One-click trading improves execution speed and reduces manual effort. This allows traders to enter the market as soon as they see an opportunity. By minimizing decision-making time and human error, it offers a reliable way to place orders. Traders can focus more on strategy and analysis, relying less on manual processes.

Follow this guide to learn everything about one-click trading and how it works.

What is one-click trading in MetaTrader 5?

One-click trading in MetaTrader 5 allows traders to place orders with a single click. This bypasses the order confirmation step. It is designed for quick execution, making it ideal for active traders and volatile markets.

One-click trading eliminates delays, helping capture quick price movements. However, it requires careful use as there's no confirmation prompt. This can increase the risk of accidental trades.

How does one-click trading work?

One-click trading in MetaTrader 5 allows traders to place orders quickly with a single click. Instead of going through the usual order confirmation window, the trade is executed immediately. Traders can enable this feature from the trading panel on the chart. They simply click on the bid or ask price to open a long or short position. It uses the predefined lot size and other parameters set by the trader.

Features of one-click trading

Fast trade execution

One-click trading allows placing market orders immediately. It eliminates confirmation steps, speeding up trade execution. Traders can long or short an order directly from charts or depth of market windows. This reduces reaction times. Hence, it suits fast-moving markets or high-frequency trading strategies.

Customization of trade parameters

Traders can set custom trade volumes and stop-loss or take-profit levels. The panel allows adjusting lot sizes and limits before placing trades. This flexibility ensures better control over risk management without the need for repeated manual entry of trade parameters.

Streamlined interface

A simplified trading panel appears on charts or market watch windows. It offers easy access to entering/exiting trades and order management. This clean interface reduces distractions. It also simplifies order placement, improving trading efficiency.

Reduced latency

By skipping trade confirmation, one-click trading minimizes latency. Faster order processing increases the chances of better price execution. It's especially useful in volatile markets where prices change rapidly.

Risk management tools

Stop-loss and take-profit orders can be set directly from the chart. Traders drag levels to adjust these limits visually. This feature improves trade protection and reduces manual errors.

No need for order confirmation

With one-click trading, traders bypass order confirmation pop-ups. This increases speed but requires caution. Mis-clicks or incorrect inputs can lead to unintended trades.

Visual feedback

When placing orders, visual cues display trade levels on the chart. A tooltip shows potential gain or loss in real-time. This feedback helps in precise trade adjustments and better decision-making.

Price deviation

Traders can set maximum price deviation tolerances. This controls slippage during fast market movements. If deviation exceeds limits, trades are canceled instead of filling at unfavorable prices.

Fill policy based on execution mode

The execution fill policy varies based on the execution mode. For market execution, 'Fill or Kill' or 'Immediate or Cancel' applies. This ensures trades are completed only within set conditions, preventing partial orders.

Requote notifications and sound alerts

When prices change before execution, the system sends a requote alert. Notifications and sound cues inform traders. This keeps them aware of potential issues in high-volatility environments.

Advantages and disadvantages of one-click trading

Advantages

- Improved execution speed: One-click trading enables faster order placement by removing confirmation prompts. This is critical in volatile markets where seconds can determine gains.

- Reduced decision-making time: With immediate trade execution, traders act on strategies faster. This minimizes delays caused by second-guessing or hesitation.

- Minimized human error: Pre-set trade parameters like lot size and stop-loss reduce manual entry errors. This streamlines the process and ensures precision.

- Better handling of market orders: Market orders can be placed directly from charts or depth of market windows. This increases overall trading responsiveness.

Disadvantages

- Increased risk of mistakes: By skipping confirmation steps, one-click trading increases the risk of accidental trades. The accidents could be due to miss-clicks or incorrect inputs.

- Lack of order review: There is no time to double-check order parameters. This potentially leads to undesired trade conditions or positions.

- Potential for overtrading: The ease of placing trades may tempt traders to enter too many positions. This can increase exposure and risk.

- No reversal option: Once executed, trades cannot be undone immediately. Hence, one-click trading should be done carefully.

How to enable one-click trading on MT5?

Open MetaTrader 5

Launch the MetaTrader 5 platform by double-clicking its icon on the trader’s desktop or navigating through the start menu. Ensure the account is logged in and the trading terminal is fully loaded for seamless operation.

Enable one-click trading

Right-click anywhere within the chart window to open the context menu. Find and select One Click Trading from the options provided. This will activate the feature, and the trading panel will appear on the chart window.

Confirm settings

A window will pop up showing the terms and conditions for using one-click trading. Read and agree to these terms by checking the I Accept these Terms and Conditions box. After that, click OK to finalize the selection and activate the feature.

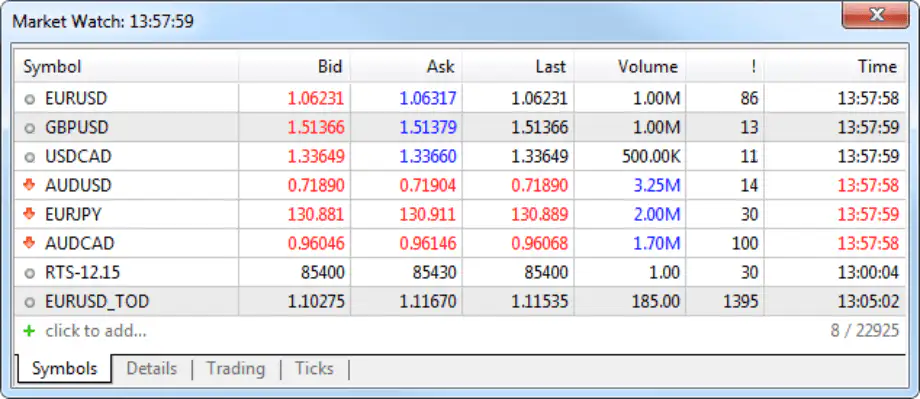

Select trading instrument

After enabling one click trading, navigate to the Market Watch or directly on the chart to choose the trading instrument one wants to work with. Traders can do this by either right-clicking on the instrument or selecting it from the chart's context menu.

Customize the settings

Once the one-click trading panel appears, customize it to suit one’s trading needs. Adjust parameters like the order volume (position size) using the easy-to-use interface displayed on the chart. Traders can also set the price levels if needed.

Place a trade

After customizing the settings, the trader should be ready to trade. Simply click the Buy or Sell button from the one-click trading panel, and the order will be executed in real-time without further confirmation. This ensures faster execution, which is ideal for active traders.

*This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry providing personal advice.

How to enable one-click trading on MT4?

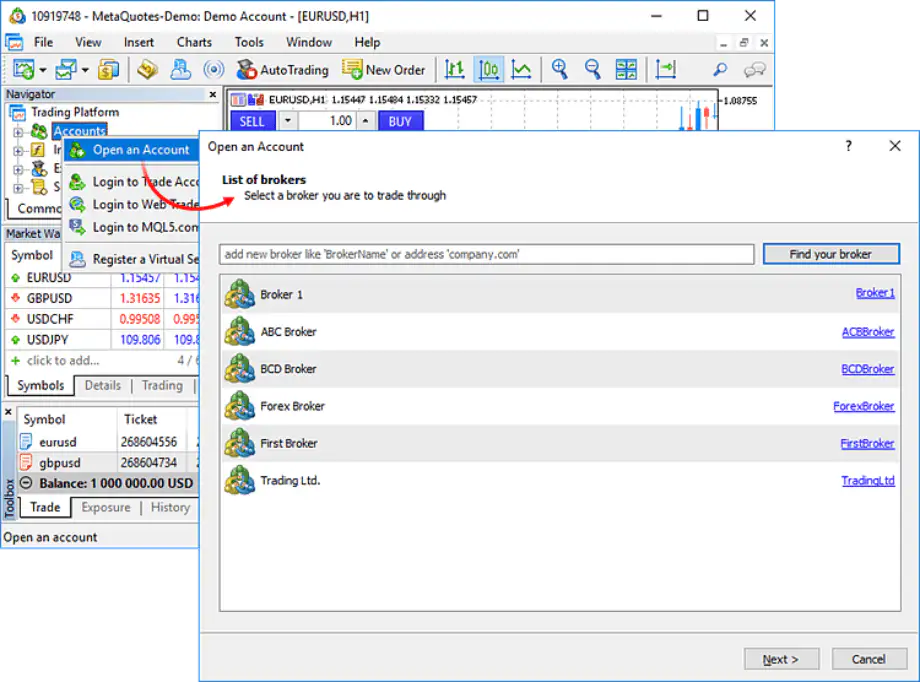

Open MetaTrader 4

Launch the MetaTrader 4 platform and log in to the account. Ensure the platform is fully loaded and connected to the server.

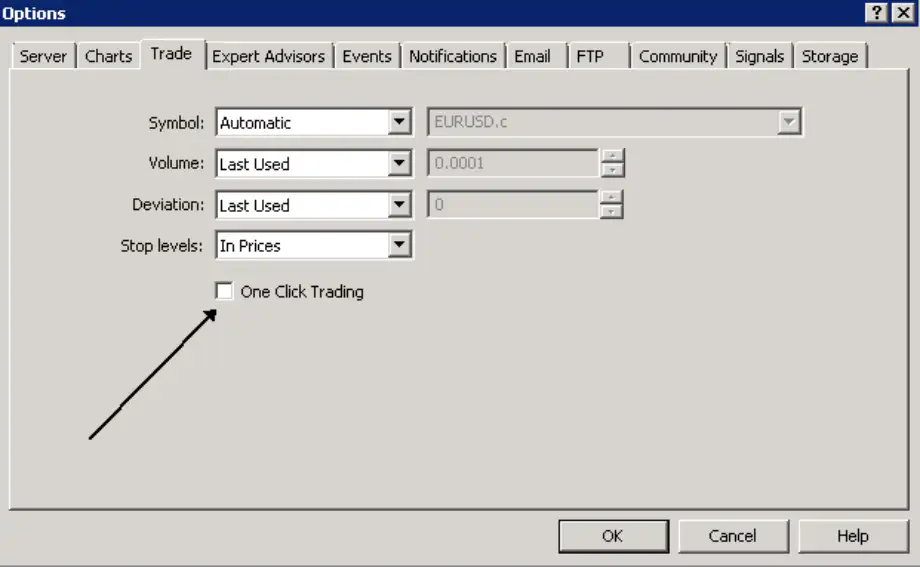

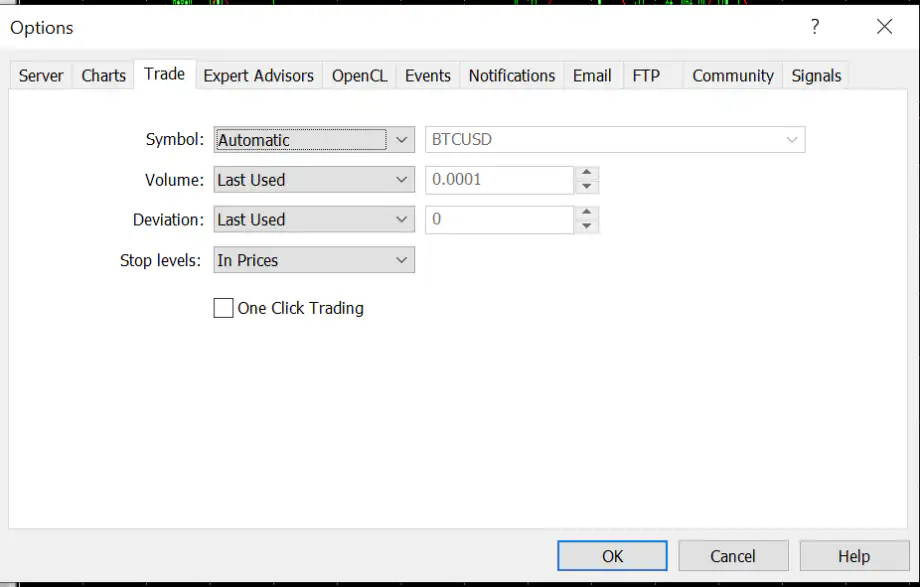

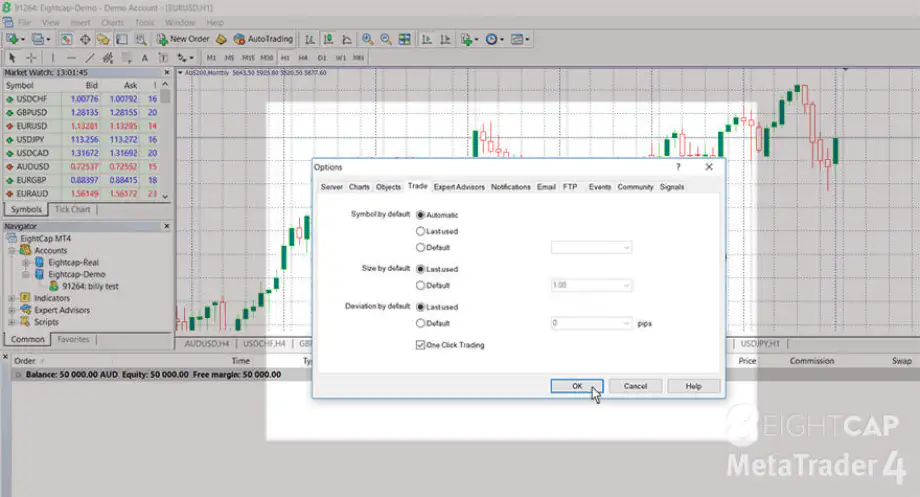

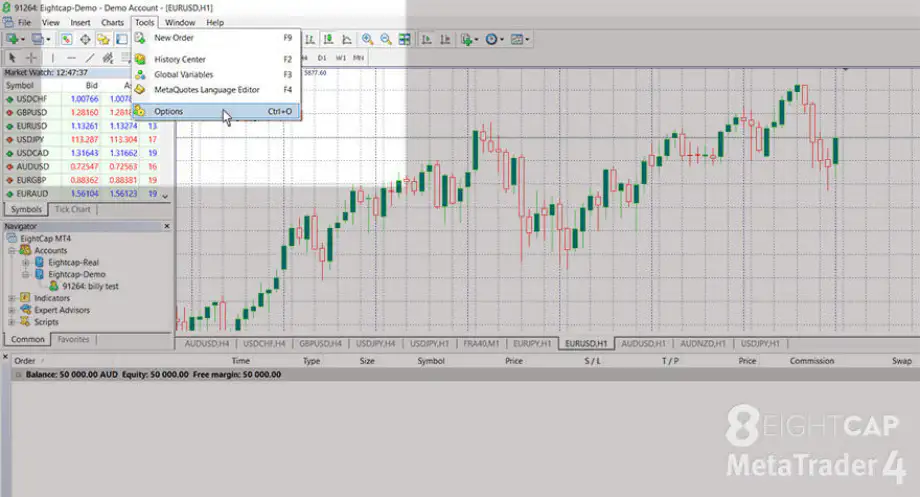

Navigate to trade settings

Go to the Tools in the top menu and select Options or press Ctrl+O. In the window that opens, click on the Trade tab to configure the trading settings.

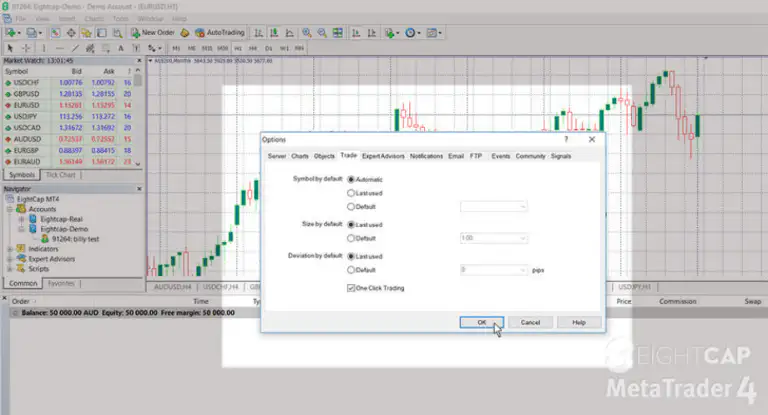

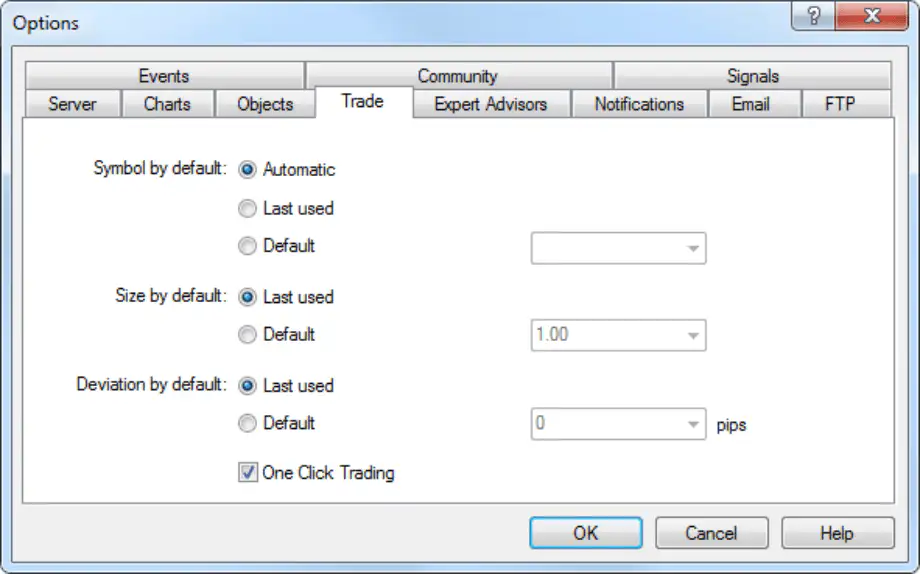

Enable one-click trading

Under the Trade settings, check the box labeled One Click Trading. This will enable the feature, allowing traders to execute trades with just a single mouse click.

Agree to terms and conditions

When the trader first enables one-click trading, a Terms and Conditions window will appear. Read the terms carefully and click I Accept these Terms and Conditions to proceed.

Confirm settings

Click OK to save the changes and activate one-click trading. The trader will now be able to perform trading actions without any additional order confirmation.

Place a trade

Once activated, the trader can use the one-click trading panel on the chart or in the Market Watch window. Simply click on the Bid or Ask button to execute an order in real-time.

How to customize one-click trading settings?

Show or hide the trading panel

The one-click trading panel provides quick access to various trade operations directly on the chart. The trader can toggle the visibility of this panel based on one’s preference.

To show or hide it, right-click on the chart and select the One Click Trading option from the context menu.

When the panel is visible, the trader can place long or short orders. This makes trading better by eliminating the need to open the Order window.

This functionality allows traders to customize the workspace based on whether they want to keep the panel accessible or out of view to maintain a cleaner chart layout.

Adjust lot size and trade volume

Within the one-click trading panel, traders can set the default lot size for each trade. By adjusting this value, traders ensure that every trade is opened with their desired trade volume. This removes the need to manually enter it each time.

This option is useful for traders who have a fixed trading strategy or risk management plan that requires consistent lot sizes.

Traders can set the default lot size or adjust it before executing each trade. This allows for customization based on the strategy or the size of the position one wishes to take. It helps to streamline the process by reducing the need for repeated volume adjustments.

Set stop-loss and take-profit

Set stop-loss and take-profit levels directly on the chart. This can be done by clicking on the price level corresponding to the entry point of the trade and dragging it either up or down.

By doing so, traders can set a protective stop or gain-taking level without needing to open a separate window/dialog box. This method saves time and ensures that the positions are properly protected.

Additionally, as one drags the levels, a tooltip will appear, showing the potential gain or loss in both deposit currency and pips. This feature provides real-time information.

Enable or disable the dragging of trade levels

Some traders prefer not to use the dragging functionality for precision or control reasons. To accommodate this, MetaTrader allows traders to enable/disable the dragging of trade levels in the platform settings.

If this option is enabled, traders can click and drag trade levels directly on the chart to adjust them. If disabled, traders will need to manually adjust these levels through the Order window.

Set and modify pending orders

With one click trading, placing/modifying pending orders becomes a quick process. To place a pending order, right-click on the chart at the desired price level and choose the corresponding order type (such as buy-limit or sell-stop).

Traders can place pending orders either above or below the current market price. The options available will change depending on the position relative to the market.

Once an order is placed, traders can modify it by dragging the order line directly on the chart to adjust the price. This feature streamlines the process of setting orders and provides an interactive way to ensure orders are placed at the right price levels.

Remove pending orders

If a trader decides to cancel a pending order, MetaTrader makes it simple to do so with just one click. Go to the Trade tab in the Terminal window, where one will see a list of all their active orders. This includes the pending ones.

There is a Delete button next to each pending order. Clicking this button will immediately delete the order. This step does not require further confirmation. It helps if one has placed an order by mistake and wants to remove it without delay.

Remove stop-loss or take-profit

To remove the stop-loss/take-profit levels from the chart, go to the Trade tab in the Terminal window. Locate the open position.

Next to the position, the trader should find an option labeled Close Position/Delete Order. Clicking this button will immediately remove the stop-loss or take-profit levels associated with that position. This ensures that the position is no longer protected or capped by those levels.

This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry providing personal advice.

Achieving trade precision with one-click trading

One-click trading offers a simple way to execute trades quickly, reducing the time between decision-making and order placement. However, it's important to be aware of the risks, such as accidental clicks or incorrect order settings, which can result in unwanted trades or losses. Proper understanding and careful use are key to avoiding mistakes and ensuring effective trading.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.