8 Top Commodity Trading Strategies

Commodity trading is one of the best ways to diversify your portfolio and protect yourself from losses incurred due to inflation. It helps traders take advantage of markets even in volatile conditions. It also allows traders to hedge risk in the Stock market as Commodity prices generally move against it. So, if a particular Stock starts to fall, you can purchase more of the Commodity related to that Stock to potentially make up for your losses.

What is Commodity trading?

Commodity trading is the selling and buying of commodities traded worldwide. The most common Commodities for day traders are gold, oil, natural gas, and copper. While Commodities can be traded in their physical form, they are more popularly traded as Stocks, Futures, Options, ETFs, and CFDs. Commodity trading allows you to make profits through price fluctuations in the market. Fluctuations happen due to a number of factors like demand and supply, seasonal changes, and the global economic state.

Top commodity trading strategies

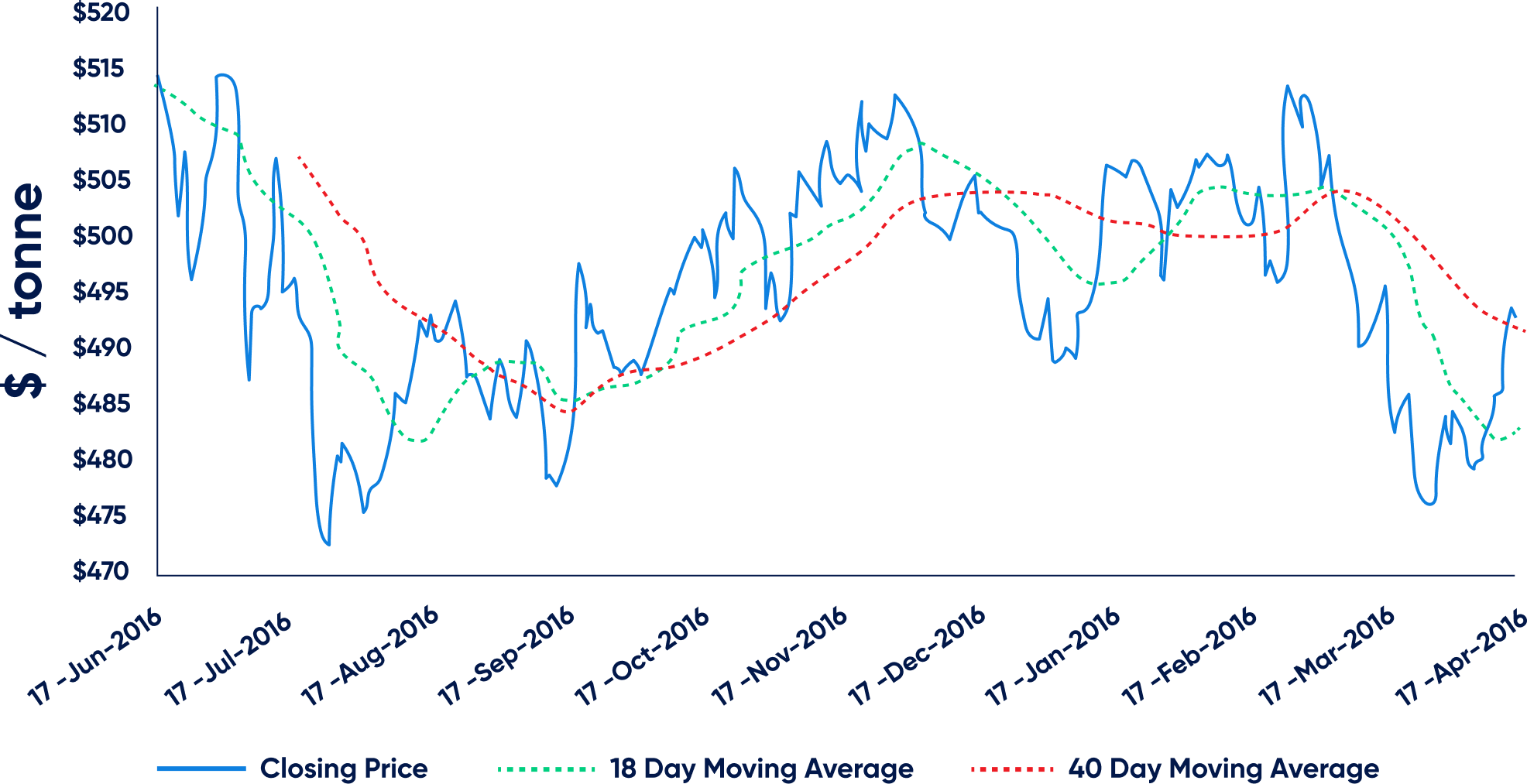

1. Moving averages for commodity

Using moving averages is one of the most common strategies for Commodity trading. It is a technical indicator that takes an asset’s average price for a specific period while smoothing out irrelevant prices by taking an average price. The average is calculated by taking the Commodity’s prices over a specific time, adding them up, then dividing them by the time frame. The average price helps you identify the market trend and place trades accordingly. It also identifies ideal entry and exit points by telling you how near the open and close price of a commodity is to its average price.

2. Range trading

Range trading involves trading within a sideways market at which you can buy and sell a Commodity over a period. Most traders buy more of the Commodity at the support level and sell at resistance level. A commodity’s price only fluctuates dramatically when its global demand and supply increases or decreases. Since range trading provides us with a support and resistance price, the commodity prices between this range fluctuate very little, providing traders a stable zone to trade and making it easier for them to identify market entry and exit points.

3. Fundamental trading

Fundamental trading involves trading Commodity-specific or economic events to determine its prices. For example, if the demand for Oil increases in Canada, the price would also increase. This causes traders to take advantage and go long in the market. Fundamental trading is based on trading the news and quantitative and qualitative factors of a particular commodity.

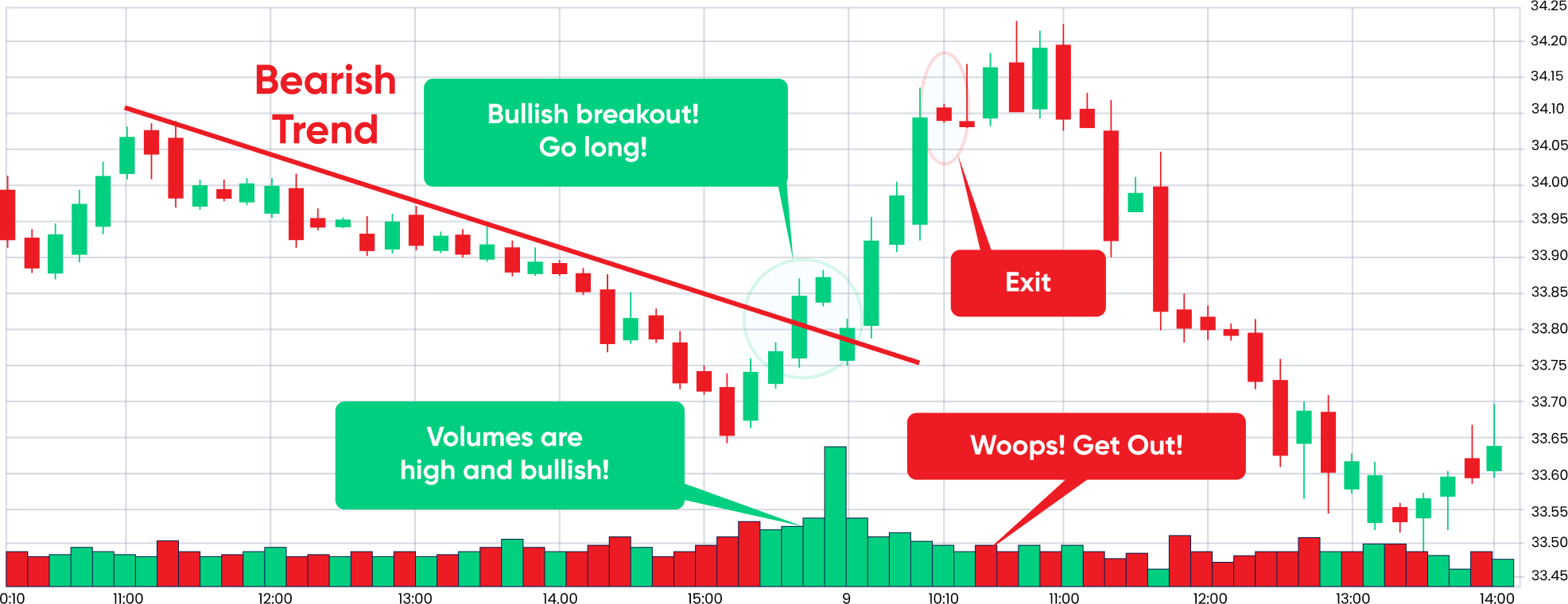

4. Breakout trading

Breakout trading involves traders taking early positions in a commodity’s fluctuating price. It offers traders a potential opportunity as soon as its price goes beyond the resistance level or falls below the support level. By making moves at the early stages of a trend, most traders benefit from major price movements when the market moves in their favour.

- Most breakout traders take a long position when the Commodity price crosses over the highest value of its price range.

- Alternatively, they take the short position if it falls below the lowest value.

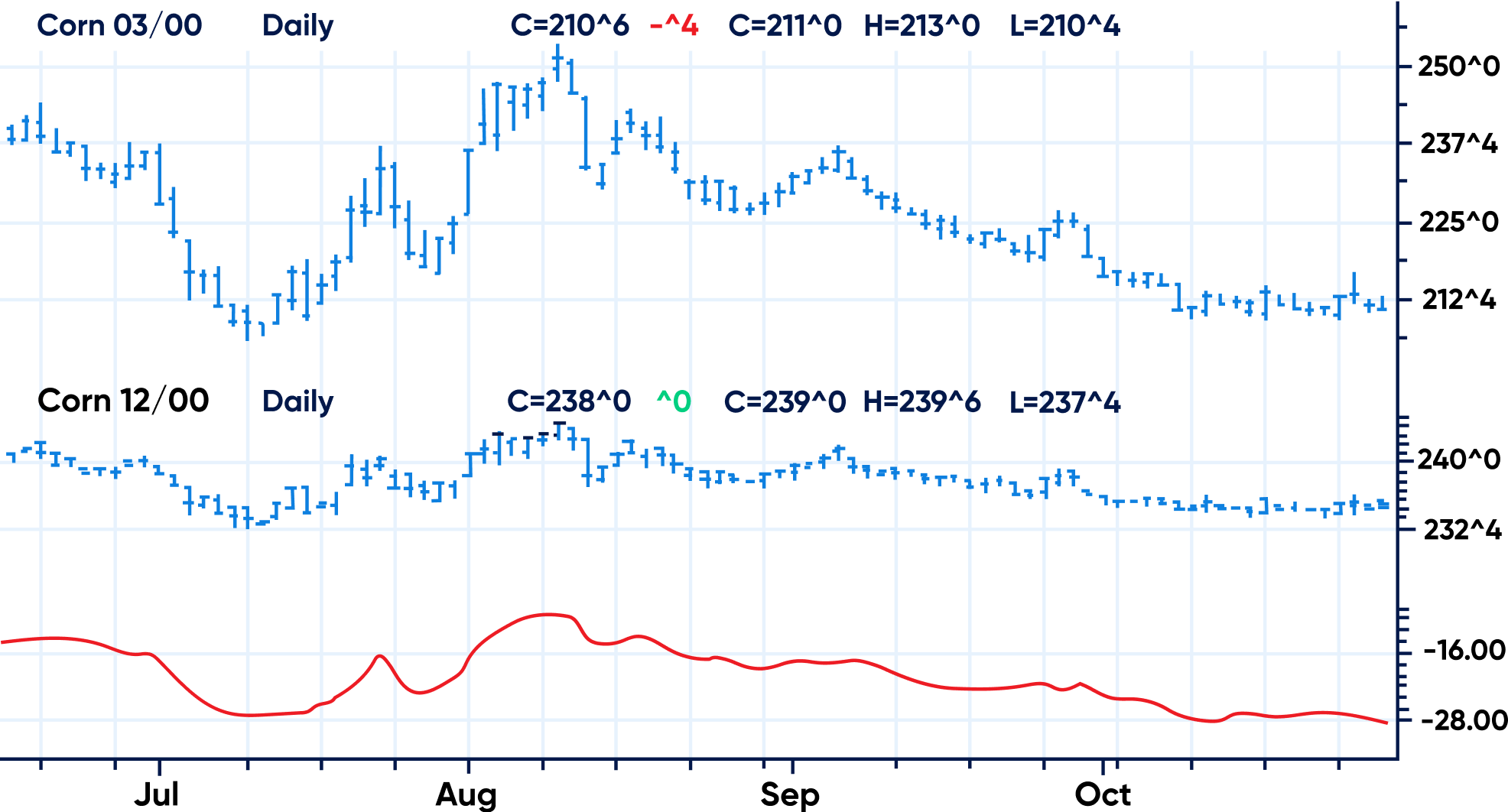

5. Commodity spread trading strategy

You can also trade Commodities by trading their spreads.This strategy involves buying a particular Commodity and selling a similar one simultaneously to earn profits from its spread or the difference in prices. For example, you can buy a Future of a raw commodity when its prices are low and sell the Futures of a finished product as soon as the prices are high, which could reap you profits.

6. Specialising in a single Commodity

Instead of trading multiple Commodities, you can specialise in just one. For example, you can choose Gold to trade as a single Commodity and keep a close eye on its fluctuating prices, place trades accordingly, and profit from the same. When you trade a single Commodity, it gives you more time to analyse it in-depth. It also provides you with better trading prospects by allowing you to focus on just one prime Commodity.

7. Position trading

Position trading allows you to hold a trade for a long time, like months or even years, to benefit from long-term price movements. Position traders ignore all short-term price movements and only rely on fundamental aspects of the market and long-term trends.

8. Season trading

Season traders benefit from the seasonal patterns of a Commodity by taking long and short trade positions. For example, the winter season is best known for wheat worldwide and it is generally harvested in the spring season. Traders holding wheat in the Commodities market can hold larger positions as the spring season approaches as it is expected to rise due to a surge in demand.

Start Commodity trading with Blueberry Markets

Most traders hold positions in the Commodities market through CFDs, Futures, and Options as it allows them to trade without

investing the entire trade value. Blueberry Market allows you to trade Oil and Metal Commodities via CFDs on their industry-level platform.

Sign up for a live account on Blueberry Markets to start your trading journey.

Recommended Topics

-

Top Pivot Point Strategies

Pivot point analysis can predict not only price movements but also help time entries and exits correctly to develop a risk management strategy.

-

How to Use The Bill Williams Indicator

Bill Williams Indicator is helpful in analysing trending markets, reversals and momentum.

-

How to Use Relative Vigor Index in Forex

The Relative Vigor Index (RVI) is a technical analysis indicator that helps measure a trend’s strength in forex trading.

-

Technical Trading Strategies for Day Traders

Technical trading strategies for day traders include technical analysis tools to identify short-term trading opportunities in the market.

-

How to Use The Force Index Indicator in Forex?

The Force Index indicator combines the currency pair’s price and volume to determine the power of bulls and bears in the market.

-

The Ultimate Guide to Trading Trends in Forex

Trading trends in forex provides you with opportunities to identify the strong market direction and enter an order accordingly.

-

MT5 Indicators Every Trader Should Know

MT5 is a forex and stock trading platform that enables traders to place automatic orders.

-

What is Volume Trading Strategy

Volume trading in forex is all about trading currency pairs with high buying or selling pressure.

-

Top Low Spread Scalping Strategies For Forex Traders

Scalping strategies allow traders to leverage on the small price changes in the forex market to turn the trends in their favour.

-

What is Forex Currency Swap?

Forex currency swap helps reduce foreign borrowing costs and mitigate exchange rate risks.

-

What is Forex Spot Trading

With forex spot trading, one can make significant short-term profits by trading at prevailing prices.

-

How to Short Sell a Currency

Short selling enables traders to place lucrative forex orders even in a falling market.

-

How to Use The Chaikin Money Flow Indicator

The Chaikin Money Flow indicator provides future market direction by analysing the strength of the market trend and underlying buying or selling pressures.

-

What is Momentum Trading? Top Momentum Trading Strategies

Momentum trading leverages market volatility to the trader’s advantage by identifying the strength of the market’s current trend.

-

How to Trade With VWAP Indicator in Forex

The Volume Weighted Average Price (VWAP) helps eliminate any unwanted price fluctuations during the trading period.

-

5 Top ADX Trading Strategies

The Average Directional Movement Index (ADX) strategy measures the forex market’s overall strength.

-

How to Identify a Trend in the Forex Market

Identifying market trends in forex is also helpful in understanding if your trading strategy is going as per plan and where you can improve.

-

Forex Trading Robots: How Do They Work?

Forex trading robots make multitasking possible by processing multiple conditions like order entries/exits and entering stop loss orders automatically.

-

What Are Momentum Indicators in Forex

Momentum indicators measure how strong the price change is in the currency pairs.

-

How to Use Gator Oscillator For Forex Trading

Gator Oscillator helps in identifying a trending or consolidating market.

-

What is The Exponential Moving Average

Exponential Moving Average (EMA) helps in understanding the market’s trend direction.

-

Top Forex Volatility Indicators

Forex volatility defines the risk an investor takes in the market. The higher the volatility, the greater the risk and the higher the potential returns.

-

How to Use Forex Market Sentiment Indicators

Sentiment indicators in the forex market indicate extremely volatile market conditions.

-

How to Use The Hanging Man Candlestick Pattern For Forex Trading

The Hanging Man Candlestick pattern provides downtrend reversal signals, which helps traders place sell or short orders to profit off falling markets.

-

How to Add MT4 Indicators

MetaTrader 4 comes with several built-in and custom indicators to boost your trading strategy.

-

Top MACD Trading Strategies

Moving Average Convergence Divergence (MACD) strategies enable traders to measure market momentum and trend strength.

-

Top Indicators for MT4

MT4 indicators help analyse forecasted currency pair prices and place exit or entry orders accordingly.

-

How to Trade Bullish and Bearish Divergences

Bullish and bearish divergences enable you to trade market reversals.

-

Top Support and Resistance Indicators

Support and Resistance indicators identify price points on the forex chart where the markets can potentially reverse.

-

What is The Donchian Channel Indicator

The Donchian Channel indicator can determine volatility and potential breakout signals in the market.

-

How to Install MT4: A Beginner's Guide

MetaTrader 4 (MT4) is a powerful forex trading platform with a user-friendly interface and advanced analytical tools for automating trading.

-

What are Trendlines in Forex Trading?

Trendlines in forex provide clear market signals for placing long or short orders.

-

Market Order vs Limit Order

Market and Limit orders help execute automatic trading transactions, as per your trading preferences.

-

Bearish and Bullish Markets

In the trading world, it is essential to be aware of the bull and bear market trends because they define the direction of the market

-

How to Read Trading Charts

Trading forex live charts can help identify ongoing market trends, which can help you place successful traders.

-

Top Reversal Patterns For Forex Trading

Reversal patterns provide traders with price levels at which the market can potentially reverse.

-

How to Find The Best Forex Trading Signals

Forex trading signals are important market triggers that provide traders with ideal entry and exit price levels in the market.

-

Top Forex Trading Strategies That Actually Work

Trading in forex, you will come across several forex trading strategies -- some more complex than the others. It is immensely crucial to start forex trading with the right strategy.

-

Scalping vs Swing Trading: What’s the Difference?

Every forex trader has a different purpose, objective, time constraints, and investment capital. The right forex trading style for you depends on your main trading goals and requirements.

-

What are Volume Indicators

Volume in the forex market can be used to determine the upcoming market trends. Volume indicators are forex trading indicators that can identify if the volume for a particular currency pair is high or low, providing traders with market continuation and reversal signals

-

Shooting Star Candlestick Pattern

The Shooting Star Candlestick Pattern can identify bearish market reversals and provide traders with ideal price levels to short or exit the trade.

-

Top Trading Chart Patterns

Predicting future currency pair prices help in confirming market continuation and reversal signals.

-

What is Slippage in Forex Trading?

Slippages occur when a currency pair order is executed at a price different from the set market order price.

-

Buy limit vs Sell Stop Orders in Forex

Placing buy limit and sell stop orders help employ a price control strategy on forex trades. Let's take a look at buy limit vs sell stop orders.

-

The Best Time Frame For Forex Trading

A time frame is a designated time period where forex trading takes place. Time frames can be measured in minutes, hours, days, weeks, months and years.

-

Top Technical Indicators in Forex

Technical indicators are a market direction signal based on the current and historical price movement of a currency pair that provides traders with future price expectations

-

Top Continuation Patterns

A continuation pattern indicates if the current market trend is going to continue in the same direction or not

-

How to Ace Divergence Trading in Forex

The forex market is all about timing your trades well. Divergences give traders a market reversal signal right before a price trend changes

-

How To Trade Forex With Japanese Candlesticks?

A Japanese Candlestick is a technical analysis tool used to analyze the currency pair’s price movement in the forex market.

-

Top Momentum Indicators To Analyse Trend Strength

Momentum indicators are technical analysis tools that determine in which direction the market is headed and how strong or weak the ongoing trend is

-

Types of Moving Averages Every Trader Should Know

Moving Average is a technical indicator which averages out currency pair prices in a specific time period in order to accurately identify market trend reversals and support-resistance levels.

-

8 Popular Intraday Trading Indicators

Intraday Trading Indicators help place successful short-term trade orders in the forex market.

-

What is the Tweezer Candlestick Formation?

The Tweezer Candlestick formation is a reversal pattern that indicates either a market top (strong uptrend) or market bottom (strong downtrend)

-

Average Directional Index

The ADX is a strength indicator that measures how strong or weak a particular market trend is.

-

How to Use Elliott Wave Theory For Forex Trading?

The Elliott Wave Theory analyses a currency pair’s long-term price movement in the forex market.

-

What are Pivot Points in Forex

Pivot Points help traders identify market reversals. With Pivot Points, traders can predict the support and resistance levels of a currency pair to make entry and exit decisions.

-

Keltner Channel

Keltner Channel is a technical indicator that provides traders with strong continuation signals and trend directions by assessing a currency pair's price volatility.

-

Leading vs Lagging Indicators

Leading and lagging indicators help traders measure the future and current performance of a currency pair, respectively. These indicators can help make successful trading decisions.

-

What is Relative Strength Index?

Relative Strength Index (RSI) helps traders understand how frequently the currency pair prices change in the forex market to predict the future market prices.

-

Wide Ranging Bars

Wide Ranging Bars are strong momentum indicators that help traders understand the market direction and identify ideal entry and exit points.

-

Harmonic Price Patterns in Forex

Harmonic Price Patterns allow traders to predict future price movements and trend reversals to make ideal entry and exit decisions in the Forex market.

-

Double tops and bottoms

Double Tops and Double Bottoms chart patterns help traders identify solid bullish and bearish trend reversals in the Forex market, and in turn, find the ideal market entry and exit points.

-

Falling and Rising Wedges

When you are trading currency pairs in the Forex market, it is essential to know when the market can possibly reverse. The Falling and Rising Wedges pattern help identify market reversal signals and accurate market entry and exit points.

-

Forex Scalping Strategy

Scalping refers to trading currency pairs in the Forex market based on real-time analysis. With Forex scalping, you hold a position for a very short period and close once you see a profit opportunity.

-

Symmetrical Triangle Pattern

Symmetrical Triangle Patterns help identify market breakdowns (price fall) and breakouts (price rise), and in turn, help you plot the entry and exit prices for profitable Forex trading.

-

Introduction to Technical Analysis in Forex

Technical analysis in Forex trading provides you with significant market trends, reversals and fluctuations and in turn helps you long and short term trades.

-

Trading breakouts and fakeouts

Breakout and fakeout trading enable traders to take positions in rising and falling markets.

-

Fundamental Analysis in Forex Trading Explained

Fundamental analysis in Forex trading is one of the several methods you can use to determine the relative security and intrinsic value of a nation’s currency.

-

What is a Doji Candlestick?

The Doji Candlestick is a pattern used in technical analyses of trend reversals in a market.

-

Moving Average: The Complete Guide

Moving Average is used in Forex trading to compare the current currency pair pricing and where it stands with respect to the current average pair prices.

-

What is Volatility Index (VIX) and How Do You Trade It?

One of the most popular trading markets in the world, the foreign exchange market allows investors to make quick money by trading currencies.

-

Forex Profit Calculator

On average, a Forex trader can make anywhere between 5 to 15% of the initial amount they invested in the market.

-

Understanding markets gaps and slippage

The foreign exchange rate reveals valuable details about particular currencies a trader wishes to trade-in.

-

What is a pip in forex?

When trading in the Forex market, you need to have a close eye on two currencies at the same time. PIP helps you denote the change in a currency pair’s value.

-

Introduction to Order Types in Forex

Forex has different order types which allow traders to automate entering and exiting positions.

-

Using orders to manage risk

Forex risk management includes a robust set of rules and regulations that protect you against Forex's negative impacts.

-

Managing risk in 7 steps

Risk management in Forex is essential to individuals, groups of individuals, and organizations since it enables them to implement measures that help mitigate Forex risk and its negative impact.

-

Bullish and Bearish Flag Patterns

Blueberry Markets discusses why it is essential to study the bullish and bearish flag patterns in Forex. Learn more.

Advanced

Master risk management and

become an expert forex trader.

Move on to the advanced course.

Guide to Forex

Trading indicators.

Enter your details to get a copy of our

free eBook

Start a risk free

demo account

News & Analysis

Catch up on what you might

have missed in the market.