NZDUSD has continued the bearish trend even after the RBNZ hiked interest rates. Will this offer further bearish trend trading opportunities?

Watch the video to learn more…

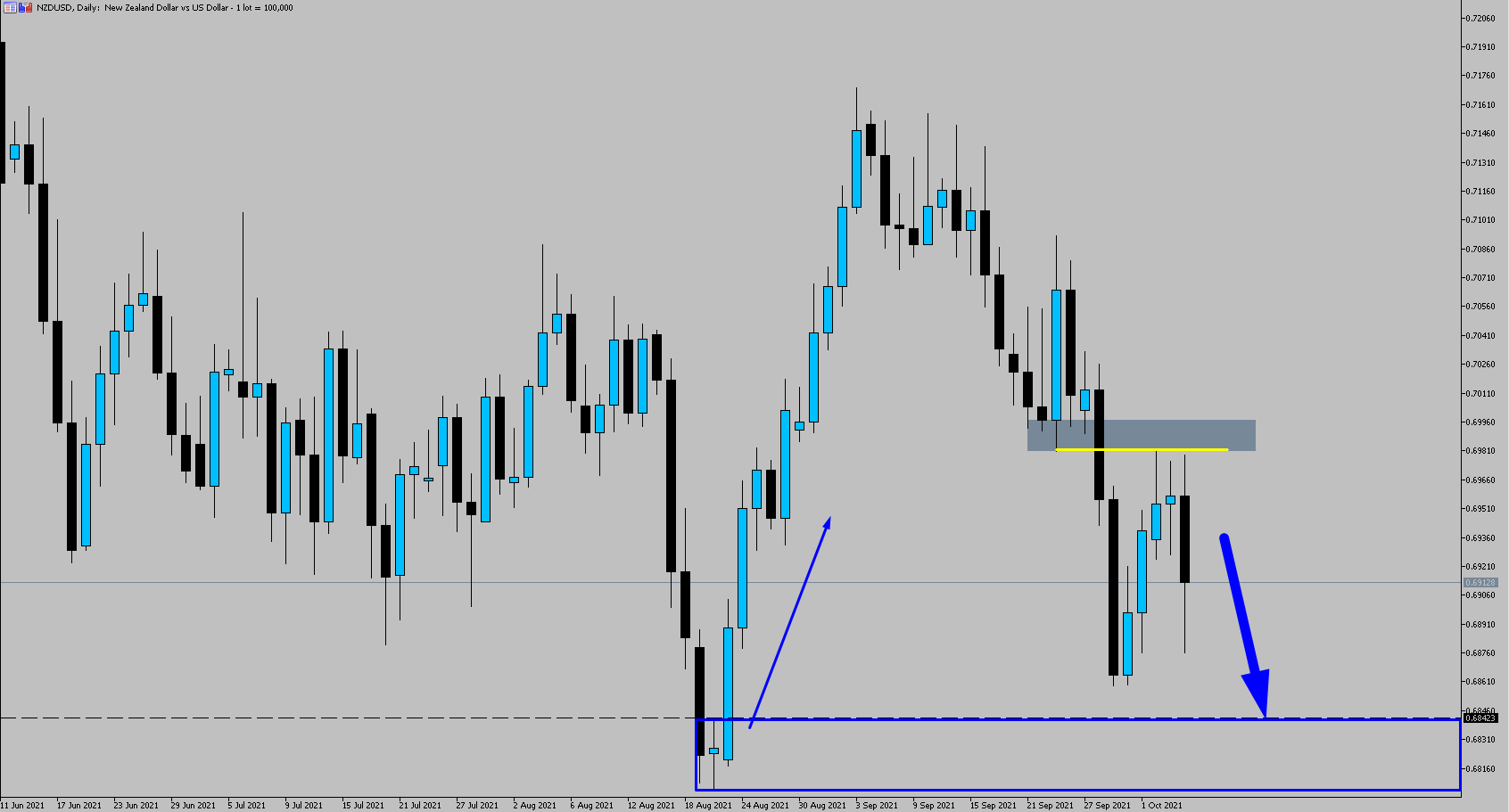

Daily Chart

The RBNZ recently hiked interest rates from 0.25% to 0.5%. Typically retail traders will be caught on the wrong side of the markets in these events as they see a rate hike as a good thing. However, rate hikes and cuts are often already priced in by investors as they are usually pre planned events. So seeing the price of NZDUSD continue the bearish trend wasn’t a surprise and was something we mentioned in our week ahead analysis.

Now the price is forming a bearish daily close, we could assume the bearish trend will continue and that could lead to shorting opportunities.

If the daily is going to move into the impulse phase we would likely see the 4hr time frame form lower lows and lower highs until the market comes into a key area of support.

The 4hr Chart

As we can see from this 4hr time frame the price formed a double top reversal pattern and the price made new lower lows. In a daily downtrend impulse phase we should see the continuation of these lower highs and lower lows.

If the price retests the previous swing lows and neckline are of the pattern we can look for a bearish rejection for short opportunities back into the previous swing lows.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you from your quick account setup to any future concerns. Start trading with Blueberry Markets today.

ภาษาไทย

ภาษาไทย

Tiếng Việt

Tiếng Việt