Silver is one of the most liquid assets that is traded in high volumes, right behind Gold. The tight Silver spreads allow traders to maximize their profits with a low cost of trading. Since Silver is a smaller market than Gold, it has been more volatile over the last few years.

With increasing industry Silver demands, Silver prices have been bouncing in the upward direction, resulting in heavy profits for Silver day traders.

Let's take a look at how you can get into Silver trading:

What is Silver trading?

Silver trading allows you to speculate and profit from the changing Silver prices in the market. Just like Gold trading, you can gain exposure to the Silver market without actually taking any ownership of the physical commodity by trading the metal through futures, CFDs, shares and ETFs.

How to trade Silver?

1. Contract for differences

CFDs or Contract for Differences are the most popular and easiest way to trade Silver as it gives you access to the asset at a lower cost and enables you to either go long or short in the Silver market. When you trade it through a CFD, you do not own Silver, but the price fluctuations in the asset give you significant benefits. You sign a contract between you and your broker at the actual price of Silver. After purchasing the minimum quantity of 100 units, you can utilize the leverage that comes with CFDs and minimize any associated risks.

For example, if 100 units of Silver are trading at a total value of $100,000 today and you decide to enter a position through a CFD, and your broker demands 10% of the total trade value as a deposit, to enter a market position worth $100,000, all you have to do is deposit $10,000 and earn profits on the total trade value itself. Now assume the total price of 100 Silver units go up by 40%, and the new total price is $140,000. This means that you earn a profit of $30,000 by only investing $10,000 in the Silver market.

2. The futures market

You can also trade Silver futures by agreeing to a futures contract in order to either sell or buy the future for a specific price on a pre-decided future date. A futures contract comes with an expiry date, and if the position is still open by that date, you either need to settle the trade completely or roll it over to a new delivery date. Silver futures can be traded on any exchange around the world, and each standard Silver contract is valued equal to 5,000 troy ounces Silver.

3. Spot market

When you trade Silver in the spot market with spot prices, you can trade the asset at its current price at that exact point in time. Hence, spot trading involves on the spot settlement of the trade – you buy immediately, and you sell immediately at the ongoing prices. The spot prices never expire, and hence you can trade the continuously growing or falling market prices and decide to short or long a position.

4. Stocks and Exchange Traded Funds (ETFs)

You can indirectly trade Silver by investing in companies that explore and mine Silver. Many companies involved in the industrial production of Silver can also be traded to gain indirect exposure in the Silver market. Silver prices and Silver stocks have a positive correlation. Hence, whenever the Silver demand increases, the prices of such companies also increase since they start earning more through mining, production and exploration. The incremental prices result in significant profits while trading Silver through stocks.

You can also get greater exposure in the market by trading Silver through an ETF. ETFs are traded the same way as a stock, and the only difference is that the prices that you get through an ETF are according to the Silver’s physical value or the average price of several Silver stocks grouped together.

Top Silver trading strategies every trader should know

Trend determination trading strategy

As a Silver trader, you can find several price extremes in a trending market. There is an uptrend in the Silver market when there are continuous higher highs and higher lows, whereas there is a downtrend in the market when continuous lower highs and lower lows are occurring as a series.

By using moving averages or drawing trend lines, you can identify which trend is prevailing in the Silver market and make successful trades accordingly. When you notice that there has been an uptrend in the market for quite some time now, enter the market to make profitable trades. When you notice a prevailing downtrend in the market for some time, realize that it is the best time to exit the market in order to minimize losses.

Stop-loss and take profit setting trading strategy

Like other commodities, you can set your stop-loss and take profit levels to minimize losses and maximize profits. It helps you in your trading risk management by taking no more than 5% of the risk on the open positions. You should put your stop-loss order at 1 or less percent of the total capital invested in the market, and take profit orders should be fixed at 1.5 or more percent of the total capital invested.

Trend direction signal filtering trading strategy

There are a number of ways in which you can identify the appropriate buy and sell signals in the Silver market. Trend lines are among the most accurate buy and sell indicators, along with simple moving average, stochastic, moving average convergence divergence, and relative strength index being the top trading indicators that help traders analyze the market signals effectively.

However, each trader must only choose the trading signal that they are most comfortable with and use that indicator to identify signals and generate the trend’s direction. Working with an indicator that you do not completely understand can result in inaccurate trend signals, which can lead to heavy trading losses.

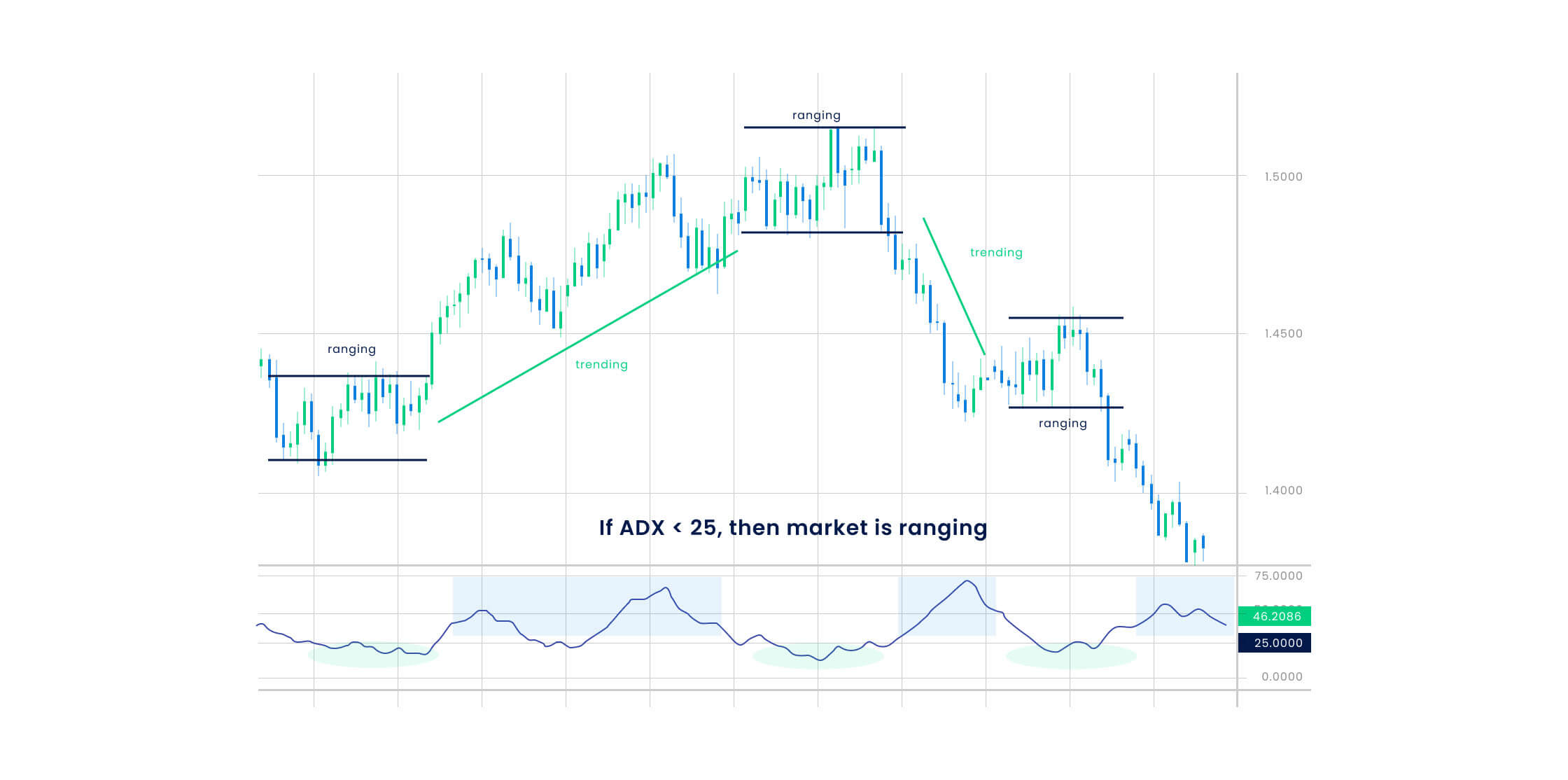

Range bound trading strategy

Whenever the Silver market is consolidating or trading within a set range, the range trading strategy helps in providing traders with entry and exit signals. In this strategy, the first step is to identify the range in which the market is trading. Once you have done that, it is time to filter your entry and exit signals by understanding where exactly the Silver prices are moving.

- If the Silver prices move near to the range’s bottom, it is a buy signal

- If the Silver prices move near to the range’s top end, it is a sell signal

Moving average trading strategy

The moving average is one of the most accurate and widely used trading strategies for Silver and other commodities trading as well. When trading Silver through a moving average trading strategy, you smooth out any irregularities in the Silver’s trading price over the last few days according to the time period you are considering. Then, you take the prices over the period of time and divide them by the time period to identify the average Silver price going in the market. Comparing the average price with the current Silver price gives you entry and exit signals in the market.

- When the current Silver price is close to its average price, it tells the trader that the market is not too volatile right now and it is safe to continue being in the market.

- When the current Silver price is not close to its average price, it tells the trader that the market is very volatile and risky. In such a case, it is best advised to move according to the market’s direction. For example, if the current price is higher than the average price, it is advisable to sell the asset and take profit and if the current price is below the average price, buy signals are generated.

Trading with Silver spreads

Last but not least, you can also trade Silver spreads to minimize your ask by trading in the actual commodity combined with trading in Silver CFDs together. In such a situation, you can take a long position in the physical asset and simultaneously a short position in a Silver CFD, which is indirectly affected by the Silver prices in the market. This way, even if the prices of Silver drop, you will be protected against heavy losses through the short position you will be holding in Silver CFDs. Similarly, if the prices of Silver rise, you will benefit through the long position that you will be holding in the physical asset.

How to trade Silver through a contract for difference (CFD)

1. Study Silver investing and trading beforehand

Silver investing and trading are two different methods to benefit from increasing Silver prices. When you invest in Silver, you own the product. However, when you trade Silver, you do that through a CFD and hence, do not have any ownership of the underlying asset.

2. Choose the market you want to invest in

There are several Silver markets available that you can trade-in, like the spot Silver market, the Silver bullion trading market (traditional method of investing in Silver by buying Silver coins and bars), Silver futures market, Silver ETFs market, Silver options market and the Silver stock market.

3. Analyze the prices that move Silver

Even when you trade Silver through CFDs, the price at which you trade is dependent upon the actual price of Silver in the market. Hence, it is important that you are aware of any industry changes, global demand and supply mechanisms, and investment decisions related to Silver.

4. Create a trading account through which you can trade a Silver CFD

Look for a broker that offers CFD Silver trading and open an account. Use the demo account to understand how the market price fluctuations work before making the actual investment.

5. Find the right opportunity to buy a Silver CFD

After analyzing the market and price fluctuation, conduct technical and fundamental analyses before you open a Silver CFD position with your broker. Open your first Silver CFD trade by agreeing to the contract and after investing the initial deposit required.

6. Choose if you want to long the trade or short the trade

While trading Silver through CFDs, you can either short (sell) a trade or long (buy) trade in the market. If you expect Silver’s market prices to increase in the near future, you opt for a long position, and if you expect the market prices of Silver to decrease, you opt for a short position in order to benefit both from rising and falling markets.

7. Monitor the trade closely and close at a profitable position

Keep monitoring your trade and keep a close eye on any global news announcements and supply and demand changes in the Silver market. Close your position when you feel that the trade has been successful.

Start trading Silver today to earn high profits

Silver is one of the safest and most prominent metals in the entire world. Trading Silver opens vast opportunities for you in the world of trading and reaps you significant profits. It also helps you save your hard-earned money against inflation. With our platform, you can trade Silver through a contract for difference and gain greater market exposure by only investing a certain percentage of the total trade value in the market.

FAQs

What is Silver trading today?

Silver price today in the US market is trading around $25.31 per ounce.

Is trading Silver profitable?

Yes, Silver is a tradable, liquid, and profitable asset that gives traders high profits when traded directly or indirectly through a contract for difference.

Can you buy stocks in Silver?

There is no stock that represents Silver directly in the stock market. However, you can invest in the listed companies that either deal with Silver and are associated with it through Silver production, mining, or related aspects.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.