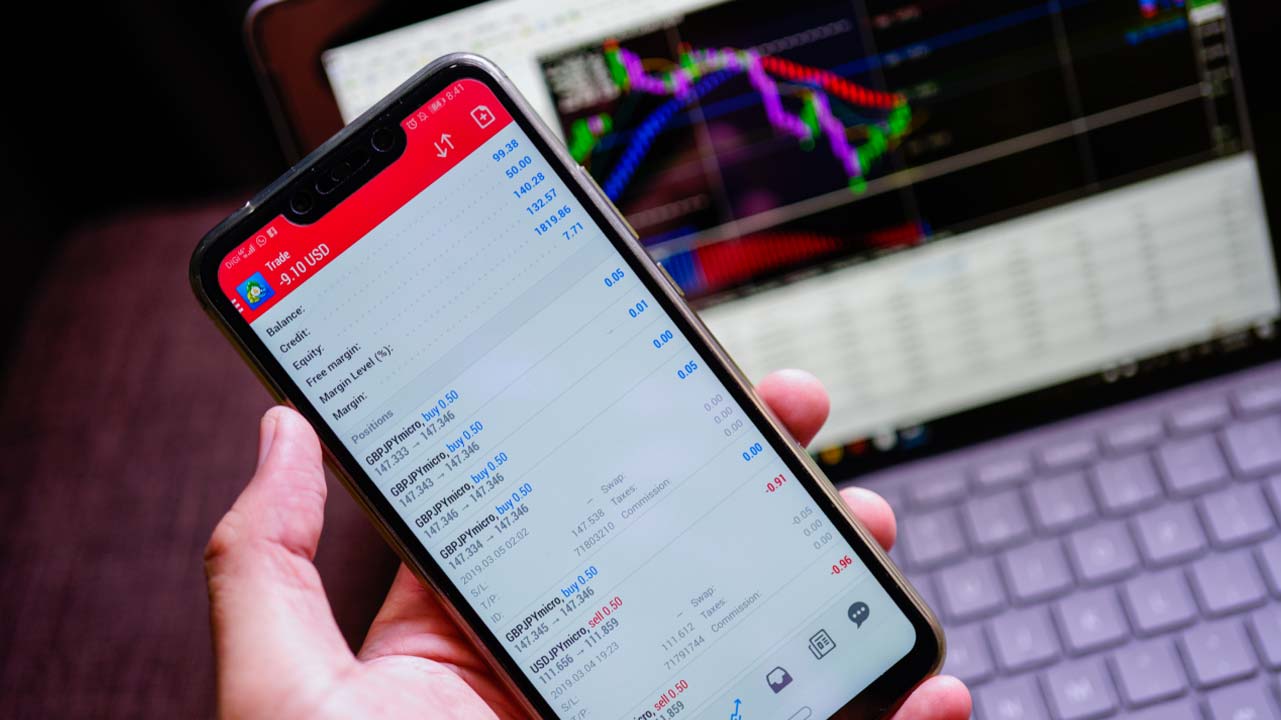

MetaTrader is a powerful and versatile trading platform that allows traders to participate in forex and other financial markets from any browser and operating system. It is widely popular because of the functionality and convenience it offers.

But, as with any other software platform, one must acquire basic knowledge about MetaTrader (such as how it works and the setup process) to utilize its full potential. This article guides traders through the setup process.

Before setting up MetaTrader

Several things need to happen before a trader even thinks about downloading MetaTrader. First, one must choose the preferred MetaTrader version. MetaTrader comes in two versions: MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

MetaQuotes Software Corporation, MetaTrader’s developer, released MT4 first in 2005. As such, most experienced traders are more familiar with MT4 because it has been around for longer. However, MT5 offers a freshened-up user interface and more options, such as 38 built-in indicators instead of MT4’s 30, six pending order types instead of MT4’s four, and so on. Therefore, one must think about what they want to achieve with the trading platform before choosing MT4 or MT5.

Second, one must consider system requirements. This step is contingent on the first one. In fact, it would be appropriate to begin here because it will determine the platform one chooses between MT4 and MT5. For example, MT5 has higher system requirements than MT4: for Microsoft Windows operating system users, it works only on Windows 7 or later, while MT4 can work on older versions (Vista and XP), requires a 2 GHz processor or faster while MT4 can tolerate slower processors, and so on.

With the basics out of the way, the trader is ready to set up the trading platform. One should know from the onset that there are two options for acquiring MetaTrader. Firstly, the trader can go through the MetaQuotes website. The problem is that MetaQuotes is a software company, not a broker. So, when a trader downloads the trading platform, they are not getting a trading account, but, instead, they are only getting the trading platform. This means the trader cannot access the Forex market. This makes the second option the recommended approach for acquiring MetaTrader, which is through a broker.

So, let’s learn how a trader can set up MetaTrader.

Step 1: Choose a preferred broker

When participating in the forex market, the trader needs a broker for the following reasons:

- Brokers connect traders to the market by allowing them to trade with other participants.

- Brokers execute trades on traders’ behalf

- They also provide traders with prices for the various trading instruments

- They allow clients (the traders) to take leveraged positions in the market

- Most importantly, most brokers offer educational material to help beginner traders navigate the market and the trading platform.

But as the trader looks for a broker, one must understand that there are bare minimums the preferred broker must fulfill, including affordable fees, evidence of adhering to regulations, and reliable customer support.

Step 2: Download and install MetaTrader

Typically, a broker will direct the new client to the download page after they create and activate a trading account. Activating a trading account usually involves verifying user information, including the supplied email address.

Download the MetaTrader platform from the broker’s website (some brokers offer one version, i.e., MT4 or MT5, and others may offer a choice between the two).

With the installer fully downloaded, go to the downloads folder and double-click on it. An installation wizard will open, guiding the trader through the installation process.

Step 3: Log into the trading account

Pause now and consider the following clarification: when the trader signs up with the preferred broker, they open a live trading account. The broker also provides the trader with login details for the trading platform.

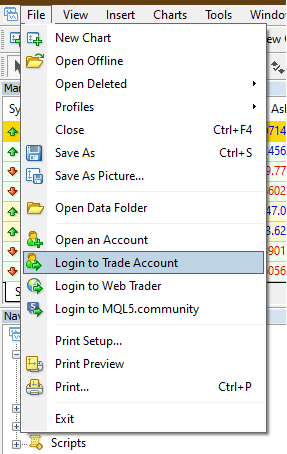

To log into the trading account on MetaTrader, navigate to the ‘File’ button in the navigation menu and move down to the Login to Trade Account tab.

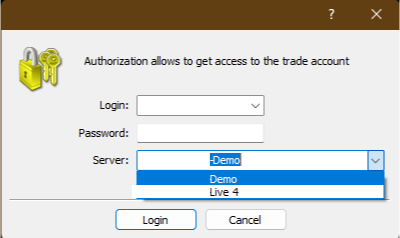

The tab opens a login window where the trader must provide the details supplied when opening the live trading account with the broker. Also, one will notice that the Server option indicates two choices: Demo and Live.

Use the Demo server if one wants to launch the practice trading account. This account provides most of the functionalities of a live account without exposing the trader’s funds to risk. However, suppose the trader wants to launch the live trading account.

In this case, one will select the Live server and ensure to enter the correct details in the Login and Password fields. We will use the Demo server for this discussion.

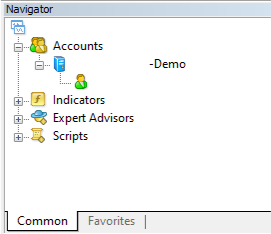

The trader will know that the login operation is successful when the details appear in the ‘Navigator’ window; see below:

If the trader launched the live trading server, the account details should show ‘Live’ after the broker’s brand name.

Step 4: Customize MetaTrader settings

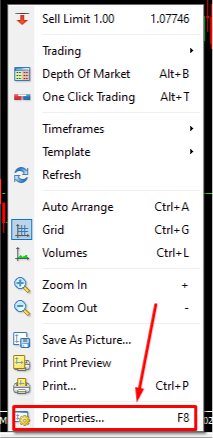

Out of the box, the trading platform may not appeal to the trader’s preferences. For instance, the interface may be a bit confusing. One area that often requires adjusting is the price chart. The trader may want to adjust the chart properties, accessible by right-clicking anywhere in the chart area (or pressing F8 on the keyboard). This opens chart properties for the specific trading instrument and allows the trader to change the appearance to their liking.

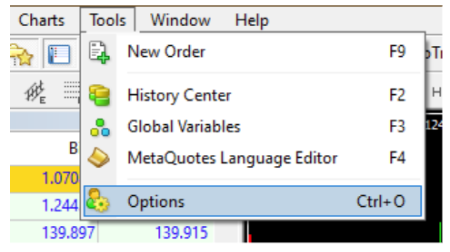

Another area that often requires adjustment is the trading platform’s general settings. To access the settings, use the Tools tab in the toolbar, then Options. Alternatively, one may use the Ctrl+O keyboard shortcut for convenience.

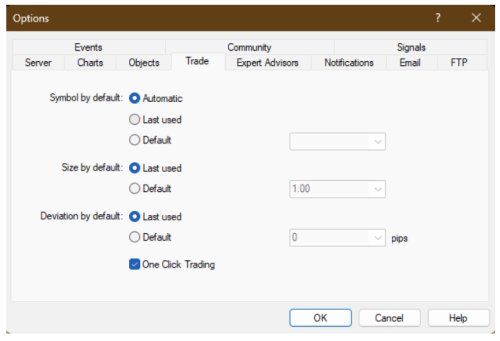

Once on the settings page, one can make various customizations. For example, the trader may activate One Click Trading in MT4. This option is available by default in the newer MT5.

Step 5: Start trading

If the trader launched the Demo server, this is the right time to test various strategies. The demo account is critical, especially for those without sufficient experience in the market. For a live account, the trader must have funds in the trading account. The trader can fund the trading account through the client section of their broker’s website.

Final Thoughts

Most brokers offer educational material to help beginners establish themselves in the market. However, it helps to expand one’s options by seeking additional information online. Thankfully, the forex trading community is vast and very active – many forums exist where traders can learn and have critical questions about MetaTrader answered.

Blueberry offers access to the MT4 platform.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.