Stop-loss (stop-loss) and take-profit levels (take-profit) help automate the trading process by establishing predetermined exit points. This ensures traders stick to their strategy and avoid emotional decisions. By setting stop-loss, traders limit potential losses, while take-profit ensures they lock in gains when the market reaches its desired target.

Let's discuss how traders can set stop-loss and take-profit levels on MT5.

This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

Stepwise guide to set up stop-loss and take-profit orders

For a new trade

1. Log into the MT5 platform

The trader begins by launching MetaTrader 5 (MT5) on their computer or mobile device. They must enter their trading account credentials to access the platform.

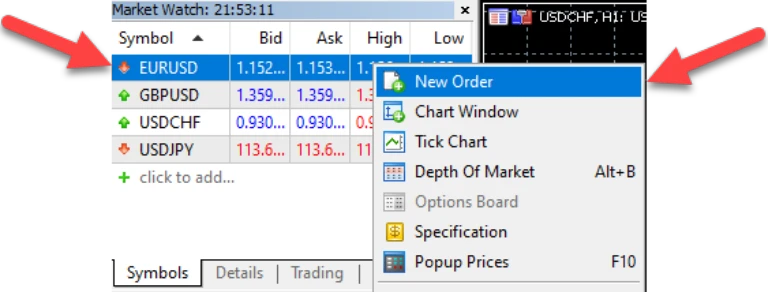

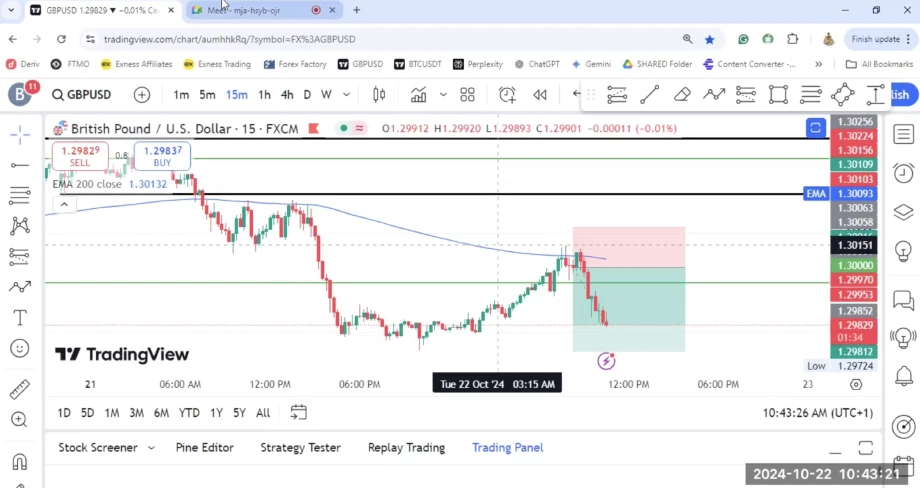

2. Access the desired instrument's chart

The trader navigates to the Market Watch window and searches for the desired financial instrument. Once found, they open its chart for analysis.

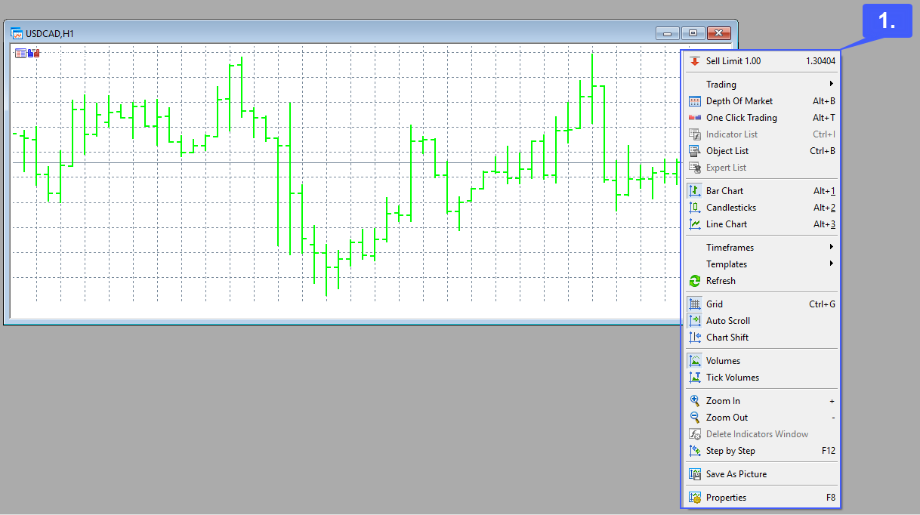

3. Right-click to open the context menu

On the chart, the trader can right-click anywhere to open the context menu. This menu provides options for trading, chart customization, and technical analysis tools.

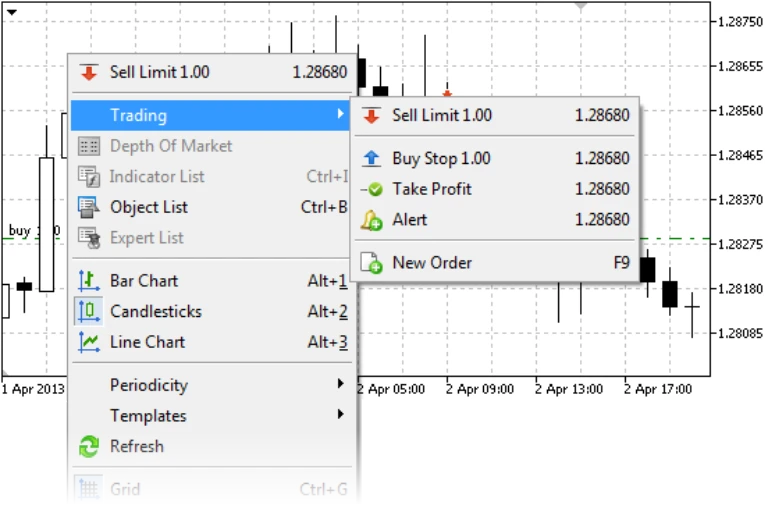

4. Select 'Trading' from the menu

The trader selects the Trading option from the context menu. This reveals additional trading-related actions.

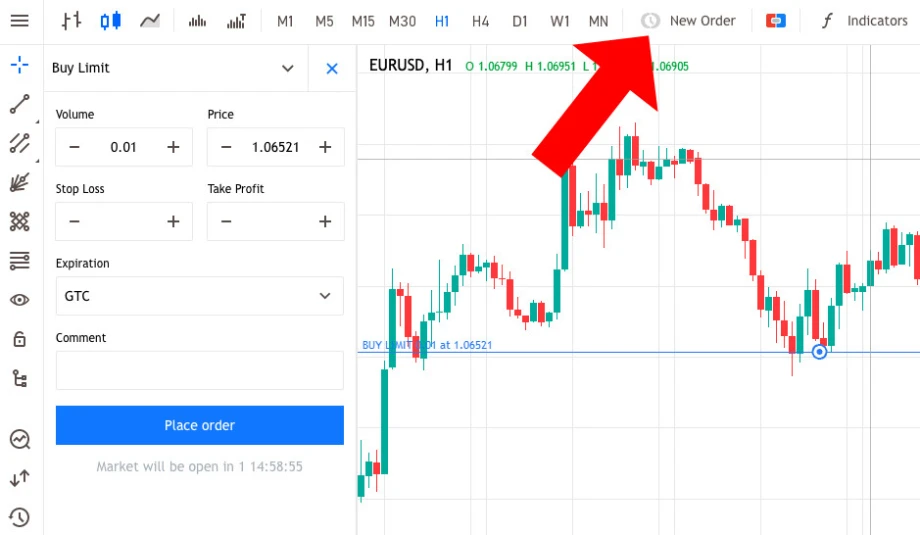

5. Choose 'New Order'

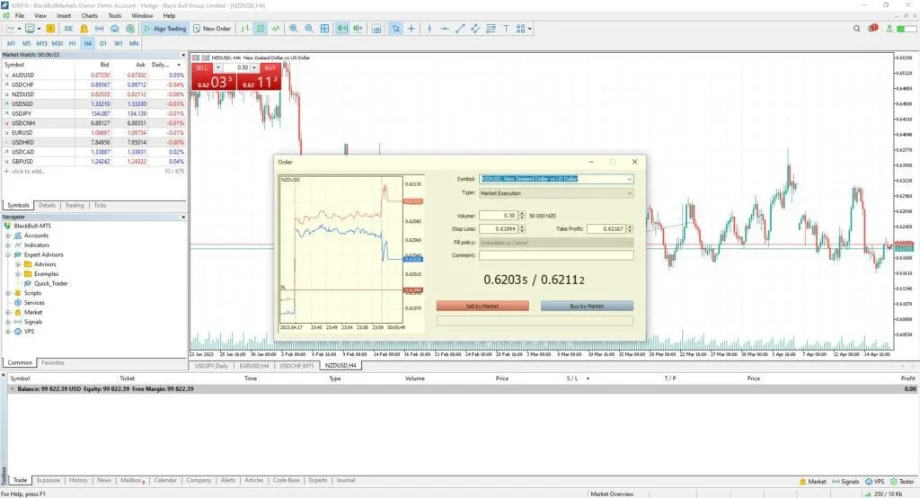

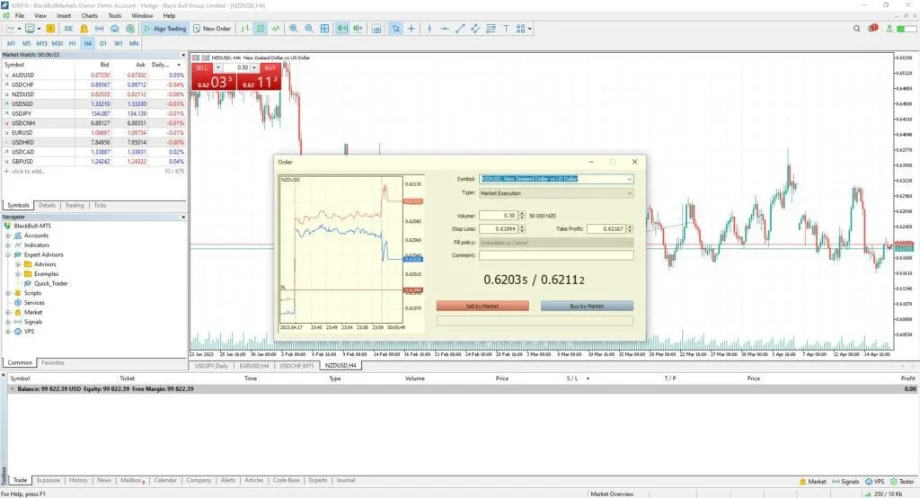

The trader selects New Order from the submenu to open the order window. Here, trade details are entered.

6. Enter trade details

The trader specifies the trade volume (number of lots) and selects the order type based on their trading strategy.

7. Specify stop-loss level

In the order window, the trader enters the desired stop-loss level to automatically close the trade if the market moves against them.

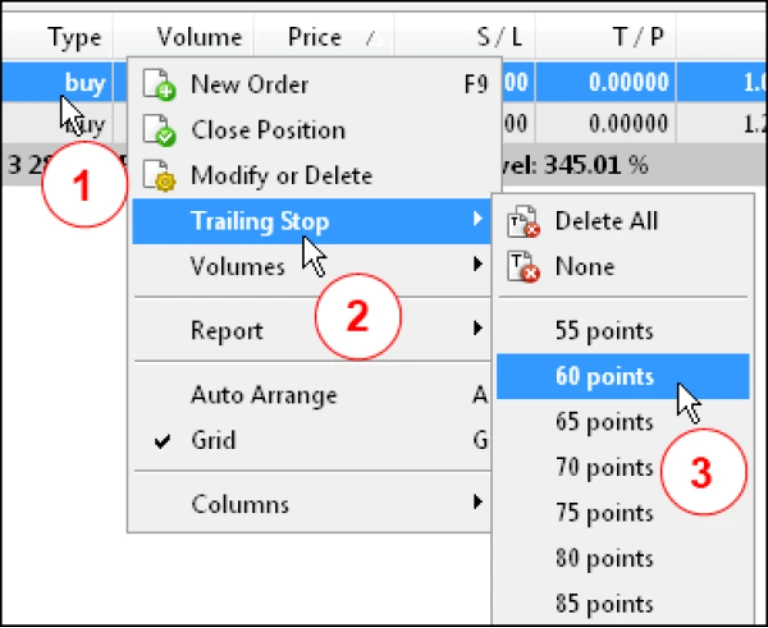

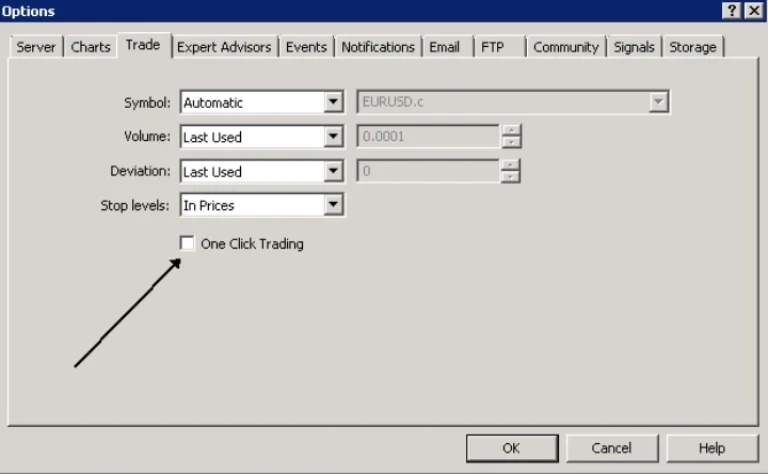

8. Activate the trailing stop option

The trader checks the Trailing Stop box below the stop-loss field to activate the trailing stop feature.

9. Set trailing stop distance

The trader defines the trailing stop distance in pips, indicating how far the stop-loss should trail the market price.

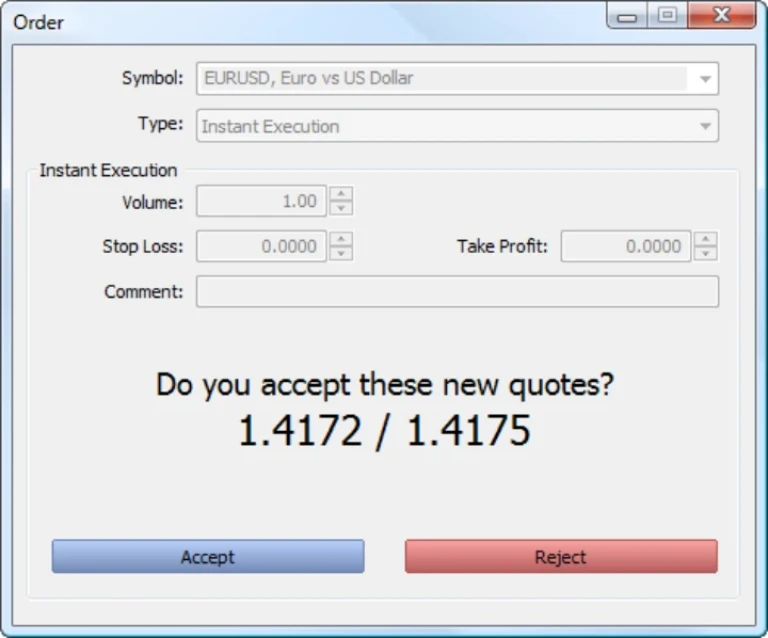

10. Confirm settings

To ensure accuracy, the trader reviews all the trade details, including stop-loss and trailing stop settings.

11. Execute trade

Once satisfied, the trader clicks Buy or Sell to place the trade, and the stop-loss and trailing stop settings are applied.

For an existing trade

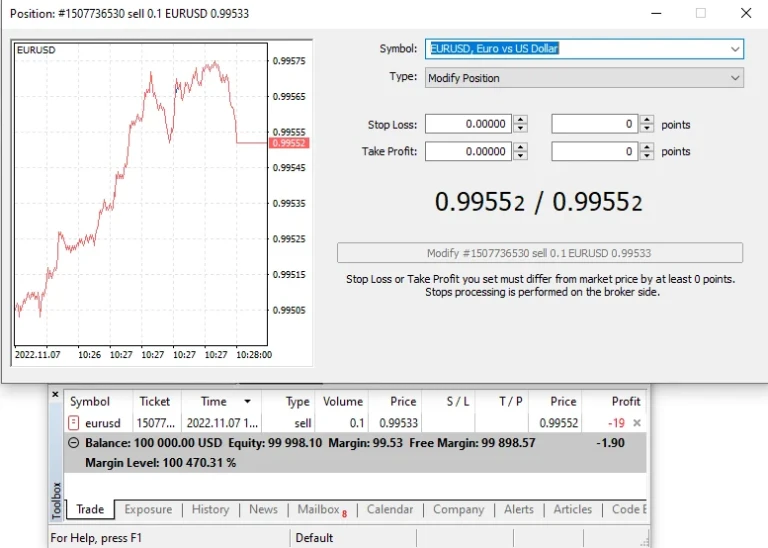

1. Double-click on a trade in the trade window

The trader double-clicks on an open trade in the Trade tab to open the modification window.

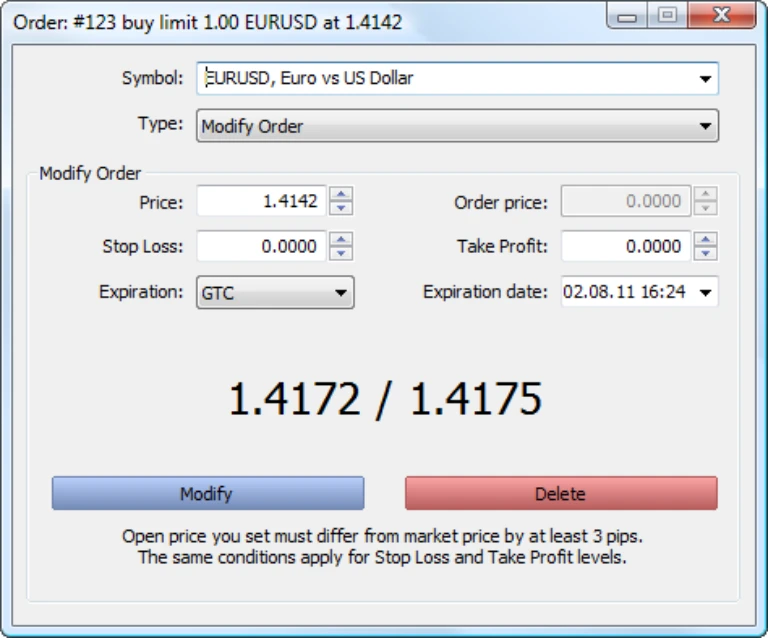

2. Modify stop-loss and take-profit

In the modification window, the trader updates the stop-loss and take-profit levels to new desired values.

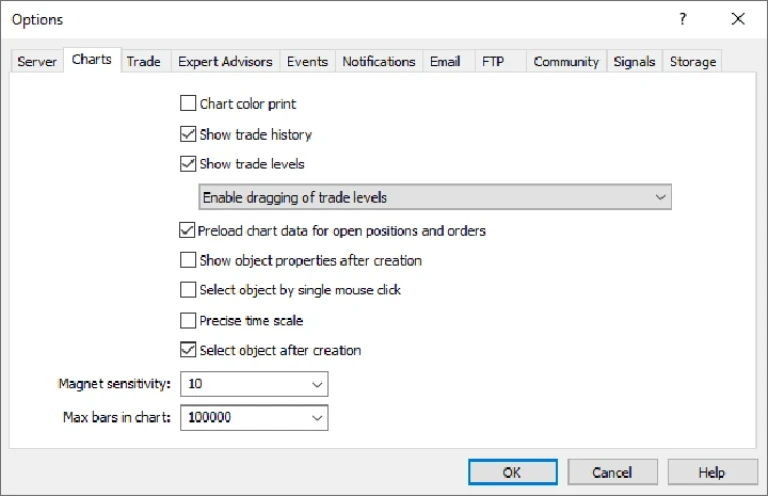

3. Drag the stop-loss and take-profit levels

Alternatively, the trader can drag the stop-loss and take-profit levels directly on the chart for quick adjustments.

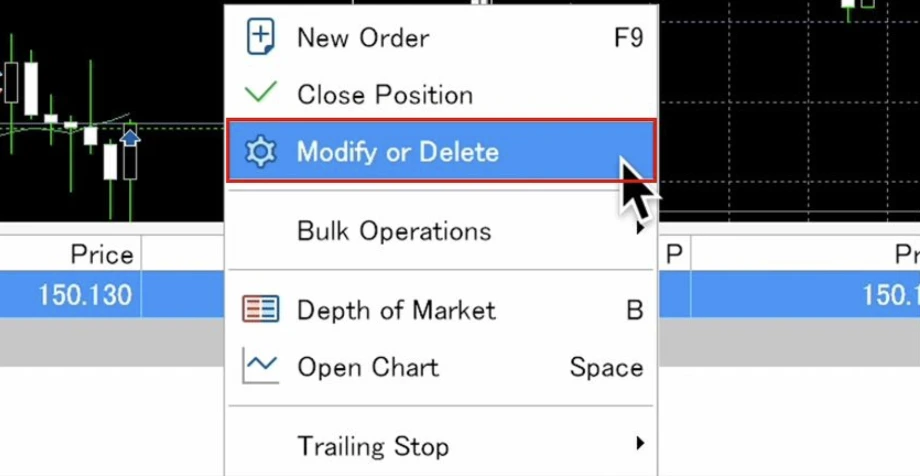

4. Right-click and select 'Modify or Delete'

The trader right-clicks on the trade in the Trade tab and selects Modify or Delete to access the modification window.

5. Enter new stop-loss and take-profit levels

The trader inputs the new stop-loss and take-profit levels in their respective fields in the modification window.

6. Click ‘Modify’ to confirm

After entering the new levels, the trader clicks Modify to apply the updated stop-loss and take-profit settings.

How to create a custom trailing stop-loss indicator on MT5?

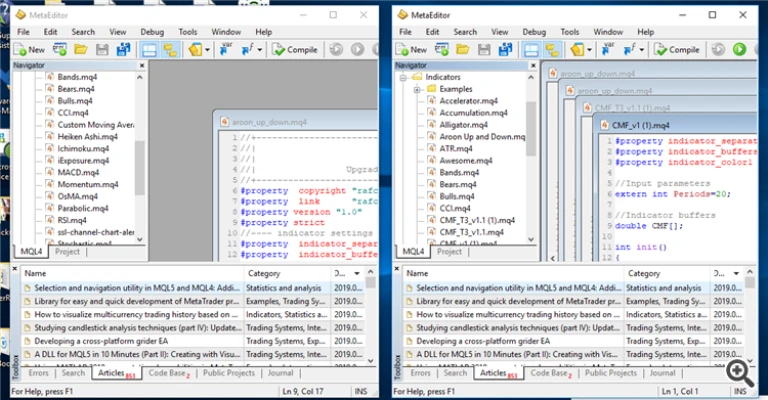

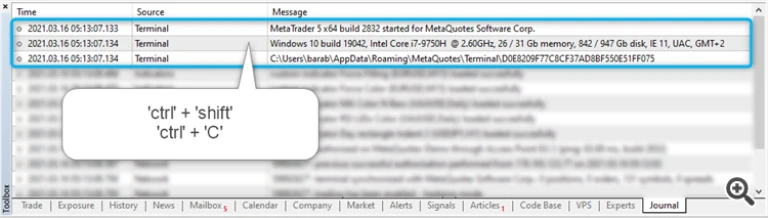

1. Open MetaEditor

The trader opens MetaEditor, the development environment for creating custom indicators in MT5.

2. Navigate to File > New > Indicator

The trader selects New Indicator from the File menu to start creating a custom trailing stop indicator.

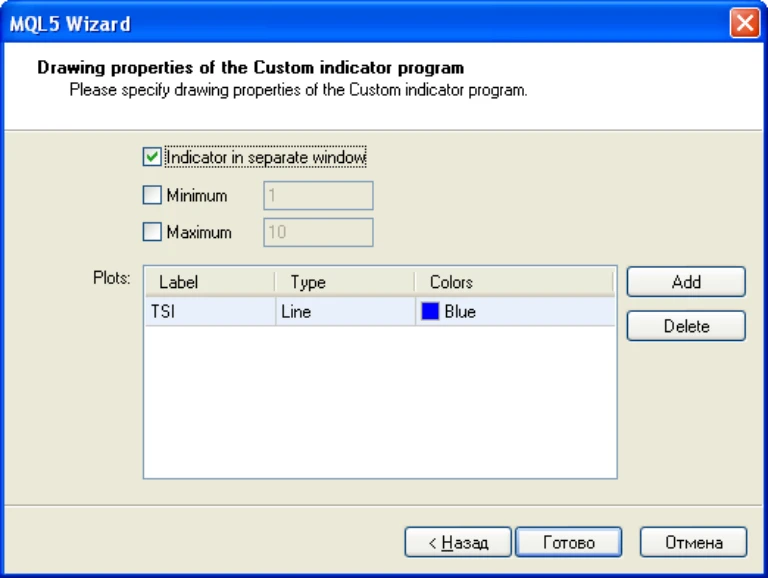

3. Define indicator properties

Based on their strategy, the trader sets the calculation methods and displays settings for the new trailing stop indicator.

4. Implement trailing stop logic

The trader writes code to track market highs and lows, adjusting the stop distance according to predefined conditions.

5. Include initialization code

The trader adds initialization code for variables and buffers that store trailing stop values.

6. Draw trailing stop levels on the chart

The trader uses graphical objects to display trailing stop levels on the price chart.

7. Compile the indicator

The trader compiles the custom indicator in MetaEditor to check for errors and generate a usable .ex5 file.

8. Test the indicator

The trader tests the custom indicator on historical data to ensure it functions correctly.

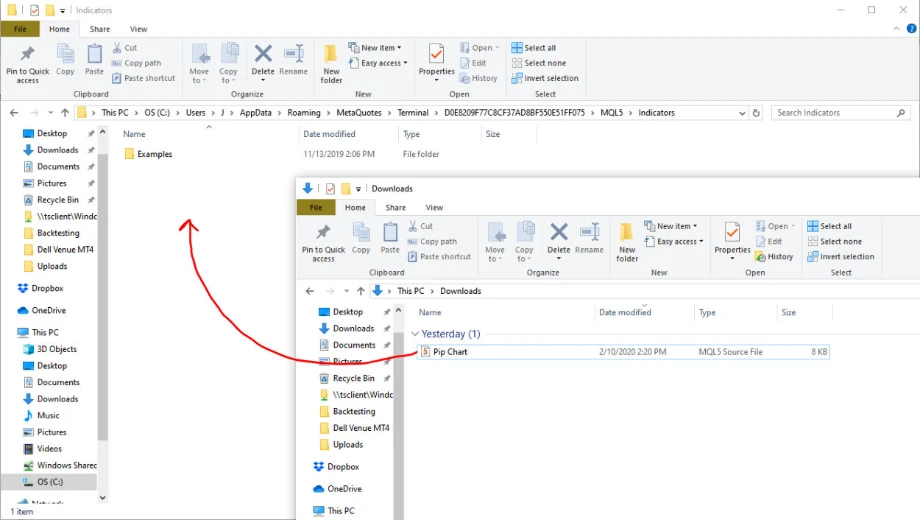

9. Deploy the indicator

The trader copies the compiled .ex5 file to the Indicators folder in MT5.

10. Apply the indicator to the chart

The trader drags and drops the custom trailing stop-loss indicator onto the price chart via the Navigator panel.

Common mistakes to avoid while setting custom stop-loss/take-profit orders

Failing to account for market volatility

Ignoring market conditions leads to poor stop levels. Volatility impacts price movements, affecting stop-loss effectiveness. Hence, traders must adapt stop levels accordingly, considering fluctuations in price to avoid premature exits or missed opportunities.

Over-tightening stop-loss or take-profit

Setting excessively tight stop-loss levels increases the risk of being stopped out prematurely. Tight take-profit targets limit profit potential, often leading to missed opportunities. Proper distance ensures trades have room to develop and reach gain targets.

Not adjusting stop-loss and take-profit after entering the trade

Failing to modify stop-loss or take-profit can leave a trade exposed to risk. As market conditions change, traders must adapt their levels. Regularly adjusting ensures better risk management and prevents losses due to unchanged parameters.

Placing stop-loss and take-profit too close to each other

Setting stop-loss and take-profit too close results in frequent stop-outs. This approach limits trade opportunities, as price movements may not reach the target before hitting the stop-loss. Proper distance between stop-loss and take-profit allows for proper trade development.

Set stop-loss and take-profit with confidence

By using trailing stop-losses in MT5, traders can adapt to market movements and reduce the risk of large losses. As the market price moves in their favor, the stop-loss moves with it. This approach helps traders manage their trades better, providing a disciplined strategy to navigate volatile forex markets.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.