What's next for the Forex market? Here's a sneak peek into the week ahead.

Watch the video to learn more...

A Glimpse into the Week Ahead: What to Expect in the Forex Markets

Manufacturing and Services PMI in Europe, UK, and US

The week kicks off with the release of the Manufacturing and Services PMI data from Europe, the UK, and the US. While the US and UK PMI are forecast to remain steady or show slight growth above 50.0, the outlook for Europe suggests continued contraction, with a forecast below 50.0. This could have significant implications for currency movements, especially in the Eurozone.

Australian CPI Data

CPI data from Australia is anticipated to show a quarterly increase from 0.6% to 0.8%, with the year-on-year CPI forecast to remain steady at 3.4%. This projection is likely to prompt the Reserve Bank of Australia (RBA) to leave rates unchanged in their upcoming May meeting.

Advanced GDP q/q in the United States

The Advanced GDP q/q release from the United States is expected to come in lower at 2.5% compared to the previous 3.4%. The Advanced GDP release, being the earliest, tends to have a higher impact. Over the past four releases, there has been an increase over expectations, and US data has been strong recently. A higher-than-expected miss here could be concerning for those who believe the Fed will cut rates in the June meeting.

Bank of Japan's Positioning

Market participants will be closely watching the Bank of Japan to see how it positions itself going forward, especially as the JPY continues to weaken, with USDJPY prices significantly above the major 152.00 handle.

US CORE PCE Price Index m/m

The week ends with the US CORE PCE Price Index m/m, which is the Fed's primary inflation method. A reading of 0.3% is forecast, but a higher miss here could put pressure on the Fed to maintain rates higher for longer.

USD Index

The price on the chart has traded through multiple technical levels and some observations included:

- The USD Index ranged last week between 106.40 and 105.80.

- If price remains above the lows of 105.80, it could continue to trade higher towards 2023 highs around 107.00.

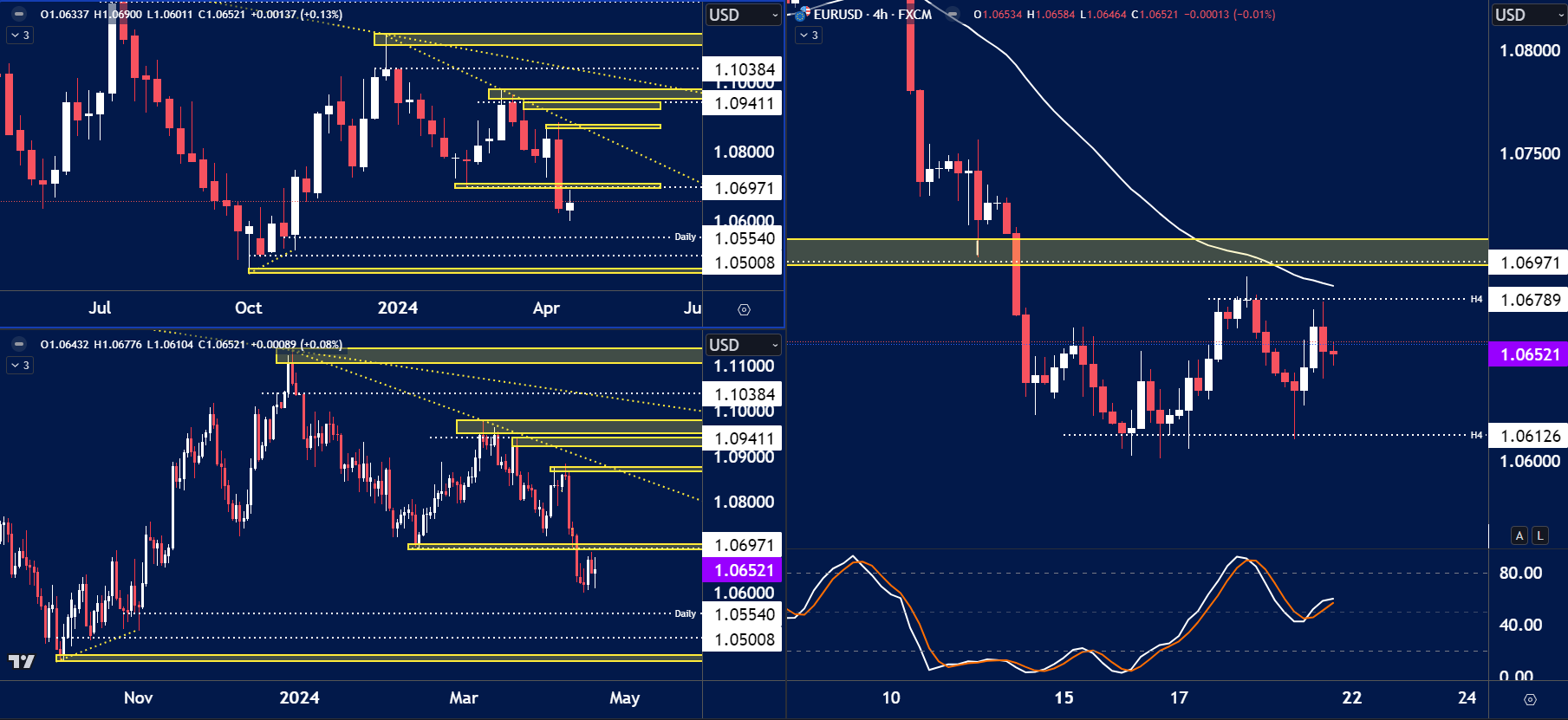

EURUSD

The price on the chart has traded through multiple technical levels and some observations included:

- The EURUSD price remained below the previous weekly lows of 1.0700.

- This could influence further selling pressure as long as price remains below this key level.

GBPUSD

The price on the chart has traded through multiple technical levels and some observations included:

- The GBPUSD price continued to trade lower last week with the price closing below the 1.2400.

- If price can remain below this level it could influence further selling pressure with the next daily support being 1.2220.

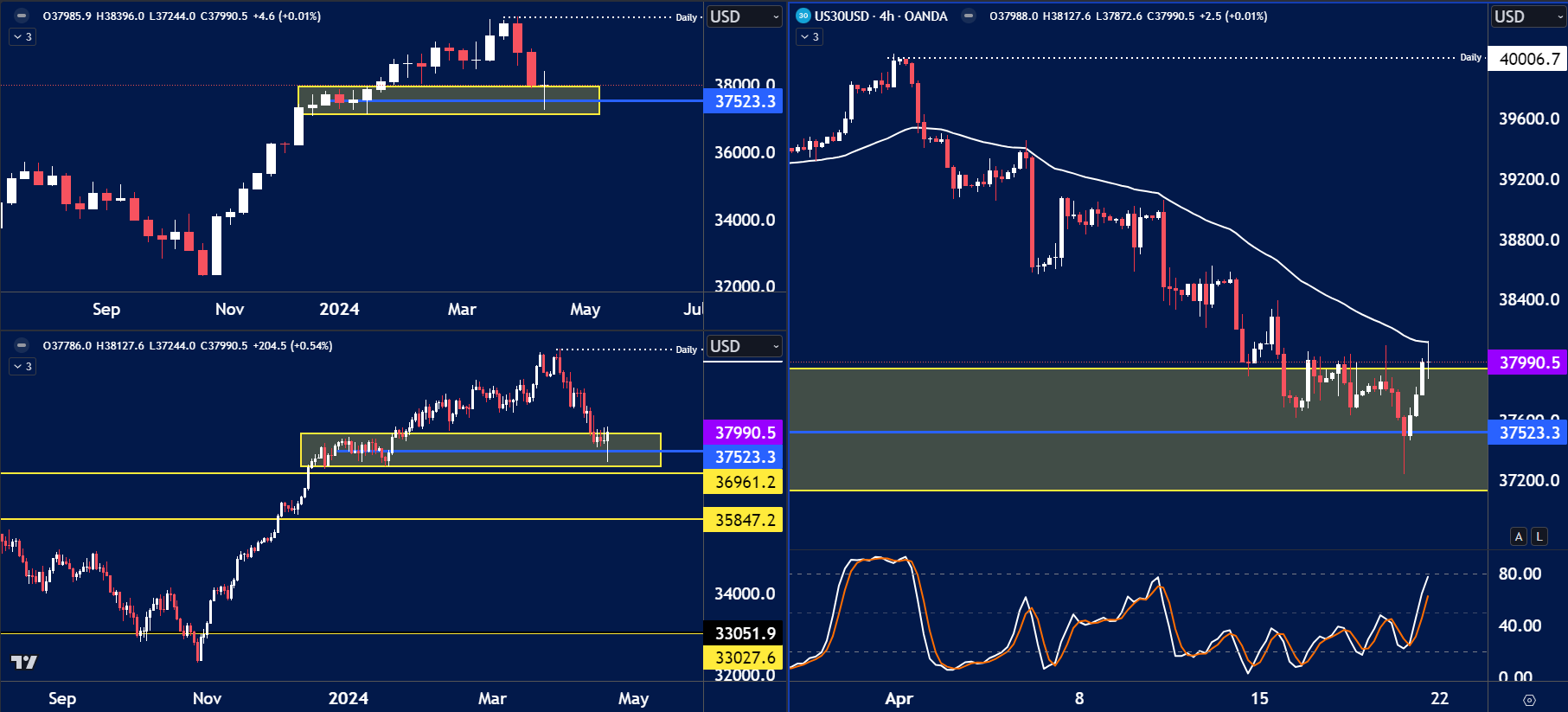

DOW JONES

The price on the chart has traded through multiple technical levels and some observations included:

- The stock markets have been under pressure of late due to the push back of expectation in rate cuts by the Fed. The price of the Dow Jones is now testing a major support level of 37,500.

- This level was the previous breakout highs, and if price breaks H4 trend and above the 50MA we could expect a shift in the short term trend.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.