The Turtle Soup strategy is a reversal technique designed to catch false breakouts in the forex market. Spotting failed 20-day highs or lows may help traders find potential reversal points while managing risk.

Understanding this setup may help traders better interpret price movements and consider potential reversal opportunities in volatile conditions. This blog will cover how it works.

What is the turtle soup trading strategy?

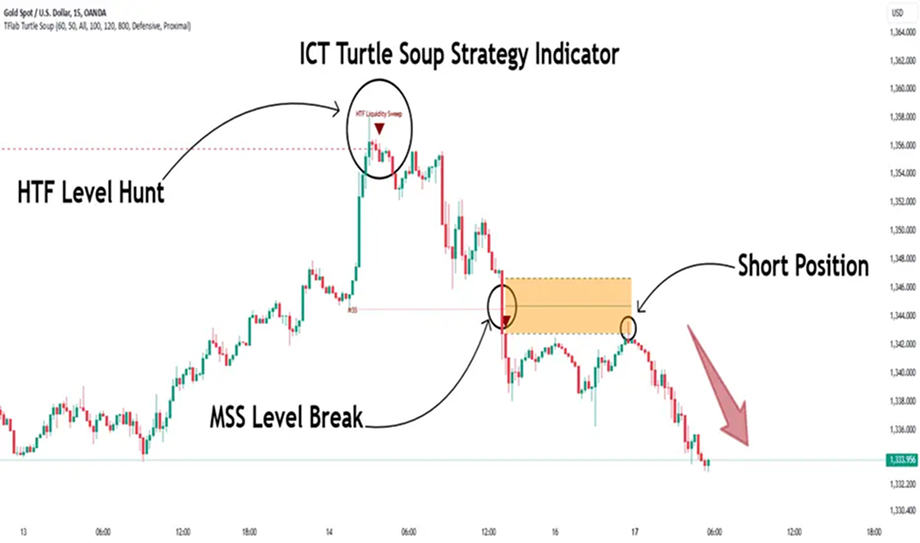

The turtle soup trading strategy is a short-term reversal technique used to trade false breakouts of recent highs or lows. Developed by Linda Raschke, it builds on the concepts of the original turtle trading system that Richard Dennis and William Eckhardt created.

The turtle soup trading strategy is based on the observation that markets often break key levels like 20-day highs or lows, triggering trend-following trades. However, these breakouts are frequently false. Turtle soup looks to fade these fakeouts, trading in the opposite direction once the price re-enters the previous range.

How the strategy works

This section is intended solely for educational purposes to explain how the strategy works. It does not constitute personal advice or a recommendation to trade.

For a long trade (bullish reversal):

-

Identify a 20-day low that occurred at least 4 trading days ago.

-

Wait for the price to dip below that low intraday.

-

Enter a long position if the price closes back above the old low.

-

Consider placing a stop-loss below the new low

-

Exit either on a retest of the range high or using a 1:1 or 2:1 risk-reward.

For a short trade (bearish reversal):

-

Identify a 20-day high that occurred at least 4 trading days ago.

-

Wait for the price to move above that high intraday.

-

If the price falls back below the old high, enter a short position.

-

Consider placing a stop-loss above the new high

-

Exit when the price moves back into the range or hits a preset target.

Key criteria for spotting false breakouts using turtle soup

Breaks of 20-day highs or lows

The strategy begins by identifying a 20-day high or low. These levels act as psychological barriers and attract breakout traders. Turtle soup specifically targets trades where the price briefly breaks these levels but fails to sustain the move, hinting at a false breakout.

One-day breakout rule

For the breakout to qualify as a turtle soup setup, it must be a one-day event. That means the breakout should occur and fail within the same trading day, suggesting the move was unsustainable. This rule filters out actual trend changes and focuses only on fakeouts.

Reversal candlestick patterns

Look for price action confirmation such as:

-

Pin bars

-

Engulfing candles

-

Hammer or shooting star formations

These candlestick patterns signal a potential rejection of the breakout level, which could indicate a potential reversal, though further confirmation is needed.

Volume confirmation on rejection

If the breakout occurs on low or average volume and the rejection occurs on higher volume, this suggests that the breakout lacked strength. This volume shift adds confidence to the idea that the breakout was false.

Entry upon re-entry into the range

Do not enter the trade during the breakout. Wait for the price to re-enter the original 20-day range. This confirms that the breakout has failed. The entry trigger is when the price closes back inside the range, aligning your trade with the reversal.

Protective stops beyond the breakout level

Traders might consider placing a stop-loss beyond the extreme of the failed breakout to manage risk. For long trades, that’s just below the new low. For short trades, it is just above the new high. This ensures you exit quickly if the breakout turns out to be genuine.

Indicators to complement turtle soup trading

RSI (Relative Strength Index)

RSI may help identify overbought or oversold conditions, which could align with potential false breakouts. If a breakout occurs while RSI shows divergence or extreme levels (above 70 or below 30), it strengthens the turtle soup reversal signal for timely entries.

ATR (Average True Range)

ATR measures market volatility and helps set realistic stop-loss and target levels in turtle soup trades. A higher ATR suggests placing wider stops beyond the breakout to avoid premature exits, while a lower ATR indicates tighter stop-loss placement.

Volume oscillator

The volume oscillator tracks changes in volume momentum. A false breakout with decreasing volume followed by a rejection candle on rising volume may indicate a potential setup for the Turtle Soup strategy. It confirms that the breakout lacked strength, and the reversal has conviction.

Risk management principles for turtle soup strategy

Set tight stop-loss beyond the breakout level

Place the stop-loss just past the breakout high or low to limit losses quickly if the breakout turns out to be legitimate.

Risk only 1-2% of your capital per trade

Limiting risk per trade may help protect capital over the long term. Even with multiple losing trades, the overall capital remains protected, and drawdowns remain manageable.

Avoid trades during high-impact news releases

Major economic news can trigger unpredictable volatility. Avoid turtle soup setups during these times, as false breakouts may unexpectedly turn into real trend reversals.

Stick to high-probability setups only

Traders may consider focusing on clear patterns that meet the set criteria. Forcing low-quality setups increases risk and reduces the effectiveness of the turtle soup strategy.

Stepwise guide to trade forex with the turtle soup strategy

For educational purposes only. Not personal advice.

-

Identify a recent 20-day high or low: Spot a significant 20-day high or low that formed at least four days ago as your reference breakout level.

-

Wait for a potential false breakout: Monitor price as it breaks above the high or below the low intraday, triggering breakout orders.

-

Confirm reversal with intraday price action: Look for signs like rejection wicks or reversal candlesticks showing the breakout is failing within the same trading day.

-

Use volume or momentum indicators for validation: Check if indicators like RSI or Volume Oscillator support the false breakout by showing divergence or weak breakout strength.

-

Enter on price re-entry into the range: Enter the trade once the price closes back inside the original 20-day range, confirming the fakeout.

-

Set stop-loss beyond the breakout point: Place your stop-loss just beyond the breakout high or low to limit the risk if the price resumes its breakout direction.

Pros and pitfalls of using turtle soup for forex trades

The Turtle Soup strategy may provide a structured approach to entries and risk management in range-bound markets, though outcomes depend on market conditions and trader discretion. It filters false breakouts effectively, improving trade accuracy. However, it can underperform in strong trending markets and requires discipline in setup selection.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.