The risk-reward ratio is a fundamental concept in forex trading that assists traders in managing their capital and making informed decisions. It enables traders to strike a balance between potential gains and potential losses, helping them navigate currency price fluctuations.

What is the risk and reward of forex?

Risk refers to the possibility of incurring financial losses when participating in the forex market. Traders face risk due to the volatile nature of currency prices, which is compounded by the high leverage typically used in forex trading. Leverage allows traders to control larger positions than the capital they invest, which can amplify both potential gains and potential losses.

To manage risk, traders employ various strategies, with one of the most common being the use of stop-loss orders.

Reward represents the potential financial gain traders aim to achieve when they enter a trade. It is the positive outcome resulting from correctly analyzing the direction of price movement and executing a trade accordingly.

The size of the reward is influenced by several factors, including the extent of price movement in favor of the trade, the position size, and the leverage used. Traders often establish gain targets, predetermined price levels at which they decide to close a trade and realize the potential gain. A favorable risk-reward ratio implies that the potential gain is greater than the potential loss, making the trade more attractive to traders.

What is the risk-reward ratio?

The risk-reward ratio measures the expected gains of a given trade against the risk of loss. It is typically expressed as a ratio where the first number represents the potential risk, and the second number represents the potential reward.

For example, a risk-reward ratio of 1:2 indicates that the potential gain is twice the potential loss. If a trader risks $100, they aim to gain $200.

Types of risk-reward ratios

Variable risk-reward ratio

A variable risk-reward ratio means that the ratio is not fixed and can change during a trade. Traders may adjust their risk and reward levels based on changing market conditions, technical analysis, or other factors. For example, if a trade is going in a trader's favor, they might adjust the reward target to capture more gain or tighten the stop-loss to protect their gains.

Positive risk-reward ratio

A positive risk-reward ratio is one where the potential reward is greater than the potential risk. Traders seek to achieve positive risk-reward ratios to increase the potential for forex gain. For example, a risk-reward ratio of 1:2 means that for every dollar at risk (potential loss), the trader aims to make two dollars in gain.

Negative risk-reward ratio

A negative risk-reward ratio occurs when the potential reward is less than the potential risk, such as a ratio of 2:1. This is generally considered an unfavorable ratio, as it implies that the trader stands to lose more than they can potentially gain. Traders typically avoid negative risk-reward ratios, as they can lead to consistent losses over time.

Breakeven risk-reward ratio

A breakeven risk-reward ratio is when the potential reward equals the potential risk, such as a ratio of 1:1. In other words, if the trade is favorable, the gain will cover the initial risk, leaving the trader at breakeven. While this type of ratio doesn't result in a loss, it also doesn't provide for significant gain potential.

Infinite risk-reward ratio

An infinite risk-reward ratio is often associated with certain risk management strategies, such as trailing stop-loss orders. In this case, the trader allows the trade to continue without setting a specific gain target, letting the potential reward grow indefinitely. The risk, however, is still defined by the initial stop-loss order. This approach allows traders to capture significant gains if a trade continues to move in their favor. Still, it also carries the risk of potentially giving back a portion of those gains if the trade reverses suddenly.

How does the risk-reward ratio work?

The risk-reward ratio in forex is calculated by comparing the potential gain to the potential loss in a trade. Here's how the risk-reward ratio works:

1- Determine potential loss (risk)

Start by identifying a suitable entry point for the trade and then decide on where to put the stop-loss. The difference between the entry point and the stop-loss represents the potential loss (risk) if the trade goes against the trader.

2- Determine potential gain (reward)

Next, identify a target price at which the trader wants to take trade gains by closing the trade. The difference between the entry point and the gain target represents the potential gain (reward) if the trade goes in the trader's favor.

3- Calculate the risk-reward ratio

At last, divide the potential gain (reward) by the potential loss (risk) to obtain the risk-reward ratio. For example, if the potential gain is $200, and the potential loss is $100, the risk-reward ratio is 2:1. So, for every dollar a trader is willing to risk, they can gain $2.

Risk-reward ratio formula = Potential loss / potential gain = risk/reward ratio

Pros and cons of using the risk-reward ratio

Pros

- Risk management: By setting predefined levels for potential loss (risk) and potential gain (reward), traders can protect their capital and minimize the impact of losing trades.

- Discipline: Establishing and adhering to a risk-reward ratio promotes discipline in trading. It helps traders avoid impulsive decisions and stick to a well-thought-out plan.

- Consistency: It encourages consistency in trading strategies. Traders can apply the same principles across multiple trades, creating a structured approach to trading activities.

- Gain potential: A well-calibrated risk-reward ratio allows traders to maintain the potential for gain while keeping losses controlled. It can lead to long-term gains, even if not all trades are favorable.

- Emotional control: It helps in emotional control by providing a clear framework for decision-making. Traders are less likely to let emotions like fear and greed drive their trading decisions.

Cons

- Market volatility: Market conditions can change rapidly, and high volatility may make it challenging to maintain a fixed risk-reward ratio. Traders may need to adjust their ratios based on evolving market dynamics.

- Rigidity: A strict adherence to risk-reward ratios may lead to missed opportunities or trades that are prematurely closed. Markets don't always conform to predefined levels, and a rigid approach can limit flexibility.

- False signals: In some cases, the risk-reward ratio may not accurately reflect the potential of a trade. Traders might set ratios based on technical analysis, but unforeseen events or external factors can lead to unexpected outcomes.

- Risk of overtrading: The desire to maintain a positive risk-reward ratio may lead traders to overtrade, risking more capital than they should. Overtrading can lead to losses, especially if risk management is neglected.

- Psychological stress: While the risk-reward ratio can provide structure, it can also introduce psychological stress if traders become overly fixated on achieving specific ratios. This stress can be detrimental to decision-making and emotional well-being.

Trading strategies using risk-reward ratios

Breakout trading

Breakout trading is a strategy where traders aim to capitalize on significant price movements that often follow a breakout from key support and resistance levels. The concept of risk-reward ratios in this strategy helps traders identify these critical levels and enter a trade when the price surpasses them. The risk-reward ratio becomes crucial in managing the trade effectively.

Traders can set stop-loss orders just below (or above) the breakout (or breakthrough) points, also known as resistance or support levels, to limit potential losses if the trade does not go as planned. At the same time, they establish gain targets at predetermined levels, which allows them to determine a clear risk-reward ratio. By doing so, traders can balance the potential losses with the opportunity for larger gains, making the strategy a disciplined and structured approach.

Harmonic patterns

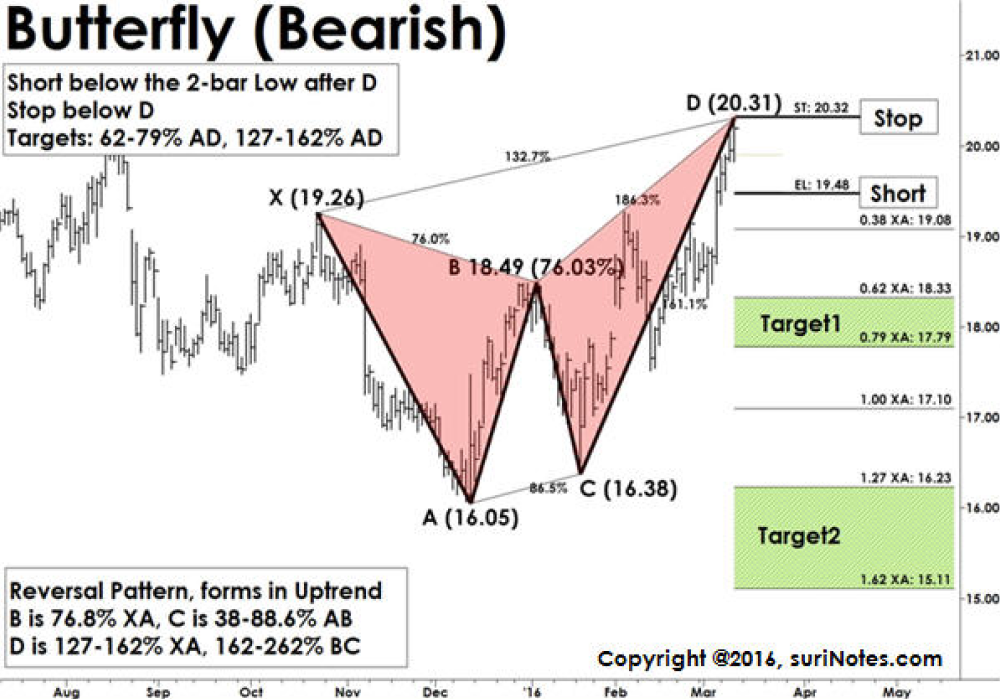

Harmonic pattern trading relies on identifying specific geometric price patterns that indicate potential reversals or the continuation of existing trends. Traders use patterns such as the Gartley, Bat, and Butterfly to make their trading decisions. The risk-reward ratio plays a significant role in this strategy as it helps manage risk.

Traders set stop-loss orders based on the structure of the harmonic pattern, which serves as a clear point of invalidation for the trade idea. For example, if a trader is identifying a bullish Gartley pattern, the stop-loss might be set just below the potential reversal zone (PRZ) of the Gartley pattern. If the price moves beyond this point, it would invalidate the pattern and suggest that the anticipated reversal may not occur as expected. This stop-loss placement helps traders limit potential losses if the trade goes against them and provides a well-defined exit point if the pattern does not materialize as anticipated.

**This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

Furthermore, they establish gain targets at specific Fibonacci retracement or extension levels, allowing them to define risk-reward ratios before entering a trade. This approach enhances discipline and control over potential losses.

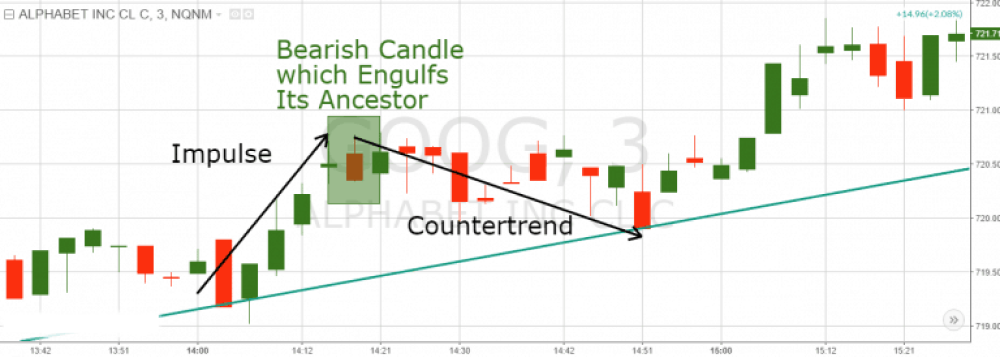

Counter-trend trading

Counter-trend trading is a strategy where traders go against the prevailing market trend and place long orders during bearish and short orders during bullish trends. They seek overextended price movements and anticipate potential reversals or retracements.

The risk-reward ratio helps in risk management and defining trade parameters. Traders tend to set conservative gain targets, aiming for smaller, more consistent gains.

Simultaneously, they employ tight stop-loss orders to limit potential losses if the market trend continues, ensuring that the risk-reward ratio aligns with their approach of smaller, controlled gains and protecting capital. Stop-loss orders are typically placed close to the entry point. This allows for limiting potential losses in case the market trend continues in the opposite direction.

Trend following

Trend following is the practice of trading in the direction of the prevailing market trend, which means placing long orders during bullish and short orders during bearish trends. Traders enter trades when they believe a trend is likely to continue. The risk-reward ratio is associated with this strategy by helping traders optimize gain potential while managing risk. Traders often set wider gain targets, aiming to capture the full extent of a trend.

Simultaneously, they establish stop-loss orders at levels that protect their capital and prevent substantial drawdowns. The stop-loss levels are often placed below or above key technical support or resistance levels, trendlines, moving averages, or recent swing lows or highs, depending on whether it's a long or short position. By using risk-reward ratios, traders can balance the desire for large gains with the necessity of controlling potential losses, making it a fundamental tool in trend-following strategies.

Volatility breakout

Volatility breakout trading focuses on identifying periods of increased price volatility and capitalizing on price breakouts during these volatile periods. Traders search for sudden and sharp price movements in the forex market. Risk-reward ratios are integrated into this strategy as essential risk management tools as they enable traders to set stop-loss orders just below the breakout levels, which protects them against potential losses.

Additionally, they establish gain targets at predetermined levels based on the expected volatility range, ensuring that the risk-reward ratio aligns with their goal of controlling potential losses and maximizing gains during periods of heightened market volatility. This approach helps maintain a disciplined and systematic trading style.

Striking the right balance between risk and reward

The risk-reward ratio is a vital tool in forex trading, offering advantages like risk management, discipline, and consistent strategies. However, traders should be cautious about potential drawbacks like rigidity, false signals, and the risk of overtrading.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.