Forex Focus: Central Banks Take the Stage! From BoJ's watchful eye on negative rates to BoC and ECB holding steady, the week ahead promises insights that could sway the forex landscape. #ForexAnalysis #CentralBanks #MarketWatch

Watch the video to learn more...

Forex Week Ahead Analysis: Central Banks Take Center Stage

As the global financial markets gear up for another week of trading, all eyes are on the central banks that hold the reins of monetary policy. In this Forex Week Ahead Analysis, we delve into the key events that traders and investors will be closely monitoring, seeking insights into potential shifts in economic policies.

Bank of Japan (BoJ) Monetary Policy Statement: A Potential Pivot from Negative Rates?

The highlight of the week will undoubtedly be the Bank of Japan's (BoJ) Monetary Policy statement. Market participants are eagerly awaiting any signals that the BoJ might be contemplating a move away from negative interest rates for the first time since 2007. Negative rates have been a staple of the BoJ's policy toolkit, and any shift could have profound implications for currency markets. Traders will scrutinize the language used in the statement and any accompanying remarks from BoJ officials for clues on the central bank's stance.

Bank of Canada (BoC): Holding Steady at 5.00%

Meanwhile, the Bank of Canada (BoC) is anticipated to maintain its current interest rates at 5.00%. The Canadian economy, like many others, has been navigating the complexities of lowering inflation. The BoC's decision to keep rates unchanged signals a commitment to supporting economic stability while carefully monitoring inflation and growth indicators. Canadian Inflation rate rose in December from 3.1% to 3.4% putting doubts into the market of a cut from the BoC. Forex traders will closely watch for any nuances in the accompanying statement that could offer insights into the central bank's outlook on the Canadian economy.

European Central Bank (ECB): Steady Course with Rates at 4.50%

Across the Atlantic, the European Central Bank (ECB) is also expected to keep interest rates unchanged at 4.50%. The ECB plays a pivotal role in shaping the monetary policy landscape for the Eurozone, and its decisions reverberate through currency markets. Forex participants will pay close attention to the ECB's assessment of economic conditions and inflationary pressures. Any hints at future policy adjustments or concerns about economic headwinds could lead to market volatility.

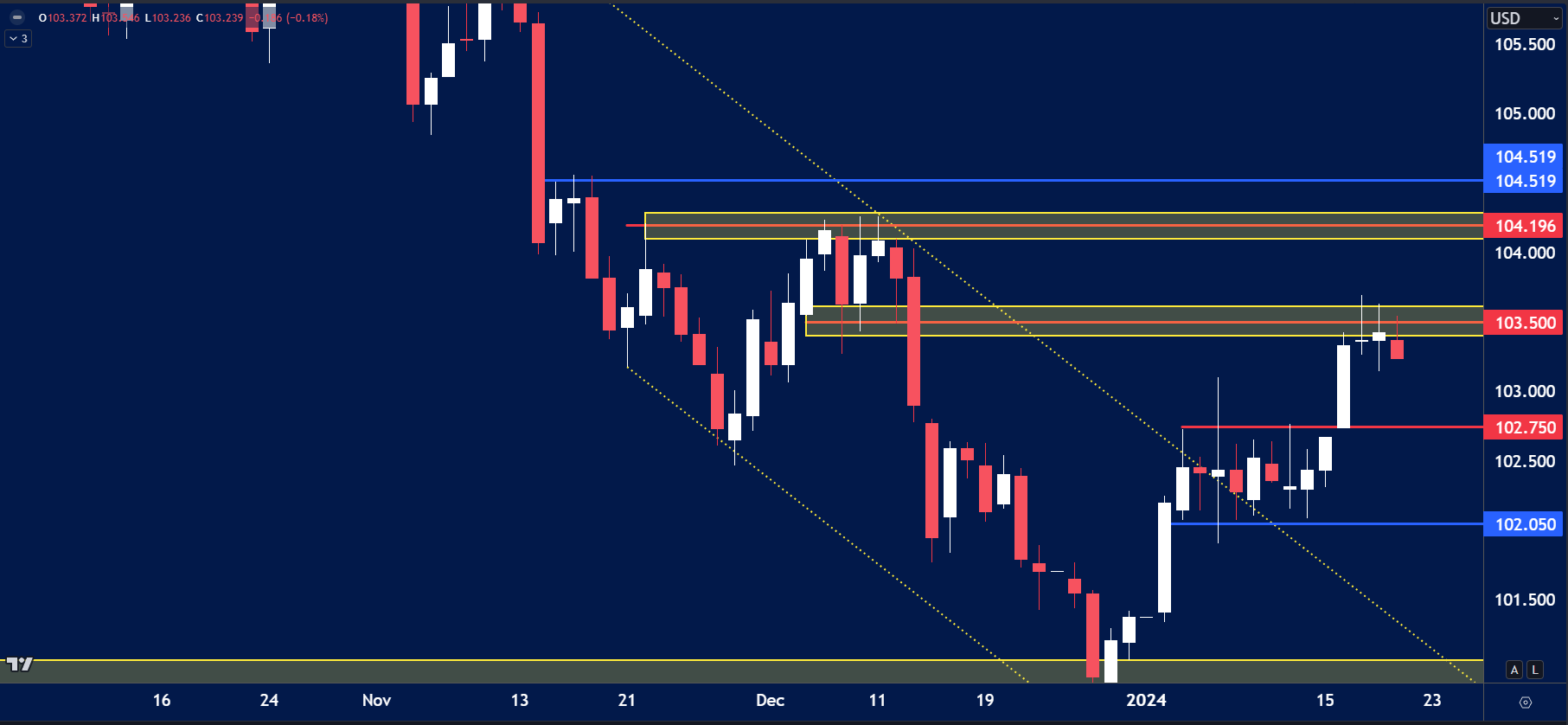

USD Index

The price on the chart has traded through multiple technical levels and some observations included:

- Price found resistance at the 103.50 level.

- This could cause the price to fall and retest prior consolidation around 102.75.

- Alternatively, if USD strength remains, price could breach 103.50 resistance and rally towards December highs of 104.20.

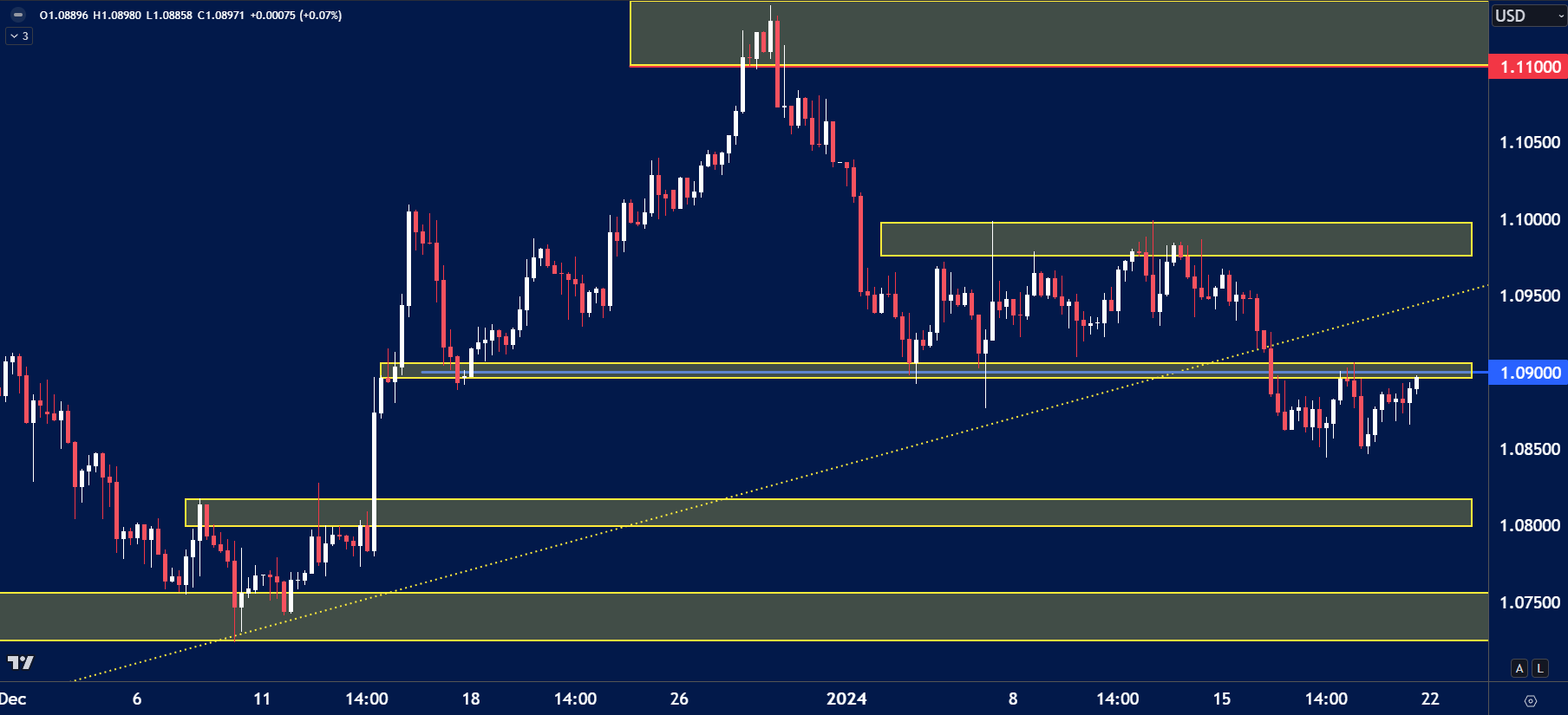

EURUSD

The price on the chart has traded through multiple technical levels and some observations included:

- EURUSD fell below the key support of 1.0900.

- This level could act as resistance going forward.

- Support below can be found towards 1.0800.

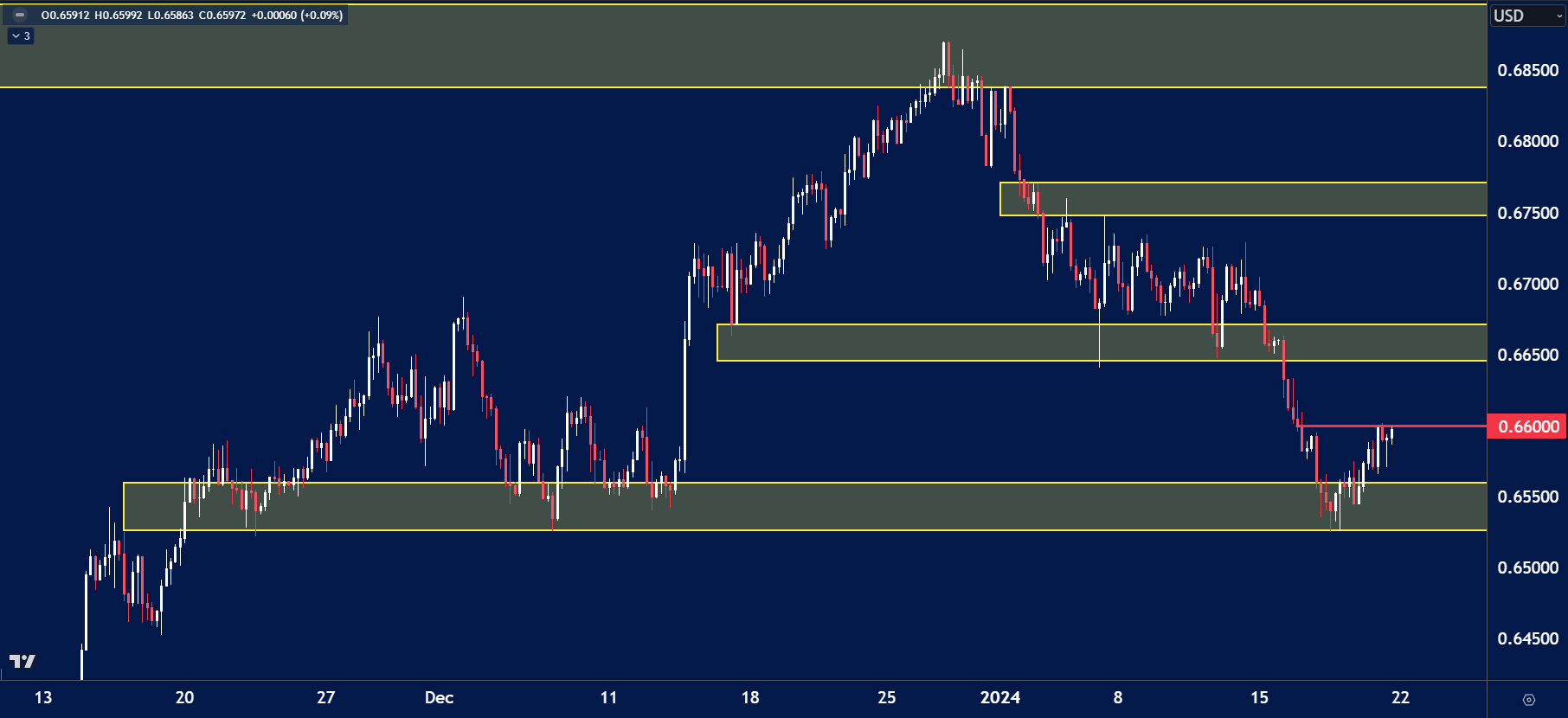

AUDUSD

The price on the chart has traded through multiple technical levels and some observations included:

- Price found support at the key 0.6550 levels.

- This could see price trade higher towards resistance of 0.6650.

- Alternatively, if the price fails at 0.6600, price may revisit the lows.

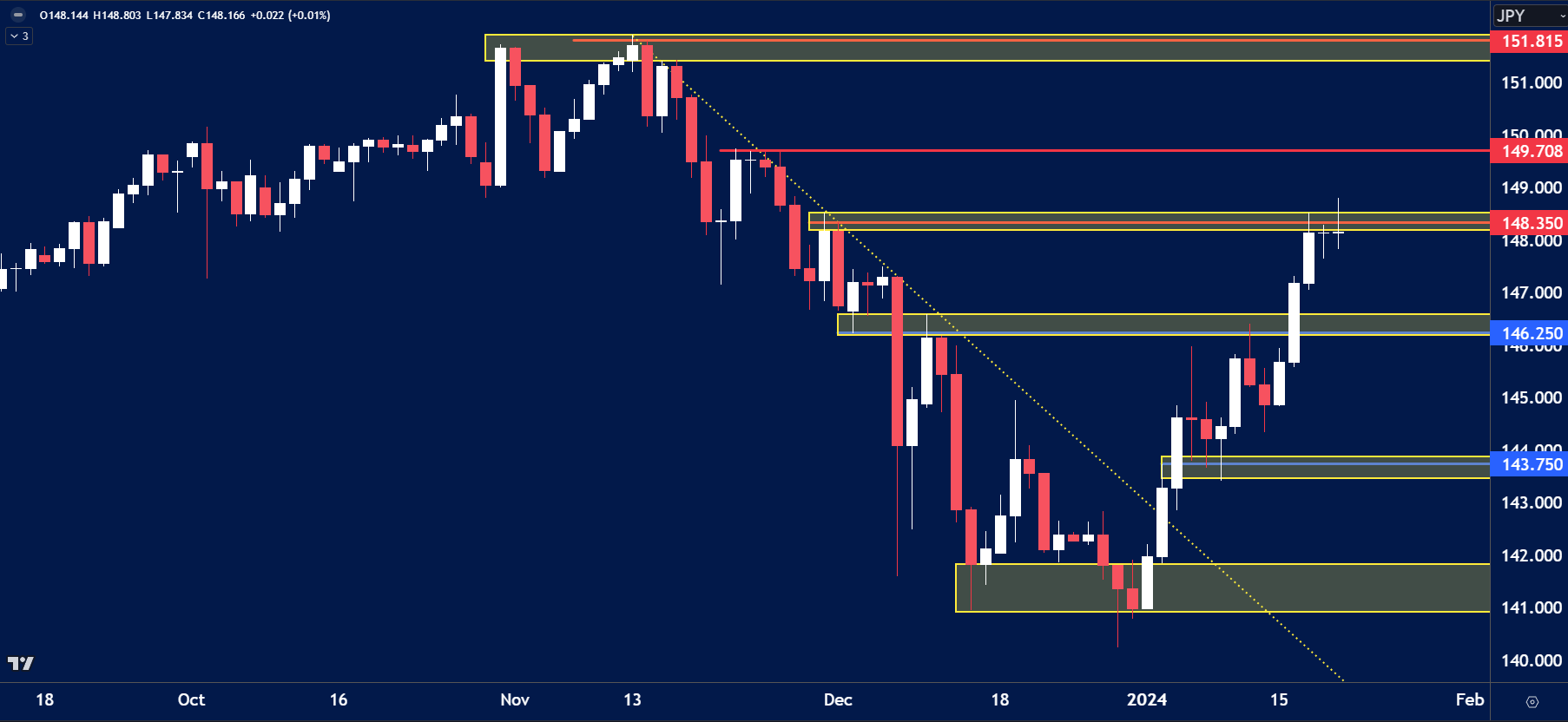

USDJPY

The price on the chart has traded through multiple technical levels and some observations included:

- Price rallied last week into the key resistance of 148.50.

- Depending on the outcome of the BoJ we could see prices either rally towards 149.70 or fall towards 146.25.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.