With Contract For Difference (CFD) trading, forex traders can open successful trade orders in both rising and falling markets. It allows them to open large positions by depositing a small percentage of the total investment through leveraged trading.

In our article, we take a look at the ultimate CFD day trading and its strategy.

What is CFD day trading?

CFD day trading is a short-term trading strategy that enables traders to enter and exit a forex trade in a single trading day. The goal is to profit from small price movements, which, when added together, become significant profits. By trading via CFDs (Contract for Differences), you do not take ownership of the currency pair but trade via a contract through the difference in the forex price (price at the time of opening the contract – price at the time of closing it).

For example, if you want to speculate on EUR/USD via CFDs during the day, you will buy a CFD contract at the current exchange rate. Assuming the current exchange rate is 1, and you buy 100 units of the currency pair at a margin of 5%, you will be investing 5% of 100*1 = $5 in opening a position worth $100. Now, if the exchange rate moves to 1.2, you will make a profit of 5% of 0.2 on every unit = 5%*0.2*100= 1, which is double of your investment by a movement of only $0.2.

Tips to trade CFDs

- Before you start trading CFDs, understand how they work in a day trading market and incur losses or earn profits

- Build a trading plan that aligns with CFD day trading only and stick to it throughout the trading process

- Analyze the market on a daily basis to employ the CFD day trading strategy. Every single minor price movement counts

- Understand the total position size of your trade as you will only be investing some percentage of the same every day

- Start small with CFD trading and enter/exit the market on a daily basis. Open bigger positions as and when you have had the hang of the market

- Place stop and limit orders before the trading day ends in your CFD trading strategy as a risk management plan

- Always have sufficient capital in your trading account so that you are able to cover the cost of the trade as the trading day ends

- Do not add to a losing CFD trading. If the markets are falling, rather open a short position than to add onto the existing long positions

Technical indicators to use with CFD day trading

Moving Averages

You can analyze the forex market by using the Moving Averages and identify entry and exit levels for CFD day trading. Moving Averages depict if the market is in an uptrend or downtrend. When the current currency pair prices are closer to the average price of the currency pair, it indicates that the market is going to continue in the existing direction. In this case, you can open a CFD long position during an uptrend and a short position during a downtrend.

RSI

Relative Strength Index (RSI) identifies overbought and oversold market conditions. It oscillates between 0 to 100. A value above 80 indicates an overbought market and signals traders to place short CFD orders due to a bearish reversal expectation. When it gives values below 20, it indicates an oversold market and signals traders to place long orders due to a bullish reversal expectation.

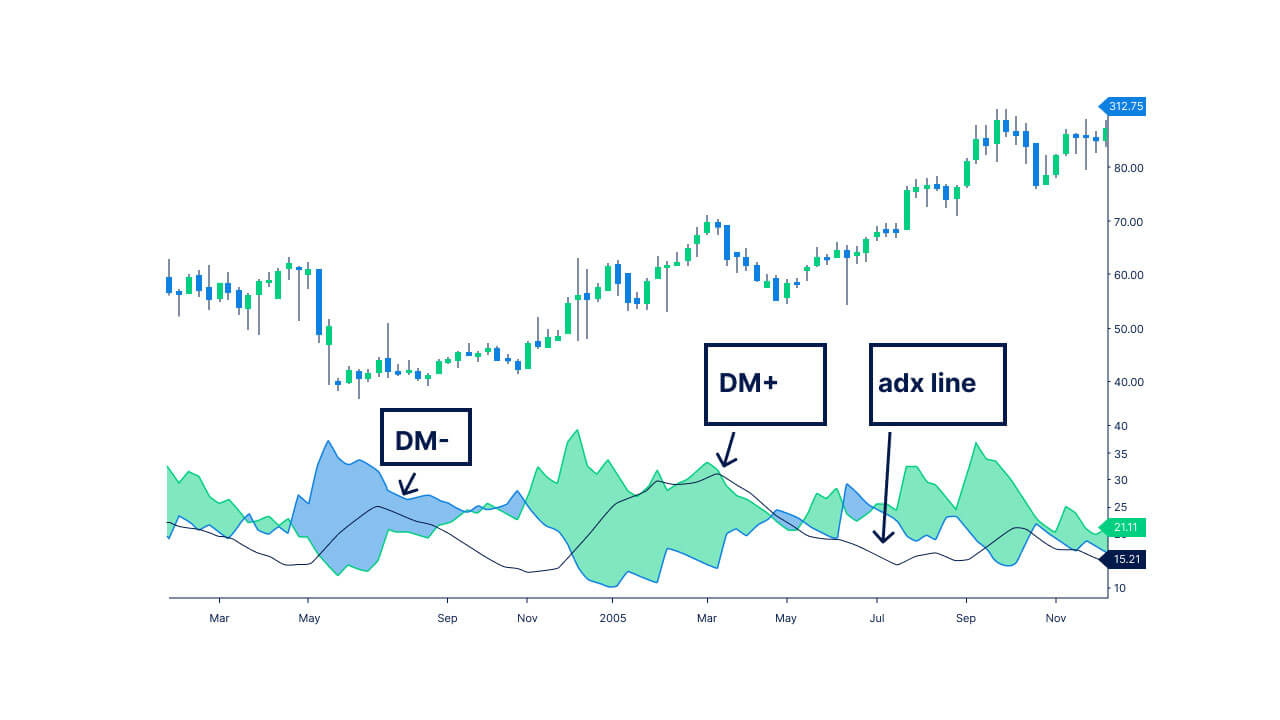

ADX

The Average Directional Index (ADX) indicator determines the market strength and momentum during the day. It oscillates between 0 and 100 as well. As soon as the ADX line rises above the 40 levels, it indicates a strong trend momentum. In this situation, traders open long CFD orders during an uptrend and short CFD orders during a downtrend.

On the other hand, when the ADX signals a value below 20, it indicates a weak trend in the market and an expected reversal, which is when you should open long CFD positions during a downtrend.

How to start day trading CFD

- Open a CFD trading account and deposit the minimum amount required to start trading with a CFD

- Analyse the market from a CFD perspective and choose the currency pairs you want to trade

- Build a CFD strategy where you will mention where to take long and short positions, maximum risk, margin levels and more

- Place your first CFD order

- Monitor the market throughout the day and place more orders accordingly

- Exit the CFD order before the trading day ends and profit from the minor price fluctuations

Place your first forex CFD order today

When you place a forex order via a CFD, you are able to get access to the currency pairs at a much lower cost. Start trading with the online CFD trading platform in Australia, Blueberry, and get commodities, metals, and cryptocurrency CFDs.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.