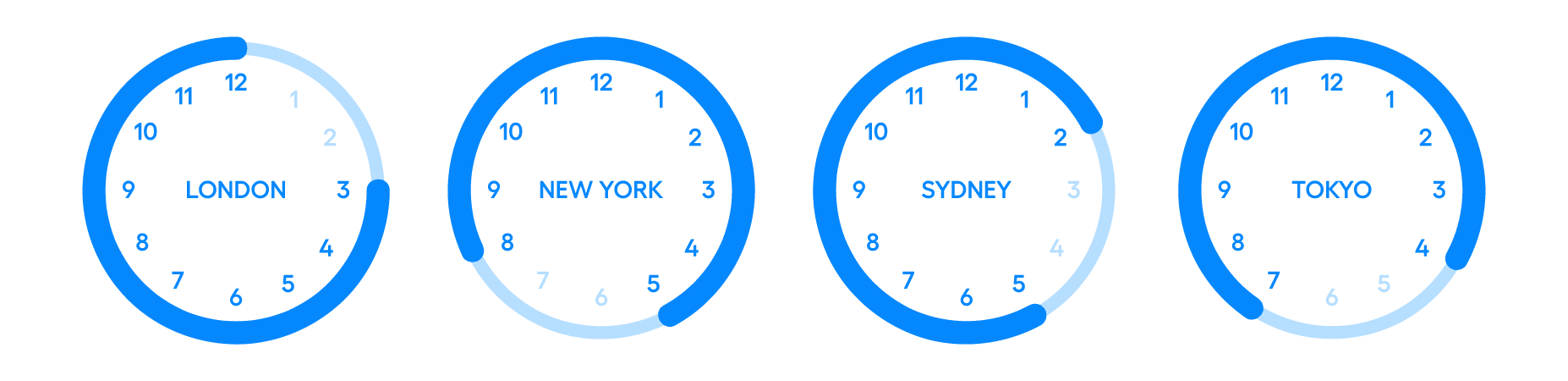

The forex market operates 24/7, offering continuous trading opportunities. However, the activity isn't uniform across the globe. Four major sessions (London, New York, Tokyo, and Sydney) dominate forex trading, each with its own peak hours.

Let’s understand these sessions and their characteristics for optimal entry and exit points.

The main forex trading session

The forex trading sessions are divided based on the working hours of three major regions; Asia, Europe, and North America. These sessions are named after each region’s major financial centers: Tokyo, London, New York, and Sydney

The Tokyo trading session

Also known as the Asian trading session, the Tokyo session is the first to open in the forex market. It opens by 5:00 AM on Monday and closes by 6:00 PM on Friday, Japanese Standard Time (11 PM-8 AM GMT).

Although the official time trading starts is subjective. Due to the volume of trade facilitated by Tokyo banks during this session, it is commonly believed that the Asian trading session opens when Tokyo banks come online. However, aside from Japan, there are other financial hot spots in the Asian trading session which include Australia, Russia, China, and New Zealand.

Compared to other trading sessions, the Tokyo market is less liquid. As such, it often leads to consolidation in the market. Consolidation is when the price moves in a narrow range until there is a breakout. Traders often look forward to trading breakouts at the end of the Tokyo session.

The currencies of Asian pacific countries, such as the Japanese Yen, Australian Dollar, Hong Kong Dollar, and New Zealand Dollar, are very volatile during this session. As such, currency pairs like AUD/USD, NZD/USD, EUR/CHF, and AUD/CHF often experience more significant moves during this period compared to non-Asian Pacific pairs.

The volatility is often due to the release of important macroeconomic data and news from the Asian Pacific countries. It is also expected that traders from these countries will likely use their domestic currencies in most of their trades.

The momentum in the Tokyo market sets the tone for the other trading sessions because traders often use what happened during the Tokyo session to evaluate and gauge their strategy for other sessions.

The London trading session

Also referred to as the European session, the London session opens by 7 AM GMT and closes by 4 PM GMT. Aside from London, other major financial centers during this session are; Frankfurt, Milan, and Amsterdam.

The London session is highly liquid and sees the most significant trading volume in the forex market. Nearly all currency pairs experience high liquidity during this period.

Trading major currency pairs such as EUR/USD, USD/JPY, GBP/USD, GBP/CHF, GBP/ JPY and USD/CHF during this period can be profitable. Due to the high trade volume, major currency pairs often experience tighter spreads. Aside from that, major economic news from Eurozone countries like the UK and Switzerland is released during this period, and it can very likely affect pairs that involve Euro and Pounds.

The New York trading session

The New York trading session is also known as the North American trading session. The session begins at 12-1 PM and ends by 9-10 PM.

It is dominated by participants from North America, such as the US, Mexico, Canada and other South American countries like Argentina. USD is the primary currency during this session which amounts to about 85 percent of the trade volume during this period.

Major economic news from the US is released at the beginning of the session. As such, USD pairs often experience rapid price movements during this period. However, like the European session, almost all currency pairs can be traded during this period.

What are the forex market trading hours?

Forex market hours are defined by the time zones of the major financial centers. Each time zone experiences varying levels of liquidity and volatility.

What time does the forex market open?

The market opens throughout the day from Monday to Friday and remains closed on the weekends.

There is no single open time because it operates 24 hours a day, 5 days a week.

Four major forex trading sessions dominate forex trading, each with its own opening time:

- London Session (08:00 GMT)

- New York Session (13:00 GMT)

- Tokyo Session (00:00 GMT)

- Sydney Session (22:00 GMT)

Forex market session opening and closing time

Here are the opening and closing times of the different forex trading sessions:

Sydney session (Australia)

|

|

Local time |

Eastern Standard Time (ETC) |

Coordinated Universal time (UTC) |

Australian Eastern Time (AEST) |

|

Open |

08:00 |

17:00 |

22:00 |

08:00 |

|

Close |

16:00 |

01:00 |

06:00 |

16:00 |

New York session (The US)

|

|

Local time |

Eastern Standard Time (ETC) |

Coordinated Universal time (UTC) |

Australian Eastern Time (AEST) |

|

Open |

08:00 |

08:00 |

13:00 |

23:00 |

|

Close |

17:00 |

17:00 |

22:00 |

08:00 |

Tokyo session (Japan)

|

|

Local time |

Eastern Standard Time (ETC) |

Coordinated Universal time (UTC) |

Australian Eastern Time (AEST) |

|

Open |

09:00 |

19:00 |

12:00 |

10:00 |

|

Close |

18:00 |

04:00 |

09:00 |

12:00 |

London session (The UK)

|

|

Local time |

Eastern Standard Time (ETC) |

Coordinated Universal time (UTC) |

Australian Eastern Time (AEST) |

|

Open |

08:00 |

03:00 |

08:00 |

18:00 |

|

Close |

16:00 |

11:00 |

16:00 |

2:00 |

Risks when trading over weekends

Market gaps

The forex market can experience significant price movements over the weekend due to breaking news, economic data releases, or geopolitical events. When the market reopens on Sunday evening, the opening price might differ considerably from the previous Friday's closing price. This gap can leave existing positions with unexpected gains or losses.

Lower liquidity

Weekend trading hours experience lower liquidity compared to weekdays. This means fewer participants are actively trading currencies, potentially leading to wider bid-ask spreads and difficulty entering or exiting trades at the desired price.

Margin calls

If a trader uses leverage (borrowing money from the broker) to trade forex, weekend gaps can trigger margin calls. This occurs when the account equity falls below the required margin level due to a sudden price movement. If a trader cannot meet the margin call by depositing more funds, the broker may be forced to liquidate positions, potentially at a loss.

Psychological pressure

The inability to actively monitor and react to market movements over the weekend can create psychological stress for some traders. The uncertainty surrounding potential price changes can lead to anxiety and potentially influence trading decisions upon the market's reopening.

News vacuum/information asymmetry

Major news releases often occur outside of regular trading hours, including weekends. This creates an information asymmetry where some market participants (those who receive the news early) might have an advantage when the market reopens. This can lead to sudden price movements that catch weekend holdovers off guard.

Do daylight savings times affect forex trading hours?

Daylight Saving Time (DST) can cause some temporary disruptions to forex trading hours, even though the forex market operates 24/5. Here's how it can impact forex trading:

- Shifted session times: When a country observes DST, its clocks shift one hour forward in spring and back in fall. This can affect the overlap period between sessions. For example, if the US observes DST but the UK doesn't, the overlap period between the London and New York sessions might shift by one hour during those periods. This can impact trading strategies that rely on the increased liquidity and volatility typically observed during overlapping sessions.

- Trading platform adjustments: Some forex trading platforms might automatically adjust the displayed session times based on the location and whether the trader’s region observes DST. However, it is always a good practice to double-check the session timings displayed on the platform to avoid any confusion.

- Psychological impact: The uncertainty surrounding potential price movements due to DST-related news gaps can create anxiety for some traders, especially those holding positions over weekends. This psychological pressure can influence trading decisions upon market reopening, potentially leading to impulsive trades.

What time is the forex market most active?

The forex market has four periods of peak activity due to overlapping sessions and market opening:

London and New York session overlap (3:00 PM GMT - 4:00 PM GMT)

The London-New York overlap window, from late afternoon in London to mid-afternoon in New York, sees a confluence of major financial players from both continents participating. This overlap creates the highest liquidity and volatility in the forex market, making it a prime time for many traders.

Tokyo and Sydney session overlap (12:00 AM GMT - 2:00 AM GMT)

While not as intensely active as the London-New York overlap, the period when the Tokyo and Sydney sessions intersect offers another window of increased activity. This is particularly relevant for traders focusing on the Japanese yen (JPY) and other Asian currencies.

London open (3:00 PM GMT)

The forex trading opening hours of the London session at 3:00 PM GMT marks a significant influx of European market participants entering the forex market. This often leads to a surge in activity and potential volatility, particularly for major currency pairs like EUR/USD and GBP/USD. Traders who focus on European economic data or technical analysis based on European market trends might find this timeframe appealing.

New York close (4:00 PM GMT)

As the New York session closes at 4:00 PM GMT, many American market participants exit their positions. This can sometimes increase volatility as orders are settled and positions are squared off. Traders who follow American economic data releases or utilize technical analysis strategies based on North American market trends might find this window interesting for potential trading opportunities.

Finding overlaps in forex sessions

Trading sessions can overlap when one session begins before the end of another session. During this period, the market experiences higher liquidity and volatility due to participants’ activities during the two market sessions.

The London session opens when Tokyo is at its last trading hour. Day traders during the Tokyo session are looking to exit, while day traders during the London session are making their entry. This hour often leads to overlap between these two sessions. Currency Pairs that involve JPY, like GBP/JPY and EUR/JPY, often experience high volatility during this period, but the spread will likely be wide.

The New York session starts in the middle of the European session. As such, the period of overlap between the two sessions is broader. During these overlapping hours, the market experiences higher buying and selling activities. However, the liquidity and volatility subside in the afternoon after the close of the European session.

What is the best and the worst time to trade forex?

Traders can trade at any hour based on their time zone and currency pairs they intend to trade. However, there can be better times to trade, and there can be worse times.

The best time to trade in the currency market is when two markets are active simultaneously.

When London and New York sessions overlap, the market experiences a higher volume of trade and more opportunities. The one-hour overlap between the Tokyo and London market session can create more opportunities for currency pairs involving the Japanese Yen.

The late Sunday evening/early Monday morning is not a good hour to trade. During this period, the market is quiet, and traders are analyzing how to begin the new week instead of jumping right into trading. There are low trading activities at the closing hours of the market on Friday; you may also want to avoid trading during this period.

For those with a low-risk appetite, trading before or after a significant news release may not be the best move. Some economic news and data influence the forex market. While the market is anticipating a vital report, trading activity can be low because everyone is uncertain about the outcome of the news. The market can also be too rapid immediately after the news is released.

Final Words

Targeting major trading sessions is an essential strategy in your arsenal. By analyzing the trading hours and their characteristics, you can figure out the best and worst times to open or close a position.

However, it’s crucial to remember that trading forex involves significant risks. The market can be unpredictable due to various factors such as geopolitical events, economic data releases, and market sentiment. Weekend gaps, lower liquidity, margin calls, and psychological pressures are just a few of the challenges traders face. Additionally, the impact of daylight saving time changes and session overlaps can affect market dynamics. Always stay informed, use risk management strategies, and be prepared for unexpected market movements.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.