Smart Money Concepts (SMC) analyze institutional trading behavior to identify high-probability market moves. By tracking order blocks, liquidity zones, and structural shifts, forex traders can gain insights into institutional activity and make more informed trading decisions in volatile currency markets.

In this article, we will discuss the smart money concept in depth.

What is the smart money concept?

The smart money concept in trading refers to the strategies used by institutional investors, hedge funds, and market makers. These participants have deep market knowledge, large capital, and access to better information than retail traders. SMC revolves around understanding how these big players manipulate liquidity and price movements to their advantage. There are eight key principles of the smart money concept –

1. Liquidity grabs (stop hunts)

Institutions move the market to trigger stop-loss orders before reversing the trend. They often target areas where retail traders have placed stops.

2. Order blocks

Order blocks are zones where institutions place large long or short orders, creating strong support and resistance levels. Traders look for these areas to align with smart money moves.

3. Market structure

Price moves in phases such as uptrends, downtrends, and consolidations. SMC traders analyze higher highs, lower lows, and breaks of structure (BOS) to anticipate potential trend shifts.

4. Fair Value Gaps (FVGs)

FVGs are imbalances in price action that institutions often revisit before continuing the trend. These gaps indicate inefficiencies in price movements.

5. Mitigation blocks

Smart money re-enters the market at key levels, absorbing liquidity before a big move. Traders use these zones to enter positions in line with institutional activity.

6. Change of Character (ChoCH)

ChoCH is a notable shift in market behavior, typically observed after a BOS. It suggests a potential trend reversal and a new phase in market sentiment driven by institutional activities.

7. Accumulation/distribution

Traders can use volume analysis and Wyckoff’s schematics to identify phases where smart money is quietly accumulating (entering) or distributing (exiting). Recognizing these phases can also provide insights into where the market might head once institutions complete their transactions.

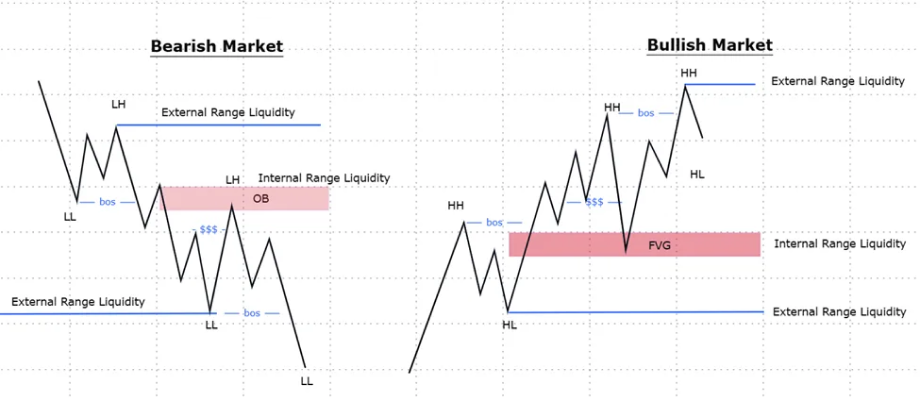

Understanding internal vs external structure in market analysis

Break of Structure (BoS) and Change of Character (ChoCH) appear across multiple timeframes, forming what traders call fractal patterns. These patterns are categorized into two key structures:

External structure (higher timeframe BoS & ChoCH)

External structure occurs during the primary trading timeframe. It represents major structural shifts in the market. The external structure also dictates the overall trend and sets the directional bias for trades.

Internal structure (lower timeframe BoS & ChoCH)

The internal structure appears on lower timeframes and provides finer details within the broader external structure. Internal movements help pinpoint precise entry and exit points while staying aligned with the dominant market trend.

Understanding the distinction between internal and external structures ensures traders maintain the correct market context. For example, if the daily timeframe shows an external uptrend, but the hourly chart displays an internal downtrend, the higher timeframe trend (bullish) takes precedence. The lower timeframe is then used to identify favorable long opportunities during pullbacks.

Advanced strategies to use with SMC

Combining SMC with order flow analysis

Order flow reveals how long and short orders interact in real-time. Analyzing volume, bid-ask spreads, and liquidity zones helps traders confirm smart money activity beyond just price action.

SMC and market microstructure

Understanding how orders are executed and impact price action provides deeper insights. Institutions use hidden orders and liquidity strategies to mask their moves. Recognizing these patterns also improves trade timing.

Algorithmic implementation of SMC

Coding SMC strategies automate pattern recognition. Algorithms scan multiple assets for order blocks, liquidity grabs, and fair value gaps, supporting analysis efficiency.

Volume-weighted average price (VWAP) confluence

VWAP tracks the average price based on volume, showing institutional interest levels. Aligning SMC concepts with VWAP zones helps traders pinpoint high-probability trade setups backed by smart money.

Time-based liquidity analysis

Institutions execute trades at specific market hours for optimal liquidity. Studying session-based liquidity patterns, such as London or New York open, reveals when smart money actively participates in the market.

Wyckoff method integration

Wyckoff’s schematics complement SMC by mapping accumulation and distribution phases. Identifying spring and upthrust patterns within order blocks enhances trade accuracy.

How to implement the SMC in trading

Data acquisition

Begin by collecting historical market data, including OHLCV (open, high, low, close, and volume). Use reliable APIs or data providers to access both real-time and past data. Ensure the dataset is clean and has minimal gaps. This helps maintain accuracy in pattern detection.

Identify key market levels

Develop an algorithm to detect swing highs and lows to define the market structure. Identify support and resistance zones based on price action, order flow, and moving averages. Psychological levels, such as round numbers, should also be mapped as they often act as decision points for traders.

Recognize SMC patterns

Program the system to identify core SMC patterns such as order blocks, FVGs, BOS, and more.

Incorporate order flow analysis

Integrate real-time order flow data to confirm institutional activity at identified SMC zones. Monitor trade volume, bid-ask spreads, and order book depth to detect potential liquidity grabs and institutional entries before major moves occur.

Develop trading rules

Establish clear entry and exit criteria based on SMC patterns and order flow confirmations. Define stop-loss levels, position sizing strategies, and take-profit targets to enforce strict risk management. Ensure rules adapt dynamically to market conditions.

Backtesting and optimization

Run the algorithm on historical data to evaluate its effectiveness. Analyze performance metrics such as win rate, drawdown, and risk-to-reward ratios. Then, optimize parameters, including indicator thresholds and time frames, while incorporating new data to refine accuracy.

Understand market microstructure

Furthermore, consider how order types and institutional participants influence price movements. Study how liquidity providers execute trades and how high-frequency traders impact short-term price behavior. This insight helps refine execution timing.

Technology integration

Select a trading platform that supports algorithmic strategies with real-time data feeds and strong backtesting capabilities. If speed is critical, ensure low-latency execution to minimize slippage and maximize efficiency in order placement.

Carefully evaluate smart money concepts in trading

SMC provides traders with deeper market insights that can help inform trade entry decisions by aligning with institutional movements. However, SMC requires experience, as misinterpreting liquidity zones or structural shifts can lead to poor execution and increased exposure to market manipulation risks.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.