A dead cat bounce is a deceptive price rebound in a downtrend, luring traders into false hope. Traders must beware of this trap, as mistaking it for a reversal can result in poor timing and costly mistakes.

Continue reading further to learn about the dead cat bounce in trading and how to avoid it.

Define dead cat bounce

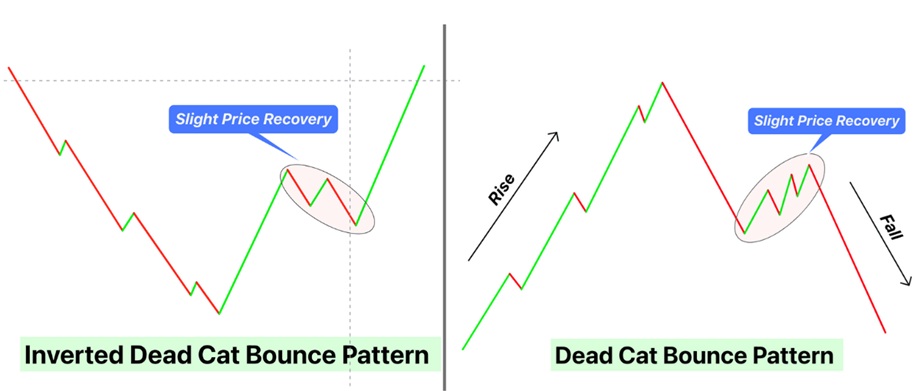

A dead cat bounce is a short-term price recovery in a downtrend that misleads you into thinking a reversal is happening. It occurs when an asset experiences a temporary bounce after a sharp decline, only to resume its downward movement.

This pattern often traps traders who enter the trade early, expecting a sustained recovery. It typically happens in bear markets or after negative news, driven by short covering or technical rebounds. Before taking positions, you can confirm a true reversal by analyzing volume, trend strength, and market conditions.

Origins of the dead cat bounce concept

The term 'dead cat bounce' originated in financial markets during the 1980s. It is based on the idea that even a dead cat will bounce if it falls from a great height. This implies that a brief rebound in a downtrend doesn't mean a true reversal.

The phrase was first used by journalists and analysts in 1985, when Singapore and Malaysia's stock markets temporarily rebounded after a major crash. Traders adopted the term to describe short-lived recoveries in bear markets, emphasizing the importance of confirming trend reversals before investing.

Characteristics of a dead cat bounce in trading

- Occurs in a strong downtrend: A dead cat bounce occurs within a strong downtrend, where a brief price recovery (driven by short covering or speculative buying) misleads traders but lacks strength, ultimately leading to a continuation of the decline.

- Followed by further decline: The asset's price falls below the previous low after the short-lived rebound. This confirms the continuation pattern of the bearish trend and trapping early bulls.

- Driven by technical factors: The bounce often occurs due to oversold conditions, support levels, or short squeezes, misleading traders into expecting a reversal.

- Common in bear markets: Classic dead cat bounces frequently appear in bear markets, where investor sentiment remains weak and economic conditions do not support sustained upward movement.

How to identify a dead cat bounce

*This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry providing personal advice.

1. Sharp but short-lived price recovery

Initially, the asset experiences a sudden upward movement, but the rally is brief. Unlike a true reversal, this bounce lacks sustained momentum.

2. Low trading volume during rebound

If you experience a weak bounce, there will be low purchasing volume. This indicates that the recovery is not backed by strong investor confidence or institutional purchasing.

3. Failure to break key resistance levels

Then, the price struggles to surpass major resistance points, such as moving averages or previous highs. This signals a lack of bullish strength.

4. Market sentiment remains bearish

Despite the temporary rise, broader sentiment stays negative, with continued fear, pessimism, and economic uncertainty driving the market lower.

5. Continuation of the downtrend

After the brief surge, the price drops below its previous low, confirming that the long-term downtrend remains intact.

Difference between dead cat bounce and trend reversal

Direction of movement

A dead cat bounce pattern is a temporary price recovery within a broader downtrend. However, a trend reversal signifies a fundamental change in market direction.

Duration and strength

A dead cat bounce is short-lived and lacks strength. The price spike may last a few days or weeks but lacks sustained momentum due to weak long pressure. In contrast, a trend reversal is long-lasting and occurs with strong market conviction. Once confirmed, the price continues moving in the new direction for an extended period.

Resistance and support levels

A dead cat bounce fails to break key resistance levels. The price may rise but gets rejected at strong resistance, leading to another downward move. However, a trend reversal breaks through resistance (in an uptrend) or support (in a downtrend).

Volume and market sentiment

A dead cat bounce often occurs with low trading volume, meaning fewer investors are participating in the rebound. Market sentiment remains bearish, leading to further declines. In contrast, a trend reversal is accompanied by high volume, indicating strong long or short pressure. Sentiment shifts significantly, with bulls (in an uptrend) or bears (in a downtrend) gaining control.

The role of market sentiment in dead cat bounces

False optimism among traders

During a dead cat bounce, some of you might mistake the short-term rebound for a genuine recovery. This false optimism leads to increased long activity, but the overall bearish sentiment prevents sustained upward momentum.

Bearish sentiment dominates

Even as prices rise temporarily, the broader market remains pessimistic. Negative news, economic uncertainty, or weak fundamentals keep you cautious, making it difficult for the asset to sustain its gains.

Short-covering and speculative purchasing

Many of you can engage in short-covering, temporarily pushing prices up as they exit short positions. Speculative traders also jump in, hoping to gain from the rebound, but short pressure soon resumes.

Lack of institutional confidence

Institutional investors often avoid dead cat bounces because they recognize the lack of fundamental strength. Without their participation, the bounce lacks strong, long support and eventually collapses.

Common causes behind a dead cat bounces

Temporary short covering

When traders who shorted the asset purchase back shares to lock in gains, it creates temporary long pressure. This can cause a quick price rebound, but the rally is short-lived since it's not driven by new demand.

Oversold technical conditions

An asset in a strong downtrend may become oversold based on technical indicators like the Relative Strength Index (RSI). This triggers automatic purchasing from technical traders, causing a brief recovery before the downtrend resumes.

Psychological bias among traders

Many traders believe prices' must' recover after a major drop, leading them to purchase prematurely. This optimism fuels a temporary rise, but panic selling accelerates the downtrend when the price falls again.

Market manipulation by large players

Institutional investors or market makers may artificially inflate prices to lure in retail traders. Once retail participation increases, large players dump their positions, leading to another sharp decline.

Low liquidity in the asset

Illiquid assets experience sharp price swings due to a lack of bulls and bears. Even small purchase orders can create a significant price jump, but the price falls again without sustained demand.

Avoiding risks of a dead cat bounce

Stock trading during a dead cat bounce carries significant risks due to its deceptive nature. False recovery signals can mislead traders into premature purchasing, resulting in unexpected losses. The difficulty in timing exit points also makes it challenging to capture gains before the sustained decline resumes.

Additionally, the potential for extended downtrends means traders may get stuck in a falling market. Psychological traps, such as fear of missing out (FOMO) or overconfidence, further increase risk. To navigate these challenges, you must rely on technical indicators, volume analysis, and market sentiment to confirm trends before making trading decisions.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.