Setting a trailing stop-loss on MT5 allows traders to manage risk by automatically adjusting the stop-loss level. As the trade moves in the trader's favor, the stop-loss locks in gains while minimizing potential losses. A trailing stop-loss allows traders to remove emotional biases, capture trends, and stick to their trading plan without constant monitoring.

Let’s take a look at how to set a trailing stop loss in MT5.

Stepwise guide to set trailing stop-loss on MT5

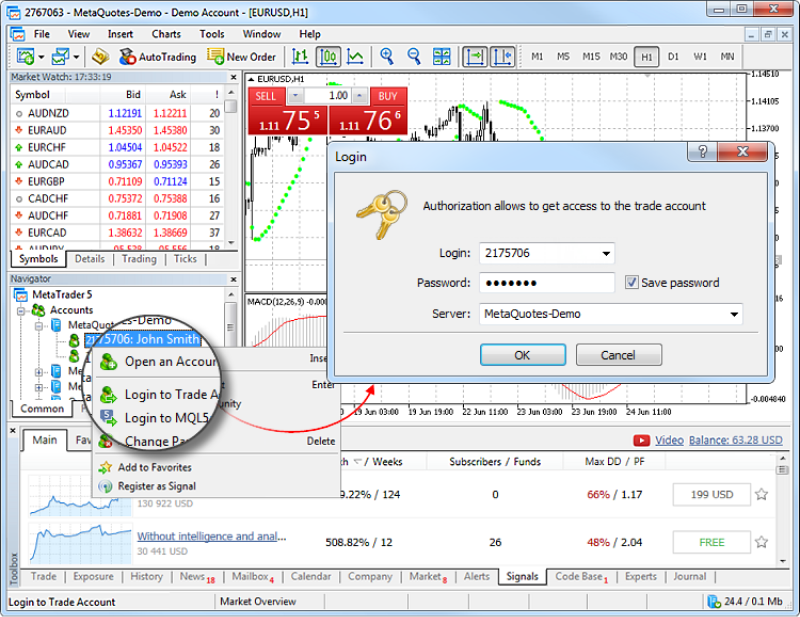

1. Log into the MT5 platform

Launch the MetaTrader 5 (MT5) platform on the computer or mobile device and enter login credentials to access the trading account.

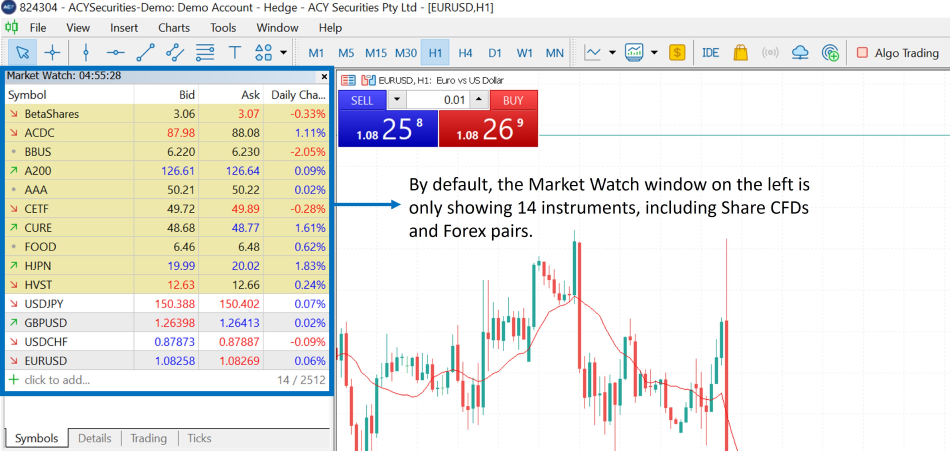

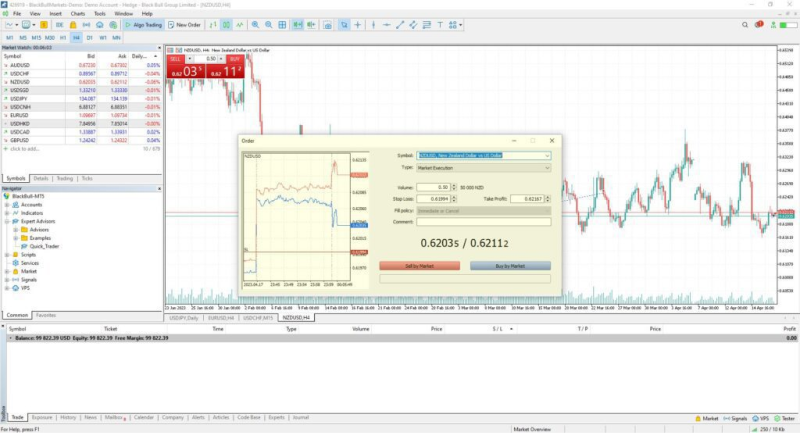

2. Access desired instrument's chart

Navigate to the chart of the financial instrument for which the trader wants to set a trailing stop-loss. Traders can do this by searching for the instrument in the Market Watch window or selecting it from their favorite instruments.

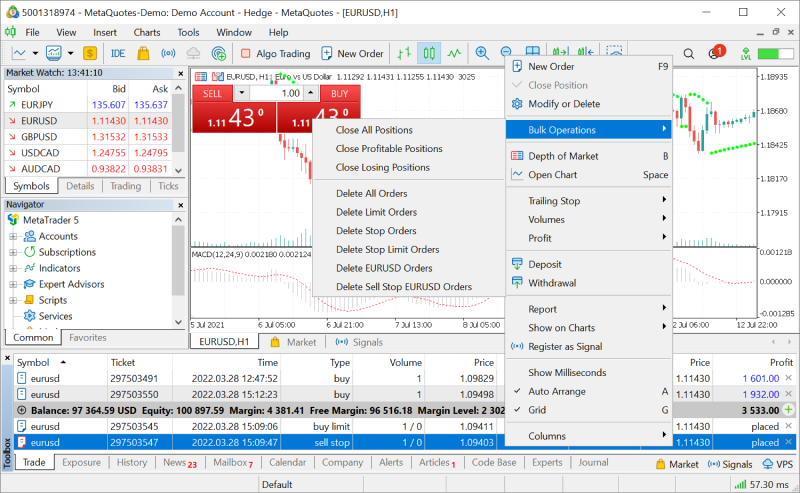

3. Right-click to open context menu

Once the trader has located the desired instrument's chart, right-click anywhere on the chart to open the context menu. The context menu appears when one right-clicks on the platform. It provides options for trading, chart customization, and technical analysis tools.

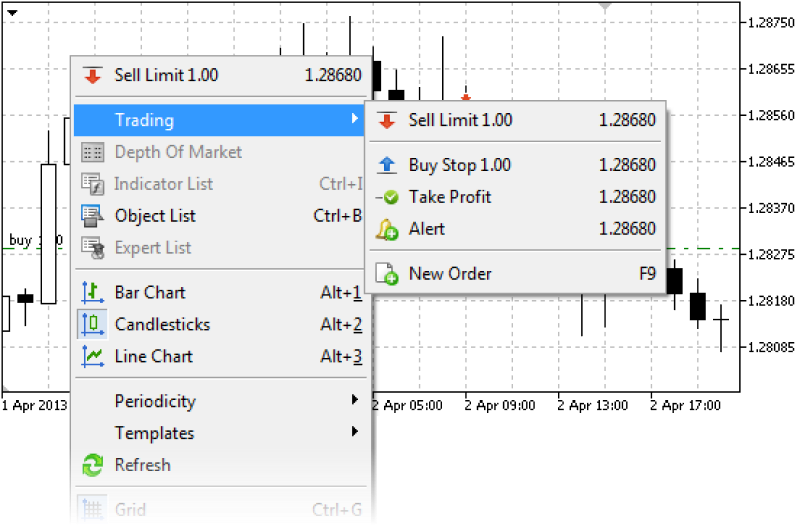

4. Select ‘Trading’ from menu

In the context menu, hover over or click the Trading option to reveal additional trading-related actions such as placing new orders, modifying existing orders, and accessing trading-related tools and functions.

5. Choose ‘New Order’

Select the New Order option from the Trading submenu. It will open a new order window where traders can enter the details of their trade.

6. Enter trade details

In the new order window, specify the trade volume (lot size) and select the order type (market or pending order) according to the trading strategy.

7. Specify stop loss level

In the new order window, locate the Stop Loss field and enter the desired stop-loss level. This is the price at which the trader wants their trade to be automatically closed if the market moves against them.

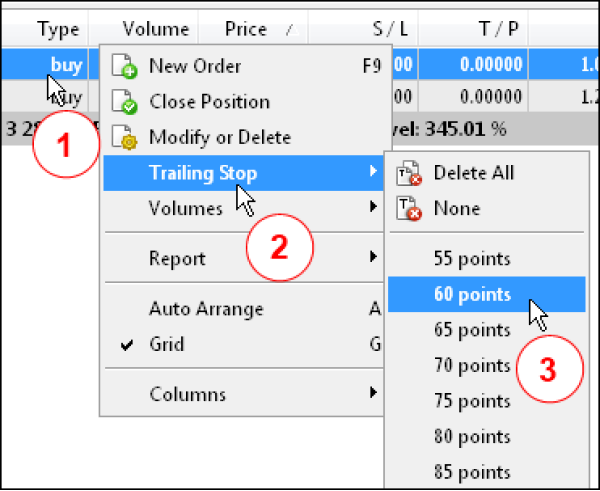

8. Activate trailing stop option

Below the Stop Loss field, the trader will find an option to enable the trailing stop feature. To activate this feature, check the box next to Trailing Stop.

9. Set trailing stop distance

Once the trader has enabled the trailing stop option, specify the distance (in pips) at which they want the trailing stop to trail the market price. This distance determines how far the trailing stop will be from the current market price.

10. Confirm settings

Review the trade details, including the trailing stop-loss parameters, to ensure they are correct.

11. Execute trade

Once the trader is satisfied with the trade details and trailing stop-loss settings, click the Buy or Sell button (depending on the trade direction) to execute the trade and set the trailing stop-loss.

Top 4 tips to set trailing stop loss on MT5

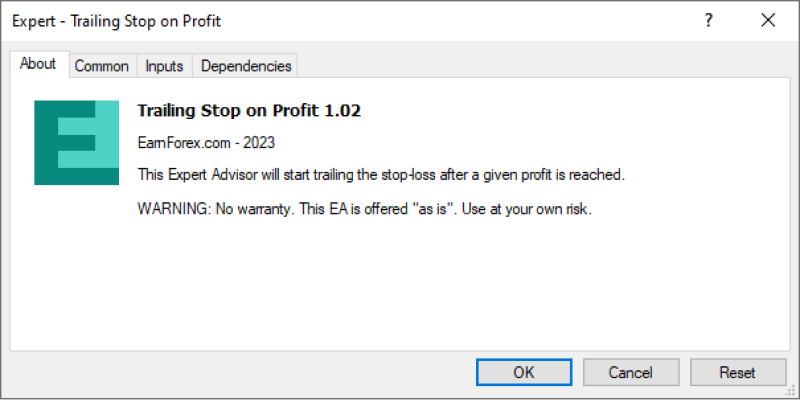

Custom trailing stop indicators

With MT5, traders can create and install custom indicators, including those for trailing stops. By utilizing or developing custom trailing stop indicators aligned with their trading strategies, users can access real-time feedback on optimal trailing stop levels. These indicators consider market conditions, technical analysis, and specific trading rules, enabling traders to set effective trailing stop-loss levels.

Use ATR indicator

Average True Range (ATR) as an indicator is a reliable measure of market volatility, offering insights into the current market conditions. By incorporating the ATR indicator into trailing stop strategies, traders can set trailing stop distances proportional to the prevailing level of volatility. For instance, traders may set the trailing stop distance as a multiple of the ATR value, facilitating adjustment to changing volatility levels and enhancing risk management practices.

Employ Breakout confirmation

Breakout confirmation is a trigger for trailing stop adjustments because it validates the strength of the prevailing trend. Traders may wait for a breakout above significant resistance levels before tightening trailing stops on long positions. This strategic approach validates the trend's strength, mitigating the risk of premature stop-outs during periods of heightened price volatility and uncertainty.

Implement partial trailing stops

Partial trailing stops are recommended to manage risk and incrementally secure gains. Rather than adjusting the stop-loss level, traders can modify only a portion of the position's stop-loss level as the trade progresses favorably. This tactic allows traders to lock in gains gradually while providing the remaining portion of the position with the opportunity to capture additional gains.

How to create a custom trailing stop-loss indicator on MT5?

- Open MetaEditor, the integrated development environment (IDE) in MT5.

- In MetaEditor, navigate to File > New > Indicator to create a new custom indicator file.

- Define indicator properties such as calculation method and display settings.

- Implement trailing stop logic from tracking price highs/lows and calculating stop distances based on user-defined parameters such as ATR or a fixed percentage.

- Include code to handle indicator initialization, such as initializing variables and setting up buffers for storing indicator values.

- Draw trailing stop levels on the price chart using graphical objects.

- Compile the indicator in MetaEditor to check for errors and generate the .ex5 file.

- Test the indicator on historical price data to ensure accuracy.

- Deploy the indicator by copying the .ex5 file to the ‘Indicators’ folder in the MT5 directory.

- Apply the custom indicator to price charts in MT5 via the ‘Navigator’ panel for usage.

Navigating the forex markets with trailing stop losses

Integrating trailing stop-loss settings into MT5 orders enables traders to adapt to market movements, minimize emotional biases, and maximize trading discipline. By capitalizing on opportunities while effectively managing risk, traders can enhance their trading efficiency with trailing stops.

FAQs

We’re here to help you every step of your trading journey. Here are some answers to the more frequent questions we get asked.

What is a trailing stop-loss in MT5?

A trailing stop-loss in MT5 automatically adjusts the stop-loss level as the market price moves in your favor, locking in profits while minimizing potential losses.

How do I set a trailing stop-loss in MT5?

To set a trailing stop-loss in MT5, right-click on the chart, select Trading, choose New Order, input your trade details, and activate the trailing stop by setting the distance in pips.

Why should traders use a trailing stop-loss?

A trailing stop-loss helps traders manage risk, reduce emotional decision-making, and lock in profits as the market moves in their favor, all while maintaining discipline without needing constant monitoring.

What is the difference between a stop-loss and a trailing stop-loss?

A stop-loss is a fixed level to close a trade at a predetermined loss, whereas a trailing stop-loss adjusts dynamically as the price moves in favor of the trade, securing profits along the way.

Can I use custom trailing stop-loss indicators in MT5?

Yes, MT5 allows for custom trailing stop-loss indicators, which can be tailored to fit specific trading strategies, improving risk management.

How does the ATR indicator help in setting trailing stop-loss levels?

The ATR (Average True Range) indicator measures market volatility, helping traders set trailing stop-loss levels based on current market conditions for better risk management.

What are partial trailing stops, and how do they work?

Partial trailing stops enable traders to adjust the stop-loss level for a portion of their position, locking in gains on part of the trade while allowing the rest to potentially capture more profits.

How can traders implement breakout confirmation with trailing stop-loss?

Traders can adjust their trailing stop-loss after confirming a breakout above resistance or below support levels, minimizing the risk of being stopped out prematurely during volatile market conditions.

Can I set a trailing stop-loss on mobile MT5?

Yes, MT5’s mobile platform supports trailing stop-losses. You can set it by selecting the instrument, entering the New Order menu, and enabling the trailing stop option.

How do I create a custom trailing stop-loss indicator in MT5?

To create a custom trailing stop-loss indicator in MT5, use the MetaEditor to define the necessary properties, implement the stop-loss logic, and test it for accuracy before applying it to your charts.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.