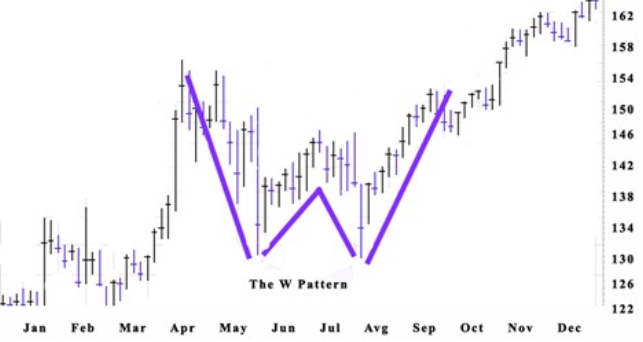

Technical analysis in financial markets relies on historical price patterns to identify potential future trends. The W pattern helps traders capitalize on trend reversals. The key to utilizing the W pattern is identifying a confirmed breakout and making market decisions accordingly.

Let’s discuss everything about the W pattern and how to use it in forex trading.

What is a W pattern?

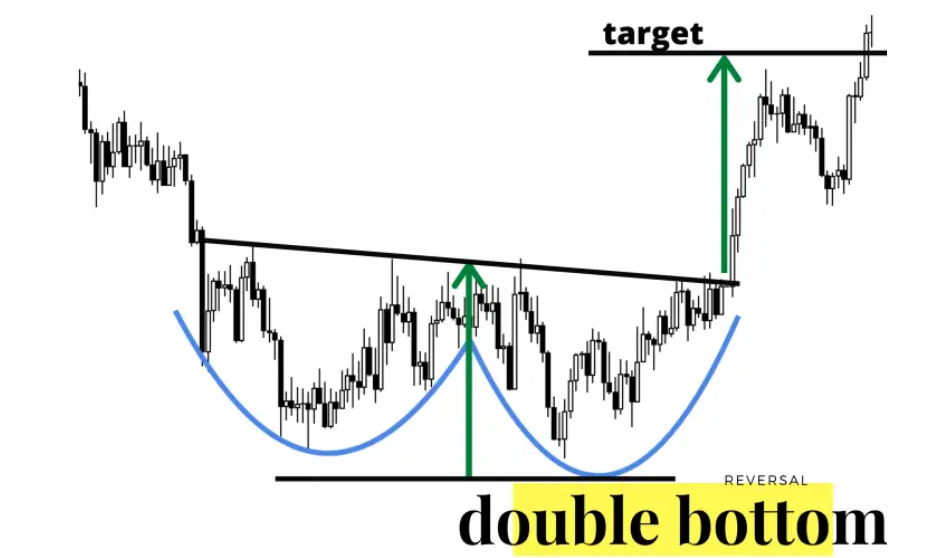

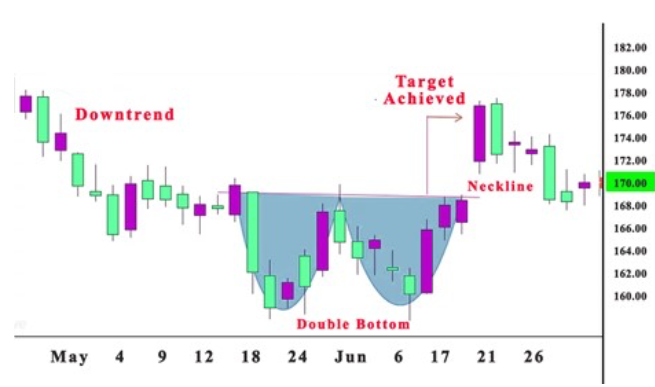

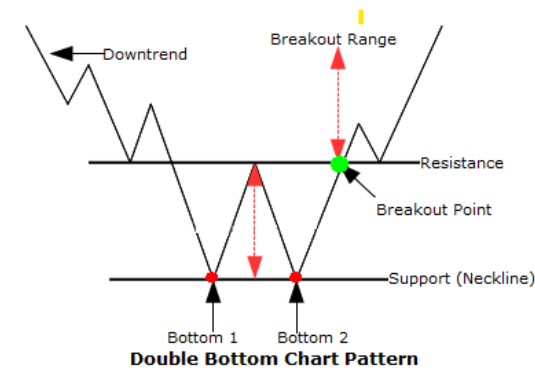

The W pattern, a double bottom, is a technical analysis indicator used in financial markets to identify potential bullish reversals within a downtrend. It is formed by two distinct price lows separated by a central high, resembling the letter ‘W’ when visualized on a price chart. These lows should be roughly the same level, indicating a level of support where purchasers stepped in to prevent further price decline.

- The W pattern suggests a loss of momentum in the downtrend. The two lows represent instances where exit pressure was met by entry pressure, preventing further price decline.

- The central high indicates a temporary price recovery but doesn't necessarily signify a complete reversal.

- The key to utilizing the W pattern lies in identifying a confirmed breakout. This occurs when the price decisively closes above the upper trendline, connecting the two lows of the W.

Identifying W patterns

Charts

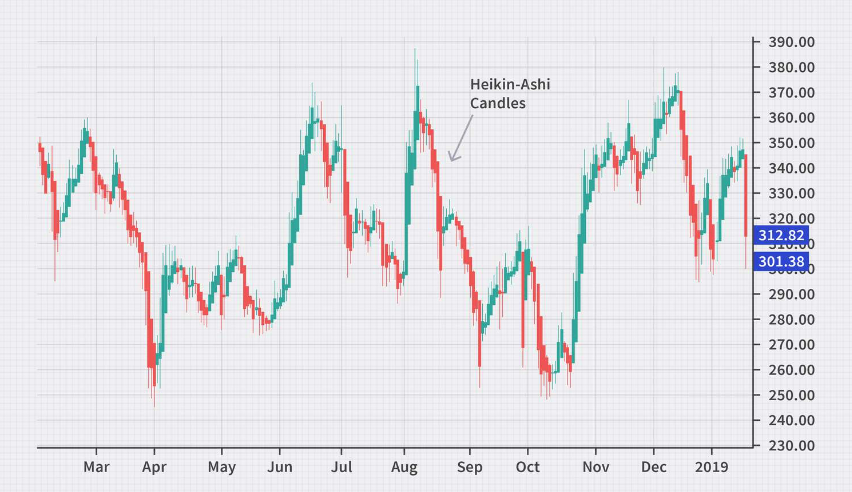

Heiken-Ashi candlesticks

Heikin-Ashi candles modify the appearance of traditional candlesticks by smoothing out price action and focusing on the underlying trend. These charts help identify W patterns because they can sometimes reduce price noise, making the overall trend and potential reversal points clearer. Due to the modified open and close prices of the Heikin-Ashi candles, the two distinct lows and the central high of the W pattern may be visually more prominent.

Three-line break chart

Three-line break charts are bar charts that plot a bar only when the price breaks a certain threshold (usually a specific percentage) from the previous bar's close. They can be useful for identifying W patterns because they emphasize significant price movements. The two lows and the central high of the W pattern can be represented by distinct bars, highlighting the potential reversal points within the downtrend.

Line charts

Line charts connect closing prices over time, providing a basic visualization of the price trend. Line charts offer a simplified view of price movements. While they might not be the most precise tool, they can still identify the general W pattern formation, particularly for traders who prefer a less cluttered chart. The two lows and the central high might be visually identifiable, but subtle price movements within the pattern might be less evident.

Tick charts

Tick charts plot a new bar every time a specific number of price ticks (transactions) occur, regardless of the time relapsed. The two lows and the central high might be more visually distinct, especially if they occur with significant volume changes. Analyzing the volume at the lows and the central high of the potential W pattern can provide additional information. Higher volume at the lows might suggest stronger entry pressure and lower volume at the central high could indicate diminishing exit pressure.

Indicators

Stochastic oscillator

This indicator measures the relationship between the current closing price and the price range over a specific period. During a W pattern formation, the Stochastic Oscillator might dip into oversold territory near the two lows, suggesting potential entry pressure. A subsequent rise above its oversold level could coincide with the price move towards the central high, hinting at a possible trend reversal.

Bollinger bands

These bands represent a volatility channel around the moving average price. As the W pattern forms, the price might compress towards the lower Bollinger Band near the lows, indicating potentially oversold conditions. A breakout above the Bollinger Band could then align with the price move above the neckline of the W, potentially signaling a trend shift.

On-balance volume (OBV)

This indicator tracks volume changes associated with price movements. During the W pattern, the OBV might show a flattening or slight increase at the lows, suggesting long activity that could halter the downtrend. A sustained rise in OBV coinciding with the price move towards the central high could further support the possibility of a bullish reversal.

Price momentum oscillator (PMO)

This indicator measures the rate of price change. During the W pattern formation, the PMO might dip into negative territory near the lows, reflecting a weakening downward momentum. A subsequent rise back above zero could then align with the price move towards the central high, potentially indicating a shift in momentum towards an uptrend.

Step-by-step guide: How to spot W patterns

1- Identify the downtrend

Start by analyzing the chart and identify a downward trend in price movement.

2- Look for the first low

Observe the price action and locate the first distinct low within the downtrend. This low represents a point where exit pressure temporarily halts the decline.

3- Watch for a price rebound

Following the first low, a price recovery should occur, forming a central high. This high indicates a temporary pause in the downtrend but doesn't necessarily signify a complete reversal.

4- Identify the second low

After the central high, the price should decline again and create a second distinct low. This second low ideally should be at a similar level or slightly higher than the first low, suggesting continued entry pressure preventing a deeper decline.

5- Confirm the neckline

Draw a trendline connecting the lows of the first and second bottom. This trendline represents the neckline of the W pattern.

6- Watch for the breakout

Finally, identify a confirmed breakout. It occurs when the price decisively closes above the neckline. This breakout suggests a potential shift in market sentiment towards a potential uptrend.

Interpreting W patterns: How do external factors impact it?

- Economic data releases: Major economic data releases (such as GDP reports, non-farm payrolls, and employment statistics) cause significant market volatility, which distorts W patterns. Be cautious of false breakouts or exaggerated price movements around major economic announcements; wait for confirmation post-event.

- Interest rate changes: Central bank interest rate decisions significantly affect market trends and price levels. Interest rate hikes cause bearish signals, while rate cuts could support bullish W patterns. Hence, traders should consider rate policies in their analysis.

- Earning reports: Company earnings reports can cause price gaps and volatility, impacting the formation and breakout of W patterns in individual stocks and, similarly, in forex rates. Positive earnings surprises can validate a bullish W pattern, while negative surprises can invalidate it. However, traders should avoid trading around earnings announcements to avoid extreme volatility.

- Trade balances: Trade balance data impact currency demand and supply. Positive trade balance data can validate bullish W patterns, while negative trade data can weaken them.

- Currency correlations: Correlated currency pairs tend to move in the same direction. If two currency pairs with a strong positive correlation exhibit a W pattern, the signal strengthens. Conversely, conflicting W patterns between correlated pairs may indicate market uncertainty and weaken the pattern's reliability.

Trading strategies using W patterns

W pattern breakout strategy

The W pattern breakout strategy captures the initial price movement after the W pattern breaks bullish. Traders should enter the trade only after a confirmed breakout, which means the price decisively closes above the neckline (the upper trendline connecting the lows of the W).

This confirmed breakout suggests a higher probability of a sustained uptrend, indicating the downtrend might be losing steam. To limit potential losses if the breakout turns out to be false, place a stop-loss order just outside the opposite trendline of the breakout (typically below the neckline).

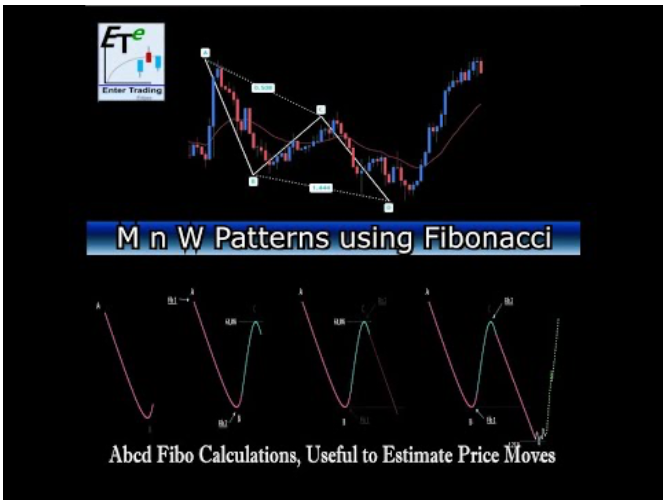

W pattern Fibonacci strategy

The W pattern Fibonacci strategy combines the principles of the W pattern with Fibonacci retracement levels to identify potential entry and exit points. Fibonacci levels act as potential areas of support and resistance.

It provides insights into where prices may pause or reverse during pullbacks. Traders can enter a long position when the price pulls back to a Fibonacci retracement level (such as 38.2%, 50%) after the breakout of the W pattern's neckline and vice versa.

W pattern pullback strategy

The W pattern pullback strategy involves waiting for a retracement or pullback to occur after the breakout of a W pattern. Enter the trade after a slight pullback following the confirmed breakout. The price might retrace slightly after the breakout before continuing its upward momentum.

This pullback can be seen as an opportunity to enter the trade at a potentially better price point. Look for a confirmation signal during the pullback to support the uptrend continuation. It could be a moving average crossover or a bullish candlestick pattern on a lower time frame chart.

W pattern volume confirmation strategy

The W pattern volume confirmation strategy uses volume analysis to validate the breakout of a W pattern. Adding volume analysis to the W pattern identification provides additional insights into entry and exit pressure.

Look for higher volume at the lows of the W (indicating prolonged pressure halting the downtrend) and during the breakout itself. It suggests stronger long pressure, potentially increasing the likelihood of a bullish reversal.

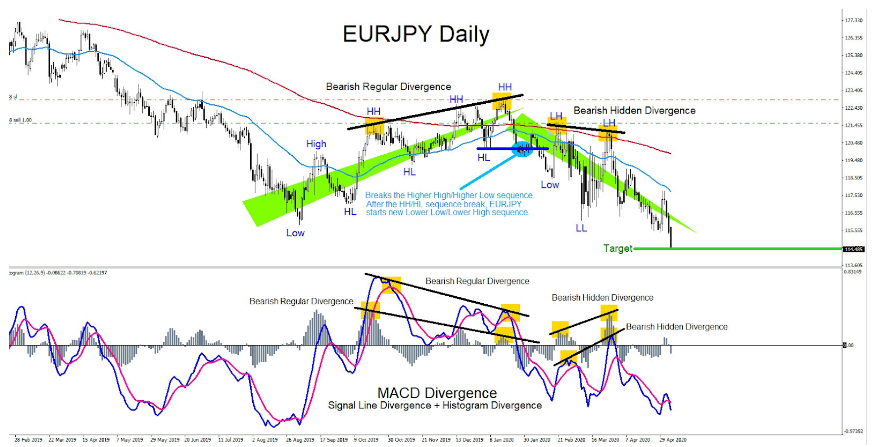

W pattern divergence strategy

The W pattern divergence strategy focuses on identifying divergence signals during the formation of a W pattern on the price chart. It provides early clues regarding a potential reversal.

During the W pattern formation, the price might make new lows while a momentum indicator like RSI doesn't. This divergence suggests weakening exit pressure even though the price is dropping. It can hint at a potential reversal brewing before the actual breakout occurs.

W pattern partial position entry strategy

Partial position entry strategy in forex is a risk management strategy that enables traders to consider scaling into the trade with partial positions. Start with a smaller initial position size and add to it as the trade progresses and confirmation signals strengthen, reducing initial risk exposure.

Common risks with W pattern trading and how to avoid them

- False breakouts: W pattern breakouts may sometimes fail to sustain momentum, leading to false signals and losses. Traders should wait for confirmation of the breakout with strong volume and follow-through price action. Additionally, consider using a higher timeframe to confirm the breakout signal, reducing the likelihood of false breakouts.

- Low-volume breakouts: Breakouts from W patterns occurring on low volume may lack conviction and increase the risk of reversal. Traders should confirm the breakout with above-average volume and avoid trading breakouts with low volume, as they may lack follow-through.

- Market whipsaws: Choppy market conditions or sudden price movements can result in market whipsaws (sudden, sharp price reversals), leading to losses. Traders should filter out noisy market conditions by using additional technical indicators or confirming signals from higher timeframes. Avoid trading during periods of low liquidity or high volatility, which can increase the risk of whipsaws.

- Confirmation bias: Succumbing to confirmation bias by selectively interpreting information that supports a bullish bias on W patterns can lead to overlooking warning signs or early exit signals. Traders should stay objective and evaluate W pattern signals impartially, considering both bullish and bearish scenarios. Avoid ignoring contradictory signals or dismissing early exit signals that indicate potential reversals.

The W trading pattern: what to remember?

The W trading pattern helps identify potential bullish reversals within a downtrend. Traders should consider the following tips to trade the W pattern:

- Combine the W pattern with other technical indicators like RSI or MACD for stronger breakout signals

- Look for higher volume at the lows and during the breakout to strengthen the possibility of reversal

- Utilize stop-loss orders to limit potential losses if the breakout is false

- Don't chase breakouts; wait for confirmation and consider entering on a pullback for better entry points

By recognizing the W formation and key elements, traders can gain valuable insights into market shifts, especially for uptrend potentials.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.