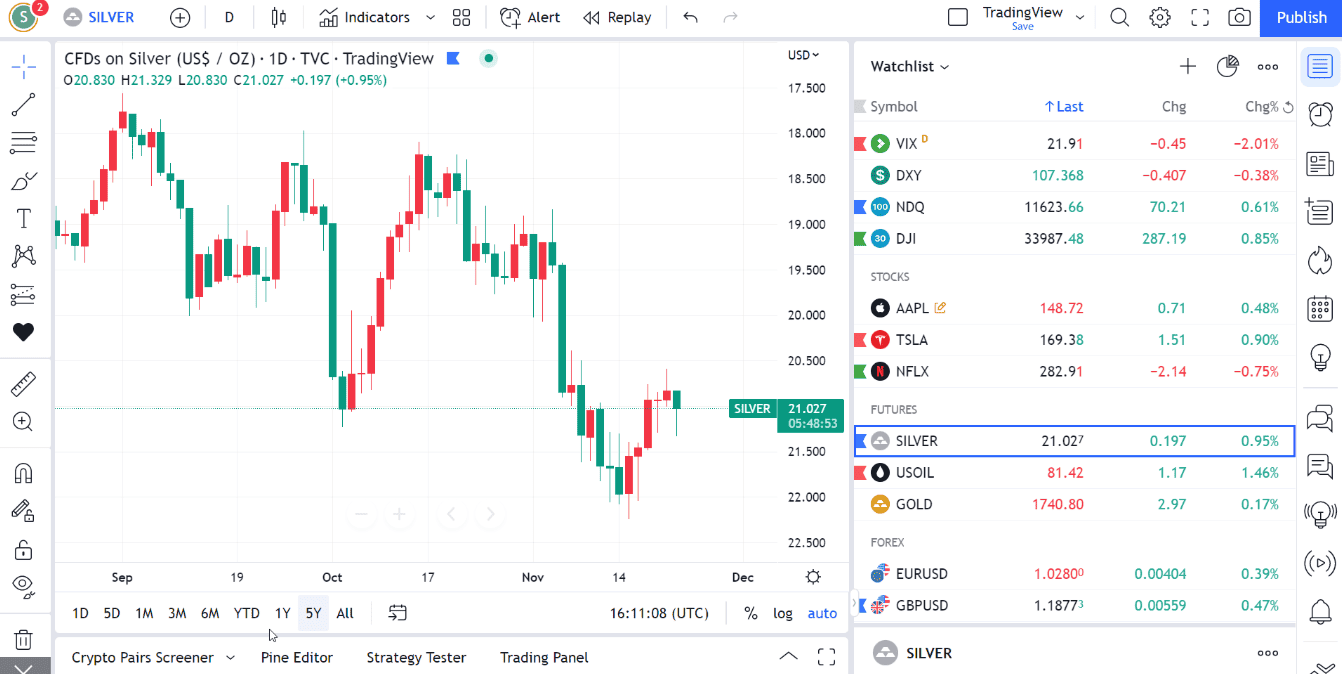

The TradingView watchlist is a tool that allows traders to monitor their preferred financial instruments in real time. Customizable columns, alerts, and chart integration offer a streamlined way to track market movements and make informed decisions.

It can be used to organise instruments of interest and observe changes in price or activity within the platform. Let's master this feature through an in-depth blog.

This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry providing personal advice.

What is a TradingView watchlist?

A TradingView watchlist is a custom list of financial instruments, like stocks, cryptocurrencies, forex pairs, or commodities, that one can track regularly. Adding these symbols allows traders to view charts, monitor live price changes, and stay updated on market trends.

To set up a watchlist on TradingView, follow these steps:

- Start a new watchlist: Open the Watchlist panel and click on Create New Watchlist.

- Add symbols: Search for the instruments one wants to track by their name or ticker symbol, then add them to the list.

- Organize and manage: Rearrange, rename, or delete symbols to keep the watchlist focused on the current trading goals.

Features of a TradingView watchlist

Customizable lists

Users can create personalized watchlists by adding and organizing financial instruments based on their preferences. They can customize the order, group similar assets, and manage multiple lists for different trading strategies or sectors.

Real-time data

Users can monitor live price changes, volume, and other key metrics for the assets in their watchlist. Real-time market data helps them stay updated and make informed trading decisions.

Price alerts

Users can set price alerts for specific instruments in their watchlist. Notifications will be sent when an asset reaches predefined price levels, enabling timely action without constantly checking the charts.

Ticker symbols

Ticker symbols allow users to identify financial instruments across markets. These short codes make referencing assets like stocks, forex pairs, or cryptocurrencies easier, simplifying searches and monitoring.

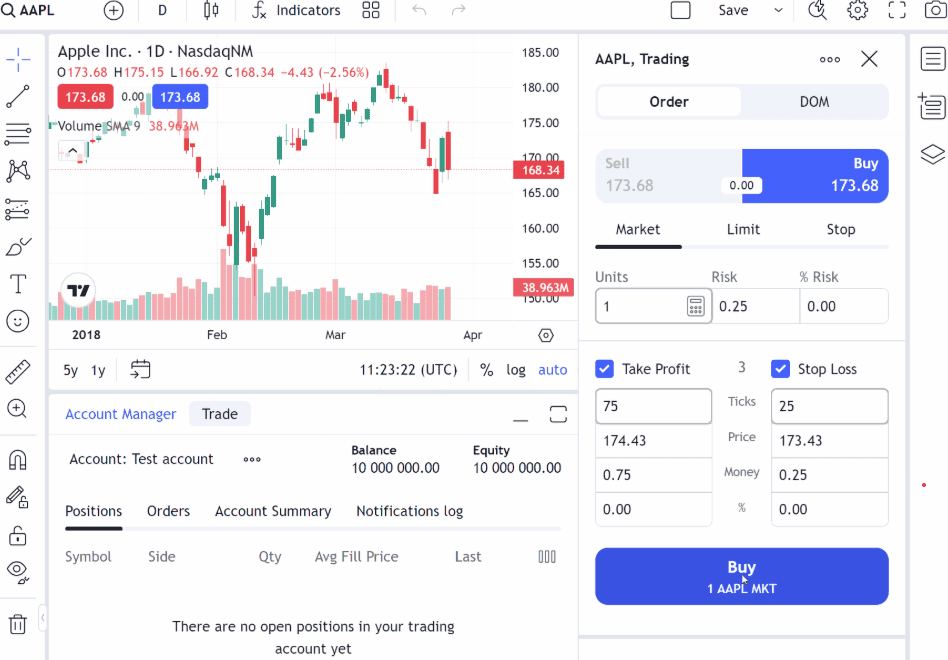

Quick actions

Users can perform key actions directly from their watchlist. This includes placing orders, viewing charts and adding symbols to other lists. Quick actions streamline the trading process, saving time and effort.

Chart integration

Users can view detailed charts of the assets in their watchlist. They can switch between instruments and integrate charts for in-depth analysis, ensuring a smooth and efficient trading experience.

Performance tracking

Users can track the performance of the assets in their watchlist over time. Monitoring price movements, trends, and key metrics helps them assess the success of their trading strategies.

Cross-platform sync

Users can access their watchlist and data across multiple devices, ensuring synchronization. The watchlist is always up-to-date and available for seamless trading, whether on desktop or mobile.

Tagging and sorting

Users can tag and categorize items in their watchlist based on sectors, trading styles, or other criteria. Sorting options help them quickly filter and find the instruments that align with a trader's strategy.

Managing the TradingView watchlist: a guide

Accessing the watchlist

The watchlist can be accessed by navigating to the panel on the right side of the TradingView interface. If the panel isn't visible, users can click the Watchlist icon in the right toolbar to bring it up.

Adding symbols to the watchlist

To add a symbol to a watchlist, users can click the Add Symbol button at the top of the panel. They can then type the ticker symbol or the name of the asset they wish to track.

Once a symbol is found, selecting it automatically adds it to the watchlist. Alternatively, right-clicking within the watchlist panel also allows users to add a symbol.

Organizing the watchlist

The watchlist can be customized by dragging and dropping symbols to reorder them. Users can also create new sections by right-clicking and selecting Add Section. These sections help group related instruments, making it easier to monitor different asset classes or strategies.

A high level of organization ensures that users can maintain a neat and efficient watchlist for quick access to key instruments.

Customizing columns

Users can adjust the columns displayed in the watchlist to improve visibility. By clicking the gear icon at the top of the panel, they can choose to show or hide columns such as Change, Volume, or P/E Ratio.

Additionally, users can resize the columns by dragging the borders to fit their preferences, ensuring only the most relevant information is displayed.

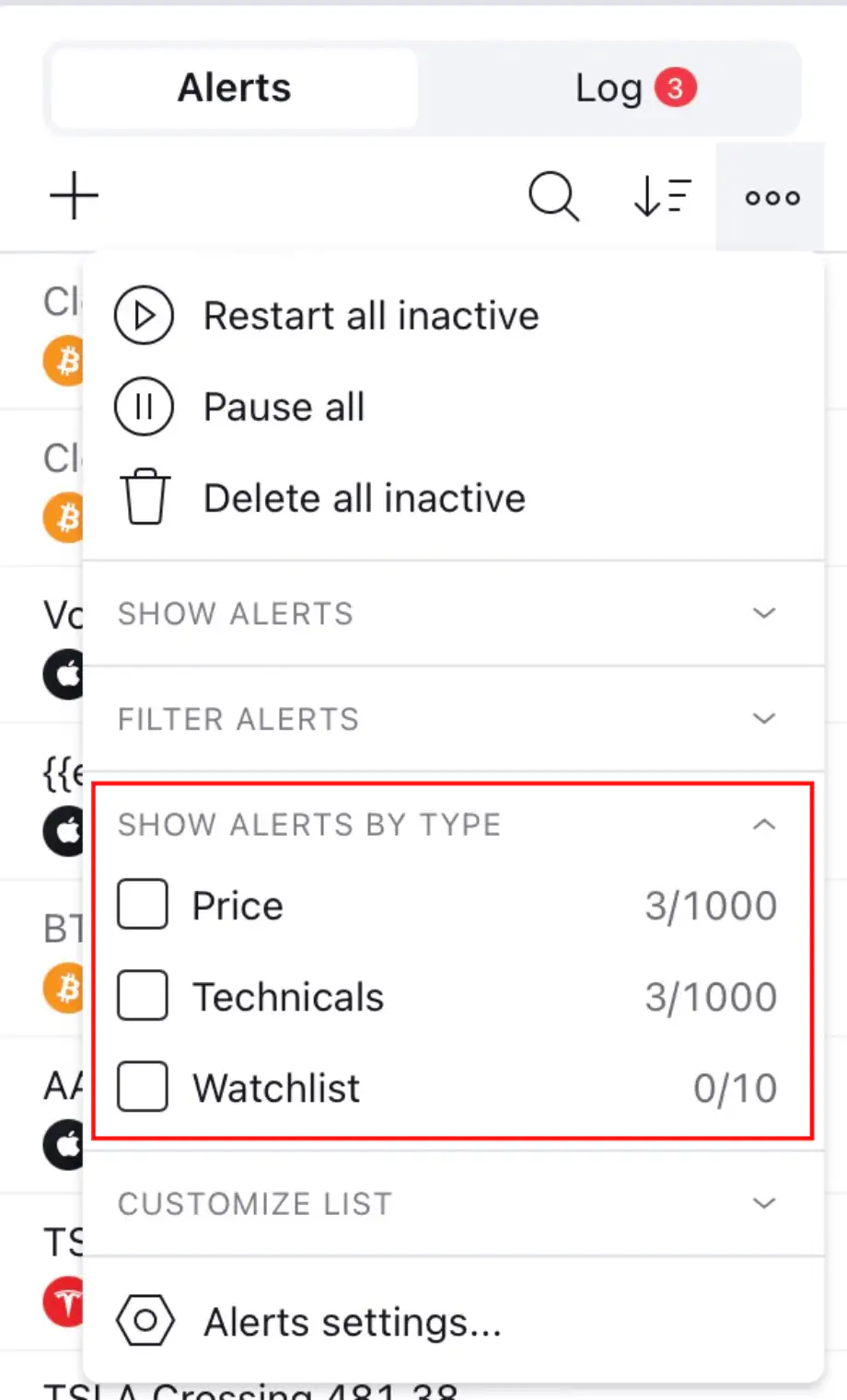

Setting alerts

To set price alerts, users can right-click on any symbol in the watchlist and select Add Alert. They can then define the specific conditions that trigger the alert, such as price changes or percentage movements.

Once set, the alert will notify users when the criteria are met, allowing for timely action without needing to monitor the asset constantly.

Importing and exporting watchlists

Users can export their watchlists by accessing the Advanced View button and selecting the Export List option. This allows them to back up their watchlist or share it with others.

Similarly, watchlists can be imported by clicking the watchlist name and selecting the Import List option. A .txt file containing the desired symbols can be uploaded for quick importing.

Deleting symbols or sections

To remove a symbol from the watchlist, users can right-click on the asset and select Remove. Sections can also be deleted by right-clicking on the section header and choosing Remove Section.

Confirmation is required for both actions to prevent accidental deletions. The watchlist should be regularly updated to keep it aligned with a trader's changing focus.

Overcome challenges to maximize TradingView watchlist advantages

Managing a TradingView watchlist provides access to preferred financial instruments, enabling efficient tracking of multiple assets. Real-time data and customizable columns ensure relevant information is easily accessible.

However, there are some downsides, too. A crowded watchlist can become overwhelming, making it difficult to manage large numbers of symbols. Over-customization might lead to confusion, and syncing across platforms may sometimes be slow. Despite these challenges, with proper organization, a TradingView watchlist can improve a trader's ability to make timely, informed decisions.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.