to determine a currency pair price trend's severity and measure its price's momentum and even identify the bearish and bullish movements in the currency pair prices.

Guide to Forex

Trading indicators.

Enter your details to get a copy of our

free eBook

Start a risk free

demo account

News & Analysis

Catch up on what you might

have missed in the market.