Creating a TradingView account gives traders access to advanced charting tools, real-time data, and a global trading community. The platform supports cross-device access, custom indicators, and strategy-building with Pine Script™, which is TradingView's programming language.

Let’s take a look at how to set up a TradingView account.

*This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry providing personal advice.

What is a TradingView?

TradingView is a charting platform and social network that provides real-time market data for various assets. Users can customize their charts to fit trading preferences.

The account includes social features for following other traders and sharing ideas. Traders can set alerts, save chart layouts, and access technical analysis. Advanced features, such as unlimited alerts, auto chart patterns, invite-only scripts, and more, are also available.

Top benefits of setting up a TradingView account

- Access to advanced charting tools: TradingView offers powerful charting tools for analyzing markets, such as custom range bars. Traders can also customize charts, use technical indicators, and apply drawing tools for better insights.

- Real-time market data: Stay updated with live market data across assets like stocks, forex, and crypto.

- Social trading community: Follow and connect with traders worldwide, share ideas, and learn strategies. The community provides valuable market perspectives and insights

- Customizable alerts: Set alerts for price movements, indicators, or news updates.

- Cross-platform support: TradingView is accessible on web, desktop, and mobile platforms

- Paper trading feature: Practice strategies with TradingView’s paper trading option. It’s ideal for beginners or testing new approaches

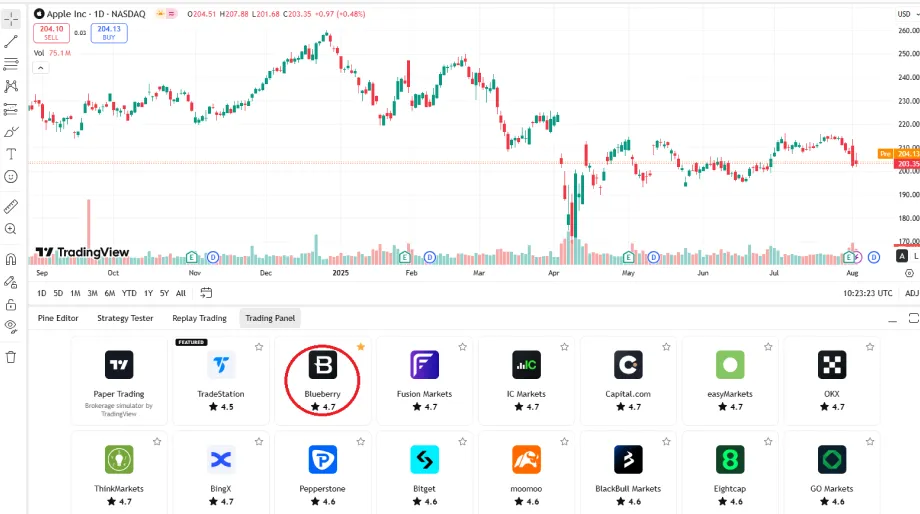

- Integration with brokers: Linking a brokerage account to TradingView allows traders to execute trades directly from the platform via API integration. This eliminates the need to switch between platforms, streamlining analysis and order execution.

Challenges in using a TradingView account

- Limited broker integration: Not all brokers are supported on TradingView

- Steep learning curve: New users may find it overwhelming to navigate as TradingView is feature-heavy

- Limited offline accessibility: TradingView is primarily an online platform. This limits access to its features and data without an internet connection

Stepwise guide to set up a TradingView account

-

Sign up for a new TradingView account

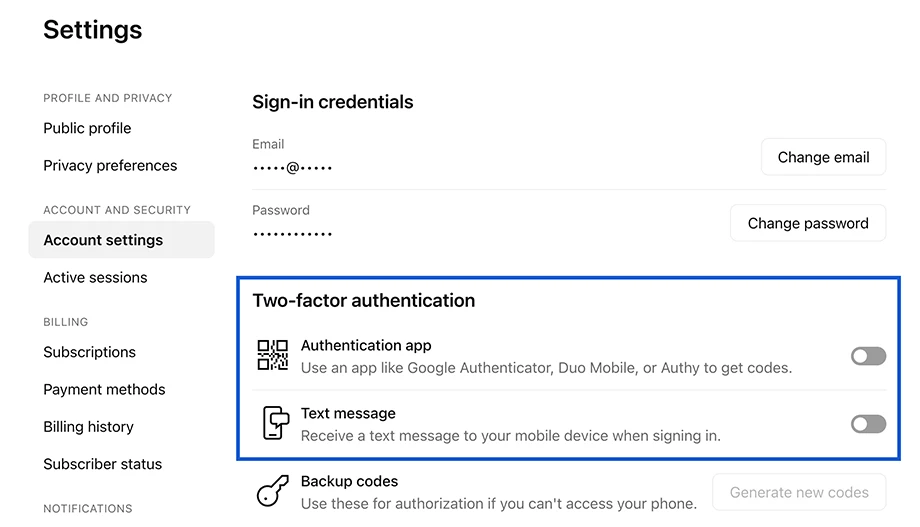

Getting started with TradingView is simple. Visit TradingView’s website and sign up. The plan includes basic features, while paid plans offer advanced tools like real-time data and enhanced charting. After signing up, personalize your profile, adjust notification settings for price alerts and news, and enable two-factor authentication for security.

-

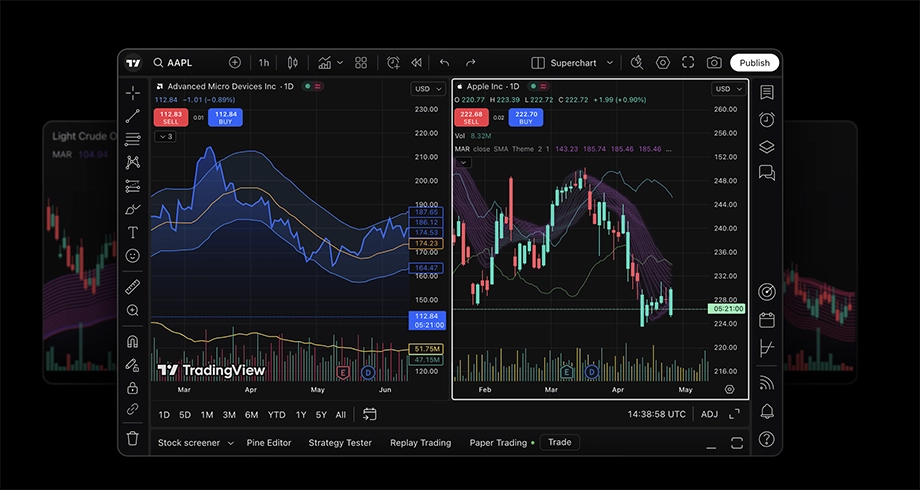

Explore charts and features

Once set up, users can explore TradingView’s charting tools. Analyze various assets, apply technical indicators, and use drawing tools. Experimenting with features helps traders develop effective strategies tailored to their trading goals.

-

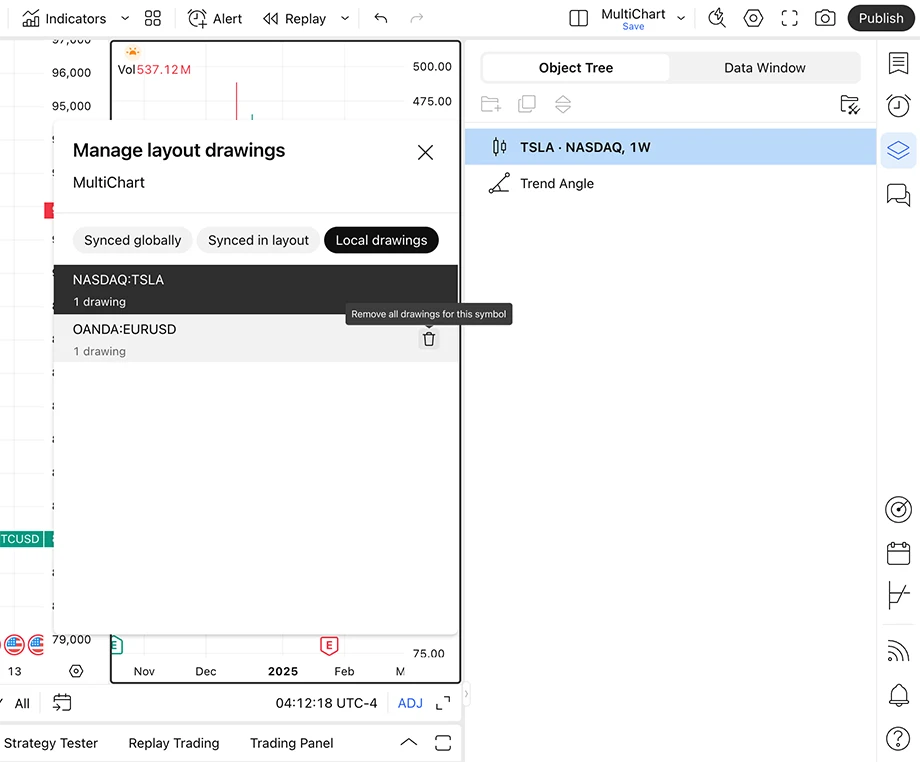

Save layouts and watchlists

Users can save chart layouts and watchlists to streamline their trading process. This feature eliminates the need to reconfigure settings and provides quick access to preferred assets, improving efficiency and organization in trading workflows.

-

Connect the broker

Connect the broker through TradingView’s trading panel to trade live. Traders can execute trades directly on the platform by linking their broker account, integrating analysis and trading for an optimum trading experience.

Unlock smarter trading with TradingView

TradingView offers advanced charting tools, customizable alerts, and real-time market data to elevate analysis. Whether one is a beginner learning the ropes or a seasoned trader optimizing strategies, TradingView provides everything one needs to implement proper trades.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.