Get ready for a week of forex action! From AUD CPI to RBNZ rates and USD PCE Index, stay ahead of the curve with our latest analysis. #Forex #Trading #MarketInsights

Watch the video to learn more...

Forex Week Ahead Analysis

Hello traders, let's take a moment to prepare for the week ahead in the forex market. Here's a rundown of the key events and forecasts that could shape our trading decisions:

Australia's Consumer Price Index (CPI) year-on-year (y/y) data is on the radar, with expectations pointing towards a modest increase from 3.4% to 3.6%. This could have implications for the Australian Dollar's performance, so it's worth keeping an eye on.

The RBNZ is set to announce its interest rate decision, widely anticipated to remain unchanged at 5.50%. Alongside the decision, the central bank's commentary will be scrutinized for insights into future monetary policy direction, potentially impacting the New Zealand Dollar (NZD).

In the US, attention is on the Core Personal Consumption Expenditures (PCE) Price Index month-on-month (m/m) data, forecasted to show a slight uptick from 0.2% to 0.4%. This metric is closely watched for its implications on inflation and the Federal Reserve's monetary policy outlook.

Canada's Gross Domestic Product (GDP) month-on-month (m/m) figures are expected to hold steady at 0.2%. Stable GDP growth reflects economic consistency, which may influence the Canadian Dollar's performance in the forex market.

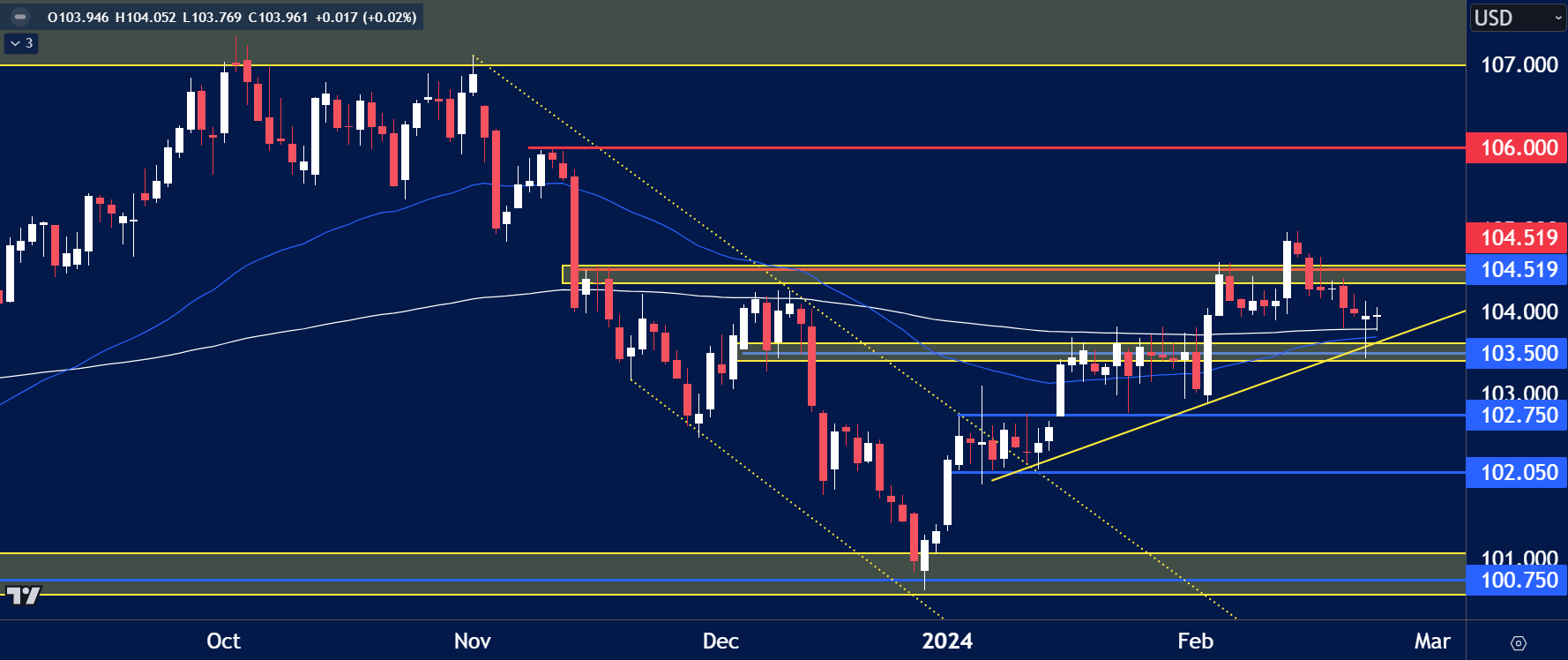

USD Index

The price on the chart has traded through multiple technical levels and some observations included:

- The price of the USD Index has fallen towards and rebounded from support of 103.50 last week.

- USD data has been strong recently but prices are reluctant to trade higher.

- If USD fails to trade higher from here, the risk could be to the downside below 103.50.

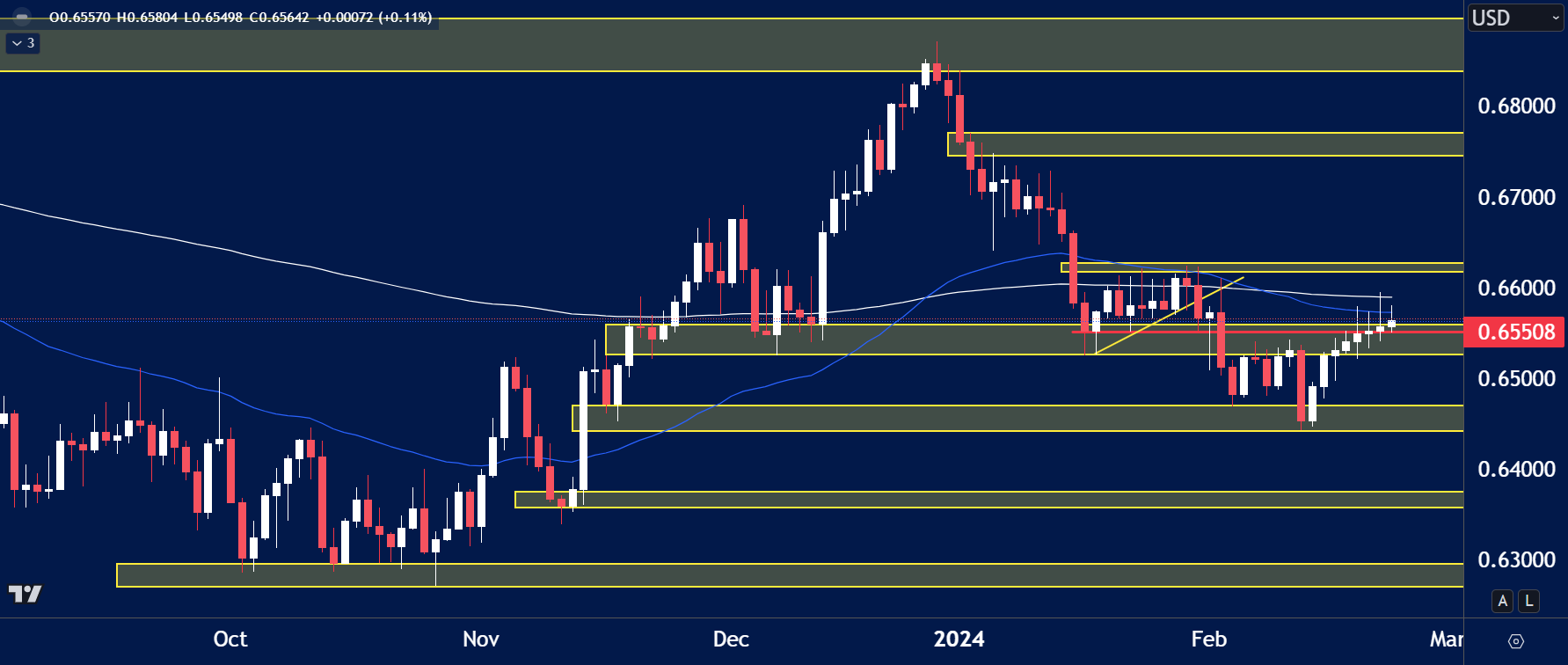

AUD/USD

The price on the chart has traded through multiple technical levels and some observations included:

- The currency strength meter highlights the potential for a reversal to form on AUD/USD.

- Price found support towards the lows of 0.6450, and price has now traded about the key resistance of 0.6550.

- If price trades higher it could target the resistance of 0.6625.

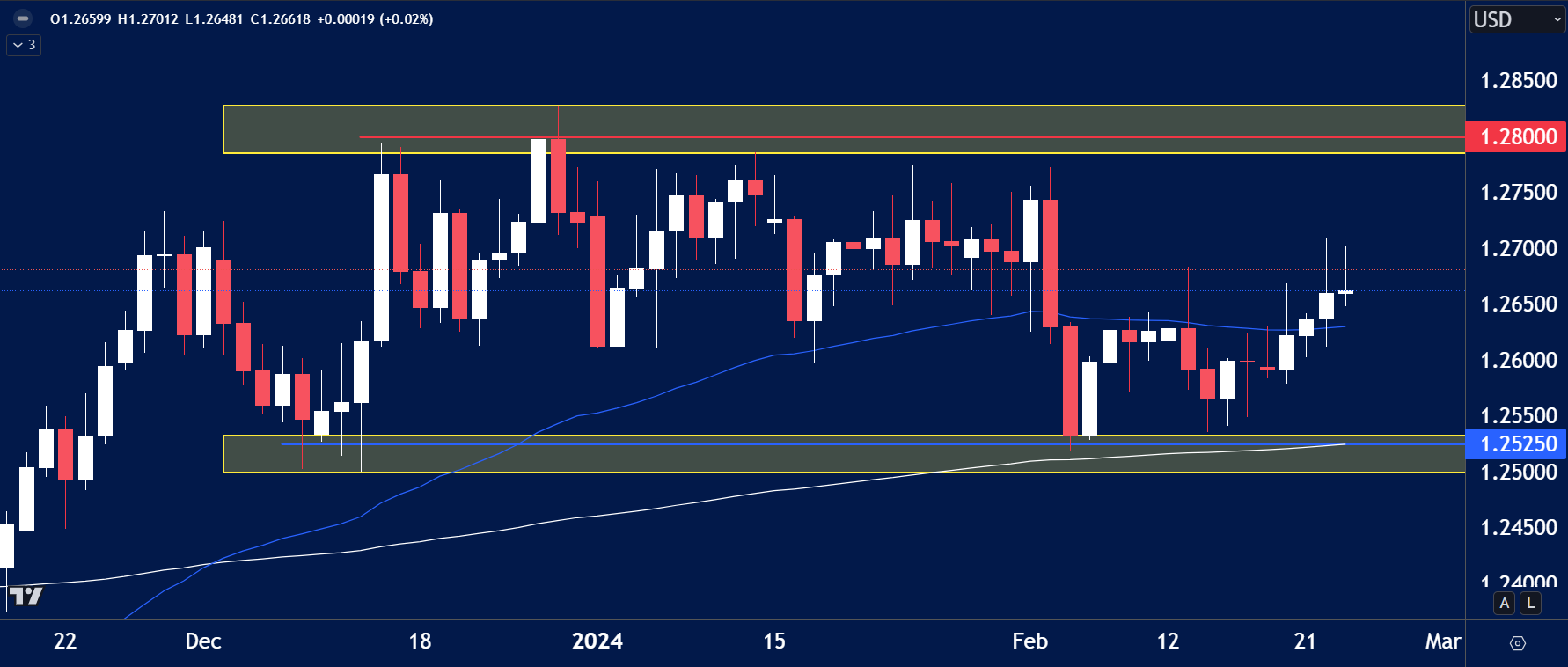

GBP/USD

The price on the chart has traded through multiple technical levels and some observations included:

- The price of the cable remains within a trading range with highs of 1.2800 and lows of 1.2525.

- Recently price found support at the range lows, which begs the question, will price trade towards range highs?

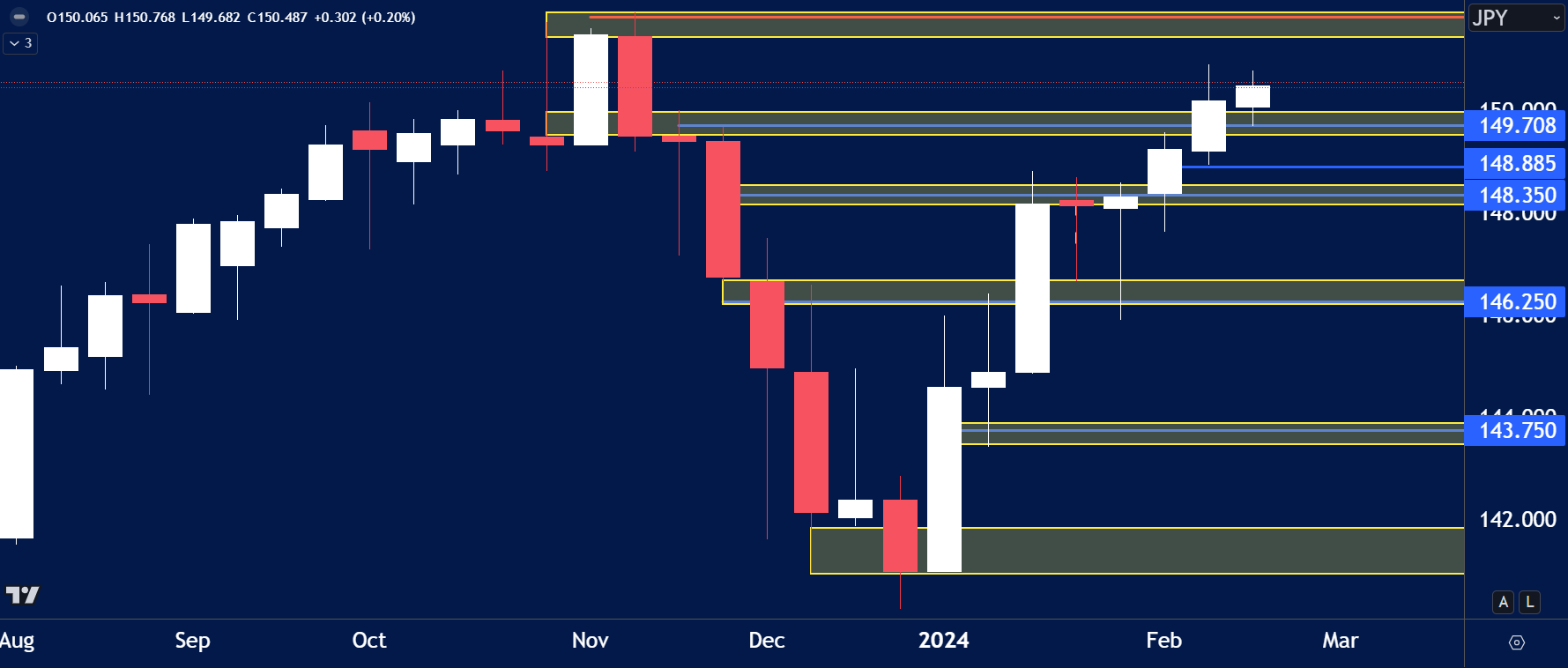

USD/JPY

The price on the chart has traded through multiple technical levels and some observations included:

- USD/JPY closed bullish again last week, as price trades towards the November/December 2023 highs.

- JPY strengthened last week, however these highs seem likely targets for traders long.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.