A bear trap occurs when the market appears to signal a bearish trend, prompting traders to bet on a decline. Traders who act on these false signals by shorting the market risk significant losses. Understanding bear traps is crucial for traders to avoid falling into them and protect their capital.

What is a bear trap?

A bear trap is a market scenario in which prices temporarily decline, luring investors into short positions. This creates the illusion of a downtrend, but it soon reverses. The sudden price surge traps investors who shorted the asset, leading to potential losses.

Typically, bear traps typically occur during volatile markets. Recognizing them early can help investors avoid costly mistakes and make timely decisions that are crucial for risk management.

How does a bear trap work?

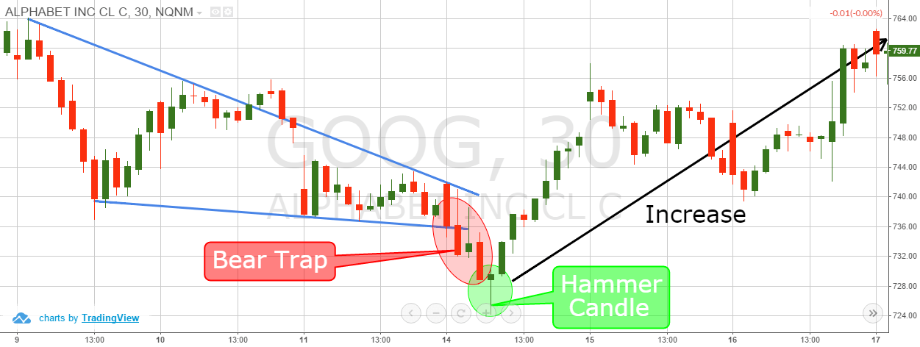

A bear trap works by deceiving investors into believing a downtrend is in motion. As prices drop, short sellers enter the market, expecting further declines.

However, the market reverses, causing a rapid price increase. The surge forces short sellers to purchase back assets, triggering further price gains. The trap creates false signals of a bearish trend, often leading to unexpected losses for those who fall for it.

Identifying a bear trap

- Sudden price decline: Identify sharp price drops that might indicate a downtrend, though they could be temporary.

- High volume during the decline: Watch for increased exit volume, which might mislead traders into thinking the market is turning bearish.

- Quick price reversal: Be alert to a rapid bounce back after the drop, signaling a potential trap for short sellers.

- Approaching strong support levels: If prices are nearing key support levels but fail to break through, it could suggest a reversal is coming.

- Failure to continue the decline: If the market doesn't sustain the bearish trend, it may indicate the initial drop was a trap.

Opportunities and risks of a bear trap

Opportunities

- Ability to capitalize on false bearish sentiment: A bear trap creates opportunities to gain by recognizing and acting on misleading market signals, allowing traders to enter positions before the market reverses.

- Increased trade volume and liquidity: The false downtrend draws in more market participants, resulting in increased trading volume and liquidity.

- Strategic positioning in rebounding markets: Traders who identify a bear trap early can position themselves strategically for a market rebound. This can maximize gains as the market recovers and continues its upward trend.

Risks

- Difficulty in accurately identifying the trap: Bear traps can be hard to identify due to their deceptive nature, making it challenging for traders to differentiate between real downtrends and temporary pullbacks.

- Risk of being trapped in losses if the trend continues: If the market does not reverse as expected, traders may face significant losses, being 'trapped' in their positions as the bearish trend continues.

- Over-reliance on short-term market movements: Focusing too much on short-term price fluctuations can lead to poor decision-making. This may cause traders to act impulsively and ignore the broader market context.

How to trade bear traps?

Identify the market sentiment

Start by assessing the overall market sentiment. If the market is showing signs of excessive fear, it might be a bear trap. Look for sharp declines in prices. These temporary drops often create a false sense of bearishness, signaling an opportunity for reversal.

Confirm the bear trap with technical indicators

Technical indicators like RSI, Fibonacci retracements, and volume analysis can help validate the bear trap. RSI levels below 30 can indicate oversold conditions, suggesting the possibility of a reversal. Fibonacci retracements help identify potential support levels, while volume analysis shows whether the price drop is genuine or false.

Wait for a clear reversal signal

Do not rush into a trade. Wait for a clear reversal signal, such as a price bounce off support levels. This indicates that the downtrend is likely exhausted, and a bullish move is beginning. Look for a candlestick pattern or moving average crossover to confirm the shift.

Enter a long position

Once a reversal signal is confirmed, enter a long position. Ensure the risk-to-reward ratio is favorable, aiming for gains from the anticipated price rise. The position should align with the overall market's broader trend, ensuring one is trading with momentum, not against it.

Set stop-loss orders

To protect the investment, set stop-loss orders just below recent support levels. This helps limit potential losses if the market reverses unexpectedly. Place the stop-loss at a level that reflects your risk tolerance while protecting against a continuing decline.

Monitor price action and market news

Stay updated with real-time market news and monitor price action closely. Changes in sentiment or external factors can quickly affect the trend. Keeping an eye on the broader market conditions may help traders adjust their strategy if necessary and prevent being caught in unexpected volatility

Evaluate the trade

Once the trade has been executed, continuously evaluate its progress. Review price movement and adjust stop-loss levels if necessary. After the trade is closed, assess the results to learn from the experience. The evaluation helps refine future trading strategies and improves decision-making.

*This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry providing personal advice.

Bear trap vs bull trap: What’s the difference?

A bear trap occurs during a downtrend, when prices fall sharply, signaling to traders that a bearish trend is underway. Traders, anticipating further declines, short the market. However, the market quickly reverses and rises, trapping those who went short and leading to potential losses.

On the other hand, a bull trap occurs when prices break above a resistance level or appear to continue an uptrend, creating the illusion of a sustained rally. Traders, lured by the upward move, enter long positions, but the market soon reverses downward, trapping the bulls in losing trades.

Bear traps can sometimes last longer, as the market may stay within a consolidation phase or false downtrend before reversing sharply. Bull traps, on the other hand, are often short-lived, with prices quickly retreating after the false breakout and catching traders off guard.

In a bear trap, traders who short the market risk losses if prices reverse upwards. In a bull trap, traders who enter long positions are exposed to losses as prices turn downward after they've bought in.

Decide whether to trade a bear trap

Trading a bear trap can be profitable if approached with caution and a well-defined strategy. Due to its deceptive nature, impulsive decisions carry higher risk. Trading a bear trap may be considered only after the reversal is confirmed with reliable technical indicators and a clear risk management plan is in place to minimize potential losses.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.