Triangle patterns signal potential continuations or reversals of existing trends. Triangles often precede a continuation of the prevailing trend. Recognizing these formations allows traders to anticipate the potential direction of the breakout (upward or downward) and capitalize on the trend's continuation.

Let’s discuss the different types of triangles and how to use them to trade the forex market.

What is a triangle pattern?

A triangle pattern is a type of chart used in technical analysis that is formed when the price of a currency pair moves within a converging range, creating a shape that resembles a triangle.

A breakout occurs when a triangle pattern is formed. It occurs when the price decisively closes above the upper trendline (upward breakout) or below the lower trendline (downward breakout). This breakout suggests a potential shift in market sentiment and a resumption of the underlying trend. There are three main types of triangle patterns:

- Ascending triangle: This pattern is formed by a horizontal upper trendline and a rising lower trendline. It often suggests a potential continuation of an uptrend after a breakout above the upper trendline.

- Descending triangle: This pattern features a downward-sloping upper trendline and a horizontal lower trendline. It can indicate a potential continuation of a downtrend after a breakout below the lower trendline.

- Symmetrical triangle: This pattern is formed by converging trendlines, both sloping upwards or downwards. A breakout from a symmetrical triangle can signal either a trend continuation (upwards or downwards) or a trend reversal, depending on the direction of the breakout.

Identifying triangle patterns

Take a look at the charts and indicators that can help identify triangle patterns:

Charts

Volume-Weighted Average price (VWAP) charts

VWAP charts include a line representing the average rate a forex has traded at throughout the day, based on volume and price. VWAP charts prioritize price movements with higher trading volume. This can help identify triangles because strong volume during the consolidation phase (converging trendlines) can emphasize the potential breakout.

Look for converging trend lines connecting the highs and lows of the VWAP line. The consolidation phase within the triangle will often be accompanied by relatively consistent volume, potentially highlighted by the VWAP line itself.

A breakout occurs above the upper trendline or below the lower trendline on the VWAP chart. Combining VWAP with price action can help confirm triangle patterns by showing if the breakout is supported by strong volume, which is crucial for trend confirmation.

Kagi charts

Kagi charts focus on price changes regardless of time. Based on price reversals, they switch between thick (yang) and thin (yin) lines. Kagi charts help by filtering out noise and highlighting the triangle's price action, aiding in identifying potential trend reversals or continuations.

Look for a series of horizontal lines forming a triangular pattern as the price consolidates. These lines get progressively shorter, indicating a narrowing range. While breakouts lack clear trendlines, a change in line direction (upward or downward) suggests a potential breakout and trend continuation. The clear depiction of trend reversals and continuations helps easily identify the converging trend lines characteristic of triangle patterns.

Ichimoku cloud charts

These charts provide a view of support, resistance, momentum, and trend direction. They consist of five lines and a shaded area (cloud). Look for the triangle's consolidation phase to occur within a trading range suggested by the cloud formations.

A breakout is signaled when the price decisively penetrates the cloud (support or resistance) in the direction aligned with the triangle's trendlines. It adds context to the triangle pattern, helping confirm potential trend continuations or reversals. Ichimoku clouds can highlight key support and resistance areas that coincide with the apex of triangle patterns, helping traders confirm potential breakouts, too.

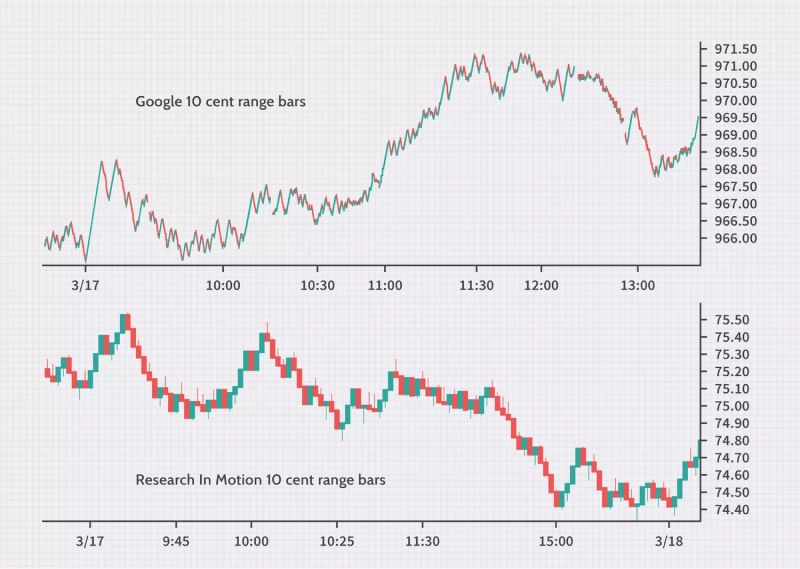

Range bar charts

Range bar charts plot price bars based on specified price movements rather than time intervals. Each bar represents a fixed price range. Watch for a sequence of smaller range bars forming as price action gets confined. It visually depicts the triangle's narrowing range.

A breakout is signaled by a breakout bar that significantly exceeds the established price range. Range bars help by emphasizing the price congestion within the triangle, making it easier to identify potential trend continuations or reversals based on the breakout direction.

Indicators

Average Directional Index (ADX)

ADX is a trend strength indicator that ranges from 0 to 100, with higher values indicating a stronger trend. An increasing ADX value confirms that a breakout from a triangle pattern is strong and likely to continue. A low ADX during the triangle formation followed by a rising ADX after the breakout indicates increasing trend strength.

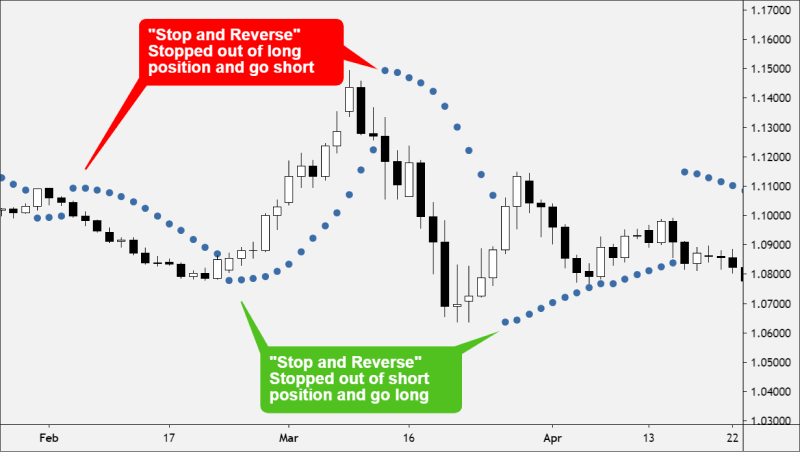

Parabolic SAR (Stop and Reverse)

The Parabolic SAR indicator places dots above or below the price to signal potential reversals in the price direction. When the price breaks out of a triangle pattern, the position of the Parabolic SAR dots confirms the trend direction. For instance, dots below the price after a breakout indicate a bullish trend and vice versa.

Donchian channels

Donchian channels plot the highest high and lowest low over a specific period, creating a channel around the price. They help confirm triangle pattern breakouts. When the price breaks out of the triangle and moves beyond the upper or lower Donchian channel, it confirms the breakout direction and indicates a potential trend continuation.

Step-by-step guide: How to spot triangle patterns

Identify the trendlines

Look for a consolidation phase where the price action is confined within a narrowing range.

- Draw the resistance line by connecting the highs (peaks) of the price movement

- Draw the support line by connecting the lows (valleys) of the price movement

Identify the triangle

Ensure the two trendlines (resistance and support) converge towards a point as the price action progresses. This creates the triangular shape.

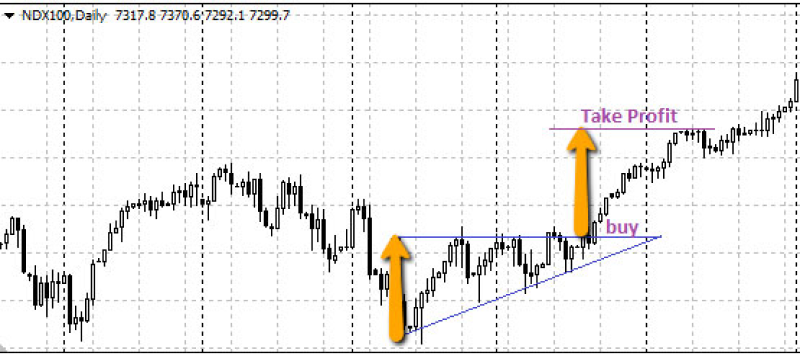

Confirm the breakout

Once the trader identifies what type of triangle is formed, identify the breakout point. A confirmed breakout occurs when the price action decisively closes above the resistance line (bullish) or below the support line (bearish).

Look for an increase in trading volume on the breakout for stronger confirmation.

Estimate target price

Once a breakout is confirmed, estimate the target price by measuring the triangle's height and adding it to the breakout point (for bullish) or subtracting it (for bearish). This estimated target price helps traders plan their potential gain taking.

When are triangle patterns most reliable?

A trader can follow certain tips to ensure the triangle pattern breakouts are confirmed and reliable.

- Timeframe: Triangle patterns tend to be more reliable on longer timeframes ( daily or 4-hour charts) compared to shorter time frames (1-minute or 5-minute charts). This is because longer timeframes offer a clearer picture of the underlying trend and price action.

- Volume confirmation: A confirmed breakout with a significant increase in trading volume suggests more conviction behind the price movement, potentially leading to a more reliable breakout.

- Market context: Triangle patterns formed during strong trends tend to be more reliable than those formed during periods of high consolidation or choppy price action.

What are the external factors impacting triangle patterns?

Take a look at the top external factors that can potentially impact triangle patterns:

- Economic news and data releases: Strong economic data for a particular currency can trigger entry pressure, potentially leading to a bullish breakout from an ascending triangle or a false breakout above resistance in a symmetrical triangle. Weak economic data can trigger exit pressure, potentially leading to a bearish breakout from a descending triangle or a false breakout below support in a symmetrical triangle.

- Unexpected events: Sudden news events like natural disasters or major technological breakthroughs can cause significant market volatility, potentially leading to false breakouts or making triangle patterns difficult to interpret.

- Supply and demand: External factors like geopolitical events (crises, trade wars, etc.) can significantly affect the supply and demand for a particular currency. It can cause price movements that deviate from the expected breakout direction of a triangle pattern.

- Central bank policy decisions: Interest rate hikes by a central bank can strengthen a currency, potentially leading to a bullish breakout from an ascending triangle or a false breakout above resistance in a symmetrical triangle. Interest rate cuts or dovish monetary policy stances can weaken a currency, potentially leading to a bearish breakout from a descending triangle or a false breakout below support in a symmetrical triangle.

Top trading strategies for using triangle patterns

Measure move

The measure move strategy uses the height of the triangle to estimate a target price for the breakout. It helps traders identify potential trading opportunities by projecting the magnitude of price movement based on the pattern's size. Here’s how a trader can trade with this strategy –

- Identify a well-defined triangle pattern (ascending, descending, or symmetrical).

- Measure the vertical distance between the resistance and support lines. This is the triangle's height.

- Once a confirmed breakout occurs (price closes above resistance for bullish or below support for bearish), add the triangle's height to the breakout price (bullish) or subtract it (bearish) to estimate a potential target price for the trade.

Bollinger bands squeeze

The Bollinger bands squeeze strategy combines triangle patterns with Bollinger bands, a volatility indicator. It identifies periods of low volatility through Bollinger bands' narrow range, signaling potential upcoming price breakouts. Here’s how a trader can trade with this strategy –

- Identify a triangle pattern on the chart and overlay the Bollinger bands indicator.

- Look for a contraction (squeeze) in the Bollinger bands as the triangle nears its apex. This suggests impending volatility and a potential breakout.

- A confirmed breakout with a price move beyond the Bollinger bands can be a strong signal for entering a trade in the breakout direction.

Multiple triangle pattern

The multiple triangle pattern strategy looks for the confluence of multiple triangle patterns to strengthen the breakout signal. It lets traders capitalize on successive pattern formations, facilitating trend identification and potential gain extraction. Here’s how a trader can trade with this strategy:

- Identify a triangle pattern on a higher timeframe chart (such as daily).

- Look for the formation of a smaller triangle pattern of the same type (ascending or descending) within the larger triangle on a lower time frame chart (such as 4-hour).

- A confirmed breakout from larger and smaller triangles in the same direction can be a powerful signal for a sustained trend move.

Pivot points

The pivot points strategy combines triangle patterns with pivot points, which are calculated support and resistance levels based on the previous day's trading range. It helps traders determine entry points by incorporating pivotal price levels, leading to confirmation of breakout strength and directional bias. Here’s how a trader can trade with this strategy –

- Identify a triangle pattern and plot the pivot points for the current trading day.

- Look for the triangle's breakout to coincide with a pivot point level (support or resistance). This can strengthen the breakout signal.

- Based on the breakout direction, traders can use the pivot point levels as potential targets or entry points for their trades.

Common risks with triangle pattern trading and how to avoid them

- False breakouts and whipsaws can lead to unexpected losses. Confirm breakout signals with volume and additional technical indicators for validation.

- Over-reliance on patterns may lead to missed opportunities or inaccurate signals—supplement pattern analysis with fundamental factors and market sentiment for comprehensive decision-making.

- Delayed breakouts may result in missed gain opportunities or late entries. Use multiple time frames for confirmation and be patient while waiting for confirmed breakout signals.

- Market noise can distort pattern formations and lead to false signals. Filter out noise by focusing on patterns with strong support/resistance levels and clear trend direction confirmation.

Conform breakouts with triangle patterns in forex

Traders can identify clear entry and exit points with the help of confirmed breakouts in triangle patterns. However, one must be aware of market noise, which can lead to false pattern recognition. Additionally, employing volume analysis and supplementary technical indicators can enhance the reliability of triangle pattern signals.

FAQs

We’re here to help you every step of your trading journey. Here are some answers to the more frequent questions we get asked.

What are the different types of triangle patterns in trading?

Ascending, descending, and symmetrical triangle patterns are common types, each potentially indicating different price trends and movements

How can I confirm a breakout from a triangle pattern?

A breakout can often be identified through a clear price movement above or below the trendline, accompanied by increased trading volume.

What indicators can help identify triangle patterns?

Indicators such as the Average Directional Index (ADX), Parabolic SAR, Donchian Channels, and Ichimoku Cloud charts may assist in recognizing and analyzing triangle patterns.

How can traders estimate target prices using triangle patterns?

Some traders measure the height of the triangle and use it as a reference to estimate potential price movements after a breakout.

Why are triangle patterns observed more on longer timeframes?

Longer timeframes, such as daily or 4-hour charts, can provide a broader perspective of trends, helping reduce the impact of short-term price fluctuations.

What is the role of volume in assessing triangle pattern breakouts?

An increase in trading volume during a breakout often supports the credibility of the price movement.

How do external factors influence trading based on triangle patterns?

Market-moving events such as economic data releases, geopolitical developments, and central bank decisions can affect the validity of triangle patterns by increasing market volatility.

What are common risks associated with triangle pattern trading?

Risks include false breakouts, reliance solely on patterns without additional analysis, and market noise. Traders may mitigate these risks by considering volume analysis, combining patterns with other indicators, and continuously monitoring the market.

What strategies might incorporate triangle patterns?

Strategies such as measured moves, pivot points, and combining triangle patterns with other tools like Bollinger Bands can provide additional insights for trading decisions.

How can VWAP charts be applied in triangle pattern analysis?

VWAP charts highlight price levels with significant trading activity, which can help traders recognize consolidation within triangle patterns and assess potential breakouts.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.