It's been nearly a decade since we witnessed a particular signal on the Commitment of Traders (CoT) reports for the Canadian Dollar (CAD). The last occurrence, back in 2017, precipitated a substantial rally in CAD futures, soaring by 1000 pips. In this article, we delve into the intricacies of CoT reports and how they can be a valuable tool in identifying trading opportunities.

Understanding the Commitment of Traders (CoT) Reports

The CoT reports, published by the Commodity Futures Trading Commission (CFTC), provide insights into how different market participants are positioned. They reveal the open interest and positions of three key groups:

- Commercial Traders: These are typically businesses or entities hedging their exposure to currencies or commodities they deal with regularly. Their main aim is not speculation but risk management.

- Non-Commercial Traders: Often hedge funds or large speculators, these traders are in the market primarily to profit from price movements.

- Non-Reportable Traders: Smaller, less significant traders who don’t hold positions large enough to require reporting to the CFTC.

By analyzing these reports, traders can gauge market sentiment and potential future movements.

Why CoT Reports Matter

Although CoT reports are published weekly and thus lag behind real-time market action, they offer valuable insights into market sentiment. They can be particularly illuminating when analyzing the positioning of commercial versus non-commercial traders.

Commercials, who are primarily hedgers, often increase their positions at extreme price levels, suggesting potential reversals. For example, if commercials are heavily long on a currency, it might indicate they see value at current prices, hinting at a potential upward movement.

Spotlight on CAD Futures

image source

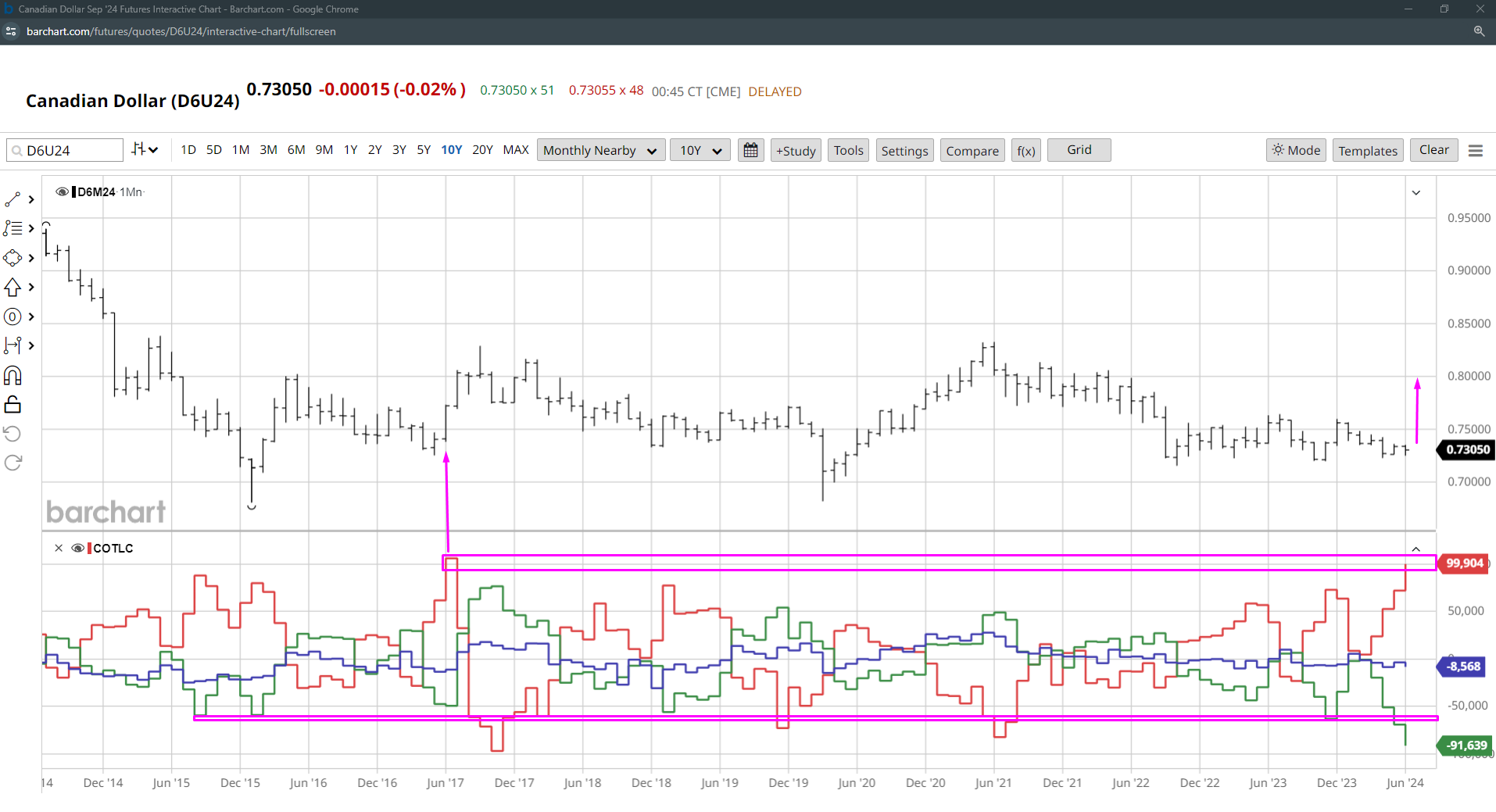

The recent CoT report highlights that commercial long contracts for CAD have hit their highest levels since 2017. Historically, such levels have preceded significant upward price movements in CAD futures.

Interestingly, non-commercial traders (trend followers) have ramped up their short positions on CAD to levels not seen in 20 years. This divergence suggests a potential conflict in market expectations, signaling a possible reversal opportunity.

For those trading in the spot market, it's crucial to note that USD/CAD moves inversely to CAD futures. Hence, a rally in CAD futures would likely correspond with a decline in USD/CAD.

Trading Strategy: What’s the Play?

With the USD/CAD currently nearing the strong resistance level at 1.3900, we should be vigilant for signs of reversal. This level has historically been a pivot point, making it a critical area to watch for potential short positions on USD/CAD.

Beyond CAD, examining other currencies under current macroeconomic pressures could be fruitful. The Euro (EUR) and the British Pound (GBP) are both facing headwinds:

- EUR/CAD: The Euro is under pressure due to the European Central Bank’s dovish stance and political uncertainties.

- GBP/CAD: The British Pound is similarly pressured with potential rate cuts by the Bank of England and ongoing political uncertainties.

Short positions in EUR/CAD and GBP/CAD might be worthwhile considerations given these dynamics.

The Commitment of Traders reports offer a unique lens through which traders can view market sentiment and positioning. The recent data on CAD futures presents a compelling case for potential upward movement in the Canadian Dollar, especially when juxtaposed with the positions of both commercial and non-commercial traders. As we approach critical price levels in USD/CAD, staying attuned to these signals can provide valuable trading insights.

Keep monitoring the CoT reports and consider how market sentiment can inform your trading strategies, especially in a landscape as dynamic as the forex market.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.