CHoCH is a market structure concept used to highlight potential shifts in price behaviour. It may help traders observe changes in market conditions and interpret developing trends within their analysis.

This article discusses how CHoCH can be incorporated into a broader market analysis framework, helping traders understand how shifts in structure may inform their approach to timing and risk consideration.

What is CHoCH?

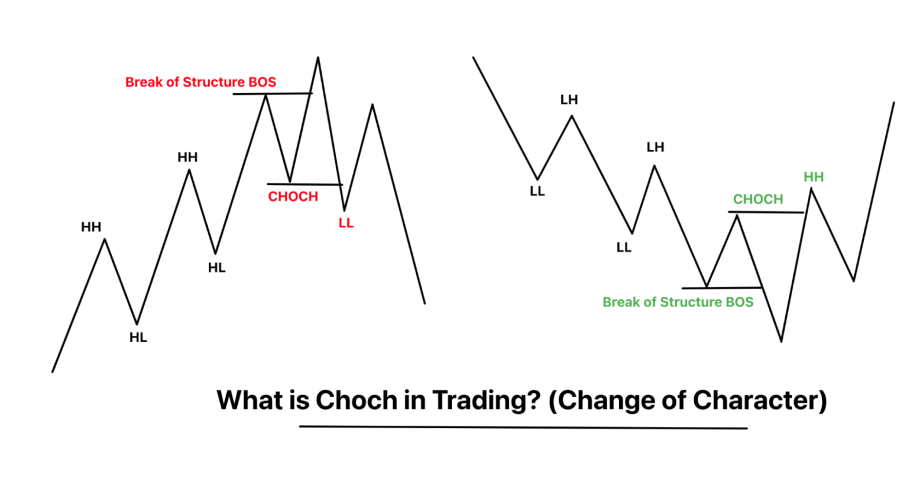

CHoCH, or Change of Character, is a price action concept used to identify a potential market trend reversal. It's especially popular in smart money and market structure-based trading strategies.

Traders may watch for a CHoCH to identify potential momentum changes and prepare for trend shifts as they develop

In a bullish CHoCH, the market shifts from lower highs and lows to breaking the previous lower high, signaling a potential trend reversal. This suggests bulls may be gaining control, especially when supported by demand zones or indicators, which traders might interpret as an early sign of emerging bullish sentiment, traders may consider long entries.

A bearish CHoCH occurs when an uptrend breaks down by forming a lower low, showing fading bullish strength. It suggests a potential bearish reversal, prompting traders to observe price behavior around supply zones or failed highs as part of their broader market analysis.

How to identify a ChoCH?

1. Define the current market trend

Begin by assessing whether the market is trending upward or downward. Look for a consistent pattern of higher highs and higher lows in an uptrend or lower highs and lower lows in a downtrend. Understanding the existing trend sets the foundation for spotting a potential reversal.

2. Identify key swing points

Mark the recent significant highs and lows on the chart. These swing points serve as structural benchmarks. A break of these levels, particularly the most recent high or low, often signals the first clue of a CHoCH.

3. Observe for a break in structure

The CHoCH pattern may indicate a potential shift in market behaviour when price moves beyond a previous swing high in a downtrend (bullish CHoCH) or the swing low in an uptrend (bearish CHoCH). This shift may indicate a change in control between bulls and bears, potentially signaling a reversal.

4. Confirm with volume analysis

Check whether the break in structure is supported by increased trading volume. A CHoCH observed alongside higher volume may suggest increased activity from market participants, which could provide additional context for interpreting shifts in market dynamics.

5. Utilize multiple timeframe analysis

Analyze the CHoCH setup across multiple timeframes to strengthen the signal. A structural break on a lower timeframe that aligns with a larger trend reversal on a higher timeframe offers may offer additional context and a clearer view of evolving market conditions.

CHoCH vs. market structure shift

Definition & timing

CHoCH represents the first indication that a market may be reversing direction. It typically appears after a sustained trend, where the price breaks a previous high or low, suggesting a shift in momentum.

On the other hand, a Market Structure Shift (MSS) may suggest that market behaviour is beginning to change. MSS happens after a CHoCH when the market follows through with new structural highs or lows that align with the emerging trend.

Position in trend reversal

CHoCH occurs early in the reversal process. It is the trader's initial clue that the prevailing trend might be ending, making it useful for spotting potential turning points.

In contrast, MSS takes place later, after the market has shown further evidence of a trend change. This confirmation is more reliable but comes with a slight delay compared to the early signal provided by CHoCH.

Use in trading

Traders often use CHoCH as an early alert to prepare for potential trade setups or to adjust risk exposure. Since it's the first sign of reversal, it helps traders anticipate changes.

MSS confirms trend shifts and is typically used by those who prefer entering trades only after stronger validation from price structure. This makes MSS more conservative but also more dependable.

CHoCH vs. break of structure

Definition and purpose

CHoCH is the first signal that the current structure might be changing direction.

In contrast, a Break of Structure (BoS) suggests the continuation of the current trend and confirms the market is maintaining its direction after a pullback or consolidation.

Market behavior signal

CHoCH typically occurs when price violates a key swing point in the opposite direction of the trend. For example, if the price breaks a lower high in a downtrend, it may signal a bullish shift.

BoS, however, happens when the price breaks the previous high or low in the same trend direction, confirming that bulls or bears still dominate.

Trader's interpretation

Traders may view CHoCH as an early indication of changing market behaviour and incorporate it into their broader analysis for contextual understanding. It's especially useful for catching the start of new trends.

On the other hand, BoS helps traders enter trend-following positions confidently, as it confirms the market is continuing along the established direction.

CHoCH trading strategies

CHoCH with order block entry

After identifying a CHoCH, traders may look for a nearby bullish or bearish order block (the last opposing candle before the impulsive move). Some traders observe how the price behaves if it returns to that zone, noting features such as wick formations or shifts in candle structure as part of their broader analysis, while keeping general risk considerations in mind. This improves precision and minimizes risk.

CHoCH with liquidity sweep

Traders may observe for CHoCH that occurs after a liquidity grab (false breakout above a high or below a low), which may trap breakout traders. A move back in the opposite direction, accompanied by higher volume, may offer additional context for interpreting evolving market dynamics.

Multi-timeframe CHoCH confirmation

Traders often use a higher timeframe to identify a CHoCH and then zoom into a lower timeframe for more precise entries. For instance, if a 4H CHoCH forms, some traders review CHoCH patterns across different timeframes, such as 15-minute or 1-hour charts, to see whether similar structural shifts appear and to support their broader market interpretation.

Spot entry opportunities with CHoCH

CHoCH may help illustrate early changes in market behaviour, though it is important to note that signals can be inconsistent, particularly during volatile or ranging conditions. Traders must confirm with additional tools to manage risk and improve the reliability of entries.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.