In forex, you can trade both ranging and trending markets. Range trending allows traders to sell at the top of the market and buy at the bottom-most level of the same.

In our article, we will learn all about a ranging market.

What is a ranging market?

A ranging market is a market where the currency pair prices move back and forth between a price range of a high price level and a low-price level. The highest price level is formed with a resistance line, whereas the lowest price level is formed with a support line. Traders depend on these lines to place ideal entry or exit orders in the market.

- When the currency pair price touches the resistance line, traders receive a signal to exit the market due to an expected downtrend.

- When the currency pair price touches the support line, traders receive a signal to enter the market due to an expected uptrend.

How to identify a ranging market?

Volatility indicators

You can identify a ranging market by using volatility indicators like Bollinger Bands, Average True Range and Donchian Channel. All these indicators come with different widths during different trading periods, with a narrow width during a ranging market. To identify a ranging market with the Average True Range indicator, traders can notice the ATR values declining significantly. With Donchian Channels, the currency pair price trades around the middle band to depict a range-bound market.

Breakouts

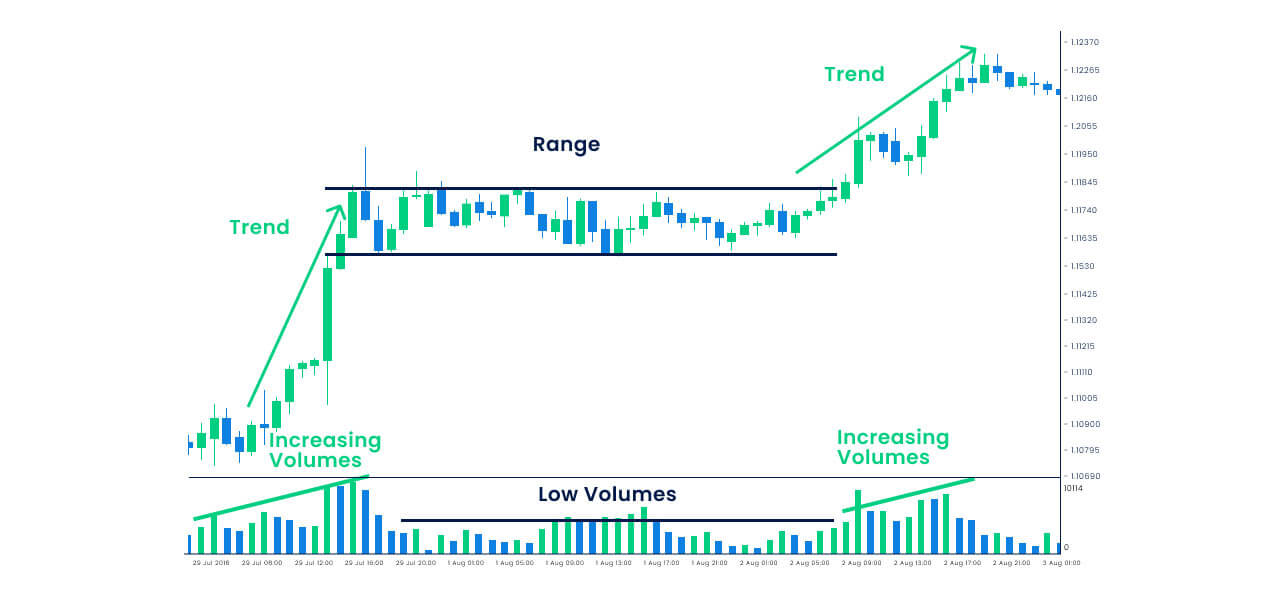

Waiting for the price to breakout also helps in identifying range-bound markets. Since every ranging market is followed by either a significant bullish or bearish market momentum, breakouts help in trading the ranging markets. You can use a pending order strategy when a currency pair price is ranging between its high and low level. You can place the stop-loss and take profit orders between this range and benefit from the ranging market irrespective of the market direction.

Alternative Markets

Alternative markets that are highly correlated with the forex market, like the stock market and commodities market, also help in identifying ranging markets. When the correlated markets are ranging, they send a signal that the forex market is expected to trade in a range as well.

Types of ranges in the forex markets

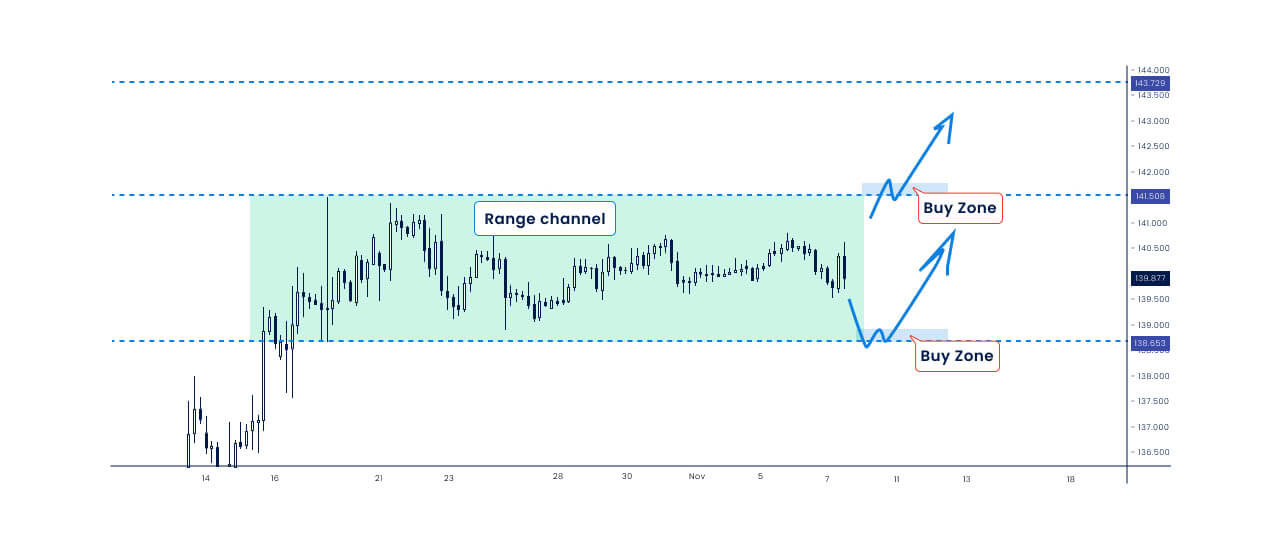

Rectangular range

A rectangular range is formed by sideways and horizontal currency pair price movements. The prices move between their resistance and support levels. It is one of the most common ranges and helps traders trade between high and low price levels and identify potential buying opportunities.

Continuation range

A continuation range occurs within an existing trend in the market. These ranges are made of triangles, flags, wedges and pennants. Such a range occurs as a correction against the existing trend and sends signals to traders about a potential breakout. Hence, with a continuation range, traders can place a trading order against the ongoing trend and benefit from the range-bound market.

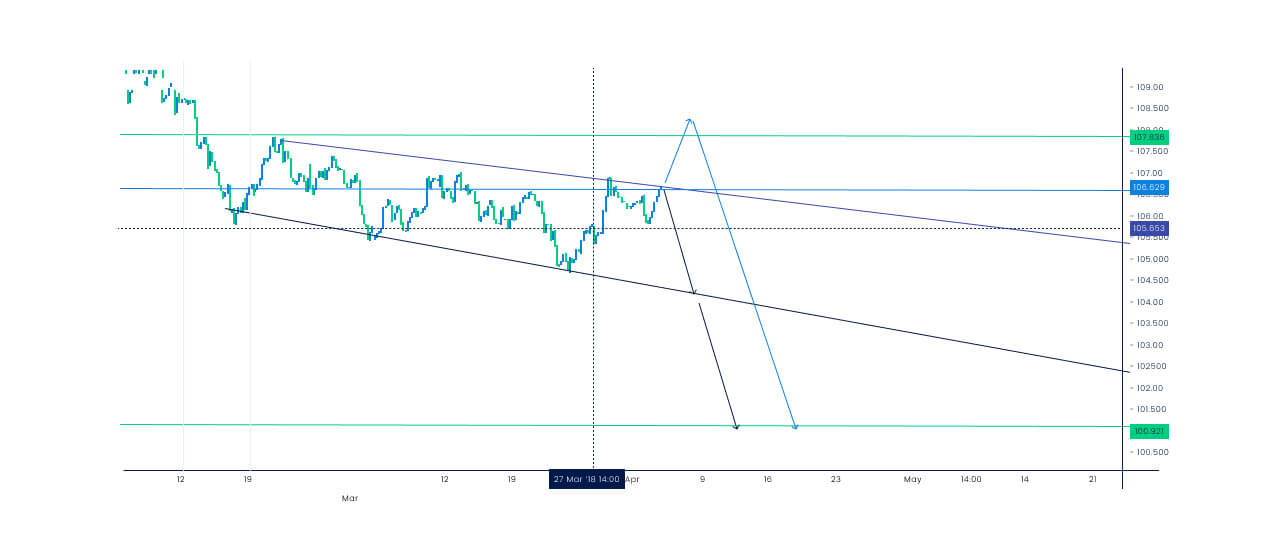

Diagonal range

A diagonal range is formed either as a descending range or ascending range. It consists of upper and lower trendlines that help identify breakouts in the market, providing traders with ideal buy or sell opportunities.

Both descending and ascending diagonals have a loping trend channel which can either be narrow or broad as the prices continue to fluctuate. If the difference between the high and low range of the prices is a lot, the diagonal range is broadening, and if the difference is less, the range is narrowing.

Irregular range

Irregular ranges do not make any particular pattern in the forex chart like rectangle, diagonal or flag. It takes place around a centreline and is bounded by the resistance and support levels. It generally occurs when two types of ranges take place together to form an irregular pattern in the market. It is tough to identify ideal buy or sell opportunities in this range, but you can trade currency pairs around the centreline according to the emerging trend (buy orders during expected uptrends and sell orders during expected downtrends).

How to trade a range market?

1. Identify the type of range

Identify the range between which currency pair prices are trading. A range usually occurs between the resistance and support levels. When a currency pair retraces from its resistance and support level at least twice, the market is said to be range bound. Connect two or more highs and lows to define the trading range in a price chart.

2. Set up an entry/exit order

After identifying the range, you can set up an entry order near the support level and an exit order near the resistance. You can also use trading indicators like Bollinger Bands to identify the ideal price levels to buy or sell the trade.

3. Place a stop-loss order

Place a stop-loss order to manage risk in a ranging market above the last high price level when you are selling near the resistance level. If you buy near the support level, place the stop-loss order near the low-price level.

4. Monitor the market

Monitor the range-bound market to either exit from an existing trade or enter a new one. If you feel that the market is shifting from a range-bound market to a trending market, you can enter trading orders that are in favour of the expected market direction.

Trading ranging markets is not that tough after all

You can trade a range market in forex after identifying a market pattern. Since ranging markets also occur between trends, you can profit by opening trades in the direction of the expected trends. Start trading with Blueberry Markets to get hold of multiple technical indicators that provide you with ideal price levels to enter and exit forex trades.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.