The U.S. Employment Data, released by the Bureau of Labor Statistics (BLS), provides insights into the health of the American economy. Key metrics like the unemployment rate and the number of unemployed individuals significantly impact economic conditions. A rise in unemployment often indicates a slowing economy, while a decline suggests a strengthening one.

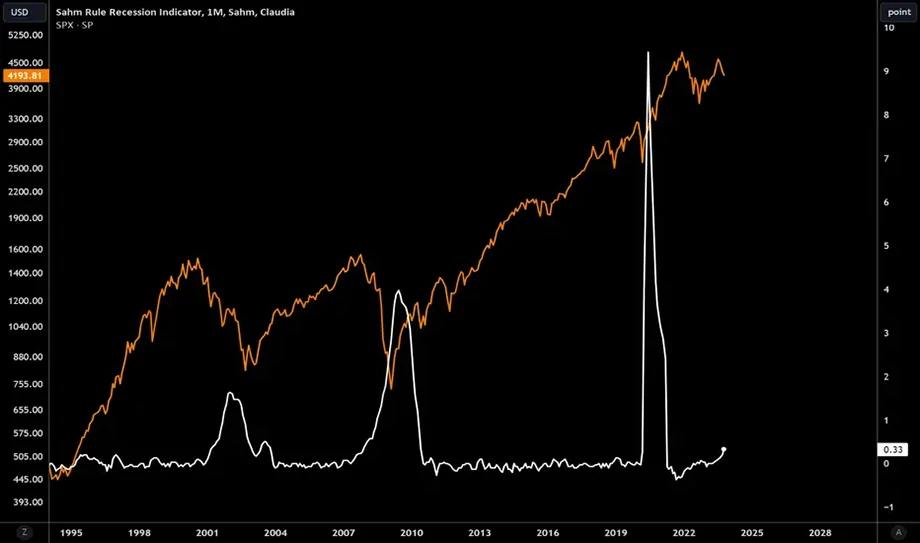

The Sahm Rule Recession Indicator, a tool for predicting recessions, heavily relies on THIS unemployment data. A significant increase in the unemployment rate, as signaled by the Sahm rule, can be a strong indicator of an impending recession. The recent BLS data for 2024 shows a stable unemployment rate of 4.1%, suggesting a relatively healthy labor market. However, it's essential to continuously monitor employment data to assess the economic outlook and make informed trading decisions.

Forex markets are sensitive to unemployment data. Rising unemployment can strengthen the USD and vice versa. Let’s understand the Sahm rule recession indicator and how to use it in the forex market.

What is the Sahm rule recession indicator?

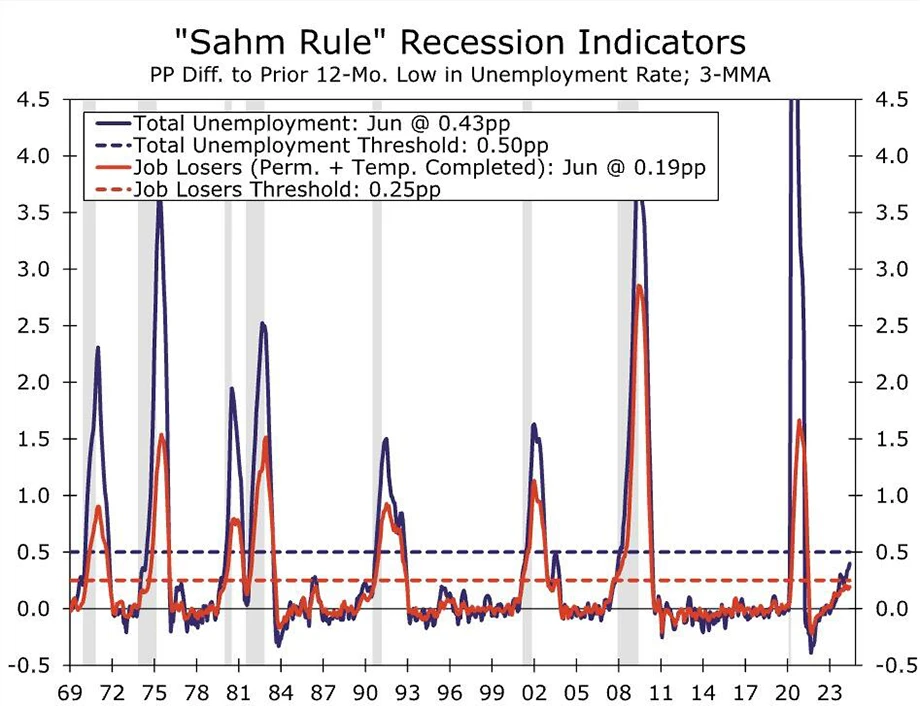

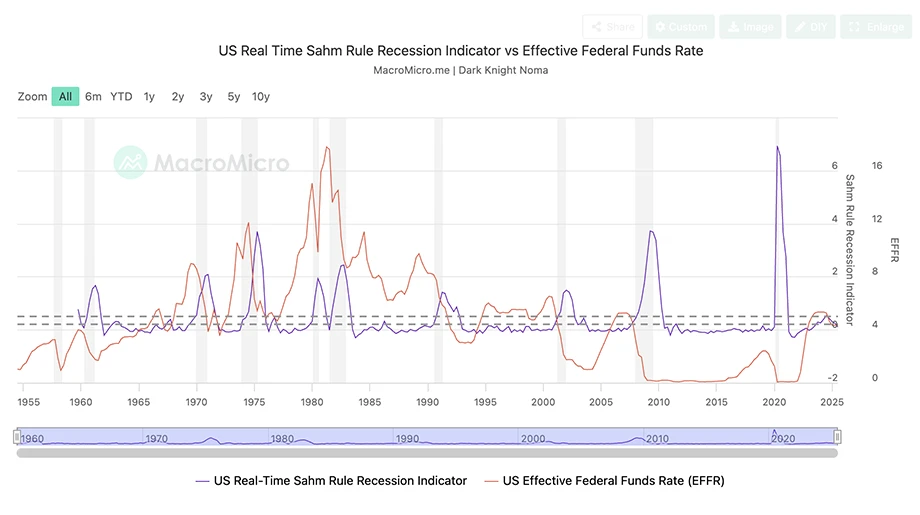

The Sahm rule is a recession indicator developed by economist Claudia Sahm. It is based on the premise that a significant increase in the unemployment rate is a reliable early warning sign of a recession. The Sahm Recession Indicator signals the start of a recession when the three-month moving average of the national unemployment rate (U3) increases by 0.50% or more compared to the lowest three-month moving average of the past year.

History of the Sahm rule

The Sahm rule was developed in 2019. It was inspired by her research on early warning indicators of recessions. Sahm observed that significant increases in the unemployment rate were often reliable precursors to economic downturns. The rule was first publicly presented in a blog post on the Brookings Institution website in March 2019. In the post, Sahm explained the rationale behind the rule and provided evidence to support its effectiveness.

Since its introduction, the Sahm rule has gained recognition and has been adopted by many economists and policymakers as a useful tool for monitoring the state of the economy. It has been shown to accurately predict the start of recessions in the United States, including the 2020 recession caused by the COVID-19 pandemic and the great recession across the OECD countries. However, it is important to note that the Sahm rule is not a perfect predictor. It should be used in conjunction with other economic indicators to get a complete picture.

Types of Sahm rule recession indicators

Current Sahm rule recession indicator

This indicator is based on the revised unemployment rate data. The Bureau of Labor Statistics (BLS) regularly updates the unemployment rate for previous months as more information becomes available from its surveys. Therefore, the current Sahm Rule indicator provides a more accurate picture of the economic situation.

Real-time Sahm rule recession indicator

Unlike the current indicator, the real-time Sahm Rule uses only the available unemployment rate data in a given month. This means it doesn't incorporate any revisions to the data later. It's a more immediate indicator, but it might be less accurate compared to the current Sahm Rule.

How does the Sahm rule recession indicator work?

The Sahm rule indicator works by monitoring changes in the unemployment rate over time. Here's how traders can use the indicator –

-

Calculate the three-month moving average of the national unemployment rate (U3): This is simply the average of the unemployment rates for the current month and the two previous months.

-

Compare this average to the lowest three-month moving average over the previous 12 months: If the current average is 0.50 percentage points or more higher than the lowest average, it signals the start of a recession.

In other words, according to the Sahm rule, a recession is underway if the unemployment rate rises by 0.50% or more from its 12-month low.

Advantages and disadvantages of using the Sahm rule recession indicator

Advantages

-

Timely identification of recessions: The Sahm rule can often provide early warnings of a recession. This allows policymakers, businesses, and individuals to take proactive steps to mitigate the negative impacts of an economic downturn. For example, governments might implement stimulus packages, while businesses could adjust their spending and investment strategies

-

Simple and clear: The Sahm rule is based on a straightforward unemployment rate calculation. This makes it easy to understand and apply, even for those without extensive economic knowledge. Its simplicity can also facilitate its use in real-time monitoring of economic conditions

-

Reliable historical accuracy: The Sahm rule has demonstrated a strong track record in accurately predicting recessions in the United States. This historical reliability lends credibility to its use as an early warning indicator

-

Forward-looking: The Sahm rule is designed to anticipate future economic conditions based on current trends in the unemployment rate. This forward-looking nature allows for proactive planning and decision-making

Disadvantages

-

US-centric: The Sahm rule was primarily developed for the US economy. Hence, its effectiveness in other countries may be limited, as different economic structures and factors can influence the relationship between unemployment and recessions

-

Limited applicability to global economies: In an increasingly interconnected global economy, economic downturns in one region can have ripple effects on others. The Sahm rule, being focused on domestic US conditions, may not fully capture these global interdependencies

-

Lagging effects in fast-moving markets: The Sahm rule is based on historical data. The unemployment rate might not reflect the most current economic conditions in rapidly changing economies. This can lead to a lag between the onset of a recession and the rule's signal

-

Potential for false signals during temporary unemployment spikes: Temporary fluctuations in the unemployment rate, such as those caused by seasonal factors or short-term economic shocks, can trigger false positive signals from the Sahm rule. This can lead to unnecessary economic uncertainty and potentially inappropriate policy responses

Top trading strategies to use with the Sahm rule recession indicator

USD short positions (bearish USD strategy)

During economic downturns, investors often seek less risky assets like the US Dollar. This increased demand for the USD can lead to its appreciation relative to other currencies. Traders aim to gain from this expected price movement by shorting the USD.

For example, if the Sahm rule signals a potential recession, a trader might short the USD against the Japanese yen (USD/JPY). If the USD appreciates as expected, the trader can purchase it back at a lower price, realizing a gain.

Carry trade adjustments

Carry trades involve borrowing in a low-interest-rate currency (such as the Japanese Yen) and investing in a higher-yielding currency (such as the Australian Dollar). The difference in interest rates generates a gain. However, during recessions, the risk of currency devaluation increases, and investors may unwind these trades to avoid losses.

Let’s assume a trader has a carry trade position involving borrowing the Yen and investing in AUD. The Sahm rule signals a potential recession, the trader might short the Australian Dollars and repay the Japanese Yen loan. This helps to mitigate potential losses if the Australian Dollar depreciates significantly.

Risk-off trading in emerging market currencies

Emerging market currencies are often more volatile and sensitive to global economic conditions. During recessions, investors tend to shift their funds to safer, developed market assets, leading to a depreciation of emerging market currencies.

If the Sahm rule signals a potential recession, a trader might SHORT the Brazilian Real (BRL) against the US Dollar (USD). If the BRL depreciates as expected, the trader can purchase it back at a lower price, realizing a gain.

Commodity currency short positions

Commodity currencies like the Australian and Canadian Dollar often correlate with commodity prices. During recessions, commodity demand typically declines, which can lead to a depreciation of these currencies.

If the Sahm rule signals a potential recession, a trader might short the Canadian Dollar (CAD) against the US Dollar (USD). If the CAD depreciates as expected, the trader can purchase it back at a lower price, realizing a gain.

How to trade with the Sahm rule recession indicator

Understand the Sahm rule

Start by understanding what the Sahm rule and the Sahm indicator is. Traders should ensure they know how the indicator provides an early warning of economic downturns, allowing for proactive trading strategies.

Monitor unemployment rate data

Then, track the national unemployment rate using real-time data sources like the Bureau of Labor Statistics (BLS) or the Federal Reserve Economic Data (FRED). Calculate the three-month moving average and compare it to the 12-month low.

Identify Sahm rule signal

When the three-month moving average exceeds the 12-month low by 0.50 percentage points or more, a Sahm rule signal indicates a potential recession.

Develop a forex trading strategy

Once the trader has identified the Sahm rule signal, they must develop trading strategies before entering a trade –

-

Currency pair selection: Choose currency pairs likely to be affected by the recession. For example, during recessions, the US Dollar often appreciates, so consider pairs like USD/JPY or USD/CHF

-

Trading direction: Based on the expected direction of the currency pair, decide whether to go long or short. For instance, if the trader expects the USD to appreciate, they might go long on USD/JPY

-

Risk management: Implement risk management strategies like stop-loss and take-profit orders to protect the capital and limit potential losses

Consider additional economic indicators

While the Sahm rule is a useful tool in the forex market, other economic indicators are essential for a more comprehensive analysis. Factors like GDP growth, consumer spending, and business investment can provide additional insights.

Execute the trade

Finally execute the forex trade with the Sahm indicator –

-

Enter the trade: Once the Sahm rule signal is confirmed, enter the trade based on the chosen strategy. For example, if the trader’s going long USD/JPY, purchase USD against JPY

-

Hold the trade: Hold the position as long as the underlying economic conditions and technical analysis support the trade

-

Exit the trade: Close the position when the gain target is reached or the trade starts moving against the trader. Use stop-loss orders to limit potential losses

For example, if the Sahm rule signals a potential recession and the trader believes the US Dollar will appreciate, they might go long USD/JPY. Traders could enter the trade when the USD/JPY price reaches a support level or breaks above a resistance level. They can also hold the position until their gain target is reached or if the price moves against them and hits the stop-loss level.

*This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry providing personal advice.

Top tips to trade with the Sahm indicator

Focus on currency pairs with high correlation to the US economy

Given that the Sahm rule is based on US unemployment data, consider currency pairs with strong economic ties to the United States. Examples include USD/JPY, USD/CHF, and USD/CAD.

Anticipate less risky flows

During recessions, investors often seek less risky currencies like the USD. Be prepared to position the trades accordingly, potentially going long USD against currencies perceived as riskier.

Watch for interest rate differentials

Interest rate differentials between countries can significantly impact currency exchange rates. Central banks may adjust interest rates when the Sahm rule signals a potential recession. Pay attention to these changes and their potential impact on currency pairs.

Monitor global economic indicators

While the Sahm rule is focused on the US economy, global economic factors can also influence currency markets. Keep an eye on indicators like GDP growth, inflation, and trade balances in major economies.

Entering forex trades in both falling and rising markets

While the Sahm Rule has historically predicted recessions accurately, it is essential to approach it cautiously. It's based on historical data and may not always accurately anticipate future economic conditions.

Additionally, the rule can be sensitive to temporary fluctuations in the unemployment rate, potentially leading to false signals. Traders must combine the Sahm Rule with other economic indicators such as moving averages, oscillators, and Fibonacci retracements to make informed trading decisions. Overreliance on any single indicator can lead to suboptimal results. Always consider the broader economic context and be prepared to adjust the strategies based on evolving conditions.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.