MetaTrader offers a wide range of order types that allow users to exploit various trading opportunities. Understanding these order types is crucial for optimizing strategies and capitalizing on market opportunities.

This article explores the various types of orders available in MetaTrader with particular focus on the characteristics of each order type.

What are orders in MetaTrader?

An order in MetaTrader refers to an instruction of a brokerage firm's client to conduct a trade operation. The platform divides the order types into two primary categories: market and pending.

Different types of orders

1. Market orders

A market order is a directive a trader gives the broker to execute a trading transaction immediately at the prevailing market price. This type of order has the following key characteristics:

Placement

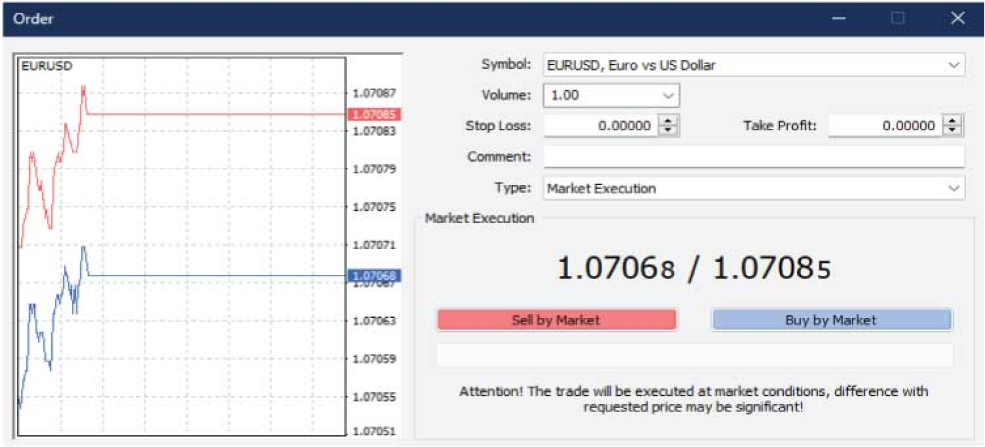

The trader submits the trading instructions specifying the symbol of the preferred trading instrument and the trade volume. Under the 'Type' box, the trader selects 'Market Execution' from the drop-down list.

Execution

Once the trader clicks 'Sell by Market' or 'Buy by Market', they indicate their commitment to the broker to execute the trading transaction as quickly as possible.

However, the speed of execution depends on specific market conditions, including market liquidity and whether the price is right. For this reason, the MetaTrader platform includes a caveat at the bottom order window, alerting the trader to the fact that the price at which the broker will execute the order may differ significantly from the requested price.

Price determination

A market order asks the broker to settle the transaction at a price level at which market conditions will allow. In other words, through these instructions, the trader gives the broker the power to execute the trade at the price level that ticks all the critical boxes as long as it happens as quickly as possible.

For example, if the trader places a market order to buy the EURUSD pair, the broker will fill the order at the sellers' most appropriate ASK price. If they place a market order to sell, the broker will fulfill the instructions at the buyers' most appropriate BID price.

This is an example only to enhance a consumer's understanding of the above note and is not to be taken as Blueberry Markets providing personal advice.

Price volatility

Because a market order asks the broker to execute the instructions at the appropriate market price, it exposes the trader's position to slippage. Slippage describes the scenario in which a trader's market order finds itself when the price level at which the broker executes the order differs from the requested price.

For example, consider a trader who asks the broker to buy the EURUSD pair at 1.07068. But due to high volatility levels in the EURUSD market, the prevailing market price suddenly changes to 1.07187. Since the broker is under the obligation to fill the order at the prevailing price, the execution must happen at this higher price level, resulting in negative slippage. The slippage can also be positive, whereby the price at which the broker fulfills the order is lower than requested.

This is an example only to enhance a consumer's understanding of the above note and is not to be taken as Blueberry Markets providing personal advice.

2. Pending orders

Pending orders are directives traders give brokers to execute a trading transaction only when the market fulfills pre-defined conditions. For this reason, traders often call these conditional or limit orders. Traders choose these order types when they want more control over the price level at which an order activates; it is also a strategy to avoid the challenges of market orders, such as slippage.

MetaTrader offers four primary pending order types: buy-limit, sell-limit, buy-stop, and sell-stop.

- Buy-limit orders: It instructs the broker to purchase a given trading instrument at the requested price or lower. Traders use this order type to exploit potential price pullbacks. However, one should know that while buy-limit orders offer price control, they do not guarantee execution. In fast-moving markets or during periods of high volatility, the market price may quickly surpass the specified limit price, and the order may remain unfilled.

- Sell-limit orders: It directs the broker to sell a trading instrument at the requested price or higher. The order allows traders to exit a position at a specific price level, which may be more favorable than the prevailing market price. But, as with buy-limit orders, this order type does not guarantee execution.

- Buy-stop orders: It instructs the broker to buy a trading instrument at a specified price or higher. Unlike buy-limit orders that traders use to control market entry, buy-stop orders allow traders to initiate a trade. For example, when placing a buy-stop order, the trader specifies the price at which they want to enter the market. This price is typically higher than the prevailing market price. The order does not activate until the trading instrument reaches and surpasses the predetermined price level.

- Sell-stop orders: It enables the trader to protect their position from market risks. The order contains instructions for the broker to trigger a trade when the prevailing market price reaches or falls below a predetermined level. As such, traders often employ sell-stop orders to limit losses or initiate a short-selling strategy.

Pending orders have the following key characteristics:

Placement

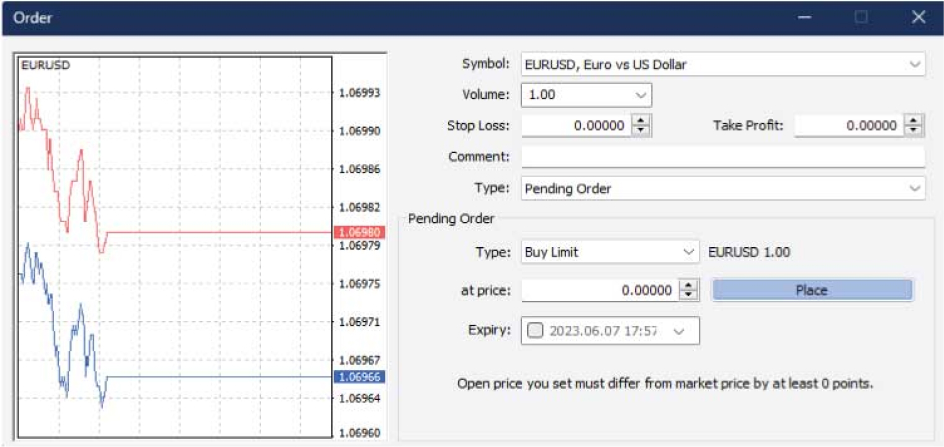

The placement process for pending orders is similar to market orders. It begins with the trader opening a new order on MetaTrader. The trader then specifies the symbol of the trading instrument and the trade's volume. But under the 'Type' selection, the trader chooses 'Pending Order' from the drop-down list.

Unlike market orders, the trader takes a few more steps when placing a pending order. For example, one must select the type of pending order they want from the list, including buy-limit, sell-limit, buy-stop, and sell-stop orders.

Then, the trader must select the price at which the broker should fulfill the order. The last step involves specifying the duration of the order; the order will expire and move to the 'Trade History' section of the MetaTrader trading platform and marked as 'Canceled' if the set duration expires without activation.

Activation

The broker does not touch the pending order until the market meets the pre-defined conditions. For example, the broker will not execute a buy-limit order until the market price reaches or exceeds the requested price.

Execution

On meeting the conditions, the order activates, and the broker executes it automatically, which transitions into a market order. However, one must understand that the broker executes the now active order as with market orders – at the most reasonable prevailing price. This opens an opportunity for slippage.

Time validity

The order window when making a pending order has an 'Expiry' selection box where the trader must specify the length of time the pending order remains active. The trading platform automatically cancels the pending order if the market does not meet the order's conditions within the period.

Final words

The different order types MetaTrader offers make it a versatile trading platform. Most importantly, the simple interface makes it easy to make and adjust orders. However, traders can optimize the potential of the order types if they take time to understand the key characteristics of each and the use cases.

Blueberry offers access to the MT4 platform.

Sign up for a live account or try a demo account on Blueberry today.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.