The price of USDJPY price rallied back into the key 145.00 highs after the US CPI data. However, buyers have failed to trade through this level instead seeing price form a double top pattern. Could this show a reversal forming for the major forex pair?

Watch the video to learn more…

USDJPY Analysis

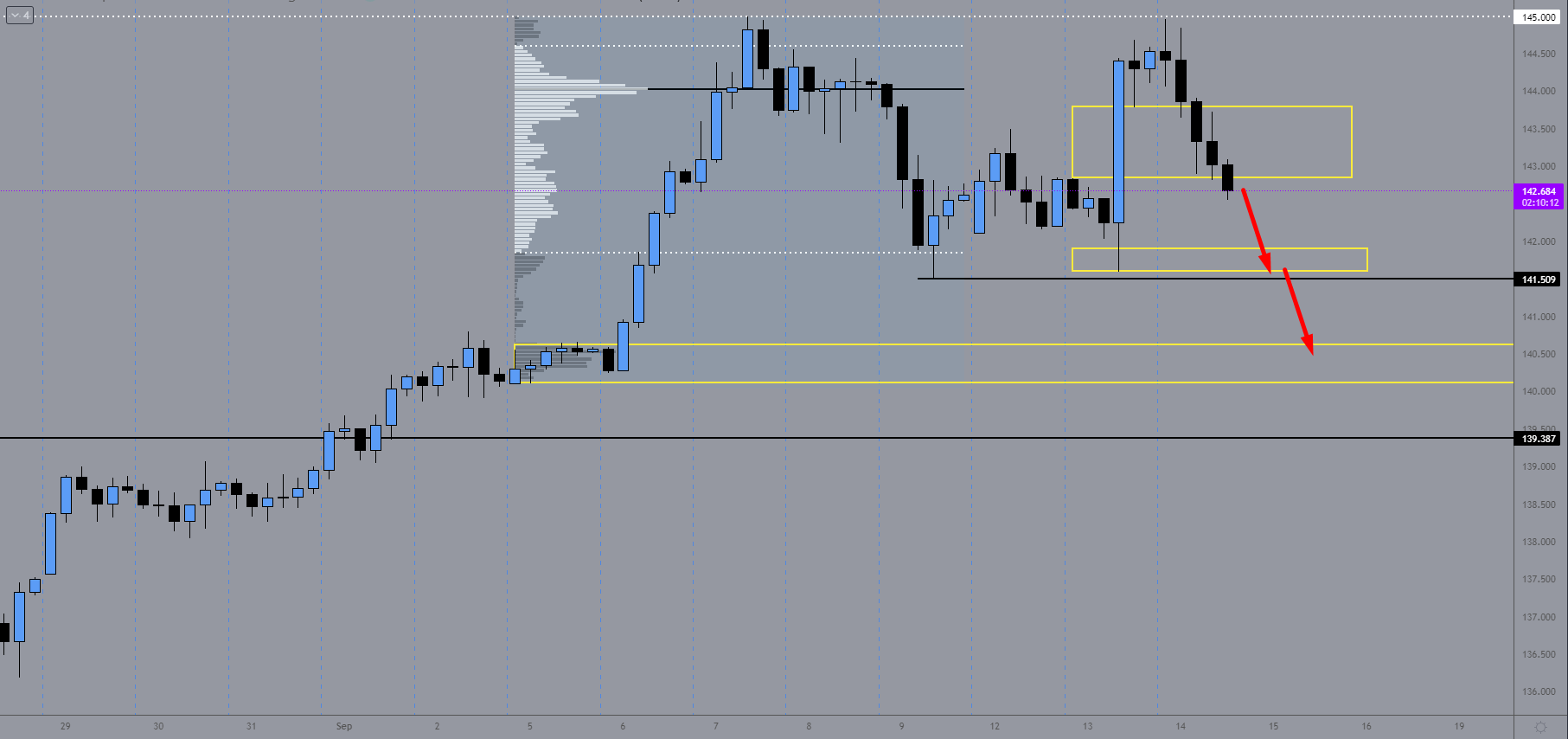

The price of USDJPY has retested and rejected the major 145.00 highs. The recent US CPI data which showed further growth in inflation saw the USDJPY rally. Not only this, the Bank of Japan has been talking of intervening as fears grow of the JPY weakening sharply. Often when this happens we can see a gap form in the volume profiles especially on the daily profiles. This then can often be filled the next day and be used as support or resistance.

The daily chart shows the price forming a double top pattern. If the price was to break the neckline it could invite further selling pressure. The 1hr chart with the daily volume profiles shows the gap that formed, which can often lead to the gap being filled. This has happened now which can see prices continue lower.

Did you see our EURUSD Analysis? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you from your quick account setup to any future concerns. Start trading with Blueberry Markets today.

ภาษาไทย

ภาษาไทย

Tiếng Việt

Tiếng Việt