Using Expert Advisors (EA) robots in forex trading streamlines execution, automates strategies, and removes emotional bias. Trading with EA streamlines the execution process, automates strategies, and eradicates emotional bias. Traders can capitalize on advantages such as precise trade entries and exits, continuous operation throughout the week, and efficient risk management with EAs in trading.

Let’s learn how traders can start trading on MT4 with robots.

What are trading robots in MT4?

In MetaTrader 4 (MT4), trading robots refer to automated trading systems or Expert Advisors (EAs). These software programs can analyze the financial markets, generate trading signals, and automatically execute trades on behalf of the trader. Traders can develop their own EAs using the MQL4 programming language or choose from a wide range of pre-built EAs available in the MT4 marketplace. These robots aim to eliminate human emotions from trading and execute trades based on predefined rules.

By automating trades, EAs allow traders to set parameters such as stop-loss triggers. This automation ensures that trades are executed seamlessly, even in the trader's absence from the computer, further adding to the convenience and flexibility of the trading experience.

Advantages and risks of using robots in mt4 for trading

Advantages

- Automation: Robots automate trading processes, executing trades based on predefined criteria without emotional interference, leading to consistent and disciplined trading.

- 24/5 operation: Unlike humans, robots can trade continuously, taking advantage of market opportunities and reacting to changes in real-time, even when the trader is not actively monitoring the market.

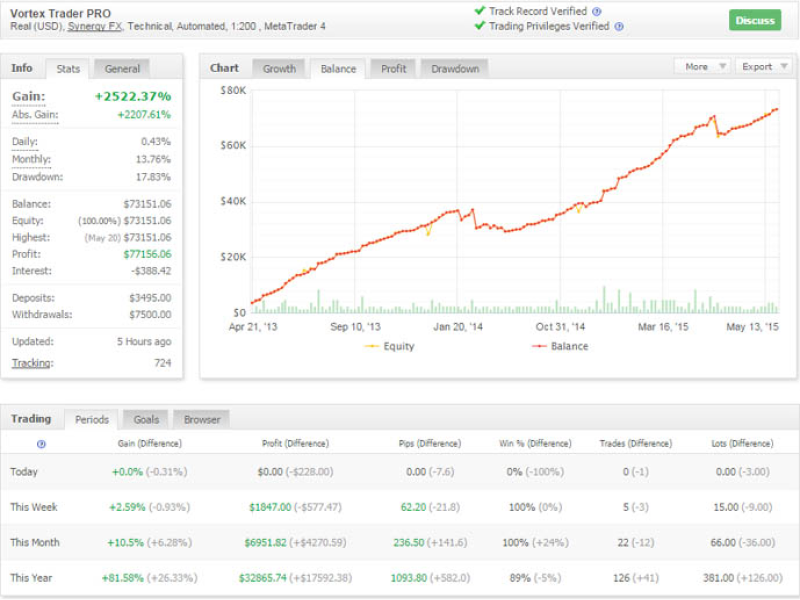

- Backtesting: Traders can backtest their strategies using historical data to assess the robot's performance under various market conditions, helping optimize and refine strategies before deploying them live.

- Reduced emotional bias: By eliminating emotional decision-making, robots can adhere strictly to predetermined rules, reducing the impact of fear, greed, or hesitation on trading outcomes.

Risks

- Lack of adaptability: Robots follow programmed algorithms and may struggle to adapt to sudden market changes, unforeseen events, or unusual market conditions that were not considered during the programming stage.

- Over-optimization: Excessive fine-tuning of a robot based on historical data (over-optimization) may lead to poor performance in live markets, as the robot may become too tailored to past conditions that may not repeat.

- System vulnerabilities: Robots can be susceptible to hacking, malware, or other cybersecurity threats, exposing traders to potential financial losses or unauthorized access to trading accounts.

- Dependency on historical data: Robots rely on historical data for decision-making, and their effectiveness is limited to the accuracy and relevance of the data used during the development and testing phases.

Tips to trade with MT4 robots

Monitor and manage robot performance

Traders actively monitor the live performance of the robot in real market conditions. They stand ready to intervene, particularly during heightened volatility or unexpected market events that may impact the robot's performance.

Implement risk management strategies

Proactively defining and implementing risk management strategies is paramount. Traders set stop-loss levels to protect their capital from significant losses, ensuring a disciplined approach to risk.

Troubleshoot and maintain EAs

Continuous vigilance is exercised as traders actively monitor the EA for any issues or errors. Remaining informed about updates or patches for both MetaTrader 4 and the installed trading robot, they troubleshoot and promptly resolve issues to sustain the smooth operation of their trading system.

How to start trading on MetaTrader 4 with robots

Establish a MetaTrader 4 account

Traders can commence their MetaTrader 4 journey by registering with a forex broker and installing the MetaTrader 4 platform.

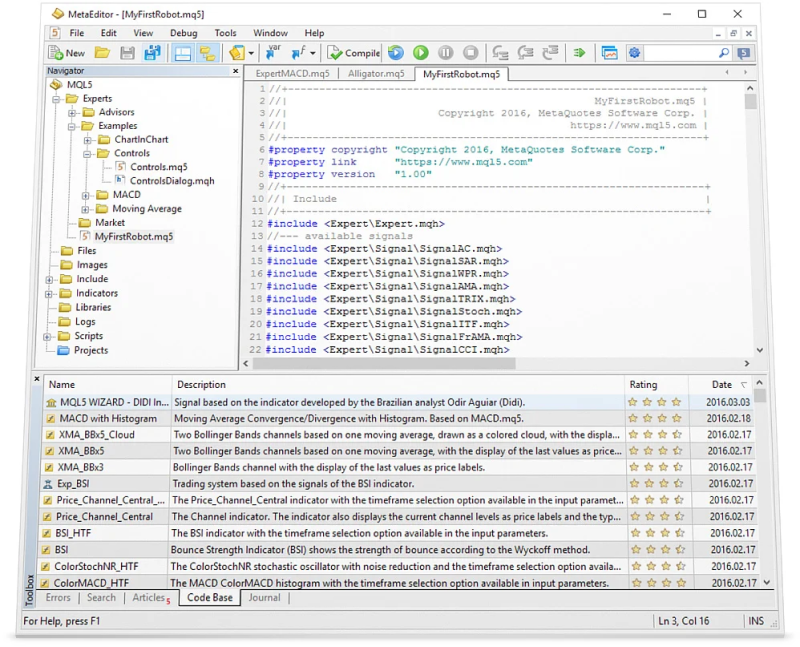

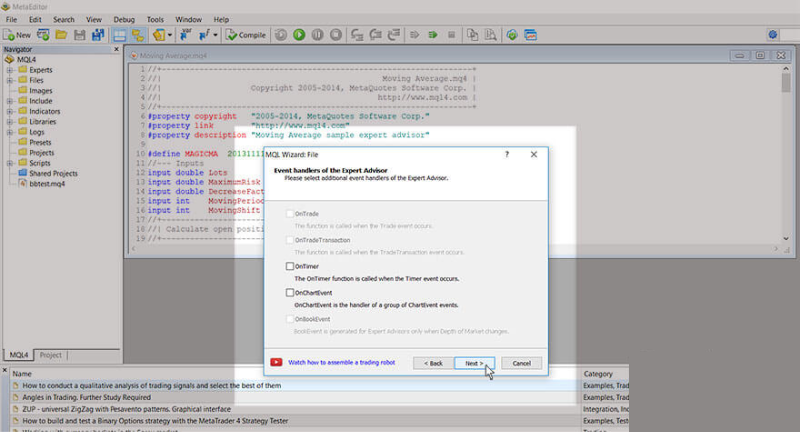

Open MetaEditor

MetaEditor is a critical tool within the MetaTrader ecosystem, specifically designed to modify and create Expert Advisors (EAs), scripts, and custom indicators. The integrated development environment (IDE) empowers traders and developers to write, edit, and debug code using the MQL4 or MQL5 programming languages. Through MetaEditor, users can customize and fine-tune their trading strategies, enhancing the overall functionality and automation of their trading systems.

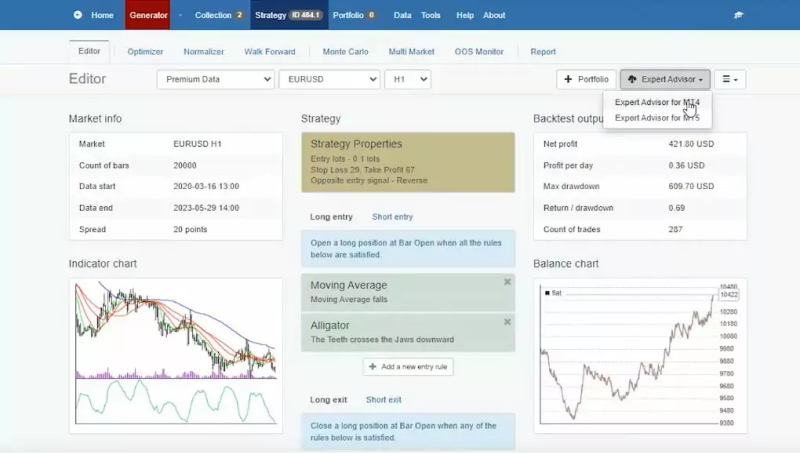

Research and choose a trading robot (Expert Advisor)

Find a suitable Expert Advisor (EA) or trading robot. Performance history, reviews, and strategy alignment are carefully considered, ensuring the selected EA aligns with their trading goals and risk tolerance. For example –

- To capitalize on established market trends, traders can opt for trend-following robots.

- In navigating sideways or ranging markets, traders may choose Range-Bound Robots to detect overbought and oversold conditions effectively.

- Tailored for those aiming to protect swift, modest gains from short-term market movements. Scalping Robots offers a strategic solution for traders.

- For individuals seeking to exploit price breakouts emerging from consolidation phases, Breakout Robots present a valuable and strategic option.

Install and activate the chosen trading robot

The selected EA is installed by copying its files into the Experts folder within the MetaTrader 4 directory. Activation is completed by restarting the platform or dragging the EA onto a chart, initiating its functionality.

Customize robot settings to fit their strategy

Traders tailor the settings of the installed EA to align with their unique trading strategy. This involves adjusting risk levels, lot sizes, and trade execution rules to reflect their preferences and risk appetite.

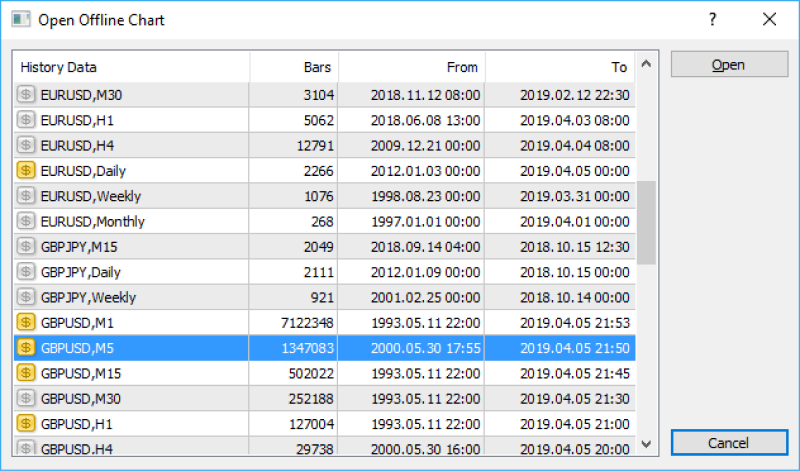

Backtest their trading strategies

To assess the EA's effectiveness, traders perform backtesting using historical data. This crucial step evaluates the robot's performance under various market conditions, validating its capabilities and identifying areas for potential improvement.

Striking a balance between trading forex with MT4 robot's precision

Using robots in forex trading provides automated efficiency and strategy diversification. While advantages include emotion-free trading and continuous monitoring, risks like system vulnerabilities and historical data dependence exist. Striking a balance between automation and human oversight, implementing robust risk management, and ensuring account security are crucial for navigating forex markets effectively with automated tools.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.