Forex trading usually provides much higher leverage compared to other financial instruments like stocks. This is one of the primary reasons why so many people are attracted to Forex, and more and more people have started to enter the Forex trading market.

However, if one wants to trade Forex, margin and leverage are the two most important concepts one shall understand thoroughly.

Margin and leverage allow traders to control large size trading positions. Margin, in brief, is the deposit in a trader's account that is needed to open and maintain a leveraged trading position.

USD/ CAD

50:1 or 2% Leverage

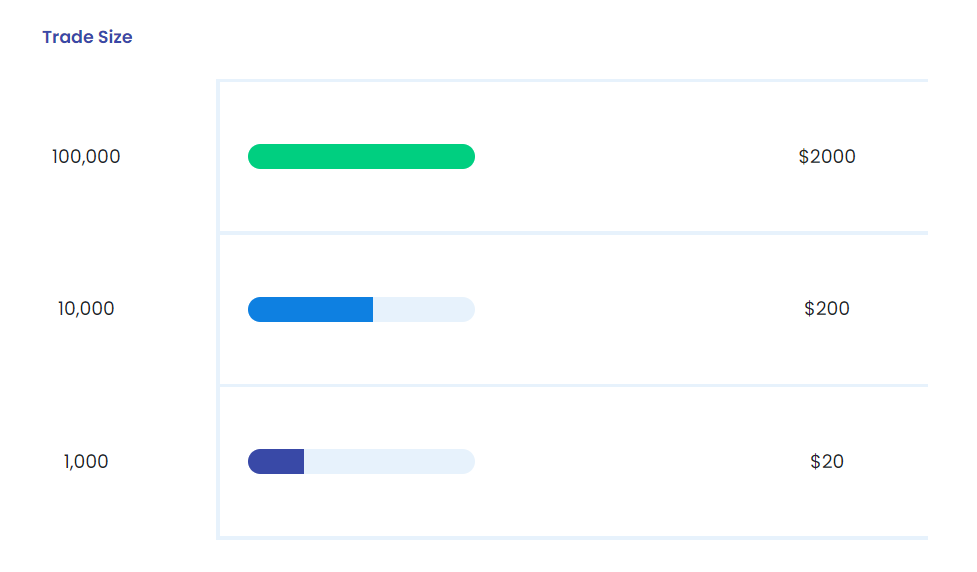

In this example, if you place a 100,000 USD/CAD trade with 50:1 leverage, your margin requirement will be $2000

What is Forex margin?

Margin is the initial amount that a trader puts forward to place a Forex trade and maintain the position. It is like a security deposit with the broker. When one trades currency on margin, it increases their exposure with a smaller initial capital.

However, margins are double-edged. They magnify not only profits but also losses, as they depend on the total value of the trade, which is volatile.

Margins are an essential factor to consider, as for every dollar the investor puts, the broker adds some significant amount of money, interest-free. In general, the minimum margin a trader finds is 10:1, giving them more leverage in the market than any other financial instrument.

Calculating Forex margin

Let us consider the broker offering leverage of 1:20 for the Forex trading. This means, for every 20 units of a particular currency in an open position, the trader needs to put forward 1 unit of the currency as margin. In short, if the size of your Forex position is $20, the margin is $1.

In percentage terms, the margin in this example is equal to 1/20 = 5%.

The margin that is required can be calculated by = Total trade volume * market price * margin percentage

What is Forex leverage?

Forex leverage is the use of borrowed funds to invest in a currency. It helps increase and strengthen one's trading position beyond what it would have been only through their available cash balance.

Forex traders use leverage to profit from small price changes in the currency.

Forex leverage is essential because by borrowing money from a broker, the Forex traders are able to trade more significant positions in a currency, which would not be possible otherwise.

This results in the leverage magnifying the returns from favorable movements in a Forex market through currency's exchange rate.

However, leverages can also amplify losses due to unfavorable market movements.

Calculating Forex leverage

In 2010 the US regulations limited the Forex leverage ratio to 100:1, signifying that a $100 deposit can trade up to $10,000 worth of currencies. The ratio was further reduced to 50:1, implying the minimum margin requirements set at 2%.

No broker charges interest on leverages since none of the currencies are actually bought or sold, but only the agreements are exchanged.

However, if you trade $100,000 worth of currency, you are not really depositing $2,000 and borrowing $98,000. The $2,000 leverage that you get is to cover your losses through the Forex margin.

The relationship between margin and leverage

Both leverage and margin are interconnected; however, they are not the same. Leverage only refers to the situation of taking on debt and instilling 'power' to trade more volumes through it, while margin is actually the debt an investor/trader uses to invest in currencies.

As and when a trader opens a position, they are expected and required to put up some fraction of the position's value as a security deposit. This makes them 'leveraged.' However, the fraction part, which is a certain percentage of the position's value, is known as the margin requirement.

Leverage can also be calculated as = 1/margin requirement.

Final words

Margin trading is a profitable forex strategy. However, it comes with its set of associated risks. It is imperative for you to read the margin agreement between your broker and you, and ask if something is not clear.

Some traders argue that too much margin is dangerous since you lose all the money in case of a loss. However, some investors believe a higher margin lets you trade more and, in turn, earn more profit. All of this majorly depends on the individual trading behavior, style, belief, and trading experience level.