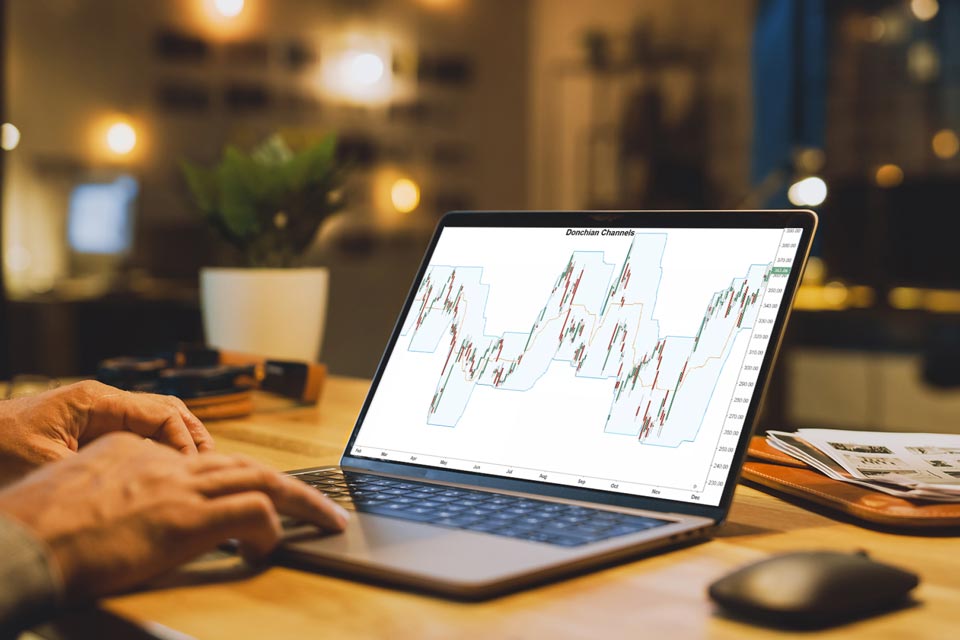

The Donchian Channel indicator can determine volatility and potential breakout signals in the market. Since it considers the highest high price and lowest low price in a particular time period, it also helps in identifying ideal support and resistance levels.

In this article, we take an in-depth look at the Donchian Channel indicator.

What are Donchian Channels?

Donchian Channel is a trend-following technical indicators that identifies bullish and bearish market extremes, allowing you to help trade market breakouts and continuations. The forex trading pattern provides ideal price levels to short a trade during a bearish continuation trend and long a trade during a bullish continuation trend.

Donchian Channel uses three adjustable bands, wherein the upper (at the highest price level) and lower (at the lowest price level) bands can be used as the resistance and support price levels, respectively. The third adjustable band is the moving average line that is plotted between these two bands.

- When a currency pair's price breaks above the upper band, it signals traders to long the trade due to an expected uptrend continuation.

- When a currency pair's price breaks below the lower band, it signals traders to short the trade due to an expected downtrend continuation.

What is the Donchian Channel formula?

Each band involves a separate calculation in the Donchian Channel –

Upper channel = highest high price in the particular time period

Lower channel = lowest low price in the particular time period

Middle channel = ((upper channel + lower channel)/2)

Once you have chosen the time period (in hours, minutes, days, weeks or months), the moving average line can have a time period of anywhere between 4 weeks or 5 weeks.

How to calculate Donchian Channels?

Upper Band (Channel High)

- Choose the time period you want to consider in minutes, days, weeks, months or years.

- Compare the high price level for each minute, hour, day, week, month or year in that period.

- Choose the highest price level.

- Mark it on the price chart.

Lower Band (Channel Low)

- Choose the time period you want to consider in minutes, days, weeks, months or years.

- Compare the low price level for each minute, hour, day, week, month or year in that period.

- Choose the lowest price level.

- Mark it on the price chart.

Middle Band (Centre Channel)

- Choose the time period that you want to consider in minutes, days, weeks, months or years.

- Compare the high price level and low price level for each minute, hour, day, week, month or year.

- Add the lowest low price level to the highest high price level and divide the sum by 2.\

- Mark the result on the price chart.

How does the Donchian Indicator work?

The Donchian indicator works in all timeframes: short, medium, and long. When you plot the upper, lower, and middle bands on the price chart, the current currency pair price movements are compared with the bands to identify bullish and bearish extreme price levels.

The upper band indicates a bullish sentiment, signaling to enter into buy orders if the current price is near the upper band during an uptrend. However, if the currency price is near the lower band during a downtrend, it indicates a market reversal and signals to short the trade instead.

The lower band indicates a bearish sentiment, signaling to enter into sell orders if the current price is near the lower band during a downtrend. However, if the currency price is near the upper band during an uptrend, it indicates a market reversal and signals to long the trade instead.

How to install the Donchian Channel Indicator on MT4?

The Donchian Channel indicator can be installed on MT4 for free. The default time period is set to 20 days but can be changed. Here are the steps to install the Donchian Channel indicator on MT4:

- Download the Donchian indicator files on the MetaTrader 4 platform.

- Unpack the indicator after it has finished downloading.

- Copy the indicator file by clicking on 'File' in the menu bar and selecting 'Open data folder.'

- After the data folder opens, you will see an MQL4 folder that you need to open. Locate the indicator folder here and copy the file into it.

- Restart the MT4 platform by clicking on 'Refresh' (Do this by going to the navigator and clicking the indicators menu).

- Add the indicator to the currency pair price chart by opening the navigator and going to the indicators section, and double-clicking on the indicator you want to add.

- Find the Donchian indicator in the list and press 'okay' to add it to your chart.

How to use Donchian Channel on MT4?

Once you have installed the Donchian indicator on MT4 and added it to the chart, a configuration window opens. This window has a simple setting of value' 20', which means that the indicator is going to plot price highs and lows in a 20-period timeframe. As and when the price fluctuates, the line will change in the same time period.

You can change this time-period value per your forex trading preferences, which means you can increase it for long-term analysis and decrease it for short-term analysis.

The Donchian indicator then plots two lines, joining the highs and lows, and a middle line which is the 20-period average. Each line is indicated as a different color for easy identification.

You can use this Donchian indicator to place buy orders whenever the currency pair price breaks above the 20-period high price line or sell when it breaks below the 20-period low price line.

What do Donchian Channels tell you?

Donchian Channels identify the relationship between the current currency pair price and the trading range between the bands over a specific period. The values of the bands help in building a price map that indicates how bullish or bearish a market is.

- The upper band tells traders that the market is in a continued uptrend.

- The lower band tells traders that the market is in a continued downtrend.

- The middle band indicates the average price between these two bands.

Using the Donchian channel, traders can identify the highest and lowest price at which the currency pair is trading in the market and place their trading orders accordingly. Long orders can be placed when currency pair prices are trading near the high price level, and short orders can be placed when they are trading near the low price levels, following the current trend momentum.

How to find entry signals with Donchian channel?

Find high momentum price breakouts

The first step in identifying a successful entry signal is to have a market momentum that supports the market move. This means that to enter an uptrend, the market must be making significant highs, and to enter a downtrend, it must be making significant lows with each succeeding trade.

The low-momentum breakouts can be filtered out and left behind by adding the Relative Strength Index indicator to the chart to avoid false breakouts. The RSI indicator will help traders identify ideal support and resistance levels which are also helpful in identifying the right time to enter a market.

Apply a trend filter for identifying accurate entry signals

Another trend filter can be applied to the Donchian indicator to confirm entry singles. For example, a long-term moving average can be added to the chart as it acts like an incredible filter to separate long and short entry orders. If you choose to place a 100-period moving average line, and the currency pair prices move above this line, it would indicate potential breakouts in the upward direction leading to long trades. On the other hand, when currency pair prices move below this 100-period line, it would indicate breakouts in the downward direction, leading to short trades.

Compare current price moves to the band

When trading the Donchian indicator, it is important to have a close look at the current currency pair prices and compare it with the Donchian bands. The upper Donchian band can act as a resistance line, whereas the lower band can act as a support line, enabling traders to trade both continuation and reversal markets.

- When the currency pair prices approach the upper band, it signals traders to enter a long order, but as soon as they cross the upper band (resistance line), it signals traders that markets can reverse downwards at any time and they should enter a short trade.

- When the currency pair prices approach the lower band, it signals traders to enter a short order, but as soon as they cross the lower band (support line), it signals traders that markets can reverse upwards at any time and they should enter a long order.

How to trade with Donchian Channel?

You can use the middle band as a reference line to open long or short positions. When the currency pair price moves above the middle line and closer to the upper band, it signals traders to open long positions. When it moves below the middle line and closer to the lower band, it signals traders to short the trades.

The traders maintain a long position until and unless the currency pair touches the upper band but does not cross it, as after touching the upper band, the markets are likely to reverse in the downward direction. On the other hand, the traders maintain a short position until and unless the currency pair touches the lower band but does not break below it, as after touching the lower band, the markets are likely to reverse in the upwards direction.

If the prices cross the upper band, it signals a continued uptrend, and traders can hold onto or add to their long positions. If the prices fall beyond the lower band, it signals a continued downtrend, and traders can hold onto or add to their short positions.

Use the Donchian Channel today to identify continued market trends

Trading with the Donchian Channel helps you identify bullish or bearish rallies where you can open long or short positions, respectively.

Start trading with the forex trading platform of Blueberry today to use the Donchian Channel with other indicators and place successful trading orders.