Everything in the Forex market, from entering to exiting a position, depends on the timing of your trade and the market dynamics.

Exiting a trade too early could lead you to miss out on increasing price actions. However, if you end up holding a position for too long, your profit margin could end up substantially squeezing.

Forex exit indicators can help you identify the correct exit opportunities in order to get maximum profit from your trade.

Here are six Forex exit indicators that you should consider adding to your exit strategy:

1. Average True Range

The average true range or ATR measures volatility by taking into account any gaps present in the price movement. It is the average of true ranges over a specific period of time. It sets stops and limits based on the overall Forex market behavior to bring the trade to a stronger position.

The indicator moves up and down along with the increasing or decreasing price of the currency pairs.

- If the ATR is comparatively larger, it will require the trader to set a wide range between the stop and limit point, as it shows that the market is volatile and will result in drastic price movements.

- When the ATR is smaller and the range set is too narrow, the position can be closed early. But when a position is closed early or prematurely, you lose out on their potential profits.

To get the right exit position, the value of the ATR should be subtracted from the closing price. If the price closes more than one point below ATR’s latest closing price, it means the market is seeing some significant changes and closing a long position at that point is the right thing to do.

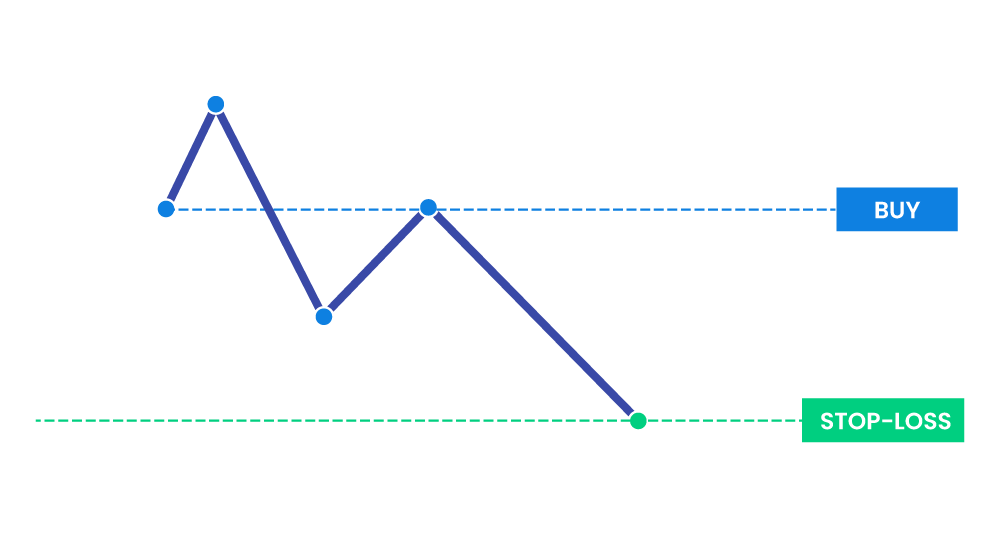

2. Stop Limit

A stop limit trader combines the features of both a stop order and a limit order. Stop orders get triggered when a currency pair price moves beyond a set price point. A limit order is an order set to buy or sell the currency pair at a specified price point. A limit order is used to mitigate risk and gives you control over when an order should be completed.

Stop limit is one of the easiest exit strategies since it helps you to hold onto the profits, whenever the price movement goes against your initially planned direction.

To implement the stop limit exit indicator, you should start by analysing the currency pair and its support as well as resistance levels. Place your stop limit order near or on the resistance level, as at this point the prices stop rising and take a downturn instead.

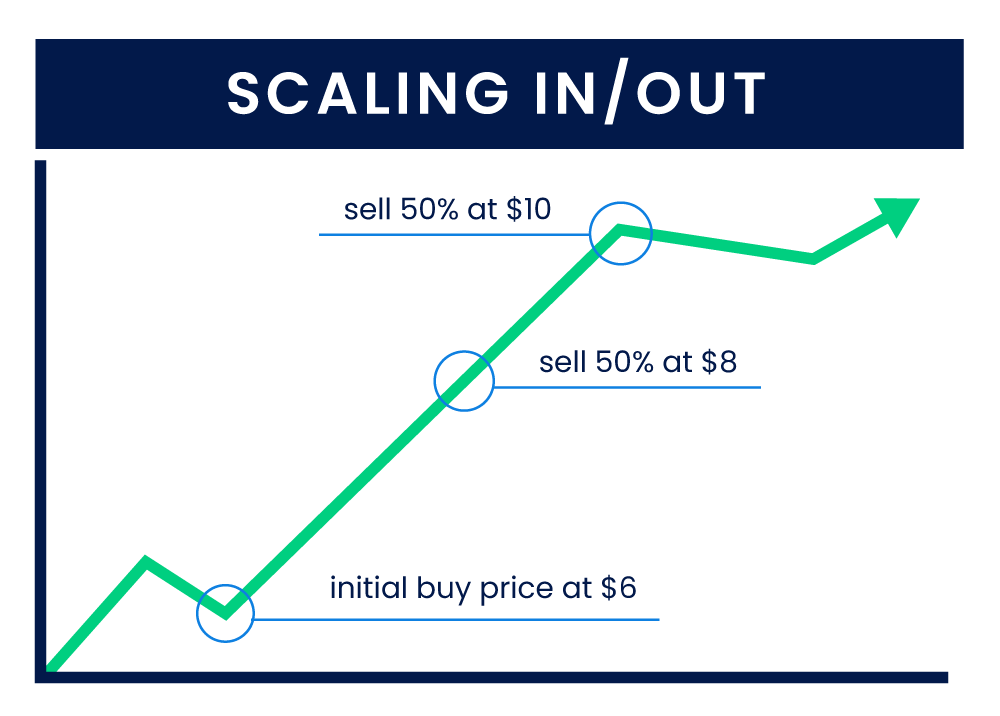

3. Scaling Exit

A scaling exit means that you, as a trader, can exit the trade at different price levels instead of sticking to one exit point. It enables you to sell off the entire value of the currency pair that you are holding, one by one, as the price increases.

When a trade moves into a profit zone, the scaling exit strategy allows you to place a stop limit order there and then, and attain the profits. This ensures that you exit the trade with the highest return on your open position.

Since this cancels out on the risk, you can aggressively target additional earnings.

If the price increases, the stop limit can be raised to guarantee maximum profit for the trader. This strategy works best when combined with other techniques in this list as it lets you target a higher percentage mark between the reward and risk targets and puts them in a safe profit zone without the risk of losing out on anything.

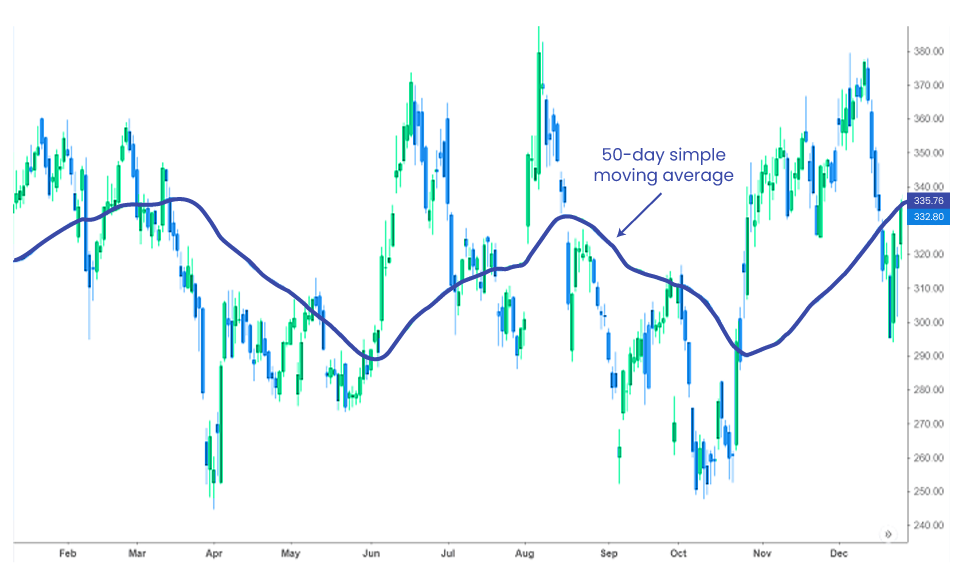

4. Moving Average Stop

The moving average stop is an indicator that lets you determine the most favorable and recent resistance level. Since the resistance level depicts a point after which the prices only fall, the moving average stop is placed right below the level or on it. The technical indicator then leads you to exit from favorable positions before they become unfavorable.

There is a simple fundamental rule that follows the moving average stop: When the price of the currency pair goes below the moving average, it’s time to sell. This can be used to identify an exit from the open position for maximized profits. To achieve this, you should set a stop loss below the moving average of the currency pair for an existing position.

The price crossover, where the currency pair’s price line and the moving average price line intersect, indicates a shift in the price trend. If you do not set a moving average stop, the shifts could dip below further, leading to losses.

5. Relative Strength Indicator

The Relative Strength Indicator or RSI is used by investors to evaluate the price momentum of a currency pair in the forex market. This helps you in analyzing the current and past strengths as well as weaknesses of the particular currency pair based on their closing prices.

RSI also measures the price change magnitude in recent times and evaluates currency pair conditions.

If it exceeds 30, it indicates that the currency pair is being overbought and tells you to exit the position.

6. Pivot Points

Through pivot points, you can understand market sentiments changing from bullish to bearish or vice versa.

In a chart, pivot points tell you the equilibrium level of the currency pair in the market. This means, if the price reaches the pivot point, the supply and demand of the currency pair are at the same level in the market.

If the prices continue rising, it tells you that the demand exceeds supply, which means the market is considered bullish. It is the perfect time for you to exit the trade by selling out the existing currency pair at a higher price since there are buyers seeking to get a hold of them.

If the prices remain below the pivot point level, it indicates that the supply is more than the demand and you can continue holding on to the currency pair for now.

Ready to make a profit in Forex?

While there are several tools and strategies that can help you exit or enter a position, the right one will depend on your trading plan and the current market conditions as well. The idea is to experiment with different exit indicators and use the one that best suits your requirements and the current trading scenario.

When trading in Forex, a lot also depends on the kind of Forex trading platform that you use. We make Forex trading profitable for you by giving you all the tools that you need to rake in large profits.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.