Long-term trading strategies allow traders to capitalize on significant price movements over extended periods by focusing on trends, market cycles, and market fundamental shifts.

Unlike short-term strategies, long-term strategies reduce the impact of daily market noise. Traders can gain from compounded gains while minimizing the stress of constant monitoring.

Let's discuss the top 9 long-term forex strategies.

Trend following strategy

Trend following is a long-term trading strategy that focuses on identifying market direction. Traders aim to enter uptrends and exit during downtrends. The strategy relies on identifying trends early and riding them for significant gains.

Traders use tools like moving averages to confirm trends. Trends can last weeks, months, or even longer. The key is to stay on the trend for as long as possible. Patience and discipline are vital in trend-following strategies. This strategy suits trending markets, where sustained movements occur. Proper risk management protects traders against sudden reversals.

Carry trade strategy

A carry trade involves buying currency pairs with low interest rates. The funds are then invested in higher-yielding currency pairs, and the trader gains the difference between the interest rates.

Traders hold positions for weeks or months to gain from the interest rate differentials. Currency pairs, especially those with significant rate disparities, are ideal. Volatile markets can cause unpredictable shifts in currency values. Hence, this strategy gains from steady trends and low volatility. Risk management is critical to protect against market reversals or volatility spikes.

Position trading strategy

Forex position trading focuses on capturing long-term market trends. Traders hold positions for weeks, months, or even years. This strategy relies heavily on fundamental analysis to make informed decisions. Technical analysis supports the entry and exit points, too.

Position traders avoid reacting to short-term market noise and focus on the bigger picture. The strategy requires patience, as trades are held for extended periods. Risk management is essential, as market fluctuations can impact long-term positions. Position traders often use stop-loss orders to protect investments.

Swing trading strategy

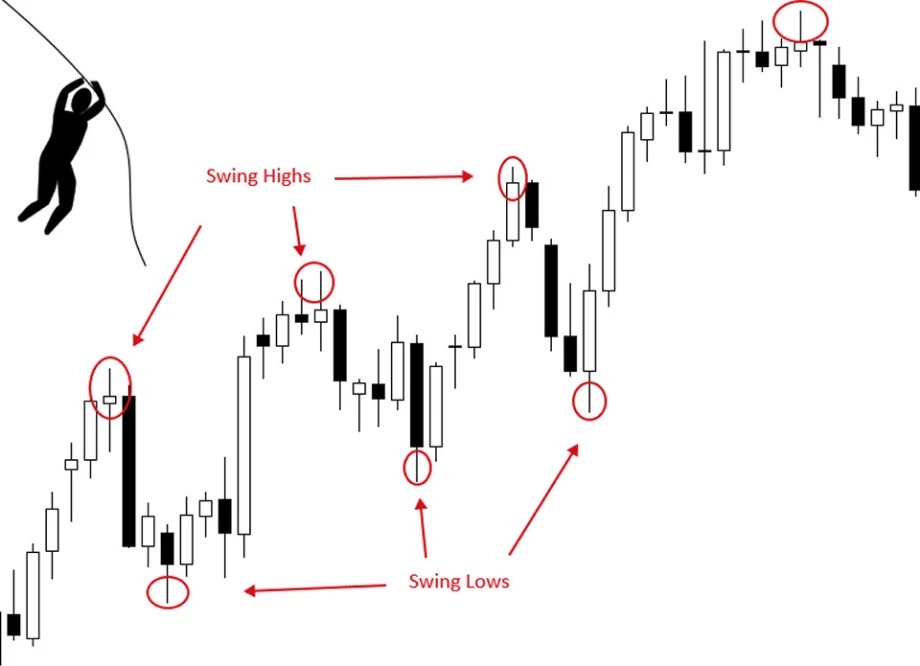

Swing trading targets short- to medium-term price moves. Traders look to capitalize on price swings within a trend. Positions last days to weeks, depending on the market. The strategy combines technical analysis with market timing.

Traders look for pullbacks or price consolidations to enter positions. They exit when the momentum shifts or when gain targets are reached. Swing traders aim to capture gains from market oscillations. The strategy works well in volatile markets with frequent price movements. Risk management is necessary, as price movements can reverse quickly. Traders must stay alert to price trends and indicators to avoid any reversal setback.

Breakout strategy

The breakout strategy focuses on price movements at support and resistance levels. Market participants look for price breakouts above resistance or below support levels. A breakout signals potential momentum and trend direction. High volatility often accompanies breakouts, increasing potential gains.

Traders watch for strong volume to confirm breakout validity. A breakout can lead to significant price movement in a short time, so traders must act quickly to catch these moves. However, false breakouts or fakeouts can lead to losses. Many forex traders use indicators, such as volume or RS to filter false signals.

Moving average crossovers strategy

Moving average crossovers indicate potential trend changes. Forex traders use two moving averages with different time periods.

- A short-term moving average crossing above a long-term one signals a long order

- A crossover in the opposite direction signals an exit or short order

The golden crossover is a strong entry signal, while the death crossover is a strong exit signal. Moving averages smooth out price data and help identify market trends. This forex strategy works well in markets with sustained trends. However, false crossovers can lead to losses in sideways markets. Traders often use additional indicators to confirm signals during this crossover strategy.

Range trading strategy

Range trading involves entering at support levels and exiting at resistance. Traders capitalize on price movements within a defined range. This strategy works well in non-trending, sideways markets. Traders rely on technical indicators like RSI or Bollinger Bands for entry signals.

Traders aim to enter a long trade when the price is low and enter a short trade when it's high within the range. The strategy requires patience and attention to price behavior. Risk management is vital to avoid losses from false breakouts. When a breakout occurs, traders must reassess their positions. Range trading thrives well in consolidating markets.

Mean reversion strategy

Mean reversion assumes that prices will return to their historical averages. The strategy looks for overbought or oversold conditions in the market. Traders enter when prices deviate significantly from the mean, expecting the price to revert to the average over time.

Common indicators like RSI or Bollinger Bands help identify extremes. The strategy works well in non-trending markets. Timing is critical in this strategy because prices can remain overbought or oversold for long periods. Traders must be cautious of long trends that defy mean reversion.

Channel trading strategy

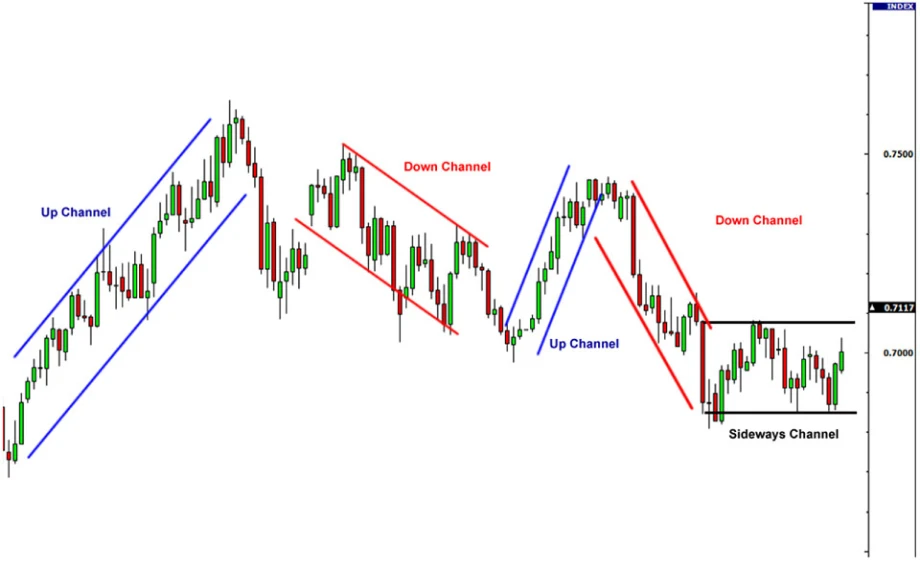

Channel trading focuses on trading within parallel price channels. Traders enter at the lower boundary and exit at the upper boundary. Channels are formed by drawing two parallel trend lines on a price chart. This strategy works well when the market moves within a defined range.

Traders use technical indicators like RSI to confirm price movement within the channel. The strategy assumes that the price will continue bouncing between boundaries. A breakout above or below the channel can signal a trend change. However, traders must monitor for false breakouts, which can lead to losses. Risk management is crucial to avoid large drawdowns during these breakouts.

Choose the right long-term trading approach

The trend-following strategy suits disciplined traders seeking long-term gains. It offers consistent gains in trending markets. However, it struggles in sideways or volatile conditions. Traders must adapt to market conditions for optimal results, making it ideal for trend-oriented investors.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.