Accurate trade placements let traders capitalize on fleeting market movements, maximizing their trading potential. MT5 grants traders full control over their strategy execution and enables them to place trades at different price levels.

Let’s delve into the step-by-step process of placing a trade on MT5.

Stepwise guide to placing a trade on MT5

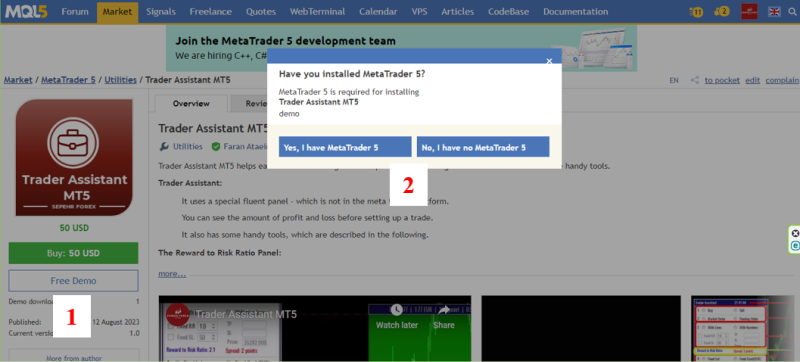

Download MT5

Begin by downloading the MetaTrader 5 platform from a trusted source. Traders can find the official download link on the chosen broker's website.

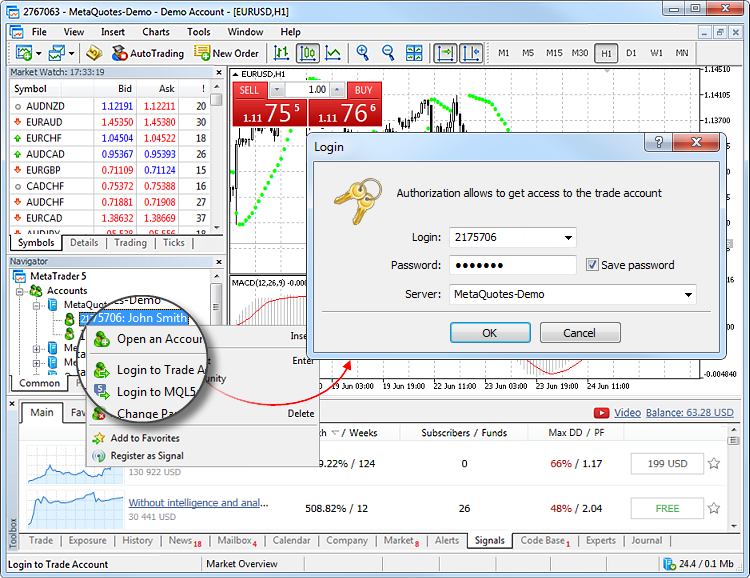

Create or login to the account

Once the installation is complete, open the MT5 platform. If the trader already has an account with a broker, log in using the credentials. If not, they must create a new account with a broker that supports MetaTrader 5.

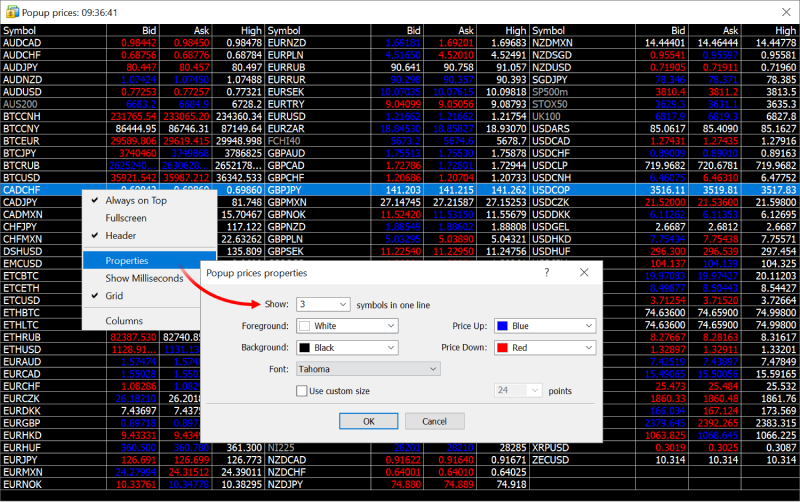

Set up workspace

Upon logging in, the trader is presented with the MT5 workspace. Traders can customize the workspace layout according to their preferences, arranging charts, market watchlists, and other tools to suit their trading style.

Choose the trading instrument

In the Market Watch window, traders can see a list of available trading instruments such as currency pairs, stocks, commodities, and indices. Right-click within this window and select Show All to display all available instruments. Choose the instrument you want to trade by double-clicking on it. This action adds the instrument to the Market Watchlist.

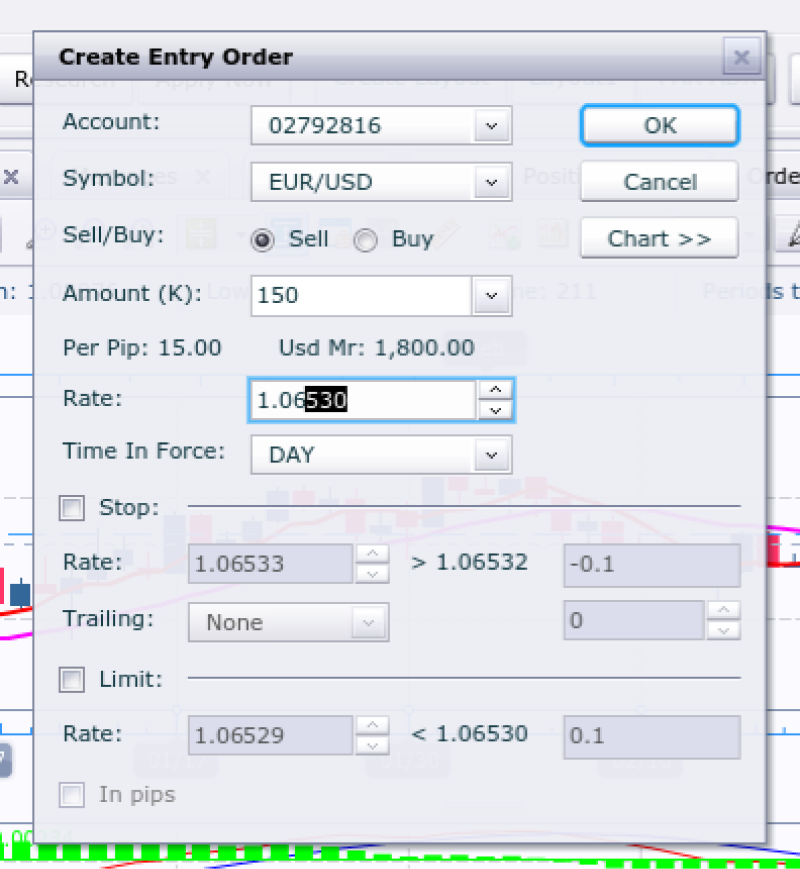

Open a new order

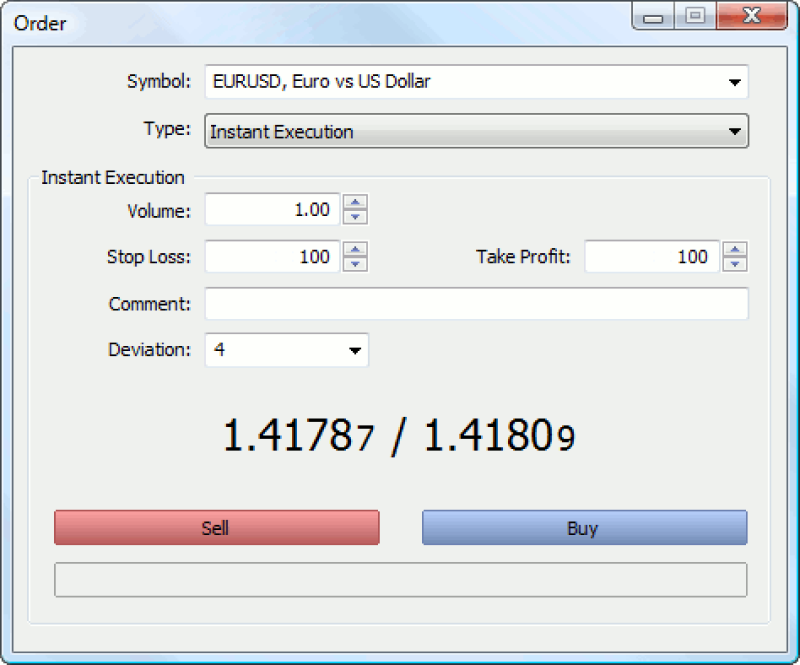

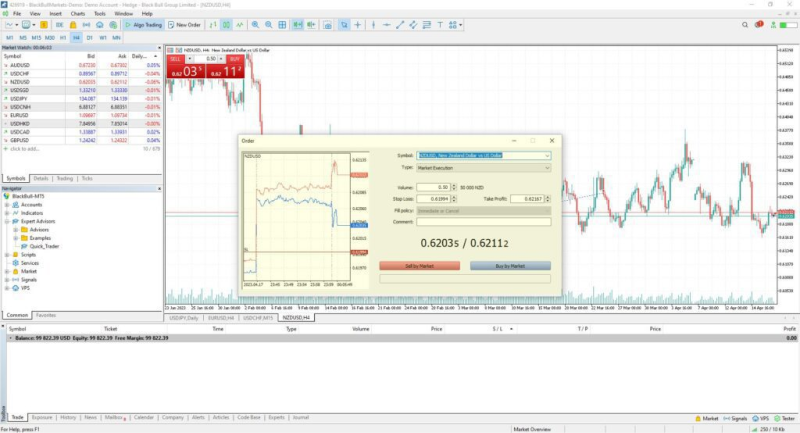

To open a new order, traders can either click the New Order button in the toolbar or right-click on the desired instrument in the Market Watch window and select New Order.

Customize the trade

In the New Order window, traders will see various parameters that need to be configured:

1- Choose the trade volume (lot size) one wishes to trade.

2- Select the order type (market order, pending order, etc.).

3- Set the stop loss and take-profit levels if desired.

4- Specify any additional parameters, such as order expiration.

5- Review and confirm the trade details before proceeding.

Execute the trade

Once the trader has configured the trade according to their preferences, click on the Buy or Sell button to execute the trade.

If the trader is placing a pending order, specify the conditions under which the order should be triggered.

Monitor the trade

After executing the trade, traders can monitor its progress in the Trade tab of the Terminal window. Here, they can also see information such as the trade's current status, entry price, stop loss and take-profit levels, and gain/loss.

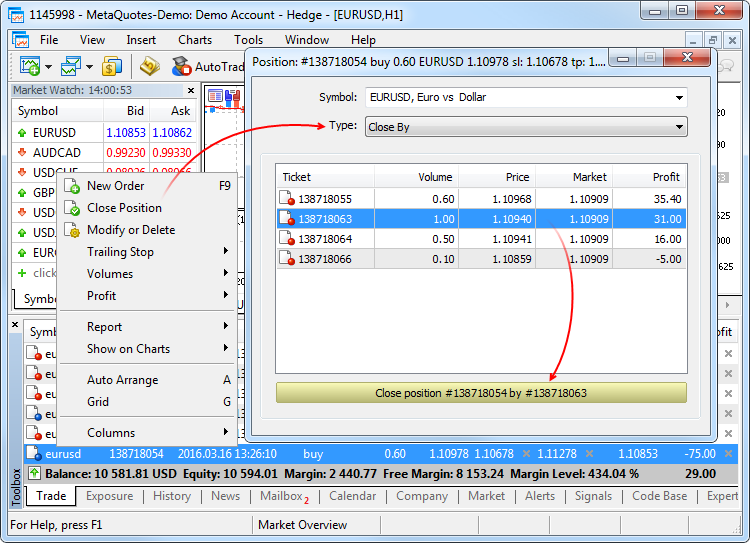

Modify or close the trade

If necessary, traders can modify the trade by adjusting the stop loss, take-profit, or other parameters. To make changes, right-click on the trade in the Trade tab and select Modify or Delete Order.

To close the trade, right-click on it and choose Close Order.

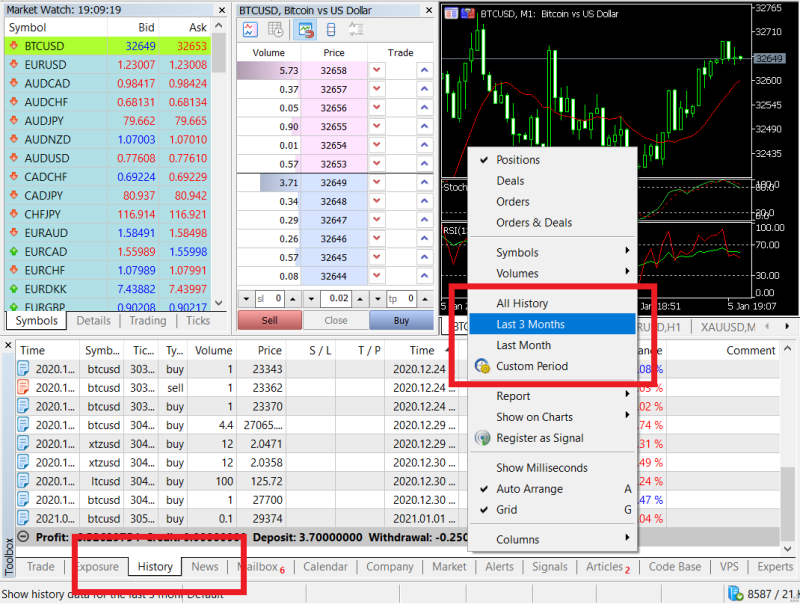

Review trading history

To review trading history, navigate to the Account History tab in the Terminal window.

Here, traders will find a record of all their trades, including entry and exit times, trade duration, and gain/loss.

Advantages and risks of placing a trade on MT5

Advantages

- One-click trading: MT5 provides a one-click trading feature, allowing users to execute trades quickly without navigating through multiple screens or confirmation dialogs. This can be helpful for active traders who need to enter or exit positions quickly.

- Multiple order types: MT5 supports various order types, including market orders, limit orders, and stop orders. This flexibility enables traders to implement various trading strategies and manage their positions.

- Real-time price quotes: MT5 provides access to real-time price quotes from multiple financial markets, including forex, stocks, commodities, and indices. Access to up-to-date market data allows traders to make informed decisions and react promptly to changes in market conditions.

Risks

- Technical glitches: Like any software platform, MT5 is susceptible to technical glitches or malfunctions. These glitches can potentially disrupt trading operations, leading to missed opportunities or unintended trades. Traders should be prepared to encounter occasional technical issues and have contingency plans to mitigate their impact.

- Execution speed: The speed at which trades are executed on MT5 can vary depending on several factors, including internet connection speed, server latency, and market volatility. Slow execution speed may result in delays or slippage, which can affect trade gains, especially in fast-moving markets.

- Slippage: Slippage occurs when the execution price of a trade differs from the price at which it was requested. While slippage can occur on any trading platform, it may be more pronounced during high volatility or low liquidity periods when prices are rapidly changing. Traders should know the potential for slippage and consider implementing risk management techniques, such as using limit orders or setting price boundaries.

Balancing trade opportunities with caution on MT5

The MT5 trading platform is suitable for both novice and experienced traders due to its basic to advanced charting capabilities and easy execution process. However, while MT5 has several advantages, such as swift execution and market access, it also entails risks, such as technical glitches and execution speed variability. Therefore, traders must exercise caution and implement risk management strategies when utilizing MT5, leveraging its strengths to capitalize on opportunities while mitigating potential pitfalls.

FAQs

We’re here to help you every step of your trading journey. Here are some answers to the more frequent questions we get asked.

What is MetaTrader 5 (MT5)?

MetaTrader 5 is a trading platform that provides tools for market analysis, trade execution, and access to financial markets through customizable layouts.

How do I download MT5?

MT5 can be downloaded from Blueberry's official website or the MetaQuotes website. Always ensure you use a trusted source for the installation process.

How do I create or log in to an MT5 account?

After installing MT5, you can log in with your broker credentials or create a new account by registering with a broker that supports the platform.

How can I set up my workspace on MT5?

Once logged in, you can personalize the workspace by arranging charts, watchlists, and tools according to your preferences.

What trading instruments are accessible on MT5?

MT5 offers a variety of instruments, including forex, stocks, commodities, and indices. These can be explored using the Market Watch window.

How do I open a trade on MT5?

To open a trade, click the New Order button in the toolbar or right-click an instrument in the Market Watch window and select New Order.

What order types are available on MT5?

MT5 supports order types such as market orders, pending orders (limit and stop orders), and trailing stops, providing flexibility for various trading approaches.

How do I monitor or modify trades on MT5?

Trades can be monitored in the Trade tab of the Terminal window. Modify or close orders by right-clicking the trade and selecting the desired option.

What are the potential risks of trading on MT5?

Risks include slippage, technical issues, and variable execution speeds, which may be influenced by market volatility, internet connectivity, or server performance.

What features does MT5 offer traders?

MT5 includes tools like one-click trading, multiple order types, real-time price quotes, advanced charting, and access to a wide range of financial instruments.

How do I close a trade on MT5?

To close a trade, right-click the trade in the Trade tab and select Close Order.

Can I view my trading history on MT5?

Yes, past trades, including details like entry and exit points, durations, and results, can be reviewed in the Account History tab of the Terminal window.

How can I manage risks when trading on MT5?

Use tools like stop-loss orders, limit orders, and proper position sizing. Additionally, ensure familiarity with the platform and maintain a stable internet connection.

Is MT5 user-friendly for beginners?

MT5 offers an intuitive interface an a range of tools that cater to both beginners and experienced traders.

How can I address slippage when using MT5?

To reduce slippage, consider trading during high-liquidity periods, using limit orders, and setting price parameters for trade execution.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.