Changing time frames on MetaTrader 5 (MT5) allows traders to access various time intervals, from minutes to months. The platform offers customizable indicators and drawing tools that adjust with the selected time frame, increasing precision in technical analysis.

In this article, we will learn how to change time frames on MT5.

How many time frames are available on MT5?

MetaTrader 5 (MT5) offers various time frames for analyzing price data and trading. In total, MT5 provides 21 different time frames, ranging from one minute (M1) to hourly, daily, and one month (MN1) time frames.

Advantages and risks of changing multiple time frames on MT5

Advantages

- Improved entry and exit timing: Analyzing multiple time frames enables traders to identify optimal entry and exit points more accurately. By aligning signals from different time frames, traders can enhance the timing of their trades, potentially maximizing gains and minimizing losses.

- Confirmation of trends: Examining price action across various time frames provides confirmation of trends. When trends align across multiple time frames, traders gain more confidence in their analysis and are better equipped to ride sustained market movements.

- Reduced noise and false signals: Higher time frames help filter out market noise and false signals commonly found in lower time frames. By focusing on longer-term trends and significant price movements, traders can avoid getting trapped by short-term fluctuations and make more informed trading decisions.

- Better market perspective: Viewing price action across different time frames offers a comprehensive perspective of market dynamics. Traders gain insights into the broader trend, key support and resistance levels, and potential areas of interest. This broader view helps traders make well-rounded decisions and adapt their strategies to changing market conditions.

Risks

- Risk of analysis paralysis: Analyzing too many time frames can overwhelm traders with information, leading to analysis paralysis. Traders may struggle to make decisions due to conflicting signals or an excess of information, ultimately hindering their ability to execute trades effectively.

- Conflicting signals: Different time frames may produce conflicting signals, creating further confusion for traders. While one time frame may suggest a bullish trend, another might indicate a bearish reversal. Traders must carefully assess and reconcile these conflicting signals to avoid making impulsive or contradictory trading decisions.

- Delayed decision-making: Constantly switching between time frames can result in delayed decision-making. Traders may spend too much time analyzing multiple time frames, causing them to miss timely trading opportunities or react too slowly to changing market conditions. This delay can lead to missed gain potential or increased losses.

- Increased trading costs: Frequent changes in time frames may lead to overtrading and increased transaction costs. Each trade incurs transaction fees, spreads, and potential slippage, adding up over time and erode gains. Traders should be mindful of their trading frequency and ensure that the advantages of analyzing multiple time frames outweigh the associated costs.

Stepwise guide to change time frames on MT5

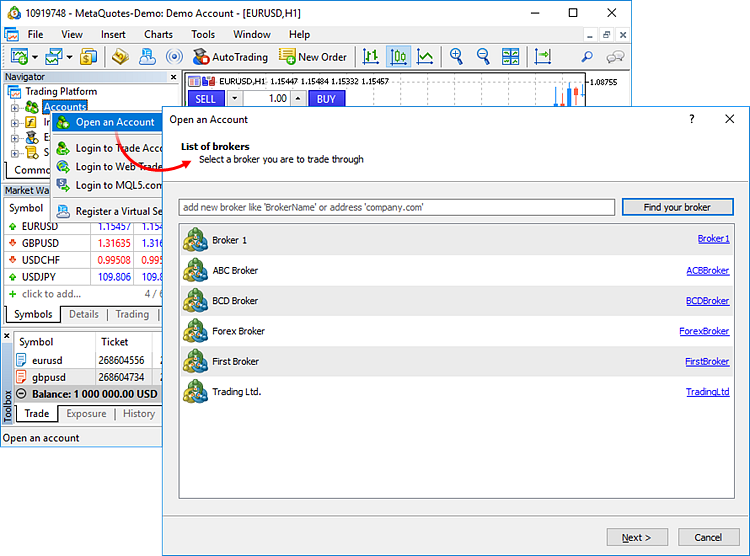

1. Open MetaTrader 5 platform

Launch the MetaTrader 5 platform on the computer by double-clicking its icon on the desktop or from the installed applications list.

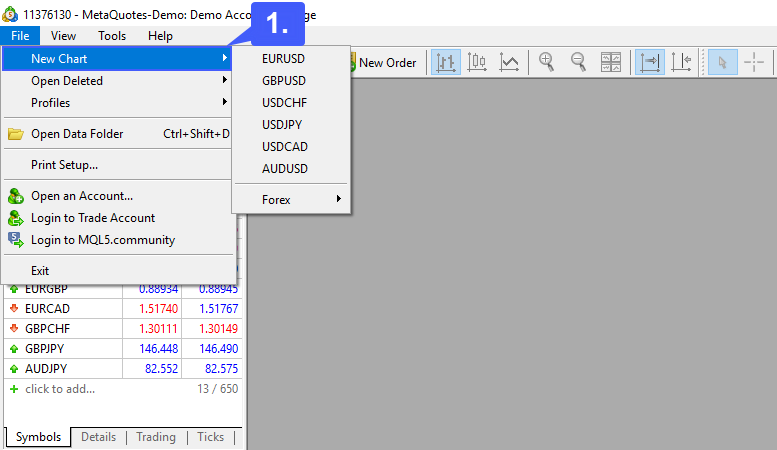

2. Select chart

Navigate to the desired currency pair or financial instrument by clicking on its symbol in the market watch window or searching for it in the symbols window.

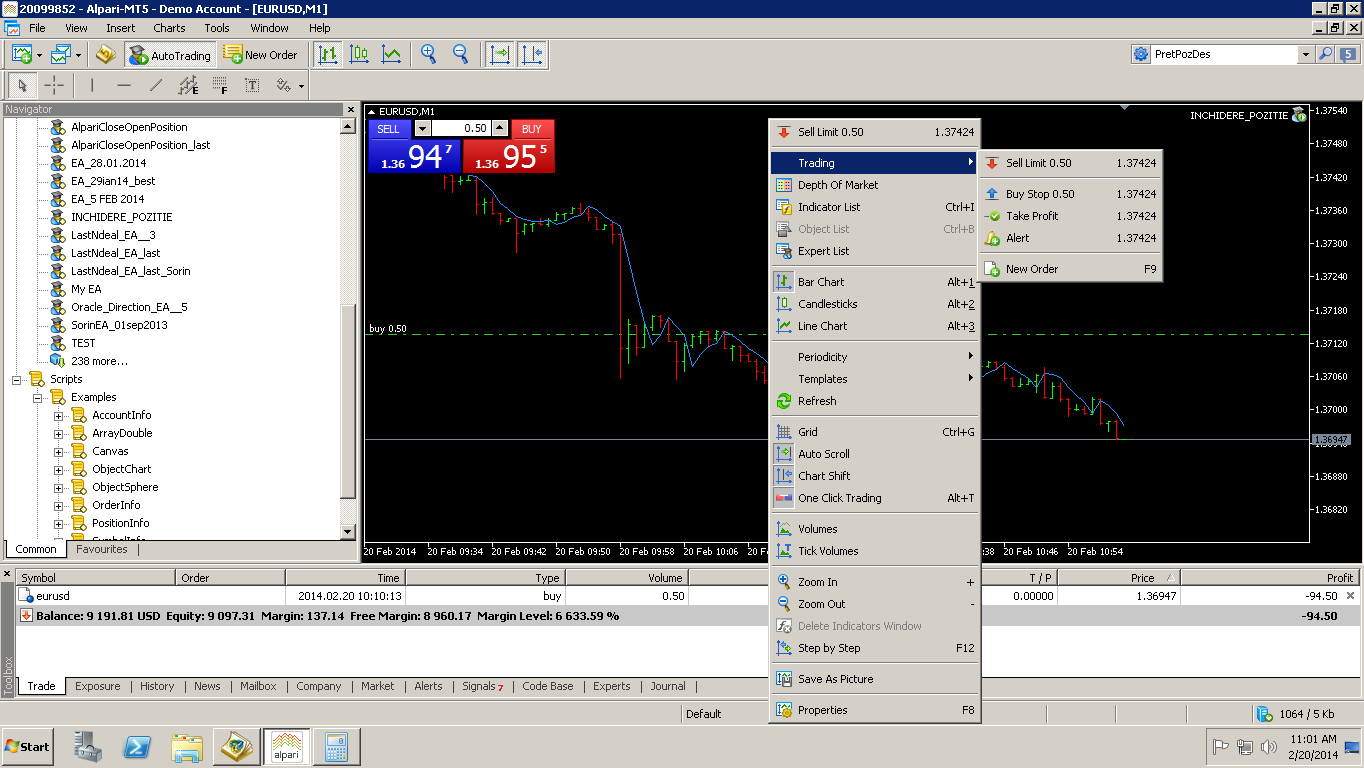

3. Access context menu

Right-click anywhere on the chart to access the context menu. Alternatively, traders can click the Charts tab in the top menu and select Properties to access the chart properties window.

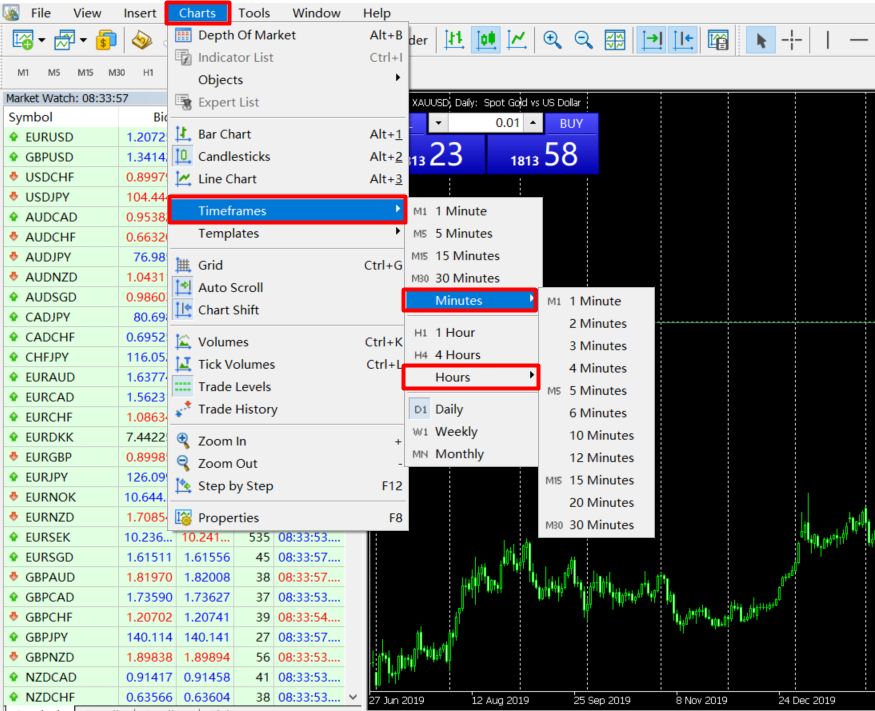

4. Choose time frames

From the context menu, hover over the time frames option to reveal a list of available time frames. Timeframes are categorized into different groups, such as minutes, hours, days, etc.

5. Click desired time frame

Click on the desired time frame from the list. For example, select hourly if the trader wants to switch to the 1-hour time frame (H1).

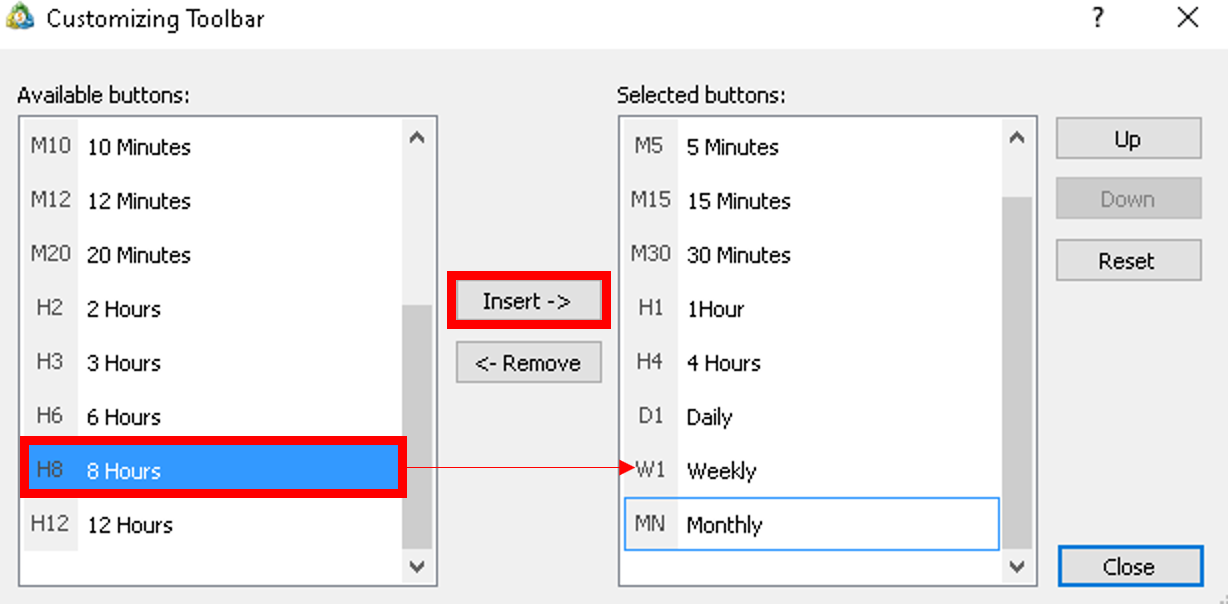

6. Customize time frame panel

After selecting the time frame, traders can customize the time frame panel by adjusting its appearance and layout. Right-click on the chart and select Properties to access chart properties and customize settings such as colors, gridlines, and scale.

7. Use keyboard shortcuts (optional)

Alternatively, traders can use keyboard shortcuts to quickly change time frames. For example, pressing the number 1 on the keyboard switches to the 1-minute time frame, 5 for 5-minute, and H for hourly.

8. Chart automatically updates

Once the trader has selected the new time frame, the chart will automatically update to display price data based on that time frame. The candles or bars on the chart will now represent that time frame.

10. Repeat as needed

Traders can repeat the process to switch to different time frames as needed. Right-click on the chart, choose time frames and select the desired time frame from the list.

11. Analyze data on new time frame

Analyze price action and indicators on the new time frame to gain insights into market trends, support and resistance levels, and potential trading opportunities.

12. Adjust trading strategy if necessary

Adjust the trading strategy as necessary based on the analysis of the new time frame. Consider factors such as trend direction, volatility, and key price levels when making trading decisions.

Balancing out trade analysis with multiple time frames

Changing between too many time frames on MT5 frequently helps traders with comprehensivemarket analysis, trend confirmation, and improved entry timing. However, it poses risks such as over-analysis, which may lead to indecision and missed opportunities, while conflicting signals can create confusion and hinder strategy execution. Hence, traders need to ensure that while they switch between time frames, they don’t overdo it.

FAQs

We’re here to help you every step of your trading journey. Here are some answers to the more frequent questions we get asked.

How many time frames are available on MetaTrader 5 (MT5)?

MT5 offers 21 time frames, ranging from 1-minute (M1) to monthly (MN1), providing a comprehensive range for both short-term and long-term market analysis.

Why is it beneficial to use multiple time frames on MT5?

Using multiple time frames enhances entry and exit timing, confirms trends, reduces market noise, and offers a broader perspective on market dynamics.

What are the risks of switching between multiple time frames on MT5?

Risks include analysis paralysis, conflicting signals, delayed decision-making, and higher trading costs due to overtrading.

How can I change the time frame on MT5?

Right-click on the chart, hover over the "Time Frames" option, and select your desired time frame. Alternatively, use keyboard shortcuts like "1" for M1 or "H" for hourly.

Can I customize the time frame panel on MT5?

Yes, you can customize the time frame panel by right-clicking on the chart, selecting "Properties," and adjusting settings like colors, gridlines, and scales.

What are the advantages of higher time frames on MT5?

Higher time frames filter out market noise, provide more reliable trend analysis, and reduce the risk of false signals that are common in lower time frames.

How do keyboard shortcuts work for changing time frames on MT5?

Keyboard shortcuts allow for quick switching between time frames. For example, pressing "5" switches to the 5-minute time frame, while "D" switches to the daily time frame.

What happens to the chart when I change the time frame on MT5?

The chart updates to reflect the selected time frame, with candles or bars adjusting to the chosen interval.

How can I avoid over-analysis when switching time frames on MT5?

Limit the number of time frames you analyze, focus on those that align with your strategy, and avoid unnecessary switching to reduce over-analysis.

Why should I adjust my trading strategy when switching time frames?

Different time frames can show varying trends, volatility levels, and key price levels, necessitating strategy adjustments for more effective decision-making.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.