Using a trading setup is crucial as it provides traders with a clear and consistent approach to trading, helping them make objective decisions, manage risk effectively, and maintain discipline. It saves time, as traders can quickly identify potential opportunities based on predefined criteria.

In this article, we will discover what a trading setup is and how a trader can use it for forex trading.

What is a trading setup?

A trading setup refers to a well-defined and systematic approach that traders use to analyze the foreign exchange market and make informed decisions about their trades. It involves a combination of technical and/or fundamental analysis, along with specific rules and criteria that guide the trader's actions.

A forex trading setup involves the selection of appropriate timeframes for analysis. Traders may choose to focus on short-term timeframes, such as 5-minute or 15-minute charts, for quick and frequent trades, or they may opt for longer timeframes, such as 1-hour or daily charts, for more extended positions. The chosen timeframe largely depends on the trader's preferred trading style and the duration of their trades.

Furthermore, traders use various technical indicators such as Moving Averages, Relative Strength Index (RSI), MACD (Moving Average Convergence Divergence), and others to analyze price patterns, trends, and momentum. These indicators help identify potential entry and exit points and provide insights into the market's overall direction.

Top 5 types of best trading setups

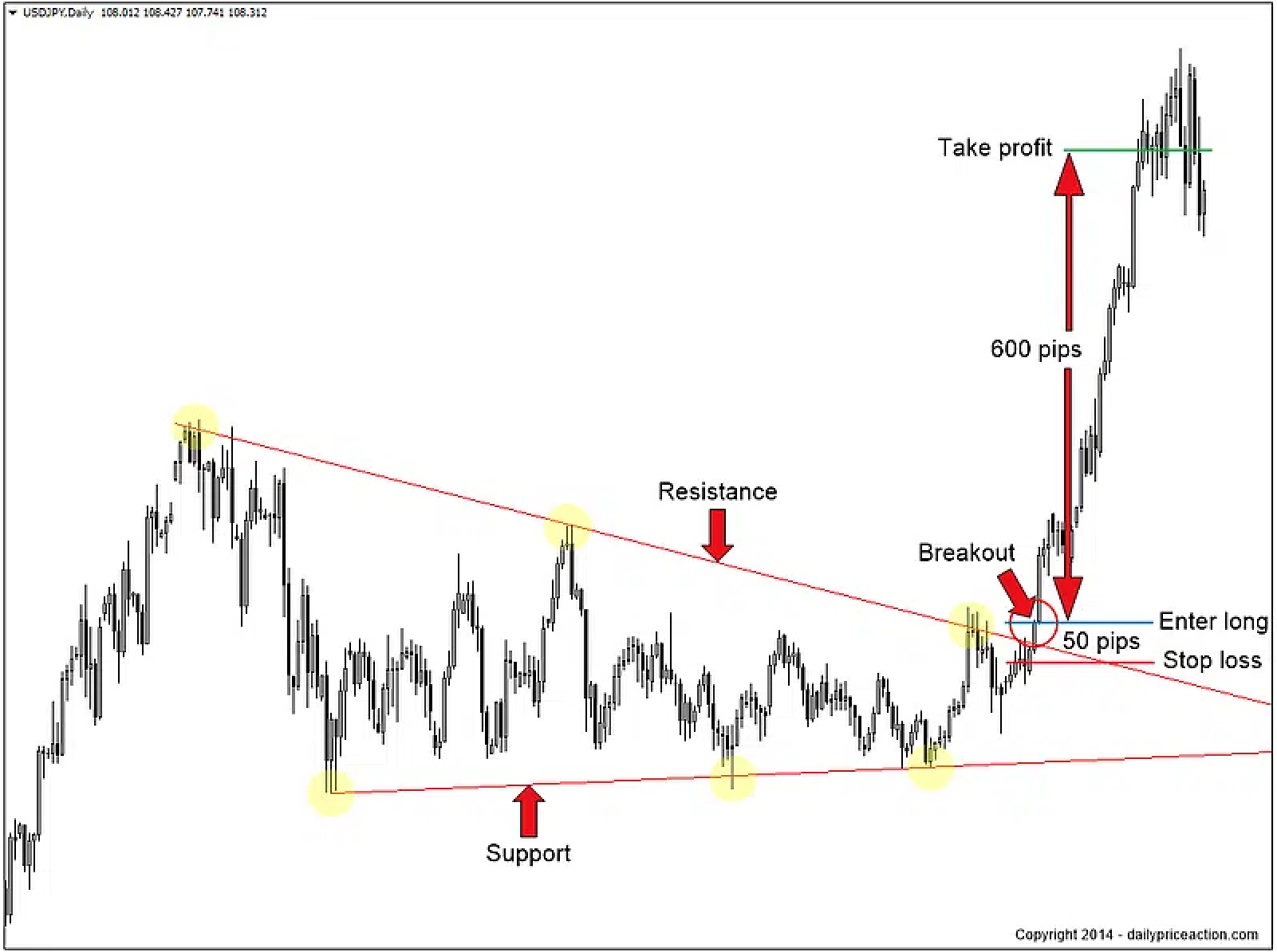

Breakout setup

A breakout setup involves identifying support or resistance levels on a price chart and waiting for the price to break out beyond these levels. Traders look for significant price movements that indicate a potential shift in the forex market's direction. When the price breaks above a resistance level or below a support level, it signals a potential trend continuation or a new trend formation, respectively. Traders may enter long or short positions accordingly, with stop-loss orders placed on the opposite side of the breakout level to manage risk.

- Traders can enter when the price breaks above a resistance level, indicating a potential uptrend continuation.

- Traders can exit when the price breaks below a support level, signaling a potential downtrend continuation.

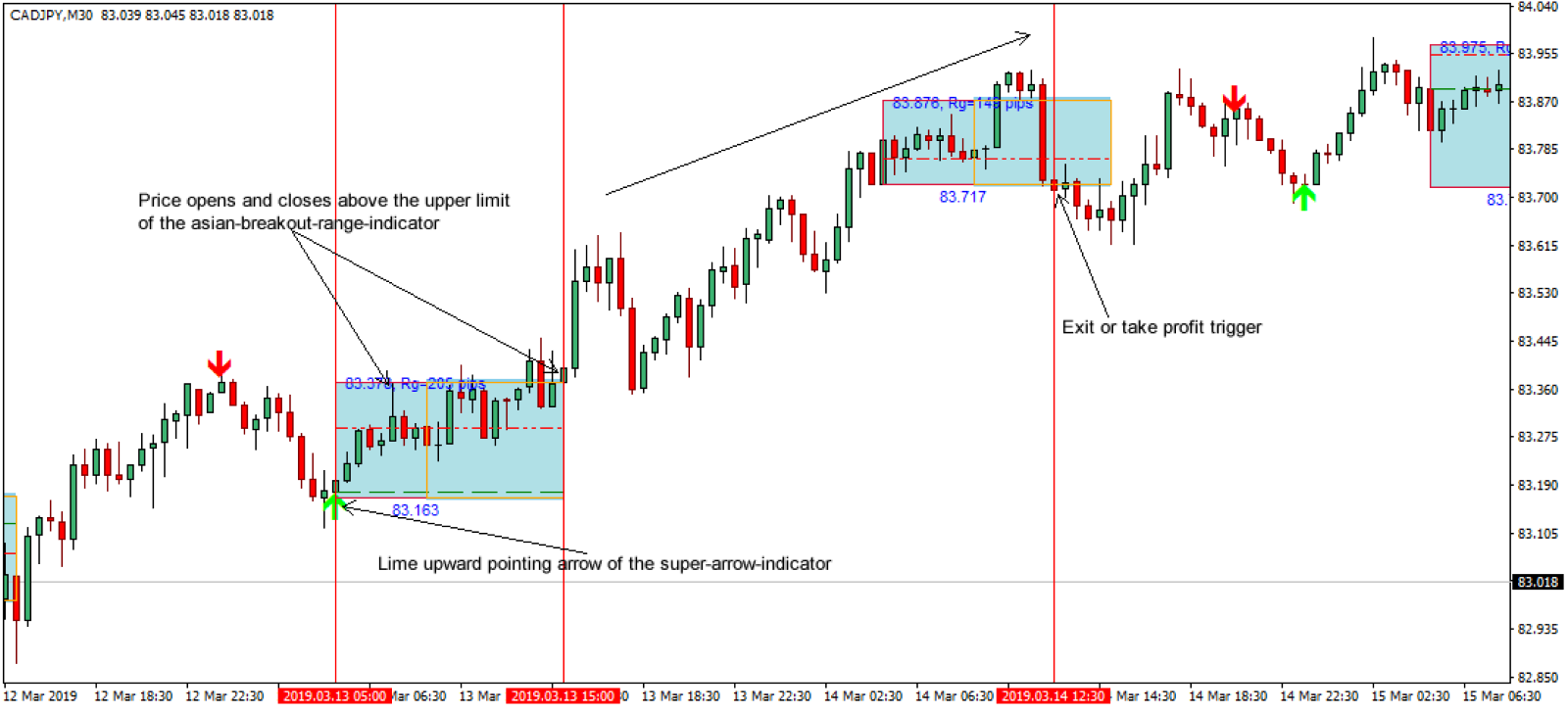

Range setup

In a range setup, traders identify a horizontal price range where the market has been moving sideways within a defined upper and lower boundary. This pattern occurs when there is a balance between trading pressure, creating a clear support and resistance area. Traders may look for opportunities to enter at the support level and exit at the resistance level. This strategy aims to capitalize on the forex price oscillations within the range until a breakout occurs, signaling a potential trend reversal or continuation.

- Traders can enter the trade when the price bounces off the support level within the defined range.

- Traders can exit the trade when the price reaches the resistance level within the defined range.

Reversal trade setup

A reversal trade setup involves identifying potential trend reversals in the forex market. Traders look for specific patterns, candlestick formations, or technical indicators that suggest a change in the prevailing trend's direction. Reversal patterns, such as double tops and double bottoms or bullish and bearish engulfing patterns, are commonly used to signal potential trend changes. Traders may enter positions in anticipation of a trend reversal, aiming to catch the new trend from its early stages.

- Traders can enter the trade when a bullish reversal pattern forms, suggesting a potential trend reversal from bearish to bullish.

- Traders can exit the trade when a bearish reversal pattern forms, indicating a potential trend reversal from bullish to bearish.

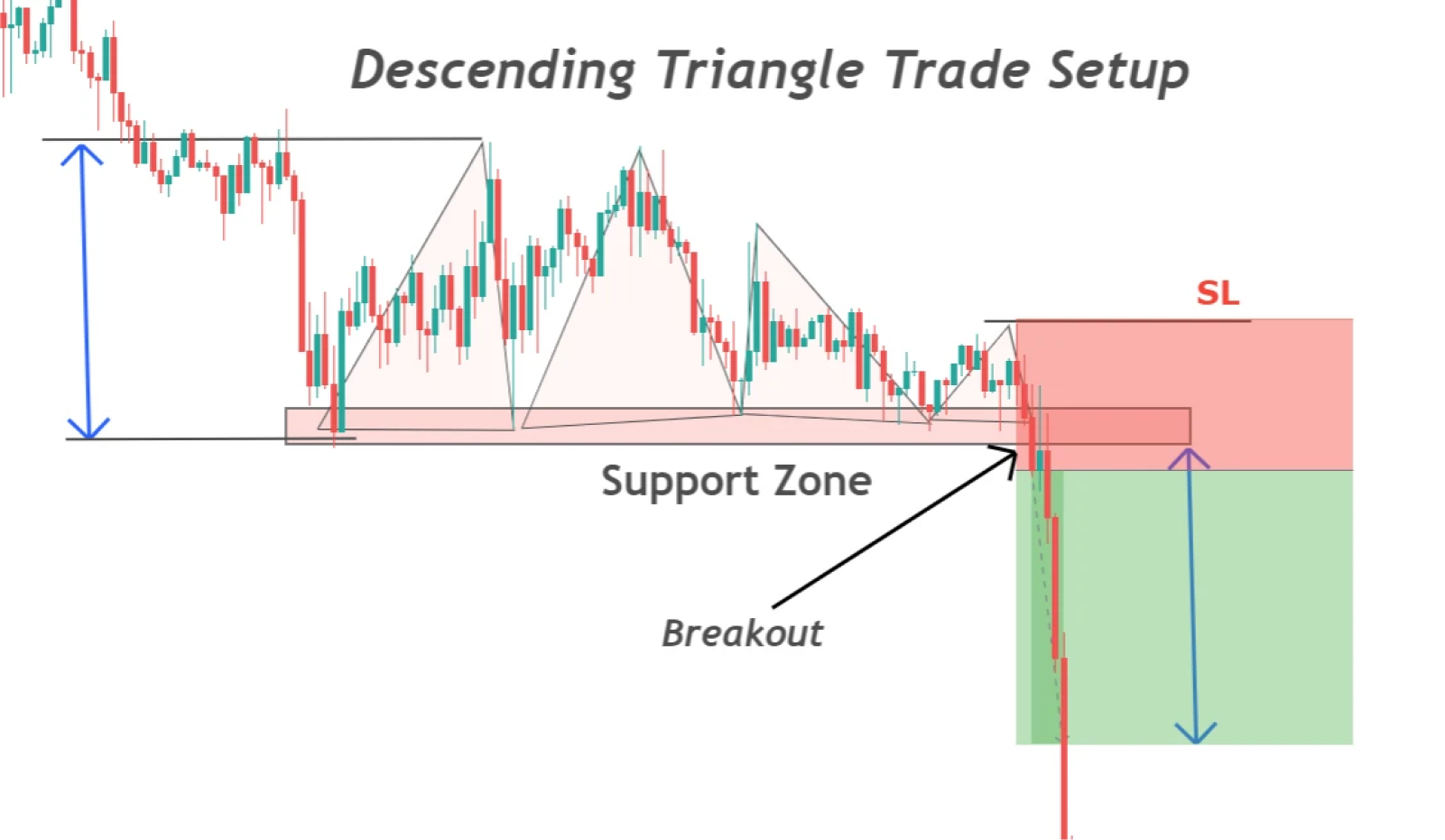

Triangle trade setup

The triangle trade setup involves recognizing a chart pattern characterized by converging trendlines, forming either a symmetrical, ascending, or descending triangle. These patterns indicate a period of consolidation where the price is making lower highs and higher lows, showing a decrease in volatility. Traders watch for a breakout from the triangle pattern, which often leads to a significant price movement. They can enter long or short positions depending on the direction of the breakout.

- Traders can enter when the price breaks out of the triangle pattern in an upward direction, signaling a potential bullish trend continuation.

- Traders can exit when the price breaks out of the triangle pattern in a downward direction, suggesting a potential bearish trend continuation.

Flag setup

A flag setup is a continuation pattern that occurs after a sharp price movement in one direction. The flag pattern resembles a rectangle, with the forex price consolidating in a tight range. This consolidation represents a temporary pause before the market resumes the initial trend. Traders watch for a breakout in the direction of the previous trend, which can offer potential trading opportunities. Flags are common in trending markets and allow traders to join the trend at a favorable entry point.

- Traders can enter the trade when the price breaks out of the flag pattern in the direction of the previous uptrend, indicating a potential upward trend continuation.

- Traders can exit the trade when the price breaks out of the flag pattern in the direction of the previous downtrend, suggesting a potential continuation of the downward trend.

Choose the best trading setup as per the trading plan

The best trading setups offer valuable tools for traders to make well-informed decisions and improve their trading performance. These setups help identify trend continuations or reversals, making them useful for capturing both long-term and short-term opportunities and also help traders adapt to changing market conditions.

Trade smarter with low spreads and lightning-fast executions. Open a live account today and experience unparalleled support from our dedicated customer service team. Blueberry is here to help every step of the way!

Trade Now Open a Demo Account