Forex Weekly Trading Ideas: 19th August

As we start a new trading week, forex markets are set to be volatile and here’s what to watch.

Jackson Hole Symposium

The Jackson Hole Symposium is the main event this week and all investors’ eyes will be on it. The event is famous for featuring big speeches from central bank officials and Fed Chairman Jerome Powell’s will be the most watched. Powell’s comments will give us clues on the Fed’s future direction especially with recent economic data and inflation trends. Market participants will be looking for any hints on interest rate moves or economic outlook which will impact the US dollar and the broader forex markets.

China Loan Prime Rate

Monday will be China’s loan prime rate announcement. We’ve seen two cuts already and if there’s another one, it will raise concerns about the health of China’s economy and lead to risk-off sentiment in the markets. Safe haven currencies like JPY and CHF will be in demand and commodity currencies could be sold.

US FOMC Minutes

Wednesday will be the release of the US FOMC minutes and that’s a big event for traders and investors. The minutes will give us a deeper insight into the Fed’s internal discussions and may give us clues if a rate cut is possible in September. The forex market will be extremely reactive depending on the tone of the minutes especially if there’s a strong hint on future policy.

Global PMIs

Later in the week, the focus will be on the release of Manufacturing and Services PMIs from Europe, UK and US. These are the key gauges of the regional economies. Weak PMIs will fuel global slowdown concerns and may lead to changes in forex strategies. Strong PMIs will boost economic resilience and will impact currency movements. In Europe German manufacturing will be watched closely after performing poorly in the previous release.

Canada Inflation Data

Canada’s inflation data will also be watched with the Consumer Price Index (CPI) expected to rise 0.4% m/m after -0.1% previous month. A higher than expected CPI will reinforce expectations of tighter BoC policy and will boost CAD. If CPI falls short, it will lead to speculation of dovish stance from the central bank and will impact the loonie.

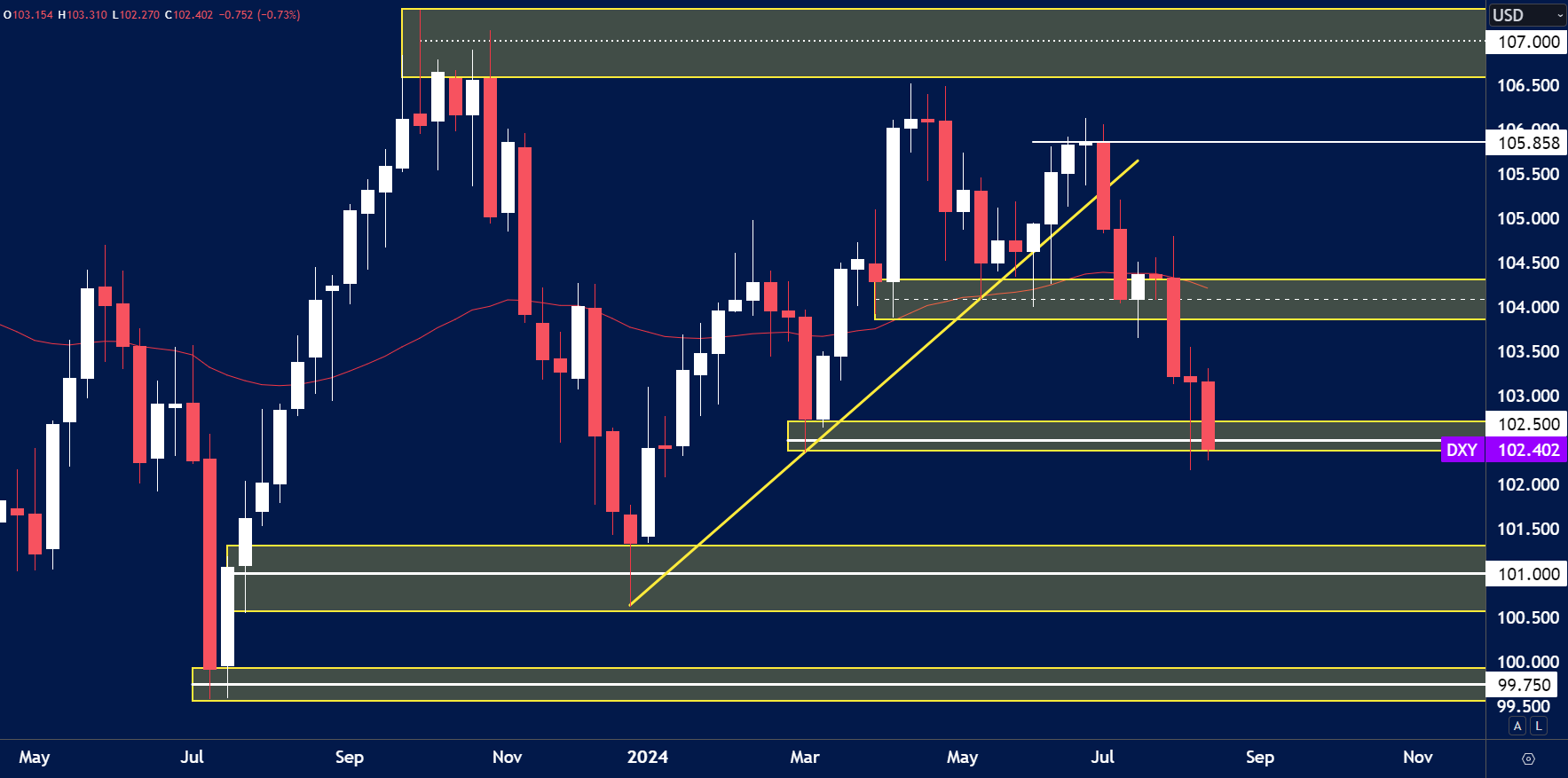

USD Index

- The USD Index weekly chart shows the price closing below the key $102.50 support zone.

- Traders may feel this is a sign of further downside to come for the greenback as it becomes the weakest currency.

- With a series of high impact data we can often see the market move towards safety which can see some short term USD strength.

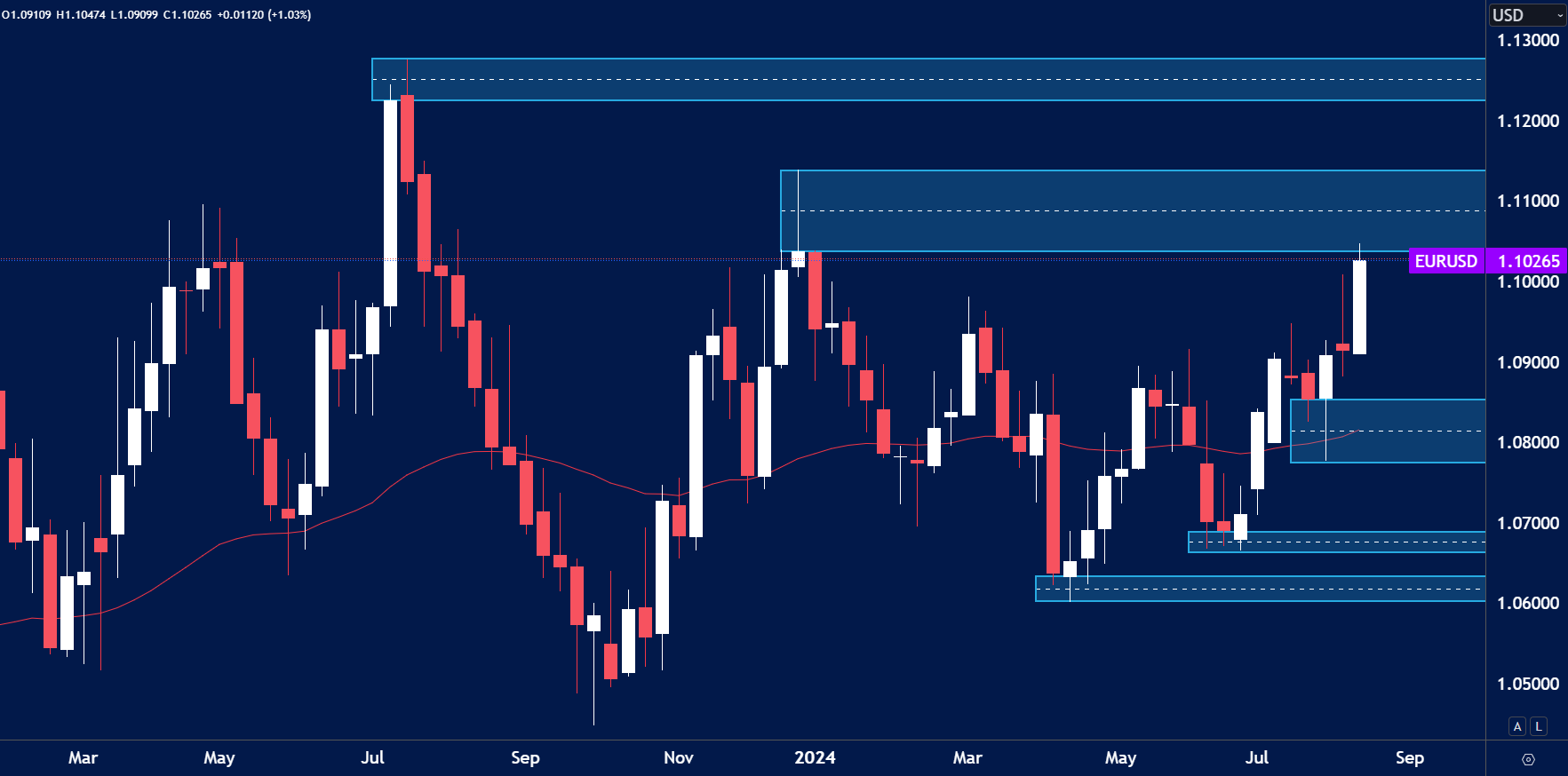

EUR/USD

- The price of EUR/USD continued to trade higher in line with the USD weakness. Price is now reaching the key resistance of 1.1025, a key weekly resistance zone.

- If buyers step in for the USD this week we could see a short term pullback from this zone.

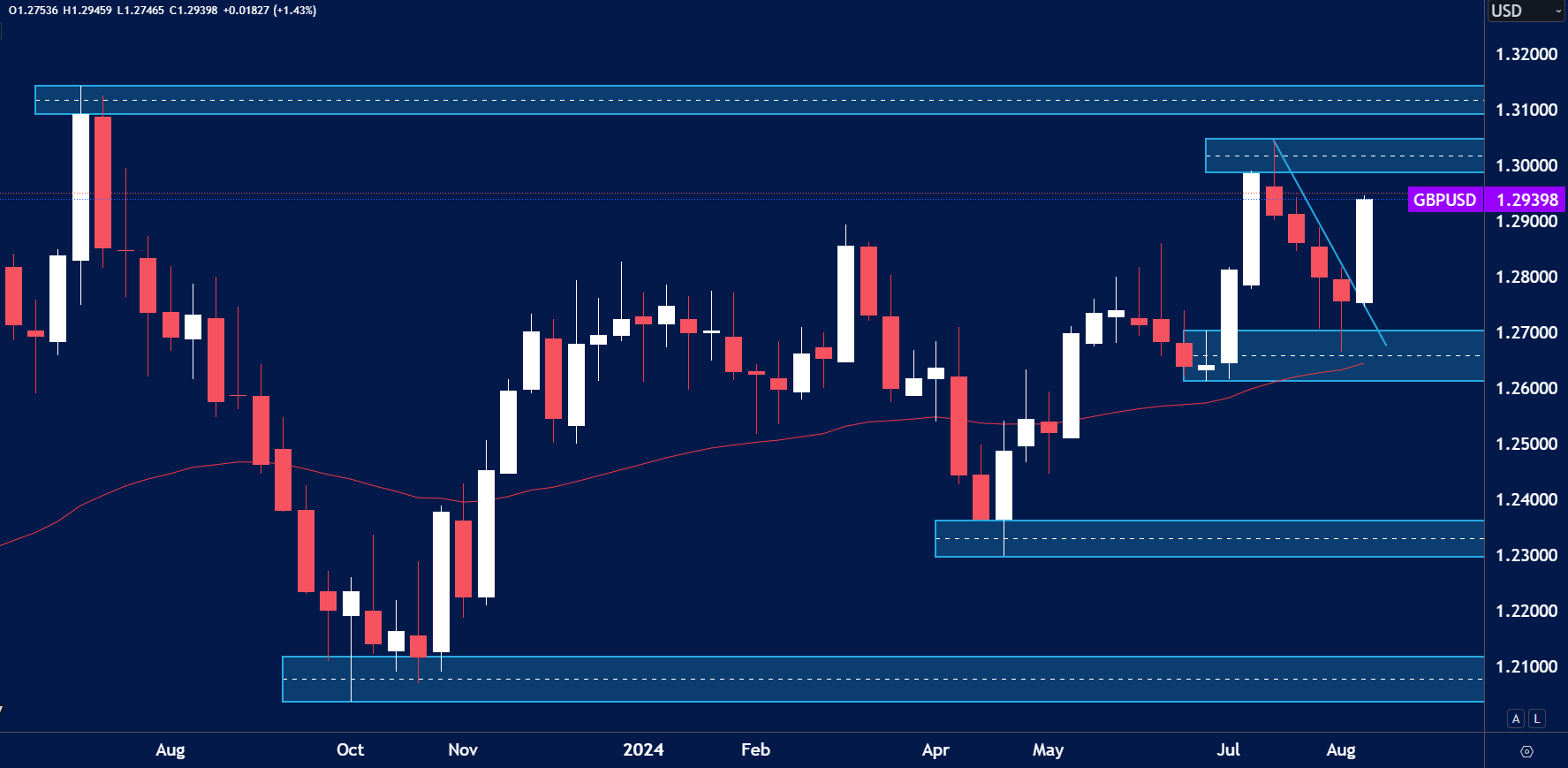

GBP/USD

- The price of GBP/USD finished the week strong, rallying 140 pips. .

- This shows us that the market feels the recent data out of the UK is positive and that we could see a move into the 1.3000 level of resistance.

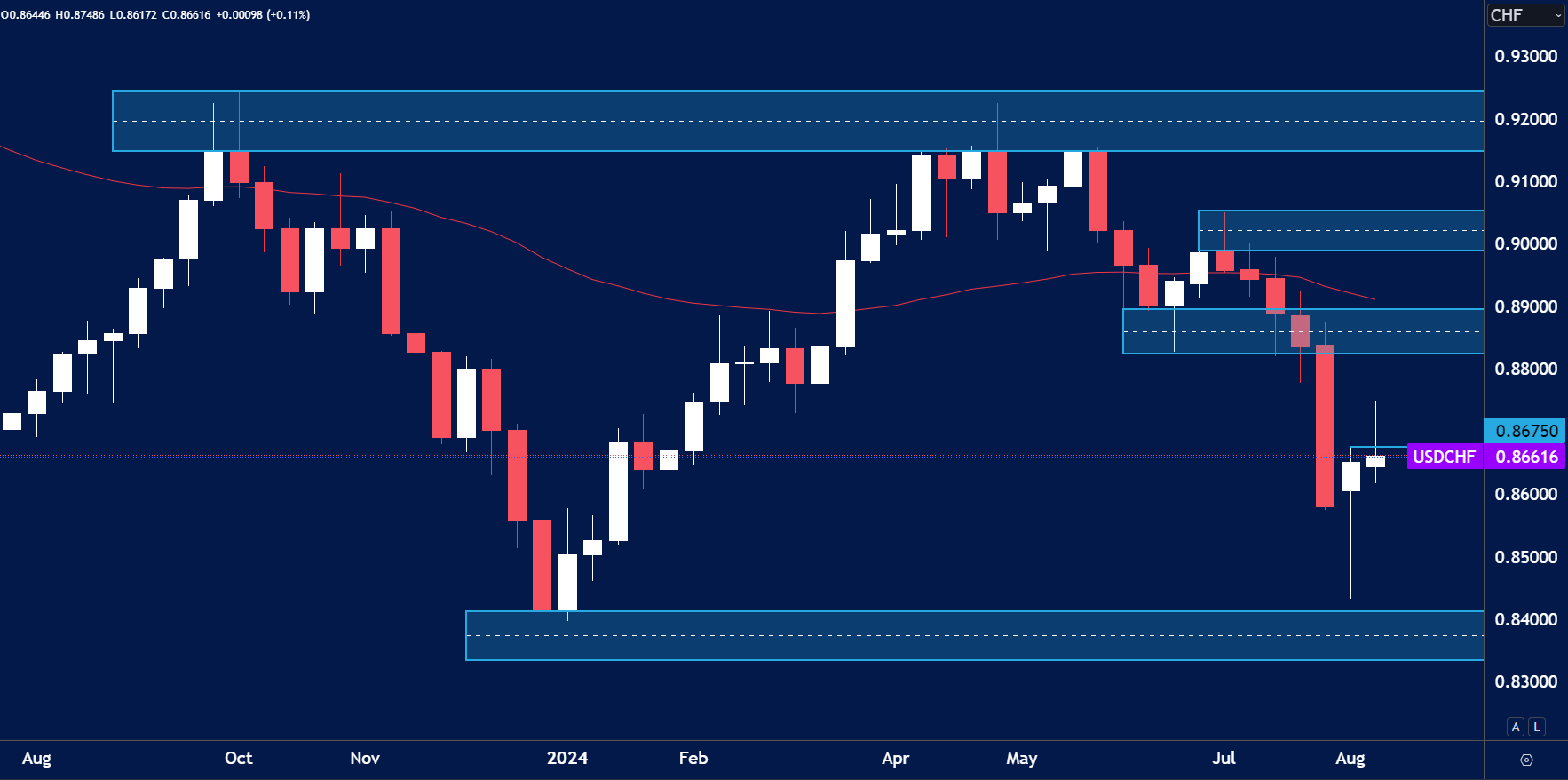

USD/CHF

- The USD/CHF price closed below the previous week’s high. This could be a bearish sign for the market as it could look to target the weekly demand zone around 0.8400.

- The market could seek safe havens this week which may benefit the CHF and JPY.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.