Is 'Sell in May and Go Away' relevant for the Australian Dollar? Despite being a stock market adage, its impact on currencies like the AUD is noteworthy. With May historically bearing down on the AUD and the RBA holding interest rates steady amid economic concerns, the outlook seems bearish. Dive into the analysis in our latest blog post! #Forex #AUD #MarketInsights

Watch the video to learn more

'Sell in May and go away' is a well known saying amongst stock market investors, but will this stick this year for the Australian Dollar? You may be thinking, if this is a stock motto, what does it have to do with the Australian Dollar.

Well the Australian Dollar has been a currency that tends to move with the sentiment in the market. If the stock market is bullish it is known as 'risk on', this can influence risk currencies such as the Australian Dollar. So if stock markets underperform, it can be seen as 'risk off' and the Australian Dollar can lose strength.

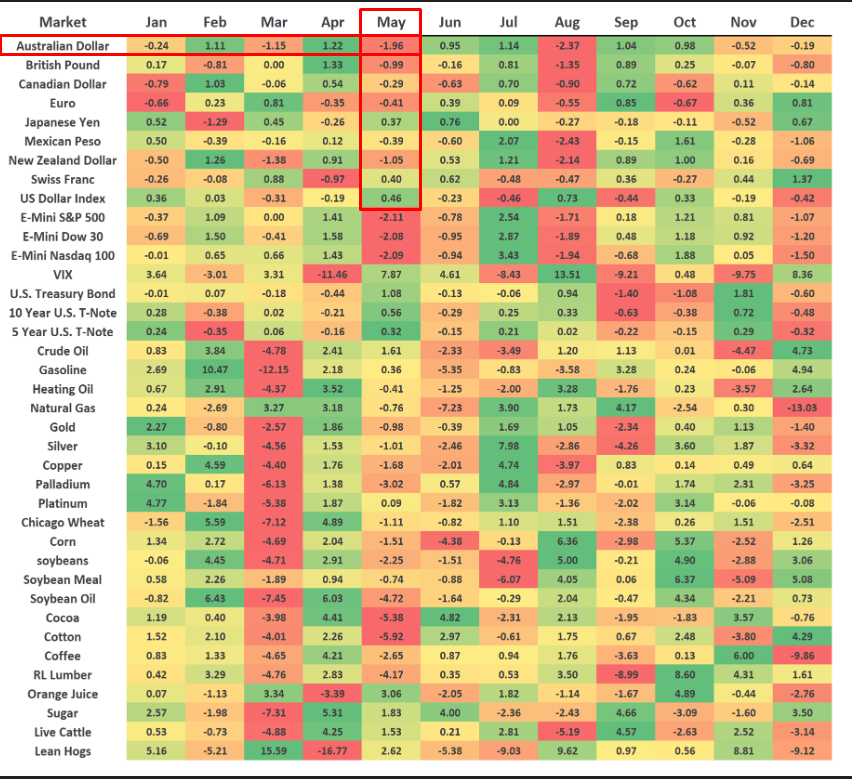

This can be seen via the seasonal currency heat map below. In the month of May the Australian Dollar has one of its worst months, this is taken over a 20 year average. Now seasonal analysis needs to be added with further confluences. This Tuesday the RBA held their interest rate at 4.35% for the 5th consecutive month.

Australia's inflation rate fell to 3.6% in Q1 of 2024, not within the target range of 2-3%. Growth in Australia has also been weak with GDP consistently falling since Q4 2022. That being said, without the inflation rate moving lower, the RBA will keep rates higher for longer.

Looking at the AUD/USD chart we can see the price is trading within a daily range between the highs of 0.6650 and lows of 0.6400. The price has formed a daily bearish close off the resistance, and today as of writing this price is bearish currently trading around 0.6580. The H4 time frame, more preferred by swing traders, shows a new low, meaning we could look for a lower high for a possible trading idea.

To conclude, the Australian Dollar seasonally is weak this time of year, the RBA will not be looking to hike interest rates as inflation remains above the target range, and AUDUSD is at a trading range high.

If the price breaks through the highs we would need to re-evaluate the idea of the price moving lower from here.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.