Contract for differences (CFDs) gives you the perfect opportunity to benefit from your trades, regardless of whether the market goes upwards or downwards.

A CFD is a written agreement between you, the trader, and the contract provider, also known as the seller (investment bank, brokerage, or a spread betting firm). At the end of the contract, both parties exchange the difference between an asset's opening and closing price.

CFDs are gaining popularity because they are quite similar to trading Stocks. The only difference is that you don’t actually own the underlying Stocks that you trade. CFD is a type of derivative trading that allows you to profit by speculating on the rising and falling prices of different financial assets, including Forex, Commodities, and Shares.

If you are still wondering whether CFDs are for you, take a look at these top benefits of CFDs:

Leverage trading

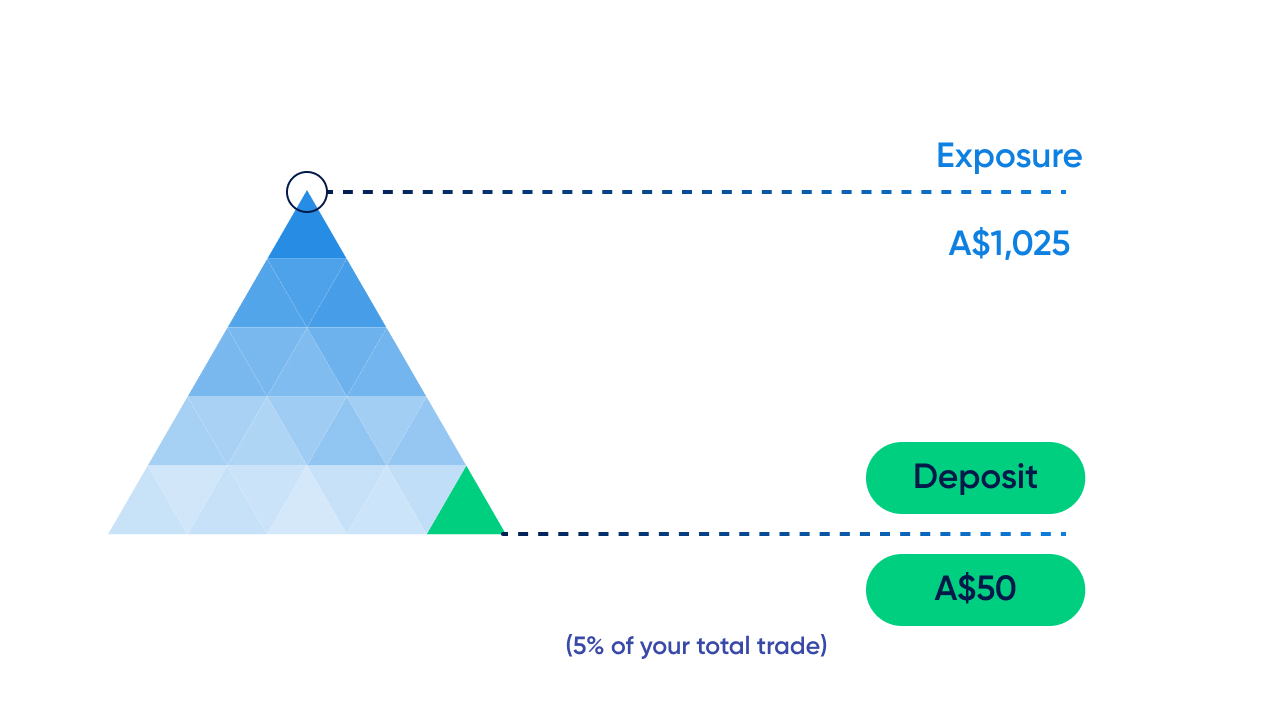

With Contract for Differences (CFDs), you only have to deposit a small fraction of the total trade’s value. This is called margin, which can be as low as 10%. The deposit depends on each trade size and the margin factor decided by the market.

For example, if a particular asset has a margin of 10%, then your deposit for 20 CFDs costing $100 each will only be 10% off (20*100) = $200.

The profits and losses with CFD trading are based on the position’s full size of your asset. This means that, in the example above, you may earn profits of $2,000 by only depositing $200 out of your pocket.

To help you understand how the profit or loss system works, here are two different scenarios:

- Your position increases to $2,025: In this situation, you make $25 or 50% of your deposit.

- Your position falls to $1,975: In this situation, you lose $25 or 50% of your deposit and nothing beyond that.

Traditional trading does not allow you to leverage like CFDs do, making CFDs a lucrative option for smaller deposits.

Shorting advantages

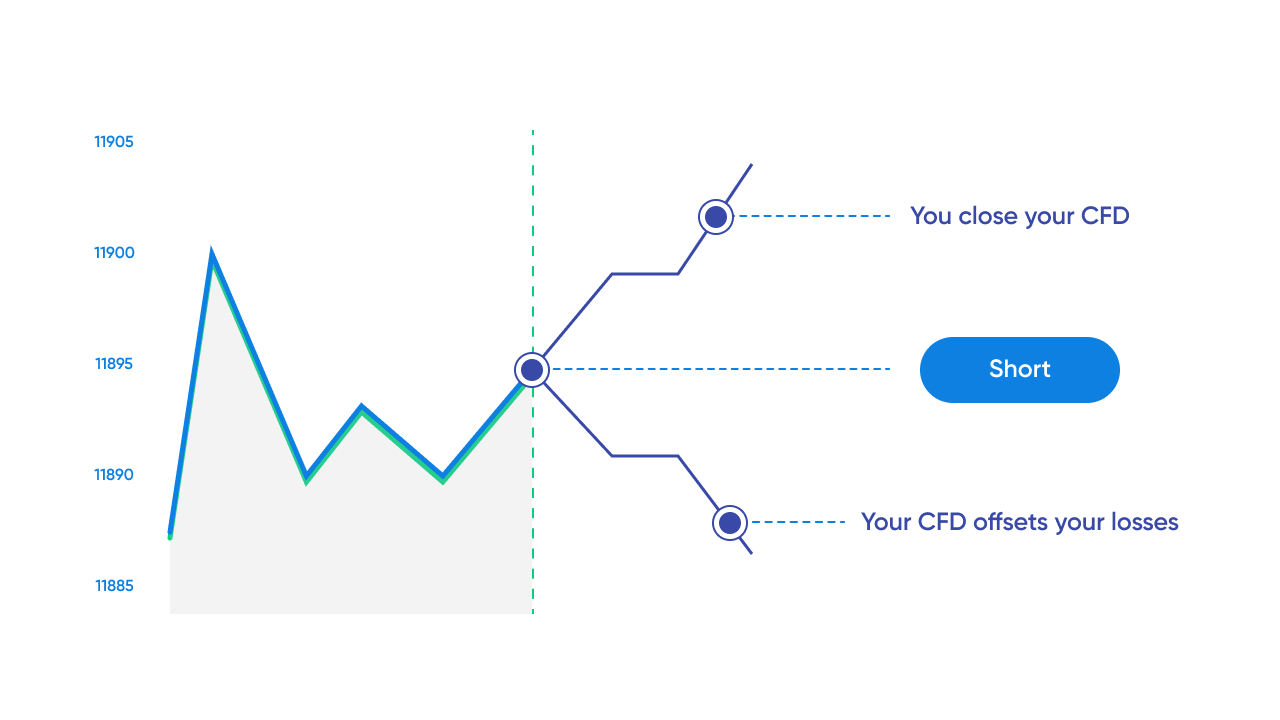

CFDs is one of the markets you could enter if you wish to potentially profit from going short in your trades. In a CFD, you and your contract provider agree to exchange the difference between the open and exit price of the asset. This makes trading CFDs more flexible as it allows you to trade in markets that are not only rising but falling. When you witness the asset prices dropping with no potential of rising again, you may open a short position.

For example, if ABC Shares trade at $100 per share and you expect a downtrend, you could open a short position and sell 100 Shares. At a later date, when prices actually start falling, the buying price reaches $95 per share. You can then choose to close the position at this price.

In that way, you could make a profit of $500 [($100-$95) *100] since the price difference was $5 per share.

Mimics the underlying asset’s movement

CFD trading mimics the market movement of any underlying asset. This means that if you wish to buy 1,000 Shares of Apple at $100 per share without actually investing $100,000, you can do so by purchasing 1,000 Share CFDs of Apple instead. It gives you similar profits as Share trading would but without any shareholder privileges. You also get to benefit from CFD’s features of shorting the market and trading on lower margins.

The case is similar to a Forex CFD. It gives you the same exposure as buying real currencies in the Forex market with a lower overall deposit and evident profits.

Hedging your portfolio

CFDs are a prominent hedging tool, helping investors mitigate risk and benefit from falling markets. It lets you open a position in an asset opposite another asset, with the scope of offsetting any loss exposure due to price fluctuations.

For example, you own some Shares in ABC Ltd., and you wish to hold the position long-term. If you feel the industry will take a downturn and asset prices will drop, you may choose to open a short position using CFDs to offset any potential losses.

If the Share prices drop, you may exit your position and gather your profit. However, if the asset prices somehow increase, you can still close your CFD position and offset the loss incurred later, against future profits, as capital gain tax purposes.

No expiry date

Unlike futures contracts, CFDs do not come with an expiry date and can be held for as long as you wish. Hence, as long as you have the funds to maintain your position, you can do so without having to worry about the contract expiring. With an anticipated growing market and increasing prices, CFDs may help you maximize your long-term trades.

Low transaction costs

Stamp duty is a government tax that you pay to trade. Since you do not own the asset in CFDs, you don’t have to pay the stamp duty. This lowers your overall transaction costs/fees. However, tax laws are different for each individual, depending on the country they reside in. Stamp duties are subject to change, which is why it's a good idea to check on that before you start trading.

Maximize your earning potential with CFDs today

With all the benefits of trading CFDs discussed, it is important to remember that CFD trading also comes with respective risks. The right trading platform carefully guides you through CFD trading. This is why finding a well-informed broker who will advise you on any risks involved is just as important as choosing the right market to trade.

Blueberry. makes trading CFDs more manageable with a seamless MT5 platform, a quick sign up to a live trading account, and a free demo account for you to practice with for 30 days.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.