You will come across several trading strategies in Forex trading. However, it is crucial to find the right strategy for you. New traders sometimes get into trading with just guesswork. They may benefit from beginner’s luck at first, but there are only so many lucky guesses one can make.

To see long-term profits, you’ll need a well-thought-out trading plan. It should be noted that every Forex trading strategy is unique and each strategy may lead to different results based on the trader’s risk appetite, lifestyle, trading psychology, and resources.

What is a Forex trading strategy?

A trading strategy generally helps you decide when you should buy or sell a particular currency pair. It considers different factors like time, risk appetite, trading style, historical data of the currency pair, and more.

A strategy is usually made with several trading signals or ideal market price points that influence a trader’s decisions.

8 Forex trading strategies

Range trading

Range trading happens when you trade between the support and resistance levels of a currency pair. This makes range trading possible only if the market is neither bullish nor bearish.

- When the price is in resistance, it may signify that a currency is overbought. You can choose to exit the market by going short before the price starts decreasing in value.

- When the price is in support, it may signify that a currency is oversold. It will likely witness a reversal, so this would be the ideal time to enter the market and go long.

Position trading

Position trading is a long-term trading style where you hold onto a position for weeks or months to benefit from long-term gains. Minor yet volatile market fluctuations do not influence position trading.

When you hold a position for a long period, you give the currency pair enough time to mature in value. To benefit from this strategy, you need to keep a close eye on central bank monetary policies, cyclical trends, and political developments in an economy.

- Wait for the prices to improve over a couple of months or years and identify the resistance level. As soon as the price reaches it, you may exit and collect profits.

- In the case of price expansion, identify the support level of the currency. Enter the market by going long before it reaches the support level to benefit from a reversal later.

Price action trading

The price action trading strategy allows you to analyse and understand the market situation based on a currency's current price movements. Since it involves studying recent and historical prices, it can identify ideal buying and selling opportunities.

- When the currency is in a long-term uptrend, you can buy more assets to increase your chances of reaping profits. Otherwise, it is best to exit the market if it is in a long-term downtrend.

- Set a ceiling and floor price when the market is less volatile. If the price falls between the floor and ceiling price, you can identify ideal entry and exit signals by using them as support and resistance levels, respectively.

Swing trading

Swing trading allows a trader to speculate a currency’s price movement over a couple of days or weeks. An open position is typically held for a few days or weeks to profit from future movements.

This strategy aims to capture the most from a price move, especially in volatile markets. It involves identifying where the price will most likely move, keeping in mind the market sentiment and ongoing economic or financial news, if any.

Short-term risks and weekend downtrends are mitigated when you swing trade. Instead, you expose yourself to mid-term gains. These gains compound into incredible annual returns when made consistently.

Scalp trading

Scalping refers to the buying and selling of an asset with small price gaps. It is mostly used by traders who only want to hold a currency pair for a brief time to make quick profits.

Scalping works best in a volatile market where traders look for constant fluctuations in smaller increments. With this strategy, you can buy and sell currencies within a few minutes to take advantage of minor price movements.

Trend trading

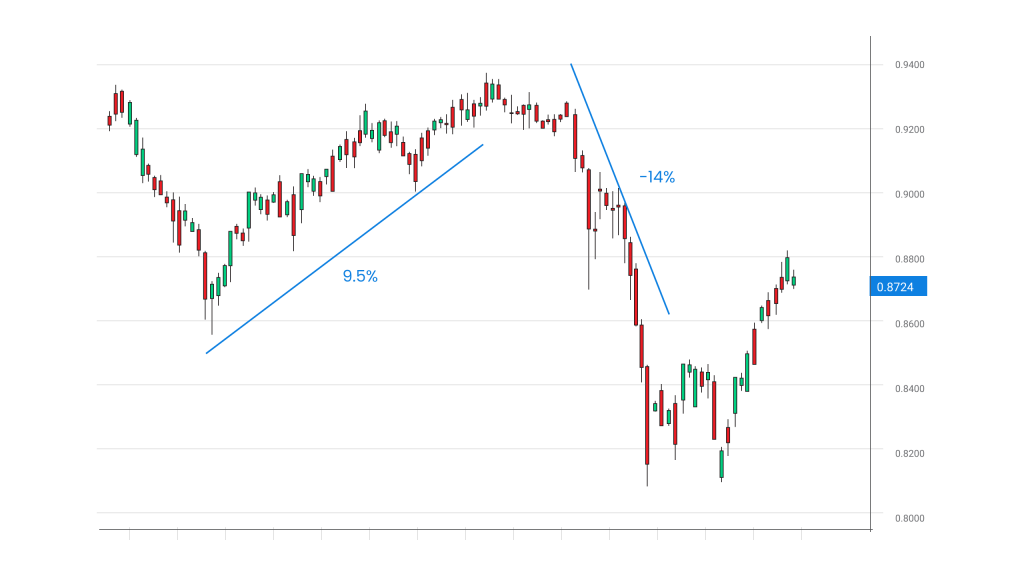

Trend trading involves identifying if a market is following an uptrend or a downtrend. Once the trend is identified, you can choose to either exit or enter the market. Trends are generally highly affected by interest rates, economic stability, government policies, and inflation.

- An uptrend may be read as a buying signal since the price will most likely continue to increase. Meanwhile, a downtrend gives a selling signal since the price may continue to decrease.

- When the market does not follow a particular trend, this means that it is in a sideways market or range. In this situation, you can apply the range trading strategy discussed above.

Carry trade

A carry trade involves borrowing money with a low interest rate to short with a high interest rate in return.

The low-interest rate currency is called the funding currency, while the high-interest rate currency is called the asset currency. It follows the ’buy low, sell high’ rule to benefit from the spread between the two rates.

- As soon as you receive news about plans to decrease interest rates in a specific country, it may be seen as a buying signal until interest rates increase again. Once it does, you may fund the currency pair with higher interest rates and go short.

- Alternatively, news about a country’s central bank increasing interest rates signals traders to sell the currency.

News trading

News trading takes advantage of the repricing of currencies due to a major news event. Experienced traders use this strategy to buy or sell the affected country’s currency immediately after key news launches. This is considered one of the most advanced Forex trading strategies since it requires a simultaneous look at the news and the markets.

It is important to be cautious when trading the news. This is because retail traders often get information later than bigger institutions. Thus, banks and corporate companies may have already secured their positions in the market before you read about it in the headlines.

News traders need to monitor economic calendars and data for critical new releases closely. It is also advised to watch a market critically and determine ideal support and resistance levels to help you react swiftly and effectively.

- Let us consider a Forex trading strategy example of an increase in foreign direct investment in the US. This would positively impact USD pairs like the GBP/USD. The news would drive you to buy as many GBP/USD as possible to maximise profits.

- But, if there is a major economic downturn or political instability, this would negatively impact GBP/USD. The news announcement will signal traders to go short on GBP/USD to avoid losses.

Find the perfect trading strategy for you

Once you’ve found which one works for you, it allows you to maximise profits and avoid losses to a great extent. Backtesting these trading strategies enable you to become the best Forex trader you can be. It is best advised to backtest with smaller trades then work your way up once you are consistently profitable.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you from your quick account setup to any future concerns.

Start trading with Blueberry today.

Frequently Asked Questions

What is the best Forex trading strategy?

There is no one best trading strategy that works for all traders. The right strategy for you ultimately depends on your requirements, budget, mindset, resources, and market conditions. This is why it is best to familiarise yourself with strategies so you can use the right one at the right time.

Is there a fool-proof Forex trading strategy?

No, there is no fool-proof trading strategy that guarantees you 100% wins. However, combining a few trading strategies in confluence with each other may help in confirming trends and biases.

How do I start Forex trading in Australia?

Forex trading in Australia is completely legal. And, you can easily start by signing up with a reliable and regulated Forex broker. You can visit our website at blueberrymarkets.com to know more about us.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.