Dive into the Forex week ahead! 📈 Federal Reserve's Powell to discuss interest rates post non-farm payroll surge. In central bank news we see the RBA's rate decision. 💹 #Forex #TradingInsights #MarketWatch

Watch the video to learn more...

Forex Week Ahead Analysis: 5th February

The spotlight for the beginning of the week falls on Federal Reserve Chair Jerome Powell, who is scheduled to speak on Monday. Powell's discussion will revolve around interest rates and inflation, following the Fed's decision to maintain rates at 5.50% last week. The central bank's commitment to keeping rates steady is likely to be supported by the surprising surge in non-farm payrolls, which rose to 353k in January. This robust job market performance reinforces the Fed's decision to hold off on any immediate rate adjustments.

Keeping an eye on economic indicators is crucial for forex traders. One such indicator to watch out for is the Institute for Supply Management (ISM) Services Purchasing Managers' Index (PMI). Forecasted to rise from 50.6 to 52.0, an upward trend in the ISM Services PMI could signal increased economic activity in the United States. This, in turn, might impact the forex market, influencing the strength of the US dollar.

Shifting our focus to the Asia-Pacific region, the Reserve Bank of Australia (RBA) is expected to announce its interest rate decision. Forecasts indicate that the RBA will leave rates unchanged at 4.35%.

USD INDEX

The price on the chart has traded through multiple technical levels and some observations included:

- The price of the USD Index rose last week breaking through the resistance of 103.50.

- This could see a move towards the resistance of 104.20 or key highs of 104.50.

AUDUSD

The price on the chart has traded through multiple technical levels and some observations included:

- AUDUSD remained below the resistance of 0.6600 and price has now breached the 0.6525 support.

- This could see the price continue lower towards the next level of support of 0.6450.

USDCHF

The price on the chart has traded through multiple technical levels and some observations included:

- USDCHF was a forex pair to watch from the currency strength meter.

- Price found support of the key level of 0.8570.

- If this sentiment remains, the price could trade to the 0.8800 resistance.

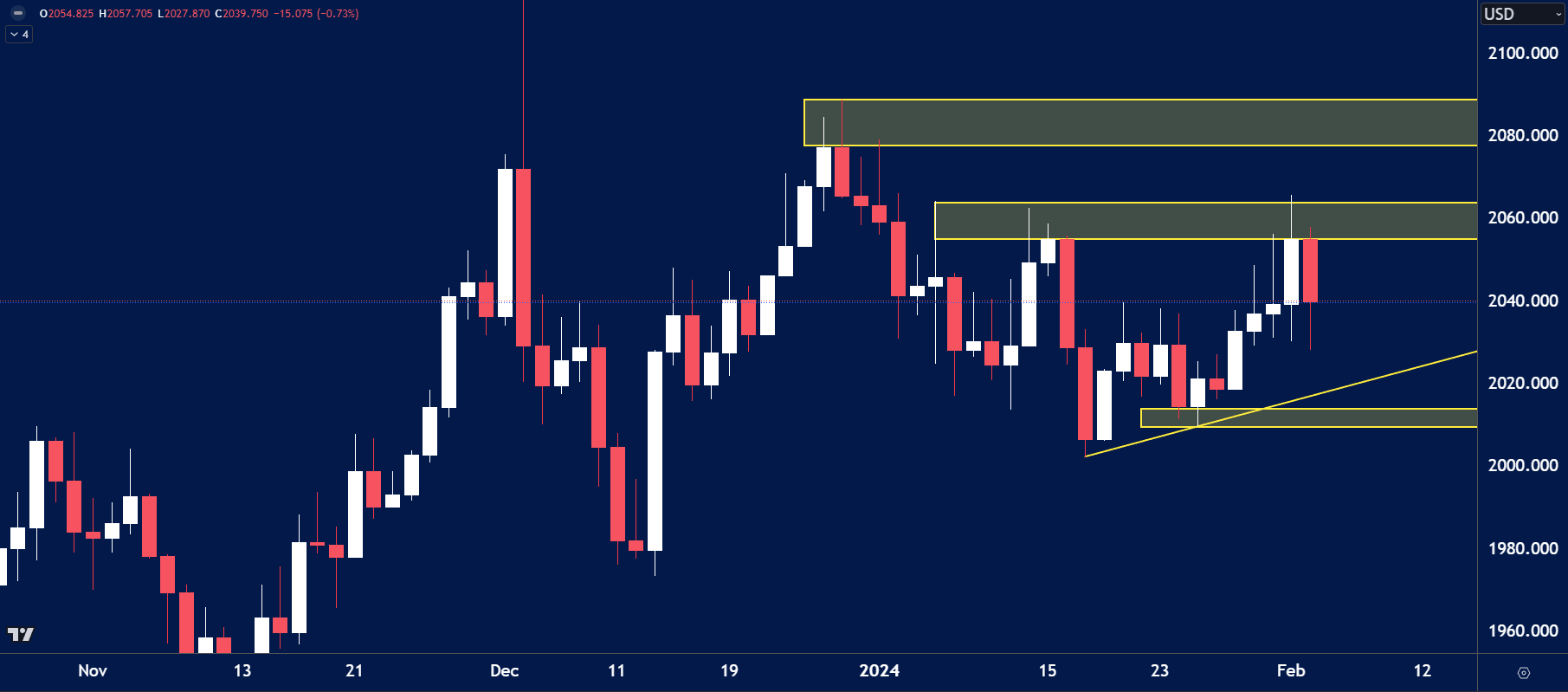

GOLD

The price on the chart has traded through multiple technical levels and some observations included:

- Gold prices have found resistance at the key level of $2060.00.

- USD strength could push Gold prices towards the lows of 2020.00.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.