Discover how combining fundamental insights with technical analysis can enhance your trading strategy.

Understanding the Forex Market

Trading the forex market is inherently challenging. With 28 currency pairs, along with various commodities and indices, traders often find themselves endlessly searching for opportunities. While some may succeed using a rule-based strategy, many struggle due to the emotional complexities of trading.

Overcoming Fear in Trading

A subscriber recently asked, "Why am I scared of losing?" Reflecting on my early trading days, I realized that fear stemmed from a lack of a solid plan, an edge, and a structured approach. The key to overcoming this fear is preparation and understanding.

The Importance of "Why"

Whenever a trader considers a forex pair, I always ask, "Why?" Why go long on EUR/USD? Why trade GBP/USD short? This question is crucial and led me to develop the currency strength meter.

What Moves a Forex Pair?

Currency movements are primarily driven by the relative strength of one currency against another. Central bank policies, particularly interest rate decisions, play a significant role. For instance, if one central bank plans to hike rates while another plans to cut them, the currency with the hiking bank will typically strengthen.

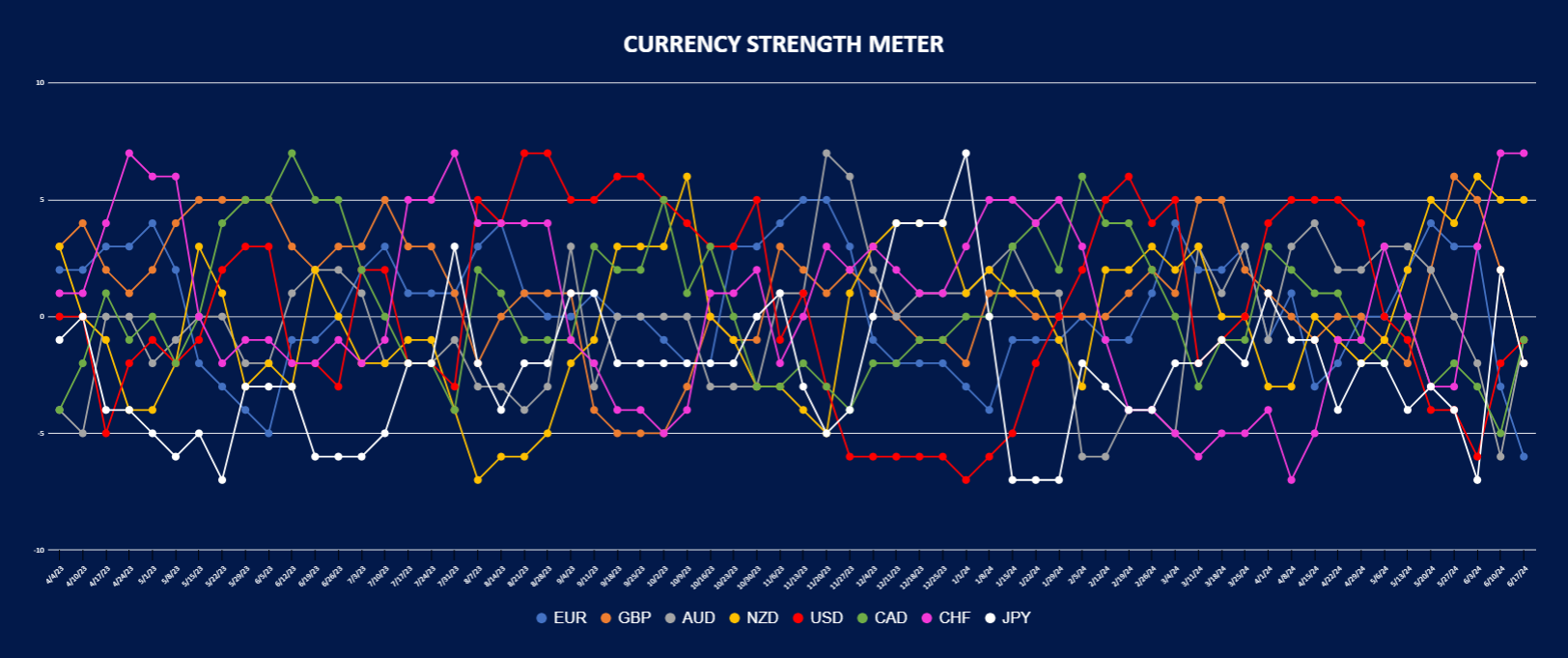

The Currency Strength Meter

To simplify trading decisions, I created a currency strength meter based on technical analysis. This tool cross-references currencies and generates a strength index, which is compared to the previous week’s data.

Case Study: Trading GBPCAD

This week, the currency strength meter highlighted several pairs. After further analysis, I focused on EUR/USD (long), GBP/USD (long), EUR/CAD (long), and GBP/CAD (long). Let's dive into the GBP/CAD trade.

Fundamental Analysis

GBP has strengthened due to political stability following the Labour government’s announcement, which ended previous political turbulence. Additionally, the UK's GDP figures rose from 0.2% to 0.4%, and the Bank of England's Chief Economist commented on inflation pressures. Conversely, CAD has weakened due to poor US economic data, impacting Canada due to their close trading relationship.

Technical Analysis

At the start of the week, we identified a reversal of the downward trend and a significant volume zone breach in the GBP/CAD chart. Typically, the market retests such zones and finds support, which was the case this week. GBP/CAD consolidated in the volume zone before breaking higher, resulting in a potential gain of over 250 pips.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

FAQs

We’re here to help you every step of your trading journey. Here are some answers to the more frequent questions we get asked.

What is a currency strength meter, and how does it help in trading?

A currency strength meter evaluates the relative strength of currencies using technical indicators, providing traders with insights into potential trading scenarios.

How can traders manage fear in forex trading?

Fear can be addressed through a well-structured trading plan, a better understanding of market behavior, and utilizing analytical tools like a currency strength meter to make informed decisions.

What drives currency movements in the forex market?

Currency movements are shaped by central bank policies, interest rate fluctuations, economic releases, and geopolitical developments.

How do fundamental and technical analysis work together in trading?

Fundamental analysis sheds light on long-term market trends, while technical analysis focuses on identifying potential entry and exit points, offering a comprehensive trading perspective.

What factors could make GBP/CAD worth analyzing?

GBP/CAD might present opportunities due to factors such as economic trends affecting GBP and CAD, alongside technical indicators suggesting potential price movements.

What role does central bank policy play in forex trading?

Central bank decisions, particularly on interest rates, significantly influence currency valuation and overall market direction.

How can traders incorporate volume zones into their analysis?

Volume zones highlight areas of concentrated trading activity, often serving as key levels of potential support or resistance.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.