The GBP/USD currency pair gained about 5.6% in the first half of 2023 and witnessed some volatility in the remaining year. Although the second half of 2023 was a little bearish for GBP, the currency pair has maintained its momentum and has provided traders with significant opportunities in the forex market.

In this article, we take a look at the different strategies for trading GBP/USD.

Golden Cross and Death Cross

The Golden Cross and Death Cross strategies rely on the intersection of the short-term (such as 50-day) and long-term (such as 200-day) moving averages. A Golden Cross in GBP/USD suggests a potential bullish trend as the short-term average surpasses the long-term one. This may signal increasing long pressure and optimism among traders, leading to upward momentum in the currency pair and signaling traders to enter a long trade.

Conversely, a Death Cross, where the short-term average crosses below the long-term average, indicates a possible bearish trend. For GBP/USD, this could imply a shift in sentiment towards shorting, potentially leading to a downward trend and signaling traders to enter a short trade. Traders often use these crossovers as part of their decision-making process, combining them with other technical indicators to confirm signals and manage risks effectively.

*This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

London breakout trading

GBP/USD exhibits distinctive price movements during the London trading session due to the significant overlap with the Asian and US sessions. Traders employing the London breakout strategy in GBP/USD monitor the price action during the initial hours of the London session. They may set purchase orders above the high and short orders below the low of the established range during the preceding Asian session.

The strategy capitalizes on the increased volatility and liquidity during the London session, aiming to catch potential breakout opportunities. The right implementation requires careful analysis of the prevailing market conditions and consideration of economic events influencing both the British Pound and the US Dollar.

Bollinger Bands squeeze

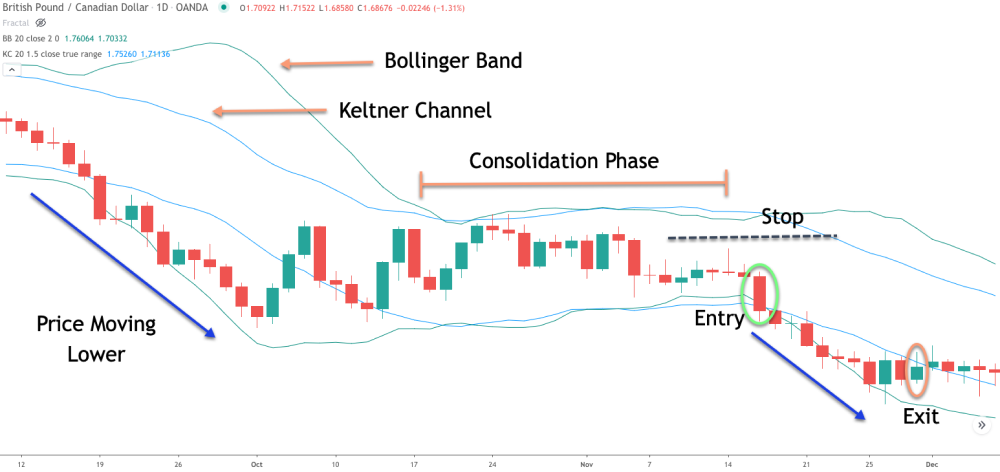

When applied to GBP/USD, the Bollinger Bands squeeze strategy involves monitoring the narrowing of the Bollinger Bands, indicating a period of low volatility. In this scenario, traders anticipate an impending breakout as volatility is expected to expand.

The squeeze visualizes the market's indecision, with prices consolidating within a tight range. For GBP/USD traders, this could signify a temporary equilibrium in the currency pair, prompting them to prepare for a potential directional movement. Once the Bollinger Bands expand again, traders may interpret it as a signal to enter positions in the direction of the breakout (long during an upward breakout and short during a downward breakout). Traders must exercise caution and use additional technical analysis to confirm potential breakout signals and avoid false alarms.

Inside bar trading

The inside bar trading strategy for GBP/USD involves identifying candlestick patterns where the current price range is confined within the high and low of the preceding bar. Traders observe these inside bars as potential signals of market consolidation and impending volatility.

In GBP/USD, entering a position is often based on the breakout of the inside bar's range. If the price breaches the high of the inside bar, traders may consider a bullish (long) position, while a break below the low could prompt a bearish (short) position. This strategy is particularly useful during periods of indecision or when the market is awaiting a catalyst to drive significant price movements.

Horizontal levels trading

Traders employ the horizontal levels of trading in the GBP/USD market, which focuses on identifying key support and resistance levels based on historical price data. These horizontal levels represent areas where the currency pair has previously encountered long or short pressure.

In the case of GBP/USD, geopolitical events, economic data releases, or central bank decisions can significantly impact these levels. Traders may enter positions when the price approaches a known horizontal level, expecting either a bounce or a breakout. Breakouts above resistance levels or below support levels can signal potential trend reversals or continuations, providing valuable opportunities for traders. The effectiveness of this strategy relies on a thorough analysis of the GBP/USD's price history and the ability to adapt to changing market conditions.

Fibonacci retracement trading

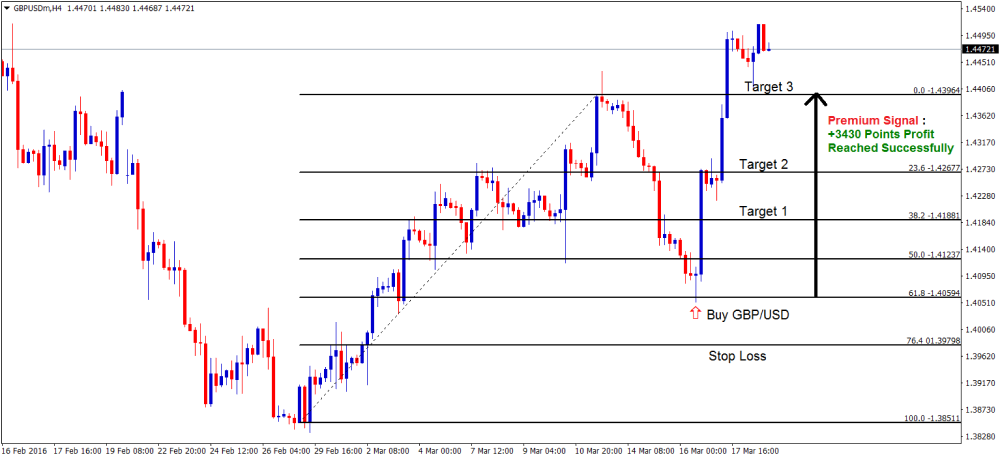

In GBP/USD trading, Fibonacci retracement levels are applied to identify potential reversal points in the currency pair's price movements. Traders use the key Fibonacci levels of 38.2%, 50%, and 61.8%, drawn based on previous price swings. As GBP/USD experiences various market events and economic releases, these retracement levels help traders anticipate where price corrections might occur.

Trading in GBP/USD requires a comprehensive understanding of the currency pair's historical price movements and the ability to integrate these retracement levels with other technical indicators.

Mean reversion trading

Mean reversion trading for GBP/USD involves identifying periods when the currency pair deviates significantly from its historical average or mean. Traders using this strategy anticipate a return to the average price over time. Various factors, including economic indicators, geopolitical events, or market sentiment shifts, can influence mean reversion.

Traders employing mean reversion must also implement effective risk management strategies to navigate potentially extended periods of deviation from the mean.

Strategizing GBP/USD for market opportunities

The susceptibility of the Pound Sterling and US Dollar to economic shifts and geopolitical events demands a strategic approach. By adeptly employing various trading strategies, including technical indicators and fundamental analysis, traders can navigate the volatility and risks associated with GBP/USD.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.