This is the week many traders have been waiting for, the Federal Reserve will announce a rate cut, but will it be 25 or 50 basis points? Volatility could be just around the corner as we also see monetary policy announcements from the Bank of England and Bank of Japan.

At the close the CME Fed Watch Tool is proving to be no help in the decision making of retail traders going into the meeting on Wednesday. Currently market participants are 50/50 on the amount of which the Fed will cut. This could change however as we do have very important retail sales data coming up on Tuesday.

Retail sales month on month in the US is forecast to show a significant decline from 1.0% to -0.2%. With Core retail sales showing a slight decrease from 0.4% to 0.2%. If we see a decline in line with expectations or slightly lower then the probability of a more aggressive cut from the Fed would be higher. If however consumer spending remains stable then the Fed will be able to cut by 25 basis points.

In other central bank news the Bank of England is forecast to leave the rate unchanged at 5.00%. GDP last week showed no growth in the UK for a second consecutive month, could this be a catalyst to leave rates unchanged? No growth isn’t a slowdown in growth so the central bank may feel it’s in a position to hold rates into this meeting.

Another central bank announcement this week comes from Japan. Forecasted to leave rates unchanged at 0.25%, the BoJ may feel the currency is positioned well, although they may be slightly worried about how the declining oil prices may influence future inflation pressures. Japan being a strong importer of oil may feel the benefit of cheaper oil prices.

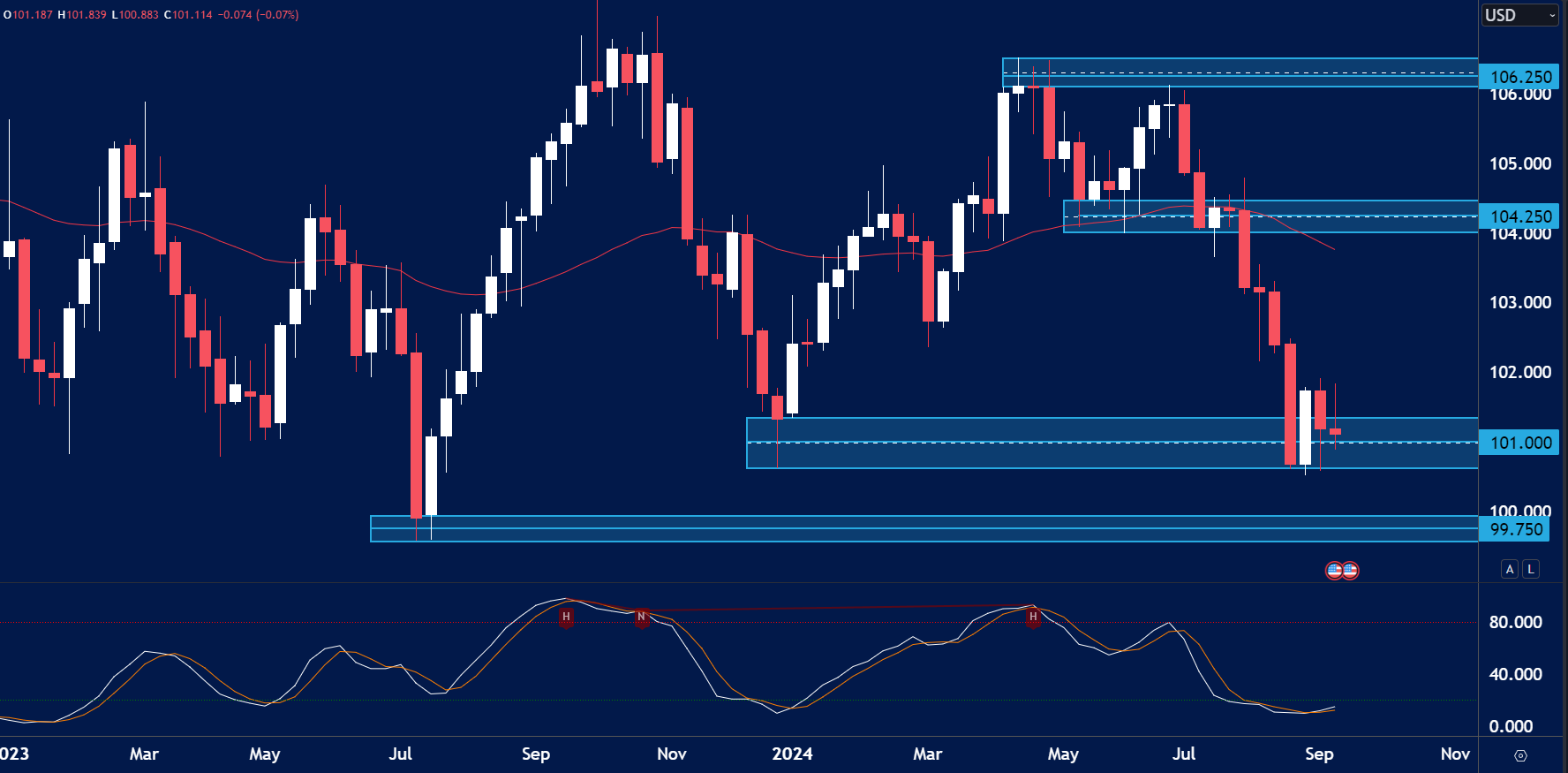

DXY (USD Index)

- The USD remained range bound last week with the price closing above the $101.00 handle.

- This market has the ability to go either way this week so it may be a smart decision to wait until the reaction to the Fed Funds rate decision on Wednesday.

GBP/USD

- The weekly chart shows the price closing bullish after rejecting support at 1.3000.

- The H4 time frame shows price forming new highs this could be a sign of GBP strength against the USD this week.

CAD/JPY

- The CAD/JPY price has been trending bearish and the price could be heading for support at 101.75.

- The H4 time frame shows price making lower lows and lower highs, resistance is found at 104.50.

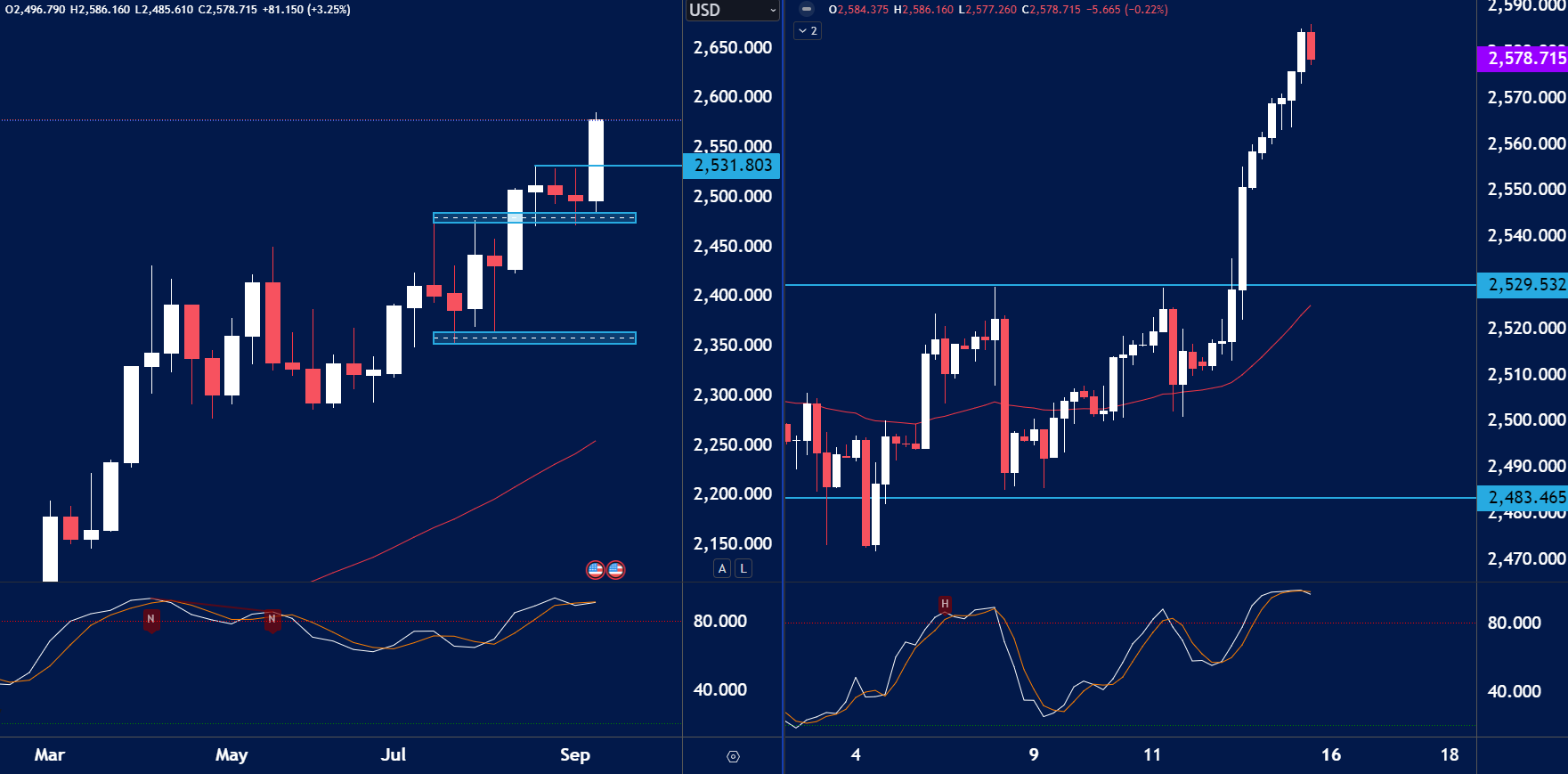

GOLD (XAU/USD)

- The price of Gold made new highs last week after a short period of consolidation.

- Gold prices could continue to trade higher this week if the market remains risk off.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.