Knowing one's trading personality can improve trading discipline, reduce emotional decision-making, and increase long-term trading accuracy. Whether the traders are risk-averse or bold risk-takers, aligning strategies with their natural tendencies helps improve decision-making, minimize emotional errors, and ultimately leads to better trade outcomes.

Let's dive deep into finding out a trader's personality profile.

This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry providing personal advice.

What is a trader's personality profile?

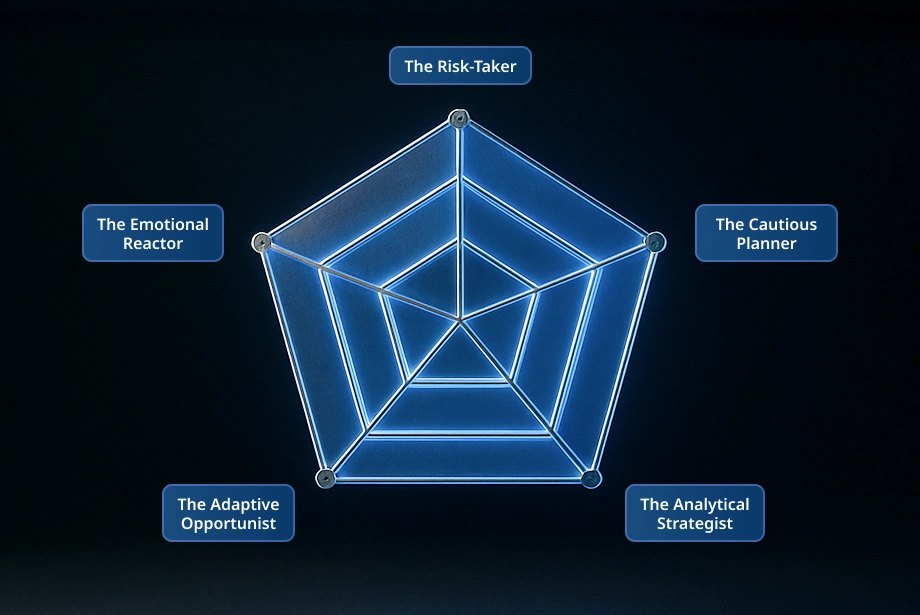

A trader personality profile defines a trader's behavior, risk tolerance, and decision-making style. It highlights traits such as risk aversion, impulsiveness, or patience. Profiles are often categorized into types like analytical, emotional, or risk-seeking. Knowing their profile can help traders tailor trading strategies that align with personal strengths and weaknesses.

How to find out your trader personality profile?

Assess risk tolerance

Risk tolerance is the amount of risk a trader is willing to accept. A trader with high-risk tolerance opts for volatility and high-reward trades. A low-risk tolerance trader seeks stable and predictable returns. Assessing past trades helps determine this.

If a trader frequently exits positions at the first sign of loss, their risk tolerance may be low. Their tolerance might be high if they hold onto positions despite increasing volatility. Understanding this helps shape a trading strategy that aligns with the trader's comfort zone and long-term goals.

Evaluate emotional control

A trader must manage emotions like fear, greed, and impatience. Poor emotional control can lead to hasty decisions or missed opportunities. A trader with good emotional control stays calm during market fluctuations. They stick to their trading plan without letting emotions cloud judgment.

To evaluate this, look at how a trader reacts during losses and gains. If emotions often lead to rash decisions, emotional control may need improvement. Regular reflection on these emotional responses helps identify patterns and improve overall trading behavior.

Examine patience

Traders must patiently wait for the right opportunities instead of chasing every trade. Impulsive decisions often lead to losses. A patient trader knows how to hold positions and wait for ideal setups. They avoid making trades based on excitement or fear.

To evaluate patience, observe how often a trader enters or exits trades without waiting for their planned strategy. They may need to work on this trait if they frequently exit too early or enter prematurely. Building patience improves the chances of long-term trading success.

Analyze discipline

Discipline keeps traders on track, preventing impulsive decisions. A disciplined trader follows their strategy, even during periods of uncertainty. They stick to their rules, whether in gain or loss. A lack of discipline can lead to emotional trading and poor outcomes.

Evaluate a trader's ability to maintain consistency by reviewing past decisions. Their discipline may need improvement if they often stray from their plan or make trades out of emotion. A disciplined trader focuses on long-term goals. Their decisions are based on strategy rather than short-term emotions or market noise.

Understand decision-making style

Decision-making style is how a trader chooses to make trading choices. Some rely on technical analysis, while others follow intuition. A methodical decision-maker uses data to guide trades. In contrast, an impulsive trader acts on instinct.

Reflecting on past decisions shows whether a trader follows analysis or acts quickly. Traders who make analytical decisions may research thoroughly before trading, while intuitive traders act quickly. Recognizing their style helps determine if adjustments are needed to avoid rash decisions and improve trading consistency.

Measure confidence level

A confident trader sticks to their analysis and strategies. However, overconfidence can lead to reckless trades. Low confidence can cause hesitation and missed opportunities. To assess confidence, observe how a trader handles winning and losing streaks.

Experience, consistent practice, and positive outcomes can improve confidence levels. Traders must strike a balance between confidence and caution to make decisions without succumbing to fear or overestimating their abilities.

Test adaptability

Adaptability is the ability to adjust to changing market conditions. The market is unpredictable, so traders must be flexible in their approach. Adaptable traders can shift strategies quickly in response to new data or trends. Those who resist change may struggle when conditions change.

Observe how a trader reacts to unexpected market events to test adaptability. A flexible mindset allows traders to make better decisions when uncertain, keeping them prepared for evolving market conditions.

Evaluate analytical skills

Analytical skills are critical for understanding market trends and making data-driven decisions. Traders must interpret charts, economic reports, and financial indicators. Strong analytical skills help identify gaining opportunities. To evaluate analytical skills, assess how a trader analyzes data before making decisions.

Consider stress management

Stress management is essential for maintaining clear decision-making. High stress can lead to poor judgment and hasty trades. Traders must stay calm during market fluctuations and avoid reacting impulsively. To evaluate stress management, observe a trader's behavior during high-pressure situations.

Developing techniques to manage stress, such as taking breaks or following a structured trading plan, can reduce emotional reactions and improve trading consistency. It can also prevent burnout and enhance long-term performance.

Review time availability

Time availability impacts a trader's approach to the markets. Full-time traders can dedicate more time to analyzing trends, while part-time traders may focus only on longer-term strategies. A trader's time availability influences the frequency and type of trades they make.

Review how much time a trader can commit each day to assess time availability. Traders with limited time may need to focus on swing or position trading. Meanwhile, those with more time can pursue day trading or short-term strategies. Time management helps traders select the right strategy for their schedule.

Refine trading strategies through self-understanding

Strong focus allows traders to notice patterns, manage risks, and execute trades with precision. Training the mind to concentrate and block out distractions improves trading performance and increases the likelihood of making accurate decisions in a fast-paced market environment.

To understand their trading personality, traders should regularly evaluate how they react to market conditions, losses, and gains. They should identify whether they are more inclined to follow trends or react impulsively.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.