📈 Eyes on the USD Index! As the Federal Reserve keeps rates steady at 5.50%, traders brace for potential breakouts. Will the Fed's tone bring USD strength or trigger a shake-up in the trading range? 🚀💹 Stay tuned for key levels shaping the greenback's path! #Forex #USDIndex #MarketWatch

Watch the video to learn more...

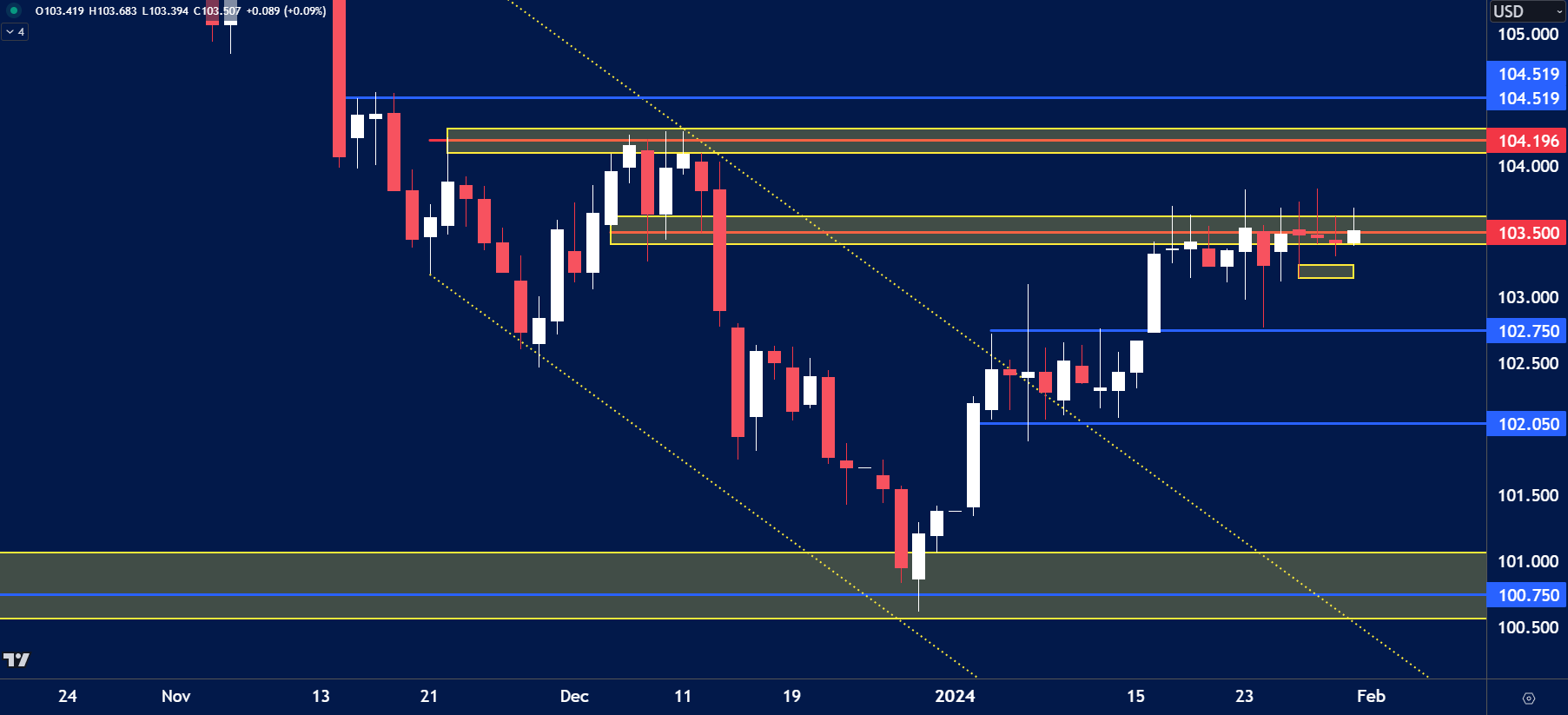

USD Index Key Levels

As we approach the upcoming Federal Reserve meeting, slated to keep interest rates steady at 5.50%, market participants are on high alert, eagerly awaiting clues that could shape the future trajectory of the greenback.

The prevailing consensus points towards the Federal Reserve maintaining the status quo on interest rates at their current 5.50%. However, the real focus lies not on the expected decision but on the nuanced language within the accompanying statement and subsequent press conference.

Should the Federal Reserve disappoint market expectations by failing to hint at future rate cuts, a surge in US Dollar strength may be on the horizon. The greenback's value often reacts sharply to shifts in interest rate expectations, and a lack of dovish sentiment could propel the USD Index to new heights.

Adding a layer of complexity to the unfolding narrative is the fact that the USD Index has been ensnared in a trading range for the past two weeks. This period of consolidation sets the stage for a potentially explosive move, with the outcome of the Federal Reserve meeting acting as the catalyst that determines whether the USD Index breaks out of its recent confines.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.