The Bullish Three Drive pattern in Forex trading is a rare pattern that gives traders information about the Forex market’s potential at its most Bearish point, and in turn, suggests probabilities for a market reversal. The pattern also provides excellent risk-reward ratios for the traders to manage their risks efficiently. The Bullish trend triggers buying opportunities and provides traders with favorable entry points in the Forex market.

What is the three drive pattern?

The three-drive pattern is a harmonic formation that tells traders the possibility of the market reversing with a prolonged price trend. It can help identify both buying and selling opportunities for the traders in the market. It is a powerful chart pattern because it covers not only quantitative aspects of a currency’s price movement but also its qualitative outlook. It helps traders understand the competitive advantage of the currencies that they wish to trade in. The pattern recognizes more significant retracements of the currency’s price and outlines projections to ensure that traders place successful trades in the Forex market. It offers an excellent risk and reward ratio for the traders and suggests the market’s potential at its most bearish phase. By this, we mean that it contains a higher probability for market reversal when the currency prices move against the trader’s will.

What is the Bullish Three Drive pattern

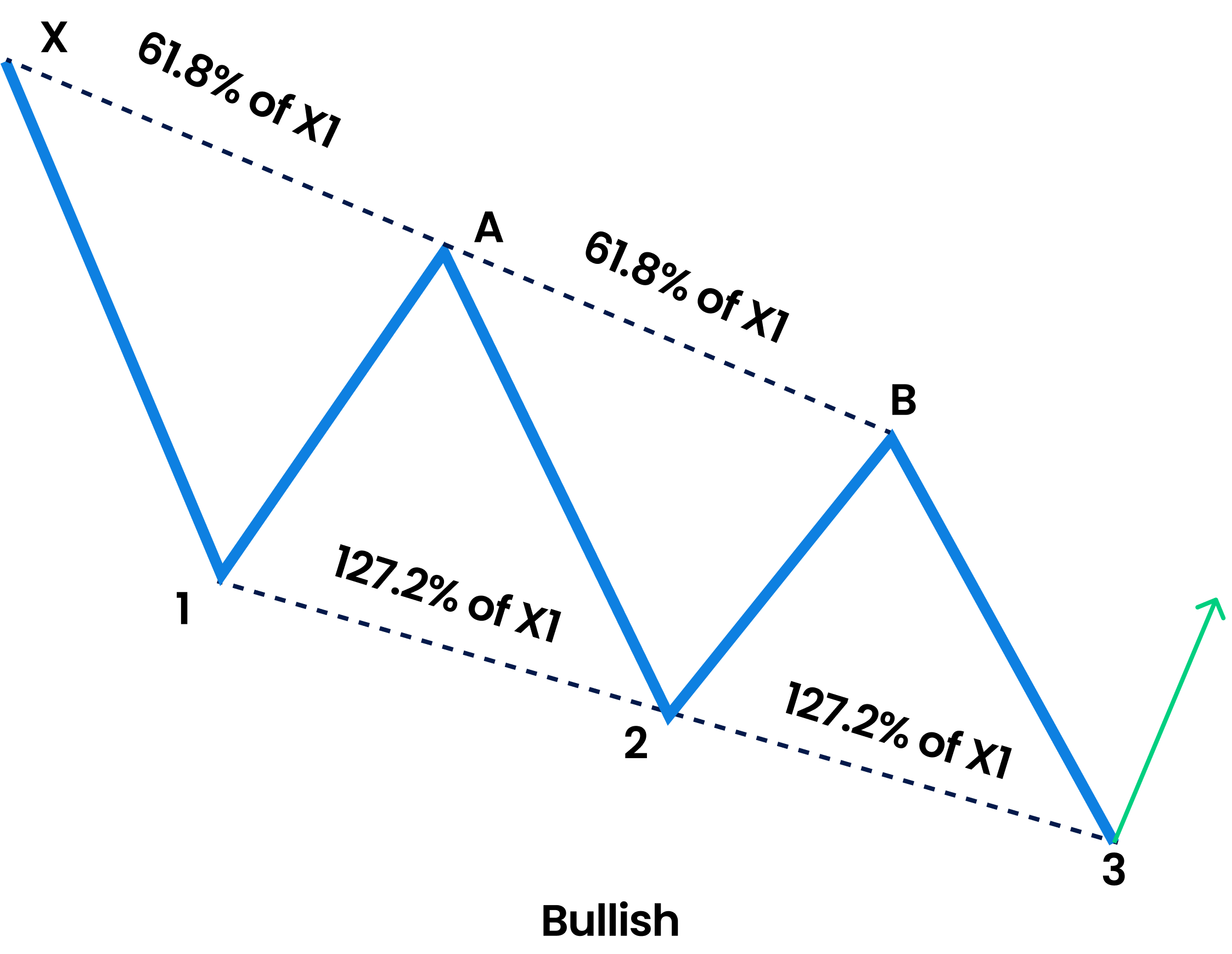

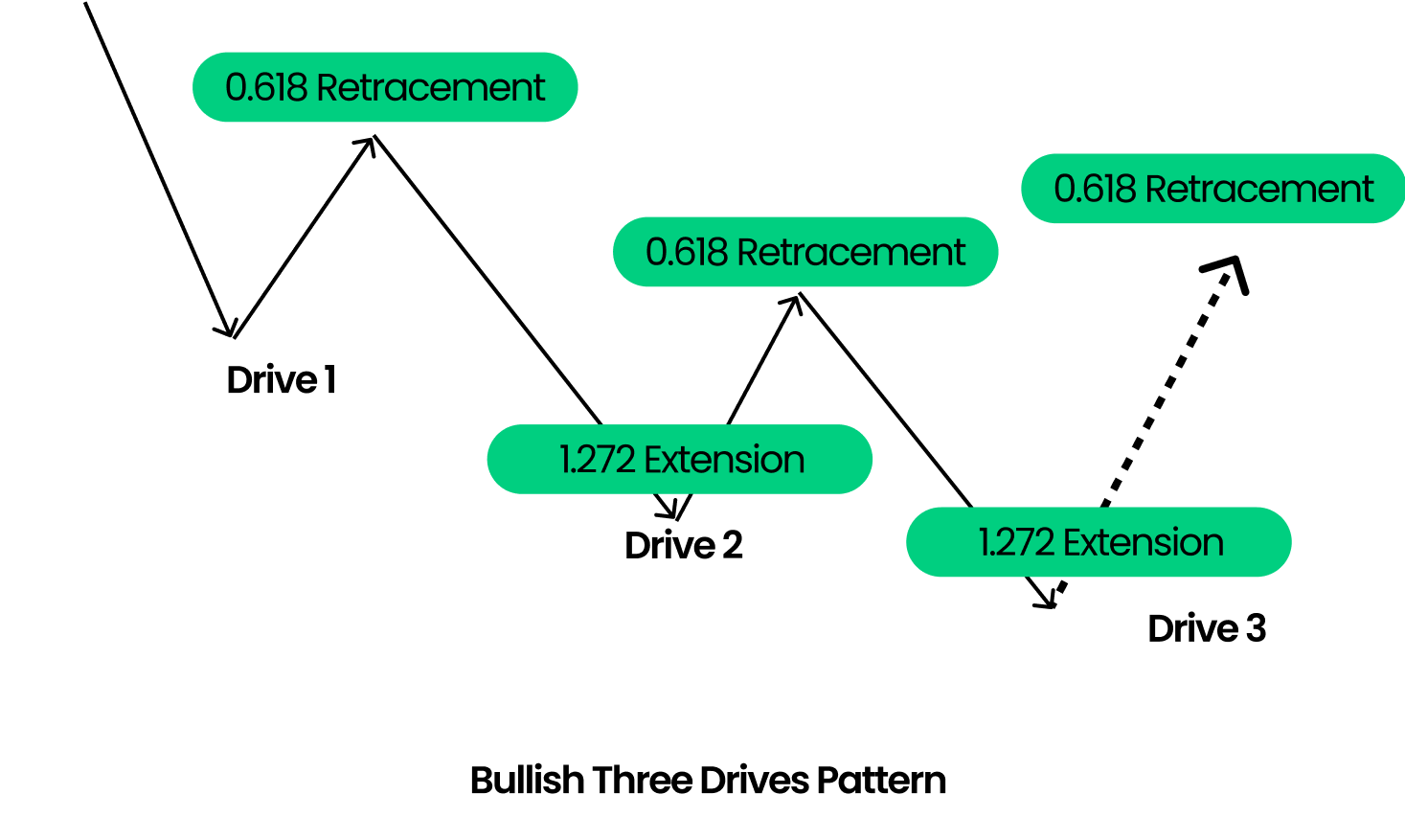

The Bullish Three Drive pattern is used to identify the best buying opportunities in the Forex market for traders. As the name suggests, the Bullish Three Drive pattern has three pushes in the upward direction. It begins with the first move being a bearish swing. The push is followed by a higher retracement to 61.8% level of the first move, giving a point A. The price then turns lower and moves to the second push/drive, completing into 1.27% extension of the first move. After that, the price then goes higher again. It goes to the 61.5% retracement of the second push and gives us point B. The last and final push is a lower one, with the price trading and falling to 1.27% extension of the second push, giving the third push that completes the pattern. At the final point, this zone is called the buying zone for the traders. It is a comparatively rare pattern that considers symmetry as a basis and is formed by two connecting Bullish ABCD patterns followed by a Bullish butterfly pattern. A close cousin of the Bullish Three Drive pattern is the Bullish ABCD pattern, which can also be called the two drive pattern because of how it appears with only two price swings. However, prices reverse more after three moves. Hence, the Bullish Three Drive pattern is considered more precise when we talk about market reversals.

Recognizing the Three Drive pattern

The Three Drive pattern can be formed either at the top of a rally or the bottom of a substantial decline. Since it is a reversal pattern, it always emerges after a strong trend is already established. The Bullish Three Drive pattern is formed by a series of three consecutive higher highs. Each of these highs is measured through the Fibonacci retracement and extension levels. The appropriate levels used in a Three Drive pattern are 0.618% retracement and 1.272% Fibonacci extension.

Recognizing the Three Drive pattern

Traders use the Gartley pattern to highlight support and resistance levels in the Forex market. At the support level, the prices stop falling, and at the resistance level, the prices stop increasing. The pattern provides a broad overview of where the currency prices will go in the long term, giving the traders the right direction to trade-in.

How to draw a Gartley pattern

The Three Drive pattern rules –

- Point A should always be a 61.8% or 0.618 retracement of the first drive.

- Point B should be the same level of retracement as mentioned above of the second drive.

- The second drive should always be an extension of 1.272 or 127.2% of point A.

- The third drive should always be an extension of the same level as mentioned above, point B.

The image attached below shows the graphical view of the three drive pattern and its required Fibonacci retracement and extension points.

Traditionally, a trader can exit or enter the market by closing the trade at the 61.8% retracement level of the entire pattern. Another way they can do it is by setting two targets. The first target in a Bullish three drive trend can be the low swing seen at the start of the pattern. The second target is the low swing seen at the beginning of the second drive. These two targets offer the best combination of winning rate and a favorable risk-reward ratio that enable traders to maximize their profits and minimize their risks.

Trading the Three Drive pattern

A trader can formulate a fully functional trading strategy using a Three Drive pattern. The model can be applied to the Forex market, including an entry mechanism, a confirmation zone, and the risk containment element, also known as stop loss. Identifying an established trend is the first step in a trading setup with the three drive pattern. The Relative Strength Index is essentially incorporated, and a reading of 70 or above is required during a Bullish three drive pattern. This validates an overbought market condition. Once this is confirmed, the trader can execute their entry in the final stages of the last drive or the third price swing. A limit order entry is placed at 127.2% of the Fibonacci extension level.

Placing stop loss

Immediately place a stop order as the buy order is executed. The stop loss is set at 161% Fibonacci extension level of the third drive. This acts as a hidden resistance in an uptrend and provides support following the pattern in the downtrend.

Taking profit

To take a profit, however, the first point is at the start of drive three. The final profit is taken at the beginning of drive two. With this, a trader has a completely functioning trading strategy backed by the three drive pattern.

How can the Three Drive pattern help traders?

The Three Drive pattern depends both on price and time. However, since it is a rare trend to occur, traders should not force themselves to identify it. If the traders do not see it in a chart, it is simply best not to trade it at all. It tells the traders about the market reversal, which occurs after the completion of the third drive. However, some conservative traders look for more confirmation about the price reversal. The targets can be set according to their wish but are generally best suited when placed beyond the last retracement level, as shown by the three drive pattern. The pattern’s non-availability results into a continuation in the previously dominant movement, implying that if the market has been continuously falling, it is more likely that the prices will keep declining. On the other hand, if the prices have previously been increasing, and there is no three drive pattern in the chart, more chances are that the prices will keep on increasing.

Final words

The Three Drive pattern uses chart patterns and technical retracement levels, enabling traders to understand market reversals and benefit from the same. Since it is a rare emerging pattern, it can be easily spotted if it exists in the chart. Blueberry. is a Forex trading platform that makes the entire process as easy as clicking a few buttons. Whether you are a seasoned trader or a beginner in the Forex world, you are bound to make successful traders with our help.

Disclaimer:

- All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. Traders should carefully consider their objectives, financial situation, needs, and level of experience before entering into any margined transactions.