Last week the stock market took yet another bearish turn after the Non-Farm payroll data. Jobs created rose to 256k beating the expectations of 164k causing the market to price in less rate cuts from the Federal Reserve. The USD will remain in focus this week with key PPI, CPI and retail sales data to be released. In the United Kingdom the bears may remain after the bond market sold off aggressively causing GBPUSD to reach its lowest level in over a year.

Forecast for January 13th, 2024

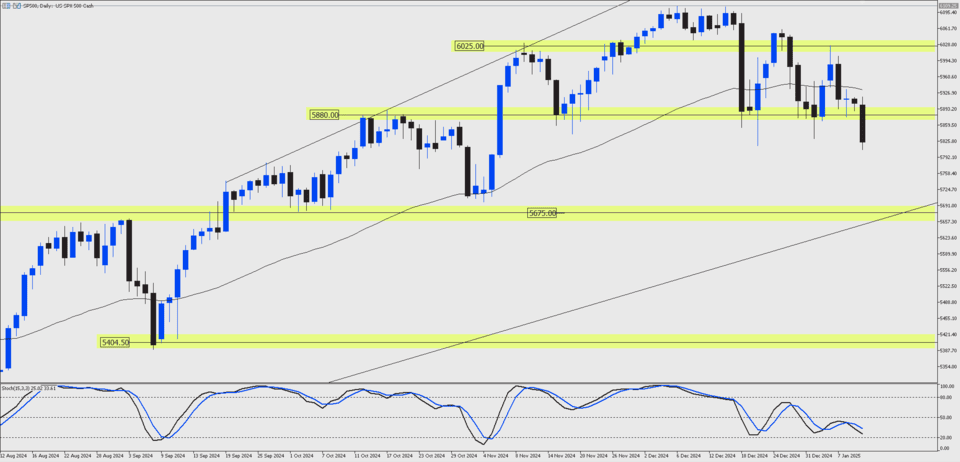

US Outlook

The S&P500 has closed below the support of $5880.00 for the first time since November 2024. The CME FedWatch Tool tells us that the bond market is pricing in a 93.6% chance of no change in the January meeting. The Consumer Price Index is forecast to climb to 2.9% annually largely due to rising energy prices. Core CPI is forecast to slow to 0.2% from 0.3% showing underlying inflation is slowing. However retail sales are forecast to fall to 0.6% which could re-ignite the stock market sell off.

US10YR bond yields rose to their highest level since April 2024 causing further strength of the USD against most if not all G10 currencies. The yield rising tells us that investors expect inflation to rise and that rates may be near to this or higher than current levels in the future.

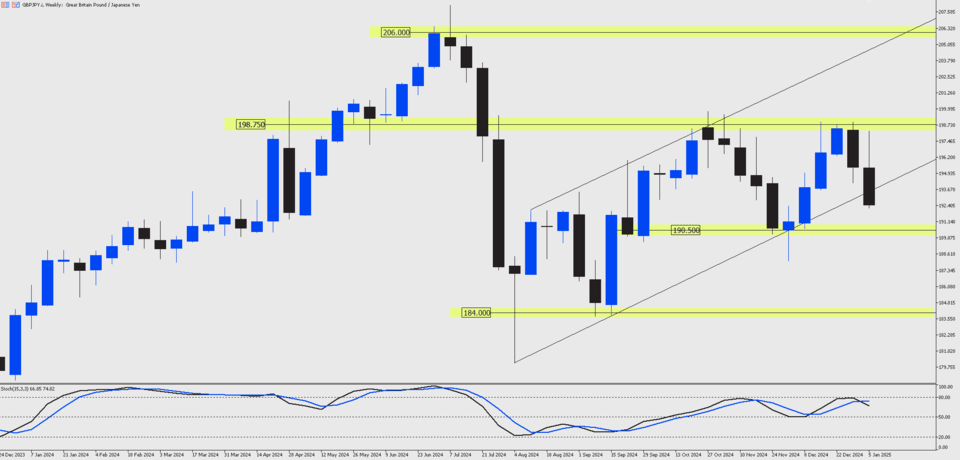

GBP Outlook

The Great British Pound was the weakest currency of last week, a major sell off in UK bonds caused by a lack of growth projection being a driver. Chancellor Reeves is coming under immense pressure by the market to 180 her policy of raising taxes and cutting government spending which is contractionary for the UK economy.

That’s not the only worry in the United Kingdom though, higher than expected inflation combined with higher unemployment and stagnant demand is putting the UK at risk of stagflation. Small to medium businesses in the UK will be hit the hardest here as well as consumers.

If GBP remains a weaker currency then traders could look to stronger ones for opportunities. The Japanese Yen (JPY) is a stronger currency as investors begin to worry about the stock market. GBPJPY has broken through the key support of the ascending channel highlighting the sentiment of the market.

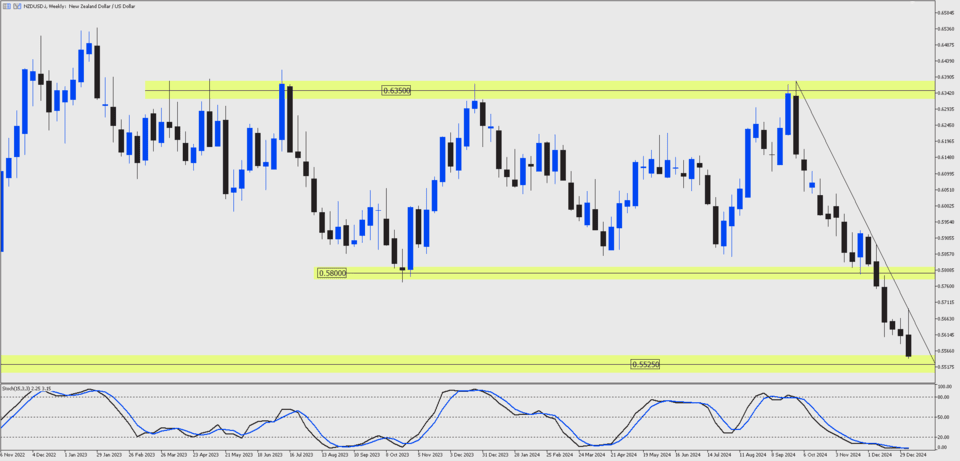

NZD Outlook

The NZDUSD price has reached the 2022 lows and support of 0.5525. The Commitment of Trader reports continue to show short positioning from the hedge funds reaching extremes we haven’t seen before in history. This could lead to a turn in the weakness of the New Zealand dollar, but against the USD the price may remain the same.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.