Backtesting in forex, using tools like the Strategy Tester on MT4/5, allows traders to evaluate the performance of their strategies on historical data.

Let's discuss in depth how traders can backtest on MT4 and MT5.

This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

What is backtesting?

Backtesting is the process of testing a trading strategy using historical data. It helps traders evaluate a strategy's performance before using it in live markets. By simulating trades based on past market conditions, traders can see how a strategy would have performed. This allows them to refine and adjust their approach to improve future results.

How does backtesting help traders?

Identifies optimal parameters

Backtesting helps identify the right settings for a trading strategy. It allows traders to adjust parameters such as stop-loss levels, take-profit targets, or indicators to improve performance.

Saves time and costs

Backtesting allows traders to test strategies without executing live trades. It saves time and money by preventing costly mistakes that could happen in real-time markets.

Increases confidence

Backtesting builds confidence in a strategy's potential. Traders can feel more confident when they see positive results from historical performance, which can improve their decision-making in live markets.

Limitations of backtesting

Data quality issues

Backtesting results depend on the quality of historical data. Inaccurate or incomplete data can lead to misleading results, which can affect the reliability of strategy evaluations.

Overfitting risk

Backtesting may lead to overfitting, in which a strategy is excessively tailored to past data. This can result in poor performance in live markets, as the strategy doesn't adapt well to new market conditions.

No account for slippage

Backtesting doesn't always factor in slippage (the difference between expected and actual execution prices). This can lead to overly optimistic performance predictions.

Stepwise guide to backtest on MT4

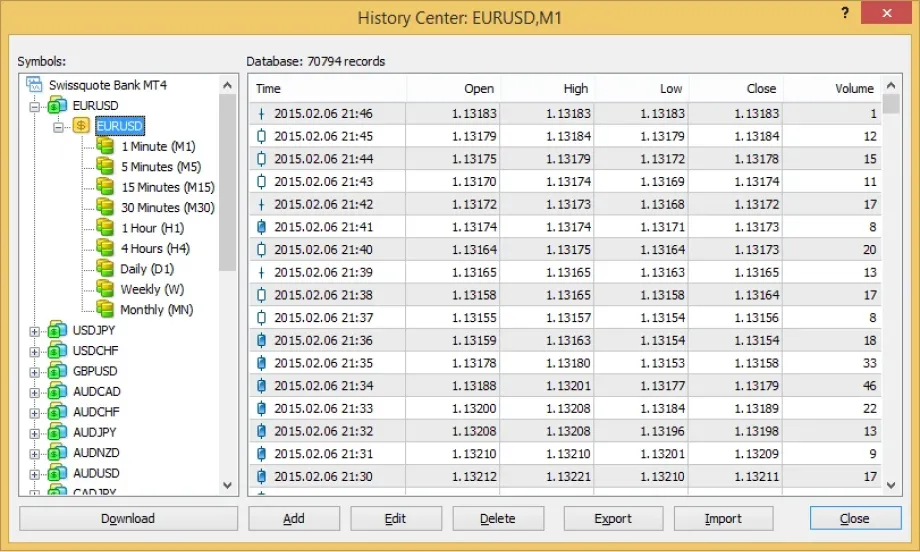

1. Understand the problem with default history data in MT4

Default history data in MT4 is unreliable for precise backtesting. It uses bar data to simulate ticks. This can lead to inaccuracies, especially in fast-moving strategies like scalping. This data does not cycle through each tick delivered in historical data, resulting in a flawed performance analysis.

2. Choose a third-party tick data provider

To overcome the above limitation, opt for third-party tick data providers. These providers offer high-quality, detailed tick data for better backtesting accuracy. Choose a provider based on the broker or desired historical data range.

3. Download Tick Data Suite (TDS)

Download and install Tick Data Suite (TDS), a tool that enhances MT4's backtesting capabilities. TDS offers access to high-quality tick data for accurate backtesting.

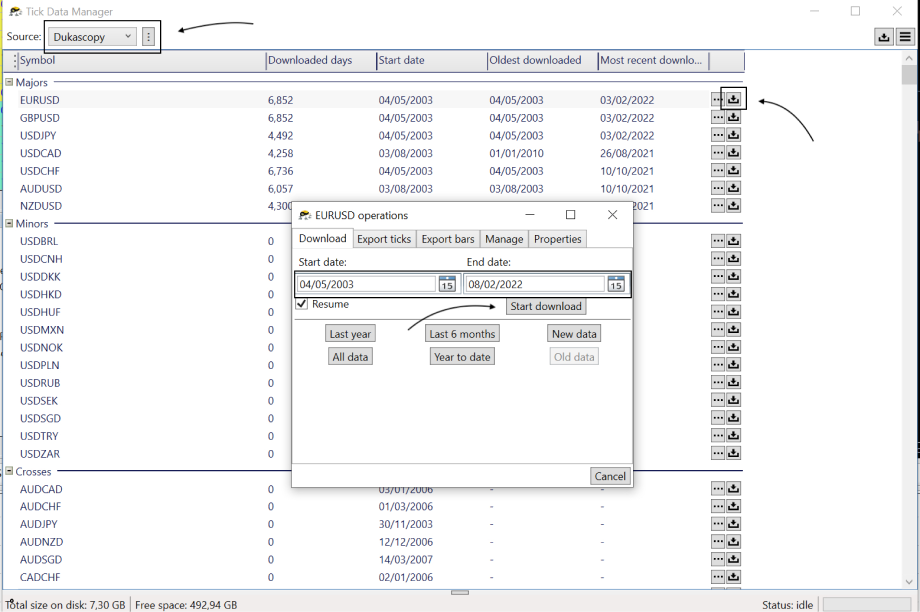

4. Select the broker and data source

Once TDS is installed, open the Tick Data Manager. Choose the broker and select the pairs and time period for downloading the required tick data. Click on the download icon and specify the time range to get the data.

5. Select the time period for data download

Decide on the historical data range one needs for the backtest. The time period is important, especially for testing strategies over extended periods. TDS allows traders to specify the exact timeframe for accurate historical data.

6. Close MT4 and reopen after downloading data

Once the tick data is downloaded, close the MT4 platform if it was open during the download process. Reopen it to ensure that MT4 correctly integrates the new data, making it available for backtesting.

7. Enable tick data in Strategy Tester

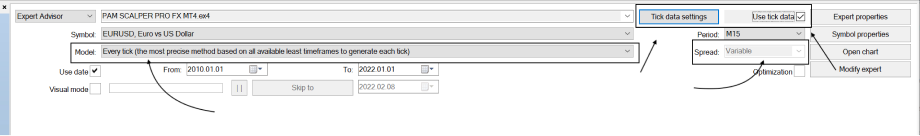

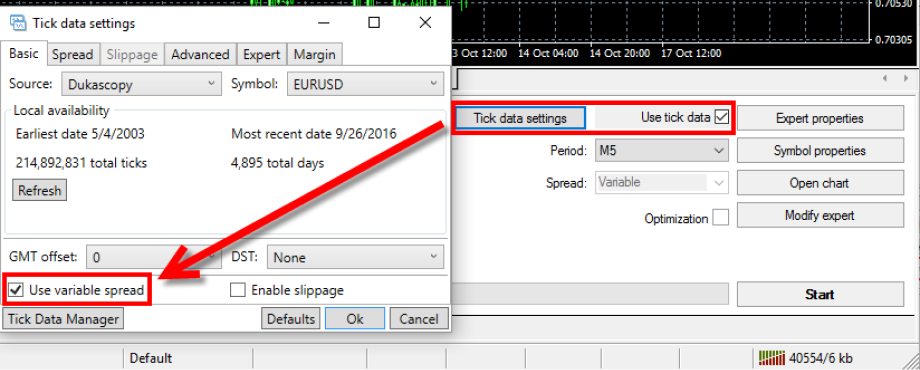

After reopening MT4, go to the Strategy Tester. Check the box labeled Use Tick Data to enable third-party tick data for the backtest. This ensures that the backtest uses high-quality, detailed tick data rather than the default bar data.

8. Select 'Every tick' testing model

In the Strategy Tester, choose the Every tick model for backtesting. This option ensures the tester uses all ticks for each bar, simulating the market more accurately for detailed performance evaluation.

9. Set the spread option

Set the spread option in the Strategy Tester. Select Variable Spread to account for real market conditions. Here, the spread changes dynamically based on market volatility and liquidity rather than using a fixed spread.

10. Emulate real trading conditions

To simulate realistic trading conditions, go to the Tick Data Settings in TDS. Enable the Use variable spread option and select Enable slippage. This will mimic real market conditions, including potential delays and price deviations during live trading.

11. Configure settings

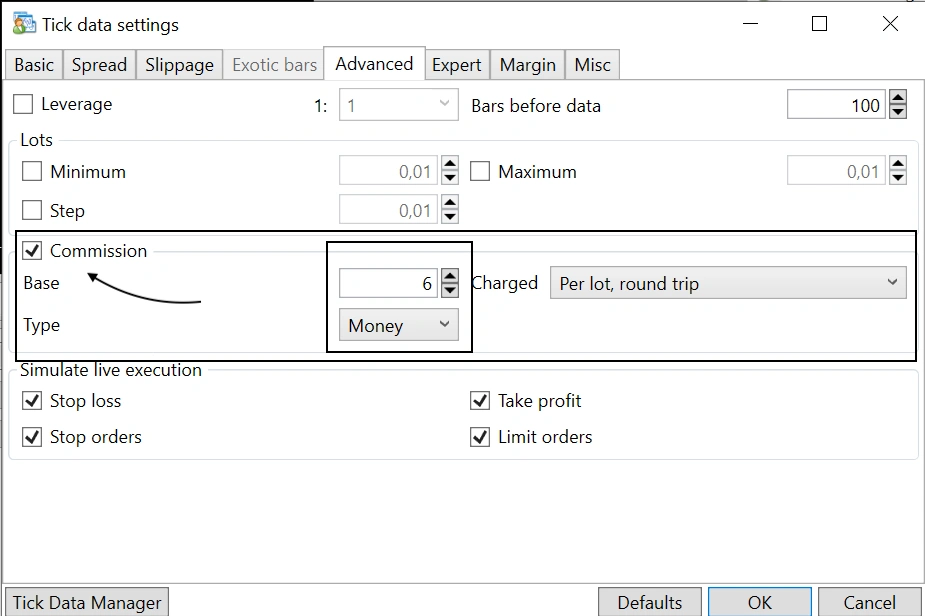

In the Basic tab of the Tick Data Settings, adjust the broker's GMT offset and daylight savings time. Also, enable the Commission option and input the broker's commission fees to model transaction costs accurately in the backtest.

12. Run and review the backtest

Finally, run the backtest in MT4 using the 'Every tick' model with variable spread and slippage. Review the results to evaluate the trading strategy's performance under realistic market conditions.

Stepwise guide to backtest on MT5

1. Open MetaTrader 5 and go to Strategy Tester

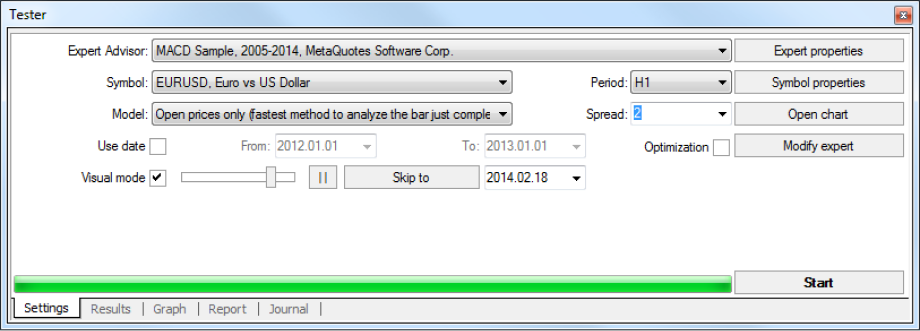

The trader launches MetaTrader 5 and navigates to the Strategy Tester. This is where they can set up their backtest for the Expert Advisor (EA).

2. Select the Expert Advisor (EA)

The trader selects the EA they want to test from the Strategy Tester's drop-down menu. This is the automated trading strategy to be backtested.

3. Choose the testing symbol

The trader picks the symbol or asset for backtesting, such as a currency pair, stock, or commodity.

4. Set the testing period

The trader specifies the time frame for the backtest, which allows the strategy to be tested against historical price data over a chosen period.

5. Select the testing model

The trader chooses a testing model based on their needs. Every tick provides the highest accuracy, while 1 minute OHLC is faster but less precise.

6. Configure EA input parameters

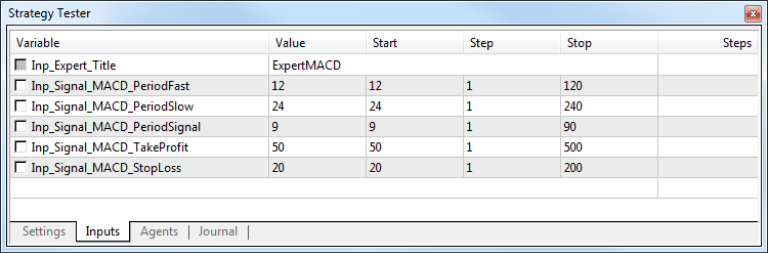

The trader adjusts the input settings for the EA. This customization simulates different trading conditions for the strategy.

7. Enable optimization (optional)

The trader enables optimization to test various input parameters automatically. This helps identify the right settings for the EA's performance.

8. Run the test

The trader initiates the backtest and allows the EA to simulate trades using historical data. They monitor its execution to assess performance.

9. Monitor test results

As the test runs, the trader tracks real-time results. They focus on key metrics such as gains, drawdown, and other performance indicators.

10. Analyze results and make adjustments

After the test, the trader reviews the results. Based on performance, they adjust the EA's parameters to improve outcomes.

11. Run MQL5 Cloud Network for faster testing (optional)

If faster results are needed, the trader enables the MQL5 Cloud Network. This uses distributed computing resources to speed up testing and optimization.

Why backtesting matters for traders?

Backtesting allows traders to evaluate strategies using historical data, identify optimal parameters, and reduce risks. It helps refine trading plans, improves confidence, and saves time by simulating real market conditions, leading to better-informed decisions before live trading.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.