Copy trading allows traders to follow multiple signal providers or strategies simultaneously and replicate trades of experienced traders in real-time. For traders, especially beginners, copy trading can save time and effort while allowing them to use advanced trading strategies.

In our article, we will learn how to copy a trade on MT4 through a step-wise guide.

What is copy trading?

Copy trading is a practice where traders can automatically replicate trades of experienced traders in real-time. It allows less experienced traders to benefit from the expertise of others and potentially improve their trading outcomes without conducting extensive market analysis or making independent decisions.

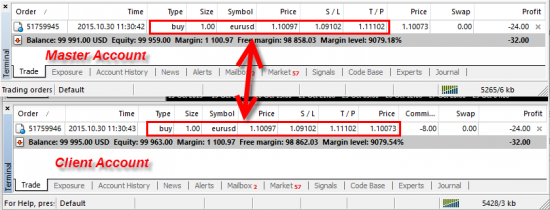

Since trades of other traders are mirrored, when an experienced trader opens or closes a trade, the same action is replicated in the copier's trading account.

How to copy a trade on MT4?

1. Download MT4

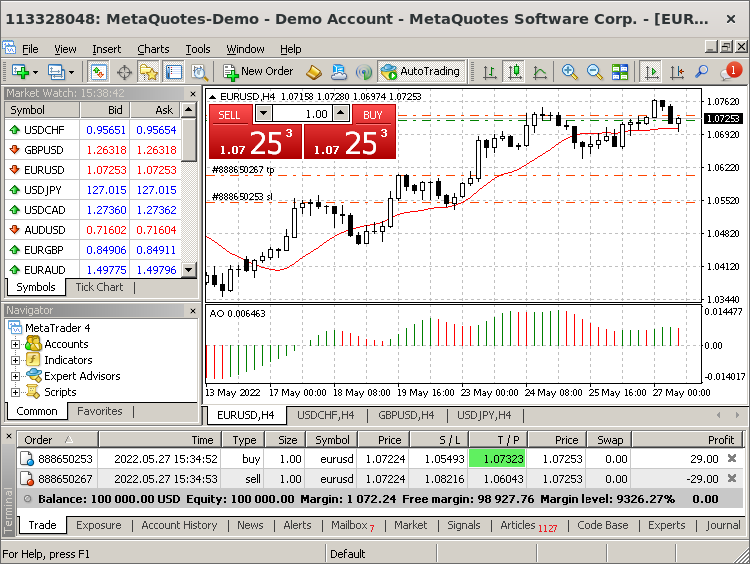

Download the MetaTrader 4 platform and create a dedicated trading account. This live trading account will provide the trader with additional functionality, such as the ability to add more signal providers to the MetaTrader 4 platform in the future. Access to multiple signal providers can expand traders' options and improve their copy trading opportunities.

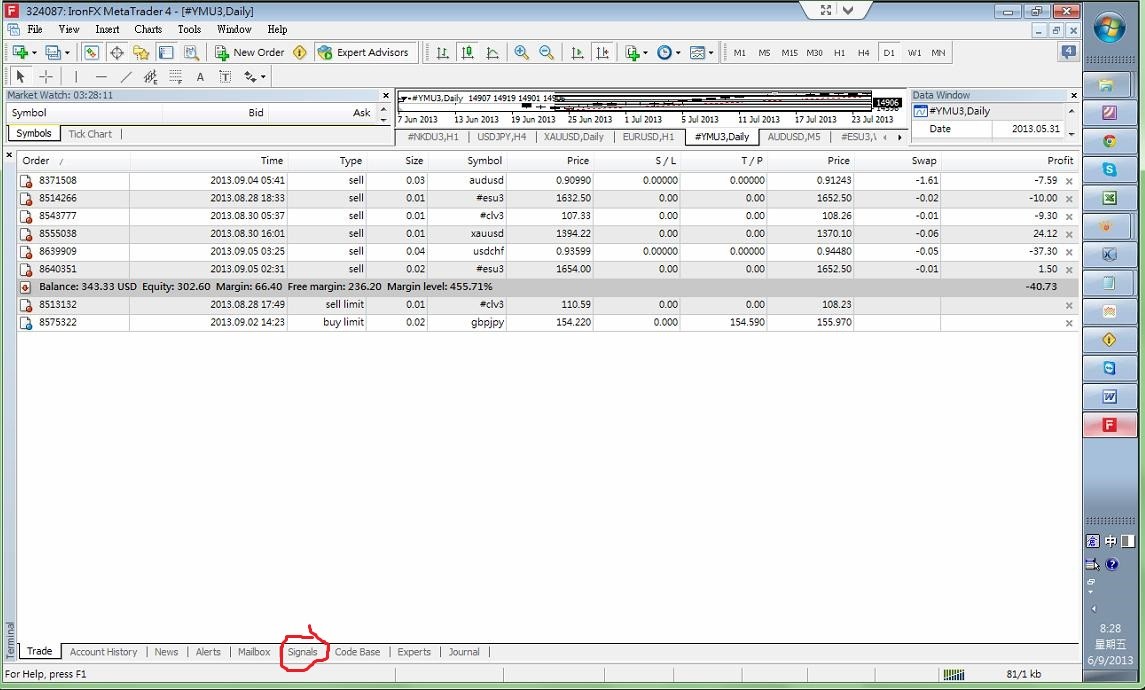

2. Locate the Signals tab

Locate the Signals tab in the Toolbox section present at the bottom of the MetaTrader 4 platform. This tab is a gateway to accessing a wide range of signal providers available for copy trading. Finding reputable and reliable signal providers is essential to ensure the accuracy and quality of the trades that will be copied.

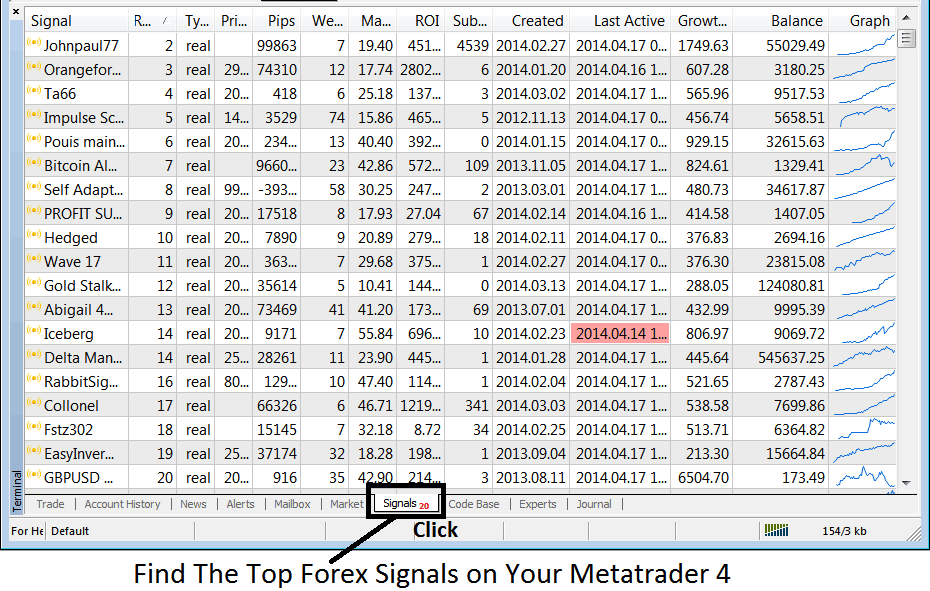

3. Choose a signal provider

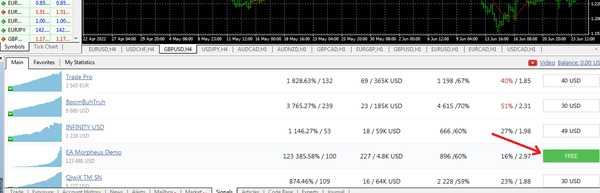

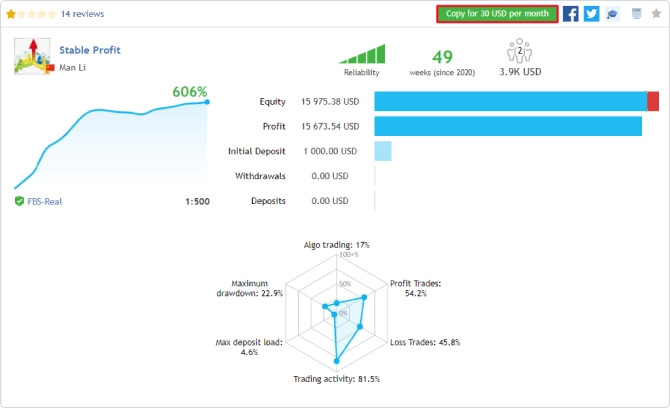

Choose the most suitable signal provider from the list and add it to the chart. Take time to thoroughly evaluate different providers based on their performance statistics, such as their trading history, profitability, and risk levels. It's crucial to select signal providers who align with the trading goals, risk tolerance, and preferred trading style of the particular trader.

4. Select a trading strategy

Select the trading strategy that fits the trader's needs from the provided list. Consider trading objectives, risk appetite, and available budget when making a selection. If the trade is new to copy trading or wants to test the platform, starting with a demo account can be a wise choice.

5. Subscribe to a signal

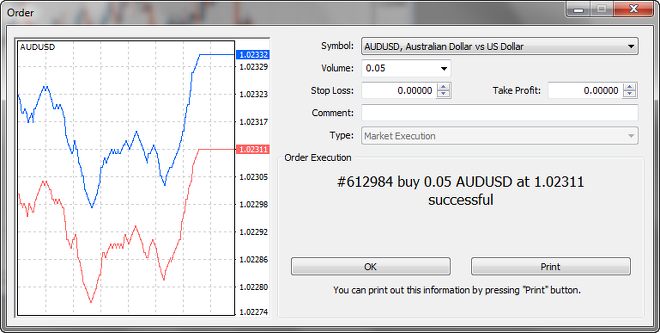

Use the subscribe button to customize trade parameters. When the trader clicks on the subscribe button, a pop-up screen will appear, allowing them to set their preferred parameters for copying the signal provider's trades. Pay attention to factors such as trade size, risk management settings, stop-loss and take-profit levels, and any other relevant parameters. The trader may be prompted to enter their login and password.

If the trader is new to copy trading on MT4, it is generally recommended to start with the default settings provided. However, experienced traders can adjust these parameters to align with their specific trading goals and risk preferences.

6. Review trade statistics

Once the trader has successfully subscribed to a signal provider, they can access and review the trade statistics of the chosen strategy. Click on the Statistic Tab to gain valuable insights into the subscribed strategy's performance, profitability, and reliability. This information will help the trader assess the signal provider’s trading efficiency and make informed decisions about their copy trading activities.

7. Adjust position sizes

If required, traders can adjust the position sizes of the copied trades based on their account size and risk tolerance. Some trade copier services allow traders to customize position sizes, while others may copy trades proportionally based on their account balance.

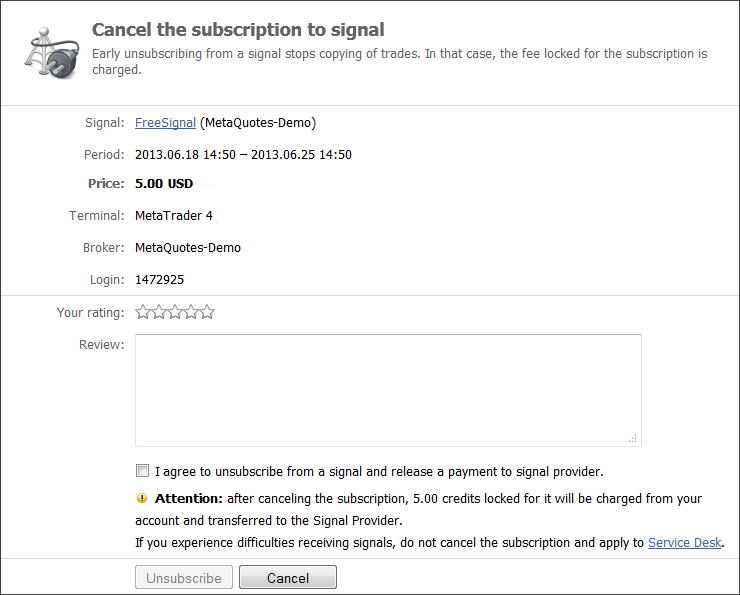

8. Unsubscribe, if needed

If, at any point, the trader wishes to unsubscribe from a particular strategy, they can easily do so by clicking on the name of the strategy they want to unsubscribe from and selecting the 'unsubscribe' button on the subsequent page. This feature provides them with the flexibility to manage their copy trading portfolio and make adjustments based on their evolving trading preferences and goals.

Copy trade on MT4 through experienced traders

Subscribing to a signal and setting up a copy trade allows traders to automatically mirror trades of reliable traders in the market. Traders should consider their performance history, risk management, and compatibility with their trading goals before choosing a trader they want to copy.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.